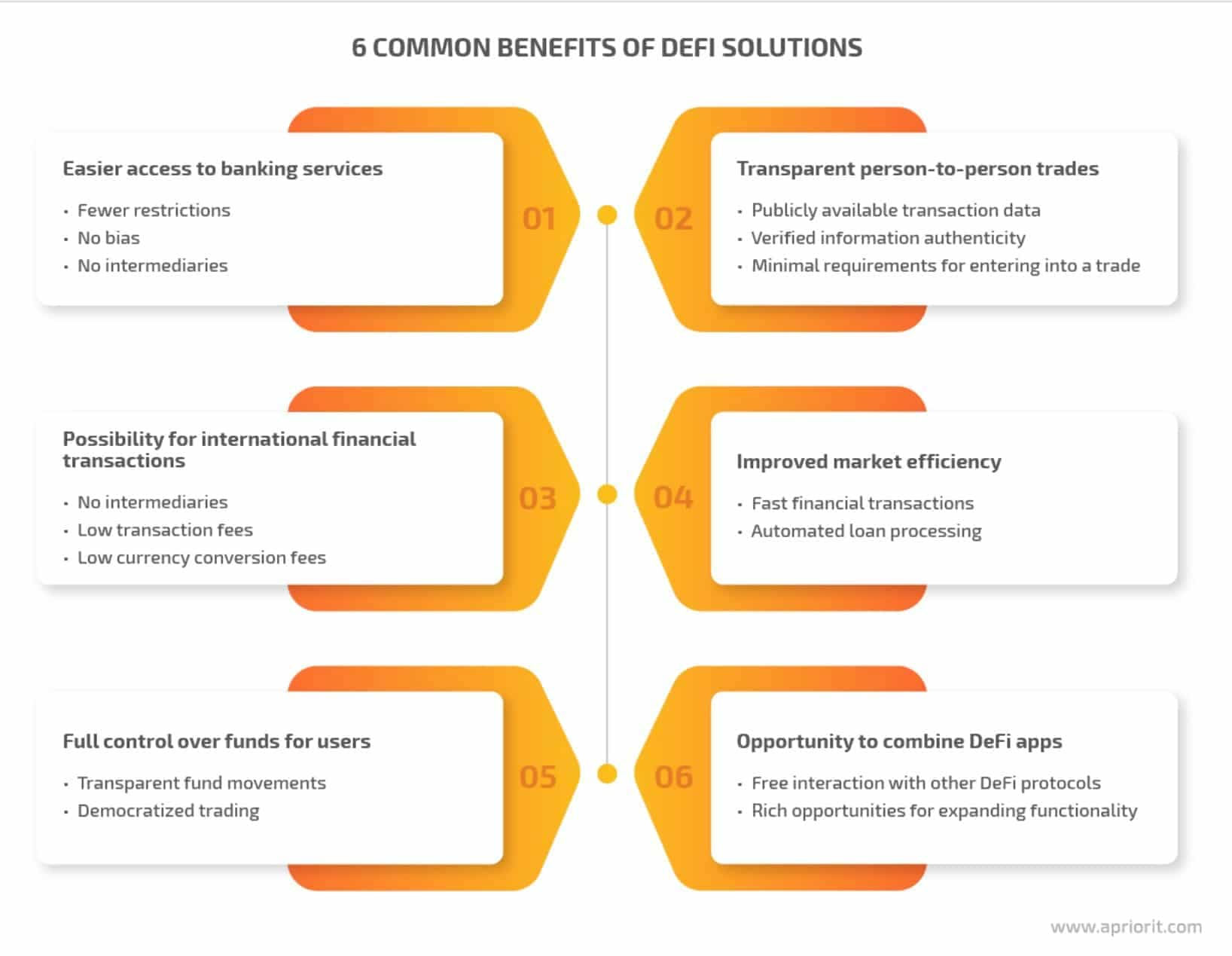

Decentralized Finance is considered by many to be “the ultimate solution.” DeFi was born out of a necessity to end the corruption that exists in the traditional financial sector and create a fair and unbiased financial system that can be enjoyed by, and benefit everyone regardless of where they are in the world or their social status.

