Emerging Market CryptoCurrency Adoption - What Needs to Be Done

Everyone is talking about cryptocurrency adoption and how it could disrupt the entire financial system.

This talk gains traction with every additional fiat currency experiencing growing inflation rates. In countries like Venezuela, it appears that fiat has crossed the point of no return and that when the collapse of the nation’s monetary system is a question of ‘if’, not ‘when’.

However, the fiat currency crisis is an opportunity for cryptocurrency to increase adoption rates and provide people with an alternative system.

The big question is: ‘What is the best way to sow the seeds of cryptocurrency adoption?’

The Case For Crypto Adoption

Cryptocurrency in its purest form is proposed to act as digital cash. This was outlined in the Bitcoin whitepaper over ten years ago. In short, this means that cryptocurrency is envisioned to act as a medium of exchange.

So, why could cryptocurrency be better than fiat currency?

- Accessible: 28% of the world's population (2.2 billion people) are unbanked and excluded from the current financial infrastructure. Unlike bank accounts, cryptocurrency does not require you to fill in an application form to allow transact or store value. Instead, anyone with an internet connection can use crypto and transfer value anywhere in the world

- You're in control: With the traditional financial system, you entrust your funds to a third party like a bank. If the bank you hold your money in goes bankrupt and the government can/will not bail out account holders, then you will lose your funds in your account. With cryptocurrency, you are the true owner of your funds and you don’t have third-party dependency.

- Fast transaction settlement: Have you ever sent money overseas and noticed it takes a few days for the transaction to go through? Well, that’s not only annoying, for businesses this slow speed can cost time and money. With cryptocurrency, transactions can be settled within minutes.

- Secure: Ledgers are stored on blockchains. This method of record keeping has been shown to be exceptionally secure. For example, the Bitcoin ledger secures around $200 billion worth of value and has not been compromised at any point during its ten year lifetime.

- Protection against fraud: Cryptocurrency transactions are stored on a public ledger. This means that no centralized party like a bank or government have any control and that nefarious actors cannot fraudulently edit the ledger for their own benefit.

- Secure: Ledgers are stored on blockchains. This method of record keeping has been shown to be exceptionally secure. For example, the Bitcoin ledger secures around $200 billion worth of value and has not been compromised at any point during its ten year lifetime.

- Inflation Resistant: Most cryptos have a capped supply. Unlike fiat currency, cryptocurrency doesn’t allow for the endless printing of money. In theory, this should protect people's purchasing power as more people adopt crypto.

Current Crypto Adoption Levels

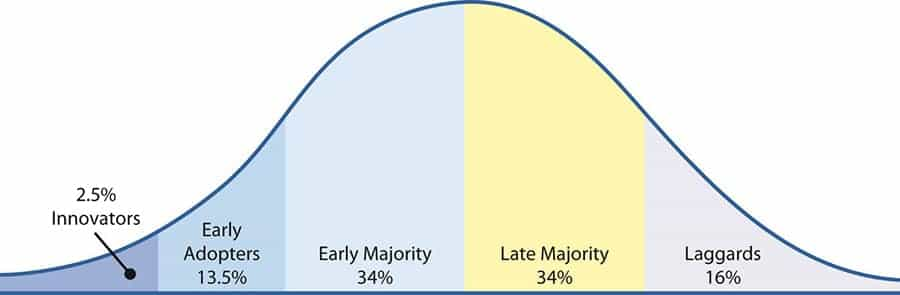

So, where are we now in terms of cryptocurrency adoption? The truth is that we currently have exceptionally low levels of global crypto adoption rates.

Bitcoin is undoubtedly the world's most popular crypto and data shows that there are only 22.9 million Bitcoin wallets in existence. Given there are 7.7 billion people on the planet, this means there is one Bitcoin wallet address for every 336 people.

That’s an exceptionally low global rate of adoption, particularly when we consider:

- A significant number of Bitcoin owners hold more than one Bitcoin wallet.

- 15.5 million of the Bitcoin wallet in existence contain less than $1 worth of Bitcoin.

- Only 2.5 million wallets hold more than $100 worth of Bitcoin.

