What Effects Could Bitcoin ETFs have on the Market

Many of the biggest cryptocurrency news stories over the last several months have been related to the possibility of SEC-approved Bitcoin ETFs. Numerous prominent cryptocurrency advocates have even speculated that ETFs could be the jolt of energy that sets off the next major bull run.

But for all of the hype surrounding ETFs, details about what an ETF actually is and what kind of an impact Bitcoin ETFs might have on the industry are frequently glossed over.

In this article we’ll cover everything you need to know about Bitcoin ETFs: what they are, their current legal status, and the possible ramifications should they actually receive approval.

What are Bitcoin ETFs?

The term ‘ETF’ stands for ‘exchange-traded fund’ and is the name for an investment fund with shares that are traded on a stock exchange. ETFs are considered a ‘pooled investment vehicle’, meaning that they involve multiple investors buying shares of a pool of assets. The underlying asset can be stocks, bonds, gold bars or many other kinds of assets.

A ‘Bitcoin ETF’ would therefore be an investment fund traded on a stock exchange in which the underlying asset is Bitcoin. Some sources will refer to this instead as a ‘Bitcoin ETP’ (exchange-traded product), but the terms are functionally the same: The fund would be responsible for owning some pooled amount of Bitcoin, and investors would be able to buy shares of that pool. Each investor would then be entitled to a proportionate share of the value of the fund’s assets.

If you’re already an active member of the cryptocurrency community, this may sound like a strange idea. Why would one want to purchase a share in a Bitcoin investment fund rather than just buying Bitcoin directly?

There are a few possible reasons.

For one, investing in Bitcoin through an ETF could be an easy way for traditional investors (both retail and institutional) to invest in Bitcoin without having to interact with some of cryptocurrency’s more esoteric features.

There are undoubtedly traditional investors who are interested in cryptocurrencies but find the notion of buying off of cryptocurrency exchanges or setting up a cryptocurrency wallet to be needlessly complicated. Such investors might be better off putting their money in a Bitcoin ETF, which would allow them to indirectly invest in Bitcoin through the comfort of their preferred stock-trading platform.

Another reason for investing in an ETF would be the increased security provided by government regulation. If a Bitcoin ETF were to be approved, the ETF would then fall under SEC jurisdiction. According to Vanguard, the SEC regulates ETFs under the Securities Act of 1933, the Securities Exchange Act of 1934 and the Investment Company Act of 1940:

“The 1940 Act imposes a host of investor protections—including restrictions on affiliated transactions, limitations on leverage, the independence of boards, and the segregated custody of fund assets—making mutual funds and ETFs subject to the 1940 Act among the most stringently regulated investment products available in the United States.”

The details of exactly how the SEC regulates ETFs are beyond the scope of this article, but suffice it to say that a Bitcoin ETF would be required to follow consumer protection laws that are not applicable in the general cryptocurrency market.

This second reason is important: Bitcoin and other cryptocurrencies are considered by many to be risky investments due to the market’s volatility and the lack of investor protection mechanisms. An SEC-approved ETF could be attractive to traditional investors who have been too risk-averse to get involved in the cryptocurrency market until now. ETFs are a great way for these inexperienced investors to take part.

Current Status of Bitcoin ETFs in the US

Much of the news coverage surrounding Bitcoin ETFs has been centered around new ETF applications and the SEC’s decisions in response to them. At time of writing, the SEC has rejected three Bitcoin ETF applications and is currently considering at least three others.

The most recent rejection, which occurred on July 26, was actually the second application rejection for the Bats BZX Exchange (BZX) to trade shares in the ‘Winklevoss Bitcoin Trust’—an ETF proposed by Gemini cofounders Cameron and Tyler Winklevoss.

The news was a significant blow to the cryptocurrency community, as many in the space were feeling optimistic about an ETF approval following the SEC’s indications that Bitcoin would not be considered a security.

But alas, the Commission rejected the application, citing many of the same reasons that they had in previous rejections: concerns over investor protection and the possibility for market manipulation and fraud.

According to the SEC’s ruling the Commission focused primarily on Exchange Act Section 6(b)(5), “which requires, in relevant part, that the rules of a national securities exchange be designed ‘to prevent fraudulent and manipulative acts and practices’ and ‘to protect investors and the public interest.’”

The SEC argues in the ruling that the Bitcoin market is susceptible to fraud and other kinds of market manipulation and that BZX does not have sufficient mechanisms in place to be able to detect or prevent such manipulation. Particularly problematic for the SEC is the fact that a significant portion of the Bitcoin market occurs internationally and is therefore outside of SEC jurisdiction.

Another concern for the SEC is that the underlying Bitcoin market is not currently regulated. The SEC argues that regulation of a Bitcoin ETF would not be sufficient because the underlying bitcoin market and the bitcoin derivatives market are not regulated.

However, the news isn’t all bad. The Winklevoss ETF application was rejected in a 3-1 decision, which means that one SEC Commissioner, Hester Peirce, voted to approve the listing of the Winklevoss Bitcoin Trust.

Peirce later took to Twitter to publicly express her dissent with the Commission’s decision. In her public statement, Peirce argues that approval for the Winklevoss application would be an important step in bringing greater investor protection to the Bitcoin market:

I am concerned that the Commission’s approach undermines investor protection by precluding greater institutionalization of the bitcoin market. More institutional participation would ameliorate many of the Commission’s concerns with the bitcoin market that underlie its disapproval order. More generally, the Commission’s interpretation and application of the statutory standard sends a strong signal that innovation is unwelcome in our markets, a signal that may have effects far beyond the fate of bitcoin ETPs.