Many consider DeFi as the ultimate utopian financial system that has the ability to dethrone the seriously broken traditional financial system and bring financial health and freedom to the masses in ways that aren’t possible with the current banking system.

Like a knight in shining armour, DeFi is saving the world from the widely considered “evil,” banks and similar to Robin Hood, DeFi is taking money away from the overly greedy rich bankers and giving money back to the fair people of the planet.

All this is made possible by a decentralized blockchain infrastructure that supports a true peer-to-peer payment system that cuts out third-party intermediaries who charge fees out the wazoo and take their cut from each transaction and providing the ability for users to access lending products for much lower interest rates and less red tape, while also providing investors and those willing to lend with significantly higher returns than any bank will ever give their customers.

Disclaimer: I use some of the platforms mentioned in this article, and hold some of the tokens mentioned as part of my personal investments strategy.

What is DeFi?

DeFi applications aim to recreate and improve upon traditional financial systems, offering all the benefits of financial products such as lending, borrowing, investments, payment systems, mortgages, and even insurance without many of the downsides present in the traditional financial system. Many of those downsides are a direct result of bankers exploiting the general population and syphoning trillions of dollars directly out of the pockets out of average folks like you and me in the form of high-interest rates and insultingly low returns on savings accounts and investments while simultaneously charging fees for every little service.

The Decentralized Financial System allows for digital currencies to be created, traded and managed on a blockchain network. This results in everything within the blockchain ecosystem being shared across multiple computing nodes which can be run by anyone that verifies transactions rather than needing to be verified and overseen by banking overlords.

People do not need to provide proof of their identities, nor go through tedious KYC processes to use DeFi, and there are no centralized parties that can come in and stop peer-to-peer transactions. DeFi is a revolutionary concept as it gives users anywhere in the world access to a financial system, provided that they have a simple internet connection without the need for a bank and funds can be sent anywhere nearly instantaneously and for fractions of a cent on some networks.

Decentralized finance also provides a financial system where every transaction is publicly viewable and verifiable, creating non-alterable records supporting the idea that if governments and institutions adopted blockchain technology it would result in less corruption and fraudulent activity as everyone would have full transparent access and able to view transfers.

Blockchain could also reduce criminal activity as using traceable transactions for illicit purposes is just not a smart way to do crime which is why, despite the ridiculous narrative that Bitcoin is only used by criminals, suitcases full of untraceable dollar bills is still the preferred method enjoyed by criminal kingpins everywhere.

Though, like everything in life and in true Yin and Yang fashion, DeFi also has its share of downsides.

What are the Risks in DeFi?