Yes, many people might have heard of cryptocurrency in mainstream news. However, the numbers do not lie. The truth is that only a tiny fraction of the world's population are in cryptocurrencies right now. If you own $100 worth of Bitcoin, then you can already count yourself amongst the top 2.5 million richest Bitcoin wallet holders.

It’s true that there are over 2,000 other cryptocurrencies out there and Bitcoin is by no means the only one. However, the point is that levels of cryptocurrency adoption may be lower than you think.

Where Is Mass Crypto Adoption Most Likely?

The vast majority of cryptocurrency projects appear to be taking the approach of ‘If we build it, the people will come’. Sure, this may be a reasonable strategy. However, is this is the best strategy and could we do more to help educate people on the benefits of cryptocurrency?

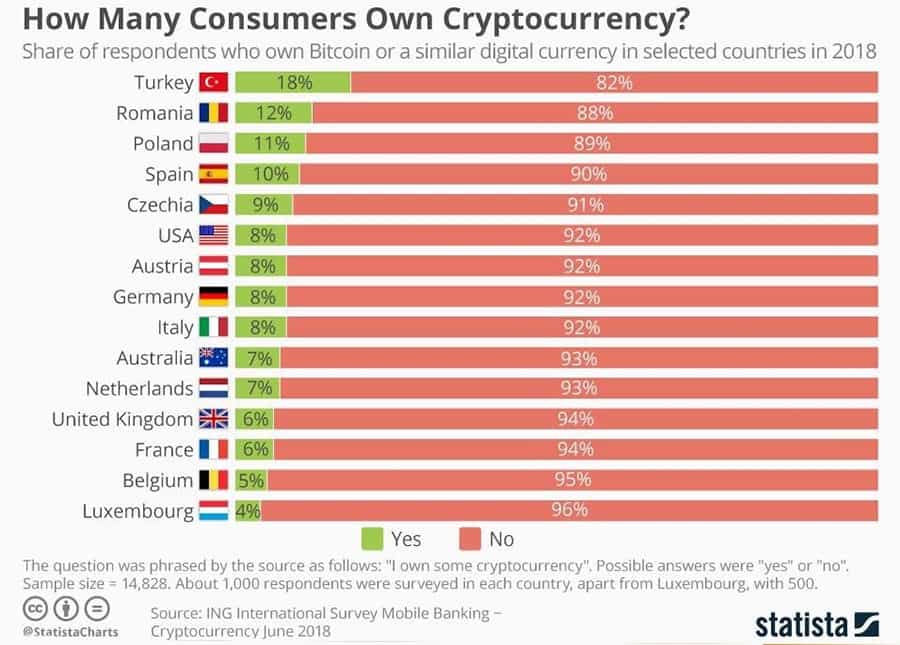

The inconvenient truth is that the majority of the cryptocurrency market is made up of participants living in developed countries. Mostly the USD, EUR and GBP work just fine as a medium of exchange.

It is true that some are ideologically opposed to these government-issued currencies. However, the point is that there is no real pressing need for the majority of the population to look for an alternative money system. Instead, crypto is mainly being used as a method of speculation.

Things are different in communities located in places like Venezuela, Argentina, and East Africa. Here, there are a significant number of communities that are affected by the following problems:

- Poor Payment infastructure

- High proportions of the population are unbanked

- High levels of inflation

It is these types of communities that could have the most practical use case for crypto. In our opinion, these are the types of locations that are the most likely to mass adopt cryptocurrency in the near future.

Are Those With Banking Or Currency Issues Adopting Crypto

Venezuela is perhaps the clearest example of a society experiencing both banking and currency issues.

- Capital controls: The government had imposed caps on ATM withdrawals, limiting citizens to cash withdrawals worth $1 per day.

- Unbanked: According to The World Bank, out of the 31.6 million people living in Venezuela, 9.5 million are unbanked. That’s 30% of the entire population.

- Hyperinflation: The IMF has warned that Venezuelan inflation could hit one million percent in 2018.

Venezuela is an extreme case. However, it does provide an interesting overview of whether these types of economic conditions encourage the adoption of crypto.

So what do the stats tell us?