Peirce also argues that the SEC may have exceeded its prerogative by basing its decision not just on the Bitcoin ETF proposal at hand, but on the underlying Bitcoin market:

[The role of the commission is to] to determine whether ‘[t]he rules of the exchange’ are, among other things, ‘designed to prevent fraudulent and manipulative acts and practices [and] to promote just and equitable principles of trade. The Commission steps beyond this limited role when it focuses instead on the quality and characteristics of the markets underlying a product that an exchange seeks to list.

Peirce’s defense of the ETF has since earned her the name of ‘Crypto Mom’. So while some of the SEC’s concerns seem difficult to completely overcome due to the decentralized nature of the Bitcoin market, there is at least one person on the Commission who seems to be advocating on behalf of the cryptocurrency community.

There is therefore still hope that an SEC-approved Bitcoin ETF could come sometime in the future.

Ramifications of Bitcoin ETFs: Pros and Cons

As you likely assumed from the aforementioned hype, it is probable that a Bitcoin ETF approval would be a major boon to the overall cryptocurrency market. A Bitcoin ETF listing on a major stock exchange like CBOE or the NYSE would open the door to a large swath of potentially untapped investor money. If approved, the Bitcoin ETFs would not be listed until 2019 at the earliest, but news of the approval alone would likely cause Bitcoin’s price to skyrocket.

What is harder to predict is how much money Bitcoin ETFs would directly bring in to the cryptocurrency market. That is, how much would traditional investors actually invest in a Bitcoin ETF?

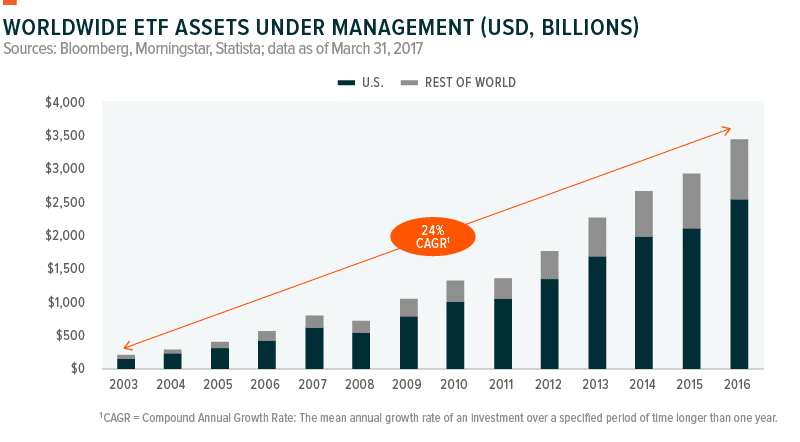

This is impossible to know. As mentioned above, an ETF could be a very appealing option to some investors compared with buying Bitcoin directly from a cryptocurrency exchange. Igor Feerer points out that the total ETF market size was about $3 trillion in 2017, indicating that there is a serious amount of money invested in these types of funds. But many traditional investors have been quite hesitant to pull the trigger with Bitcoin thus far, and it is difficult to know if an ETF is the investment vehicle that Wall Street traders have been waiting for.

Also worth considering is the possibility, which some cryptocurrency analysts have argued, that the approval of a single cryptocurrency ETF would set off a flood of additional cryptocurrency ETFs. ETFs could therefore lead to a significant influx of capital into the cryptocurrency market, even if the investments are spread across numerous funds.

While there are many benefits that could come to cryptocurrency enthusiasts should Bitcoin ETFs gain SEC approval, there are likely to be some negative outcomes as well. Perhaps the biggest is the fact that Bitcoin ETFs will further reduce the pool of Bitcoin that is actually being used as a medium of exchange, rather than simply as an investment opportunity.

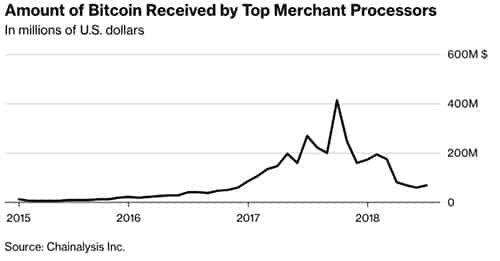

A trend has emerged since Bitcoin went on its remarkable price rally at the end of 2017. Around the same time that prices were going up, Bitcoin’s use in retail transactions went down. This makes sense: Bitcoin was becoming more valuable every day.

If you spent your Bitcoin, you could stand to lose a significant amount of money if the price continued to rise. Recent data, however, suggest that this trend has continued on to today, in spite of the 2018 cryptocurrency market crash.

Bitcoin still is not being used in retail transactions to the extent that it was a year ago. This suggests that many now see Bitcoin more as a store of value to be held than as a medium of exchange to be used. Perhaps this isn’t a problem in the long run.

Maybe Bitcoin can be repurposed as a sort of digital gold—something that has value but isn’t really used to make transactions—but this is certainly not in line with what Bitcoin was originally intended to be.

Looking Forward

While the recent rejection of the Winklevoss Bitcoin ETF application is disappointing, there are at least three other cryptocurrency ETF applications that the SEC has not yet issued a ruling on: the VanEck and SolidX Bitcoin ETF, the Direxion Bitcoin ETF, and the Bitwise Hold 10 Cryptocurrency Index Fund.

It is not yet clear whether these ETF proposals have taken sufficient steps to gain SEC approval in the areas in which the Winklevoss proposal fell short. We won’t know for sure until the official rulings on these applications are made public; all three applications are scheduled to be decided upon sometime within the next couple of months.

Whatever happens—good or bad—ETFs will likely remain an important topic in the cryptocurrency industry for the foreseeable future.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.