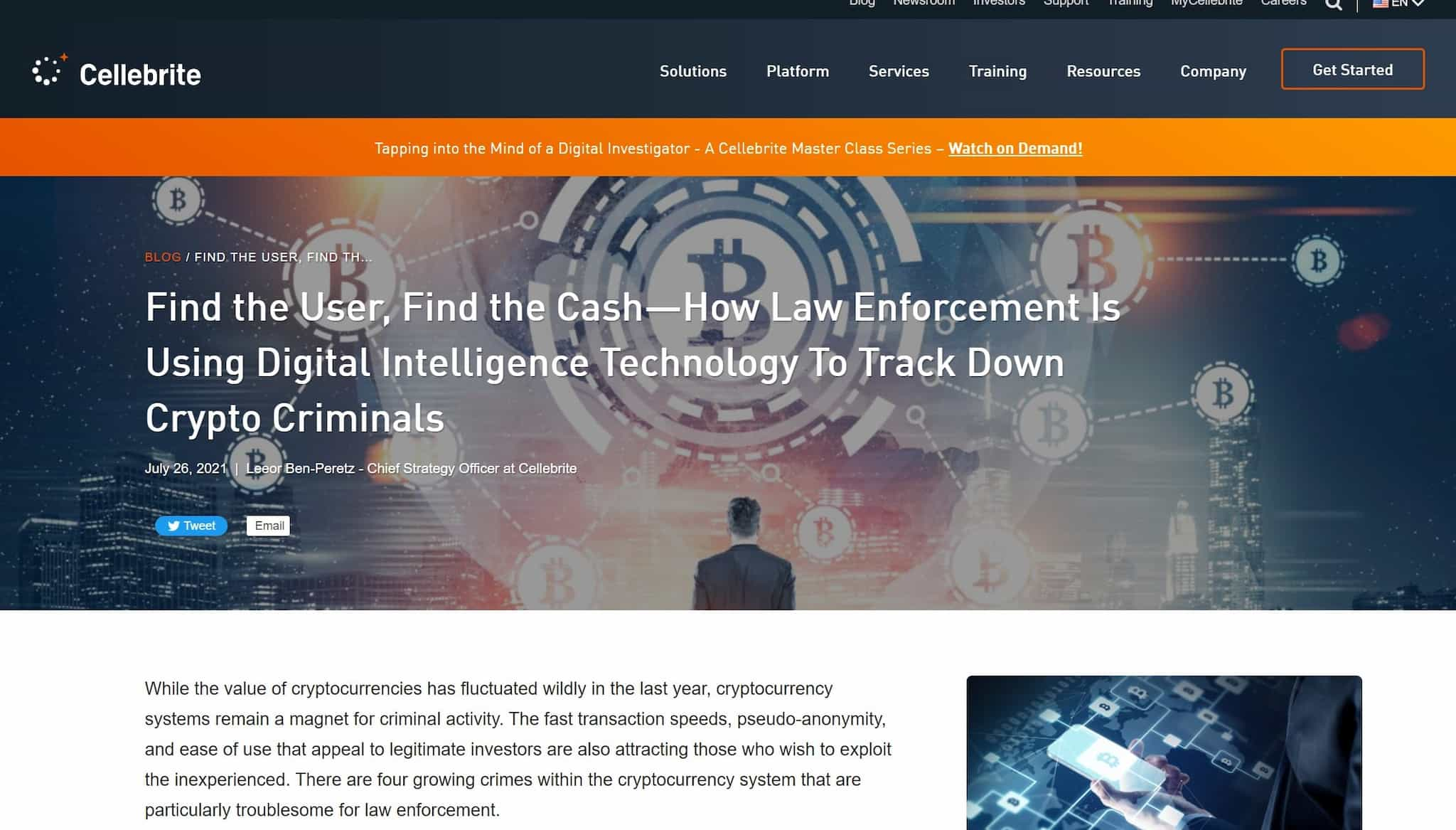

It is not Completely Anonymous

Contrary to what many people believe, DeFi and Cryptocurrency transactions are not as anonymous as everyone once thought, or hoped they were. While decentralized financial transactions can be made with no KYC needed, government agencies, you know those ones with the scary three-letter acronyms like FBI, CIA and DEA can quite easily follow crypto transactions from address to address to exchange, then to a bank account.

Of course, there are privacy coins such as Monero, and as long as you can find a way to spend your crypto without it needing to touch an exchange or deposit into a bank account then you may be able to bypass this but I certainly am not recommending or suggesting using crypto for criminal purposes, the Coin Bureau does not provide financial advice and certainly does not provide advice on how to be a criminal!

Blockchain Transactions do not Eliminate Personal Risk

Another misconception is that decentralized finance is safer than centralized systems run by a single institution as DeFi transactions need to pass through multiple nodes, miners and sources to verify and authenticate transactions. It is true that blockchain tech can help protect against administrative and accounting errors and things like bank and economic failures if the financial institution or financial infrastructure fail.