Well, it is exceptionally difficult to get cryptocurrency trading volume data by country. The reason why is that the majority of trading happens on:

- Cryptocurrency exchanges: Who don’t release stat breakdowns by country.

- Over the counter trading: It’s been speculated that more cryptocurrency trading happens on the OTC market than on cryptocurrency exchanges. Because the transactions happen off-exchange, there is no true transaction volume record of this type of trading.

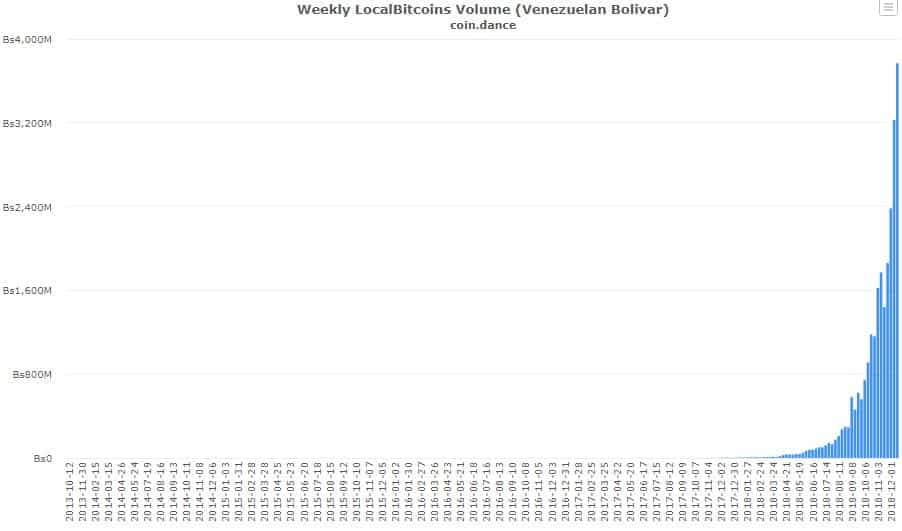

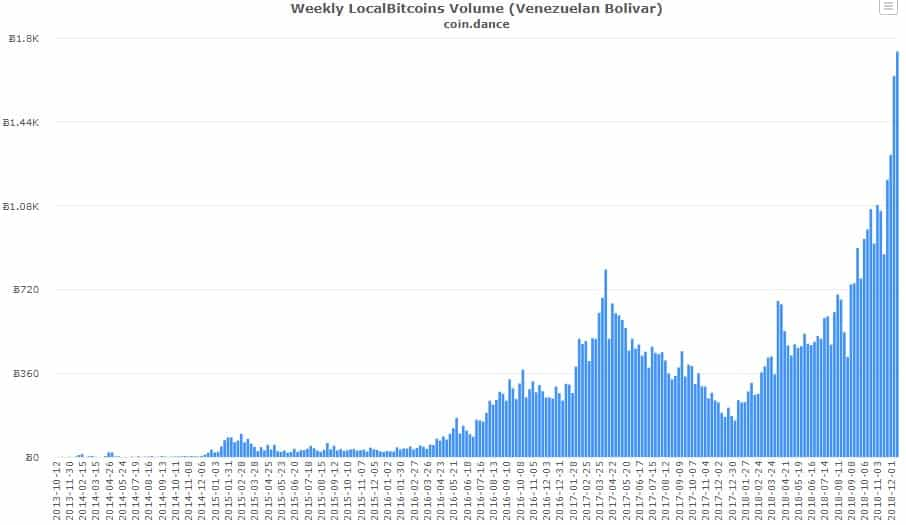

However, the peer to peer crypto trading service, LocalBitcoins, does release trading data by country. With Venezuela's hyperinflated currency it is frankly a meaningless task trying to assess Bitcoin trading volume versus the Bolivar.

When we look at Venezuelan trading volume in Bitcoin it becomes apparent that there has certainly been an increase in demand.

We can see from the chart that monthly Bitcoin trading volume has doubled from around 2,000 Bitcoin in June 2018 to 4,000 BTC per month in November. Now that may not sound like very much.

However, we must be aware that LocalBitcoins (which this data is based on) probably only makes up a fraction of the true cryptocurrency trading that's happening in the country. Also, oppressive capital controls and the devaluation of the Bolivar mean that its harder for locals to buy Bitcoin (or any other cryptocurrency for that matter) in the first place.