Another crypto feature is that crypto transactions cannot be reversed by anyone, which is a double-edged benefit with a nasty downside. If you accidentally hit a comma instead of a period and send way too much, or send funds to the wrong address, there is no financial institution that is able to reverse the transaction or help you get those funds back. That is one of the reasons I highly recommend using a blockchain domain name to transact with your crypto to minimize risks and wouldn’t you know it, I happen to have an article that teaches you everything you need to know about crypto domain names here.

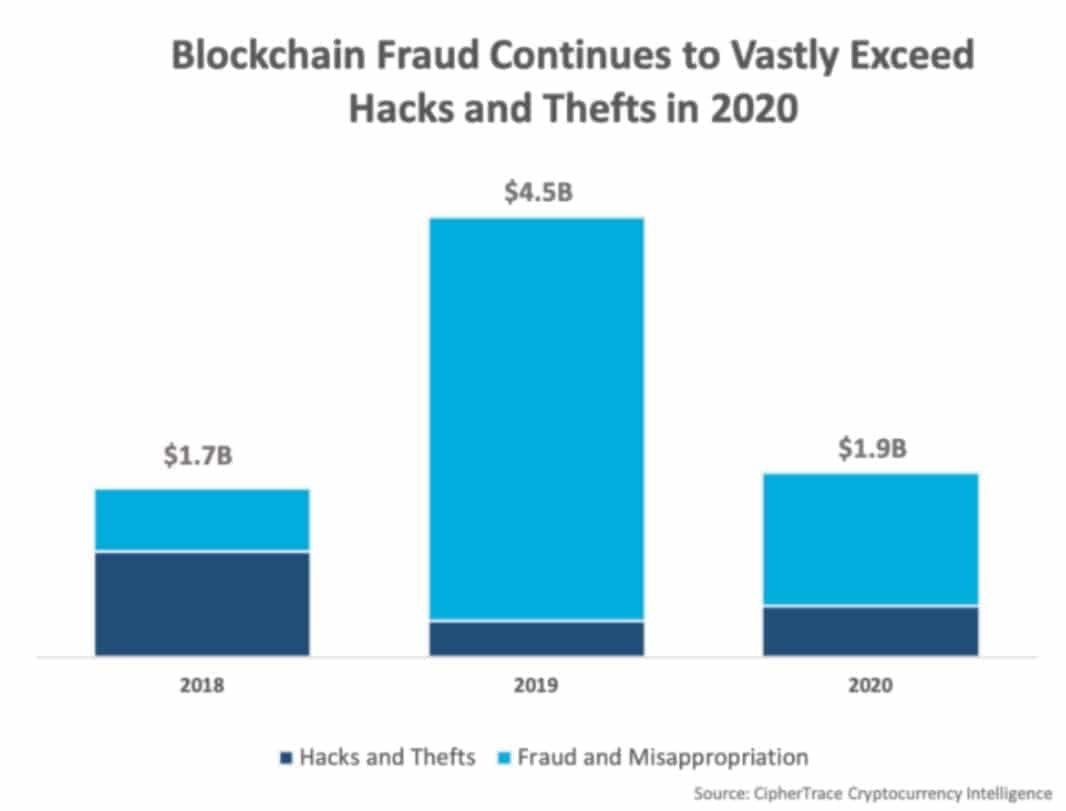

Another way that blockchain does not eliminate personal risk comes in the form of those pesky hack and scam cases which gives the entire crypto industry a heck of a black eye. Scammers and hackers are the worst, is it really that difficult to be an honest and decent human being and not ruin other people’s lives?

Anyway, banks often have comprehensive insurance plans and if your bank account suffers a hack, the financial institutions can often get those funds returned, or at least reimburse you if the hack was found to be a fault in their shoddy security systems. The same safety nets do not apply to crypto, especially with non-custodial wallets. If someone hacks a DeFi platform or wallet, there is a very small likelihood that you will ever see those funds again.