In the case of Venezuela, the data seems to support the idea that worsening economic conditions have resulted in increased interest and adoption of cryptocurrencies.

Current Emerging Market Adoption Efforts

Many of you have probably heard about how Dash Core Group employees are giving away the cryptocurrency in Venezuela and how Dash ambassadors have successfully persuaded businesspeople to accept the crypto.

There are certainly many different cryptocurrencies that are now focusing on adoption efforts in emerging markets. However, there are questions over the Dash Core Group’s tactics and sustainability.

Is an even better way to sow the seeds of cryptocurrency adoption in these types of communities?

What is Nimiq?

Most people probably have never heard of Nimiq (NIM) before. To understand how Nimiq could make a big contribution to overall cryptocurrency adoption efforts, you will need to understand what the project is all about.

Nimiq is a browser-based Blockchain designed for simplicity. Nimiq’s reason for existence is to bring the benefits of blockchain technology to the mainstream audience.

To achieve that purpose, Nimiq has been built from the ground up to address and break the barriers to entry that stop the mainstream adoption of blockchain technologies. Nimiq is encompassed by a strong philanthropic mindset and so will always remain open-source and community-driven.

Nimiq's core features are:

- Minimalistic UIs, optimal UX

- Explanations and user guidance when needed

- Onboarding procedures for new users and users new to crypto

- Runs Installation free in your browser

- Native mobile apps will also be available

- Design and language that appeals also to non-technical people

- Local community moderators speaking your language

- Offering UIs in multiple languages

- Aiming specifically for markets with troubled fiat systems

Nimiq is Crypto made simple. Nimiq aims to be the best performing and easiest to use decentralized payment protocol & ecosystem.

The project is striving to combine state of the art blockchain research and web technology. Nimiq is browser-based and that means that no installation of apps is required.

How Could Nimiq Contribute To Crypto Adoption?

There are many projects out there trying to help with adoption efforts in communities facing banking or currency issues. However, the general strategy seems to be to distribute crypto in the affected area.

Nimiq has recently announced that it’s considering an ambitious cryptocurrency adoption proposal that goes beyond mere adoption. The plan proposes to set up a case study in a location challenged by both currency and banking issues. It's been put forward that the deployment phase should be made up of three parts:

- A local exchange: To convert local currency to crypto and from crypto to local currency.

- A real-world airdrop: Where crypto is distributed to the local population as a gift. Similar to other cryptocurrency initiatives like Dash, this is to encourage free enterprise in the community and act as a local stimulus package.

- The incubator: Focused on promoting local economic growth by supporting locals with the resources and support to create online businesses to participate in the global digital economy.

Aside from the incubator, this does not appear to be a particularly new idea. However, where the plan sponsored by Nimiq differentiates itself from others is in proposing:

- Open source: The comprehensive plan also involves allowing the cryptocurrency community to further refine and improve it.

- Scientific methods: It’s been proposed that academics in economics and technology would play a key role in providing additional feedback to refine the plan and that Nimiq should open up the case study up to academic research. The plan also puts forward that it’s important to consult academics in the field of anthropological research on alternative physical currencies to help further enhance the case study.

- Academic value: The reason why most academic research has been focused on the technical aspects of blockchain is due to the lack of real life, crypto adoption case studies. If the plan goes ahead, Nimiq would not only offer academics the chance to study a real-world crypto adoption case study, but it’s also actively inviting them to shape the case study to meet their research requirements.

- Promoting economic growth in the case study: The proposal has also thought about human development in the case study area. The plan proposes the creation of an incubator, providing access to computer equipment and teaching locals how to build online businesses. It’s also been proposed that incubees are given a years salary so that they can focus all their efforts on building their businesses. The interesting thing about this concept is that if successful, this will inject new money into the local economy and boost local economic growth.

- Collaborations with charities and entrepreneurs: It’s also been put forward that local charities could assist with the deployment of the case study and provide crucial insight into the optimization of the plan. This seems to make a lot of sense. When it comes to engaging with the entrepreneurial community, the plan suggests that this group would be targeted to help run the incubator through running online seminars. A bit like an interactive Ted-Talk.