Regulatory Crackdowns

This is probably the biggest risk and that is the government stepping in to crackdown and impose restrictions on DeFi protocols and stablecoins. While many DeFi enthusiasts will state that it is impossible for the government to stop DeFi as there is no centralized entity to shut down, governments can impose such harsh penalties for using these platforms that it could drive people away from DeFi, preventing new innovation in the industry and agencies can go after the founders and the teams behind these platforms, even the people who make up DeFi DAO’s.

I think it is a bit naïve to think that it is impossible to stop users from using DeFi as we have seen entire nations such as China and North Korea block their people from accessing the internet itself, so while it is unlikely that western nations would take such extreme draconian measures to stop crypto innovation, I certainly don’t think it is, “impossible.”

We have seen DeFi users experience multiple scares in 2021 as the SEC issued a threatening warning against Coinbase for wanting to offer DeFi services and launched an investigation against Uniswap Labs which had a ripple effect through the entire DeFi market, driving an exodus of users away from the DeFi world. Regulatory crackdowns on centralized stablecoins such as USDT and USDC also pose a large risk as these stabelcoins provide the majority of the liquidity in DeFi markets and act as common on and offramps to DeFi, a stablecoin drought could also significantly dry up the world of DeFi.

Vulnerabilities in the Code

I have already briefly mentioned hackers and the world of crypto. While many DeFi protocols are coded by some of the most brilliant minds and are often run through plenty of third-party audits to ensure the security of the code, hackers are often one step ahead of the original developers and can find ways to exploit holes and vulnerabilities in the code and run off with thousands if not millions of dollars.