What Plan Has Been Proposed?

Nimiq has stated that the proposal is currently being evaluated and that it is a living document, meaning it is open to further input from the cryptocurrency community, charities, entrepreneurs and academics.

Indeed, the Nimiq team themselves report they are “assessing the ideas and any decision on whether to proceed even with phase one would only be made after receiving community feedback”. We have briefly broken down the phases for you:

1. Additional research phase: identifying a case study location, charities & academic help.

- Objective: To locate the case study areas with the highest probability of cryptocurrency adoption and assess the availability of local charity help to deploy the case study.

- Method: Use of qualitative and quantitative research. This could include collaborating with academics specializing in money, exchange, value, creativity, and social movements.

2. Outreach To - Charities, Academics, Gatekeepers & Entrepreneurs

- Objective: To form partnerships to help with case study deployment and further enhance the academic value of the initiative.

- Method: Outreach.

This phase includes forging partnerships with the following:

- Academics: To further optimize the plan and ensure that the case study provides as much academic value as possible.

- Gatekeepers: Are people who would be in charge with the day to day operation of the case study.

- Local Charities: To confirm previous research, provide additional insights and collaborate on the deployment on the case study.

- Entrepreneurs: To help support the local incubator and upskill locals with the necessary skills required to build competitive businesses.

3. Case Study Deployment

- Objective: Establish the case study in the target area.

- Method: Carry out proposed deployment actions.

The actions outlined in the plan include:

- Educational onboarding video: The creation of a video to teach locals about cryptocurrency at scale. Interestingly, the plan proposes to create another video geared towards local entrepreneurs and explaining the benefits of accepting cryptocurrency as a payment method.

- Setting up a local exchange: There is a wealth of detail in the proposed plan and particular attention has been given to both safety and security.

- Onboarding the local population: It’s been outlined that locals should be shown the onboarding video and participate in Q&A sessions before being given their air dropped crypto.

- Setting up the incubator: A phenomenal level of detail has been given on how this would work, the selection process and rules for the incubator. The proposal is publically available for those of you interested in the detail of the incentive mechanisms.

Benefits of Nimiq

It appears that Nimiq intends to target communities where their cryptocurrency has the biggest advantage. The strategy plays to NIM’s strengths and gives the case study the best chance of success (if it goes ahead).

This means that the target community should see value in the following:

- Fast & Easy Transactions: Nimiq’s focus on simplicity should help it get adoption in a wider range of communities than more complex cryptos.

- Low Transaction Fees: Currently, transaction costs are less than one cent.

- Browser-based: The interesting thing about NIM is that no downloads are required to use it. That’s actually a massive deal in areas where there is poor connectivity and low laptop/desktop ownership. Nimiq helps lower the pain point around this barrier to adoption and this indeed might be the cryptos biggest strength.

Final Word

The debate on cryptocurrency adoption is only set to intensify as more fiat currencies experience rapid inflation and the crypto space matures. After all, if cryptocurrencies truly are the future, then adoption needs to happen at some point.

Without it, the crypto-sceptics in mainstream media will always point to adoption failures as evidence that the crypto experiment has failed.

Nimiq may have sponsored one of the most comprehensive and focused plans for cryptocurrency adoption. If they choose to move ahead and can get the crypto, academic, charitable and entrepreneurial communities on board, we think that the mainstream will begin to see why crypto should be taken seriously.

Nimiq’s idea of open sourcing the adoption proposal and allowing anyone to contribute could play a massive role in the future of crypto adoption efforts, by allowing others in the future to build upon this research. After all, what we are missing in crypto adoption is a map. If the plan goes ahead, it seems likely that Nimiq will play a key role in creating this initial blueprint.

Even if the Nimiq team fail in their adoption efforts, this groundwork could certainly be built on to help other projects in future adoption efforts. That’s why Nimiq has the potential to make a big contribution to crypto adoption and why it is a worthwhile initiative to support.

Disclosure: The author holds some NIM in their portfolio and is compensated in a long-term independent consulting capacity by Nimiq. This article must not be construed as investment advice. Always do your own research.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.