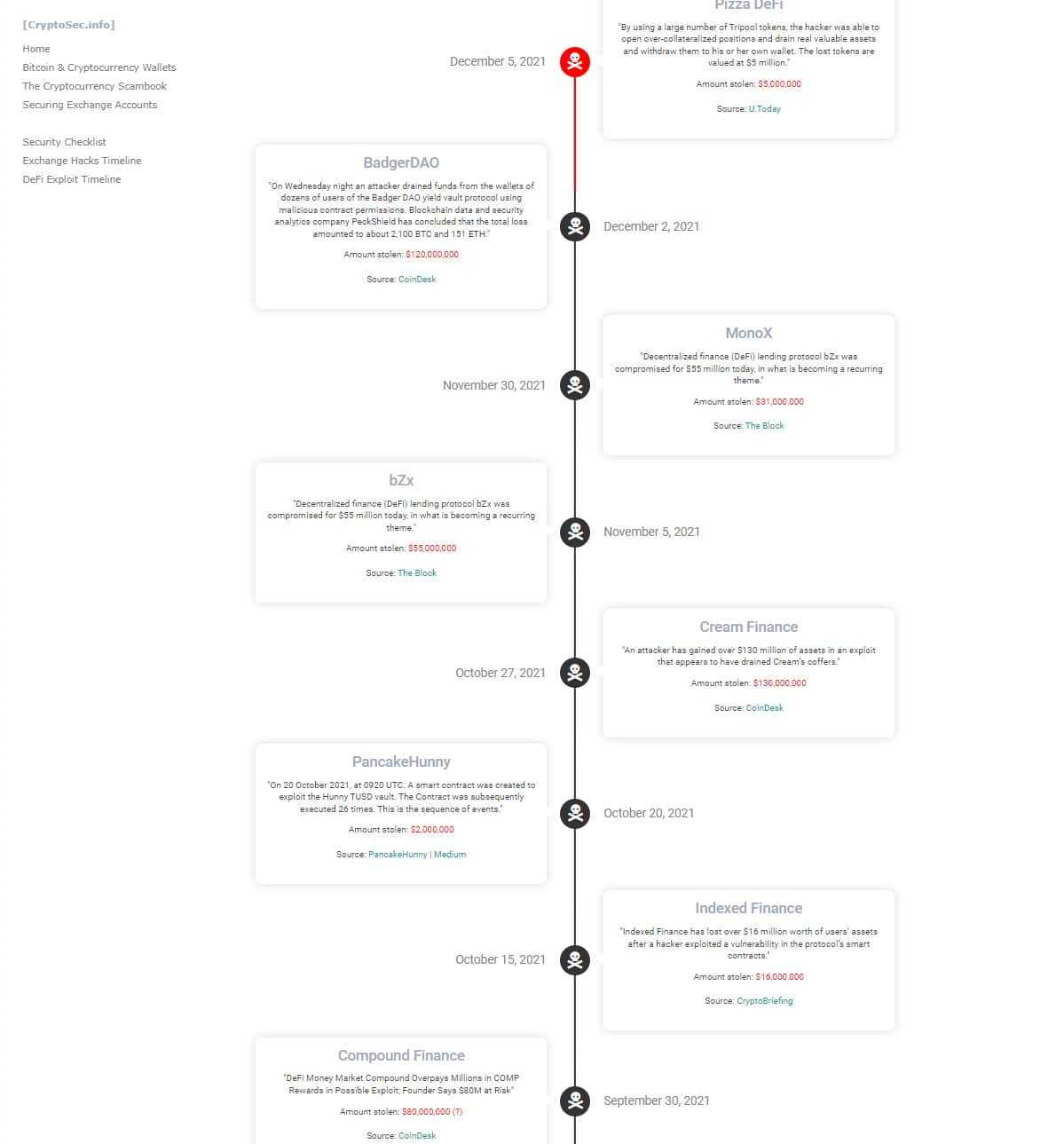

It is always very sad to see but not uncommon as we have seen dozens of hacks on DeFi protocols in the past year alone such as the Cream Finance hack where hackers made off with a hundred and thirty million dollars and the Compound Finance hack where hackers made off with eighty million dollars.

Lack of Liquidity

With DeFi applications becoming a dime a dozen, there is only so much liquidity in crypto to go around and it is being spread thin across all the Uniswap clones and Aave, Compound Finance and Maker wannabe’s, not to mention the introduction of lending platforms such as Celsius and BlockFi have taken some market share away from DeFi. This leaves many investors facing liquidity risks in the form of not being able to sell out of their assets as there is no money left or people available to take the other side of the trade.

We saw this earlier in 2021 after Shiba Inu skyrocketed turning many people into millionaires on paper, but unable to sell and lock in their sky-high returns as there was not enough liquidity in the market to convert the Shiba into other assets. This can leave many investors stuck holding the bag and unable to dump assets as they plummet in price.

Impermanent Loss

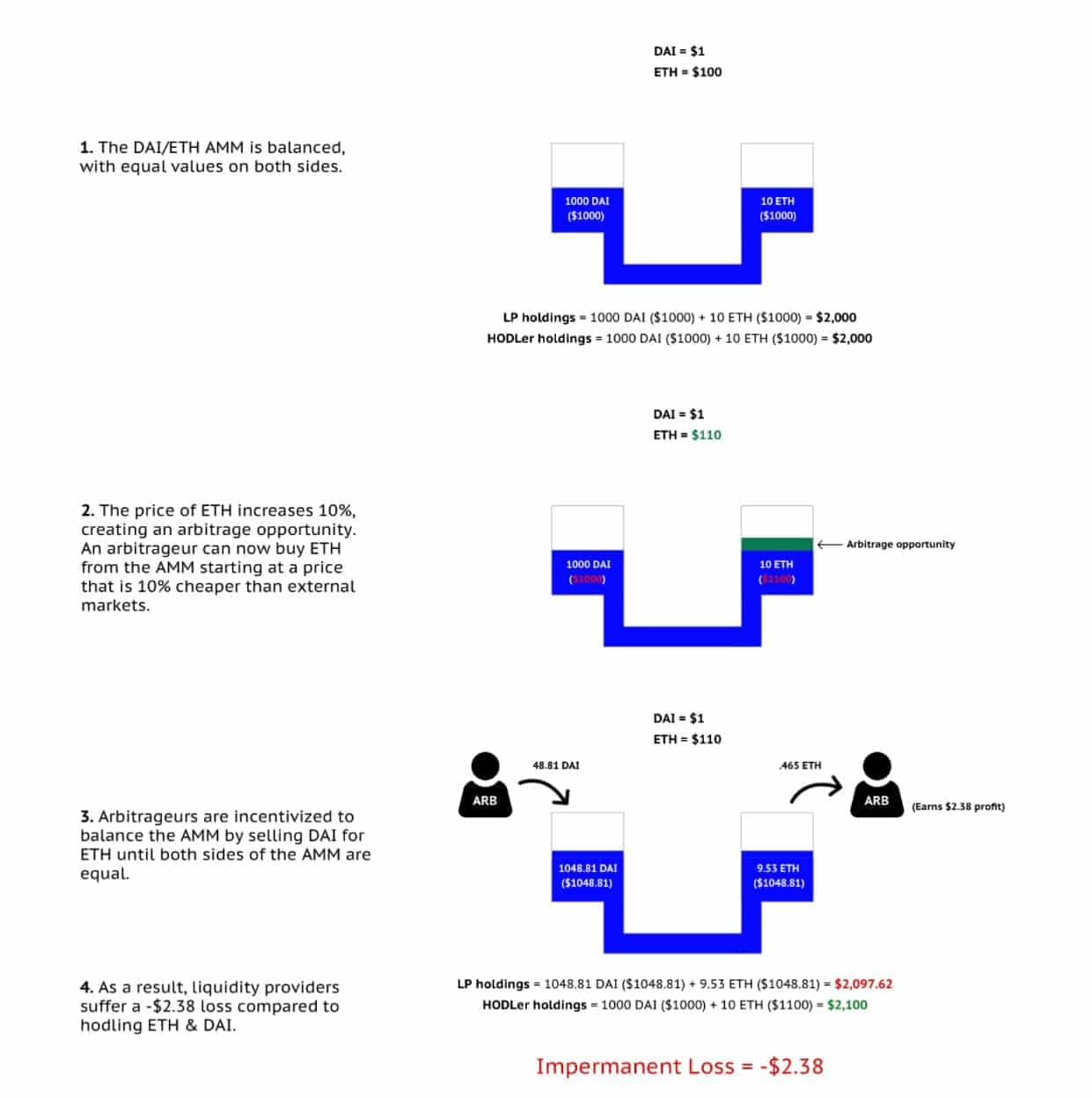

Impermanent loss is a risk involved when a user provides liquidity to dual-asset pools in DeFi protocols. It is the difference in value between depositing 2 cryptocurrency assets within an Automated Market Maker (AMM) based liquidity pool vs simply holding the asset in a cryptocurrency wallet.

Essentially, if the price of an asset drops as you lock your funds in a protocol, you experience an unrealized loss in the value of the asset and you are at the mercy of price volatility until you can withdraw the funds at a later date. You may not actually lose any money, but rather your gains may be less relative to if you had just left your assets untouched. Inversely, losses can be amplified depending on how the market moves.

The phrase earns its name because any losses are only accepted once the funds are withdrawn from the liquidity pool. Until then, any losses are only on paper and may reduce or disappear completely depending on how the market changes.

Flash Loan Attacks

Flash loans are a type of uncollateralized lending that is unique to DeFi. Flash loans are a type of unsecured loan that uses smart contracts to mitigate risks associated with traditional banking. A borrower can receive hundreds of thousands of dollars in crypto assets without putting up any collateral, with the catch being that the borrower needs to pay back the full amount within the same transaction it was sent which is normally within a few seconds.

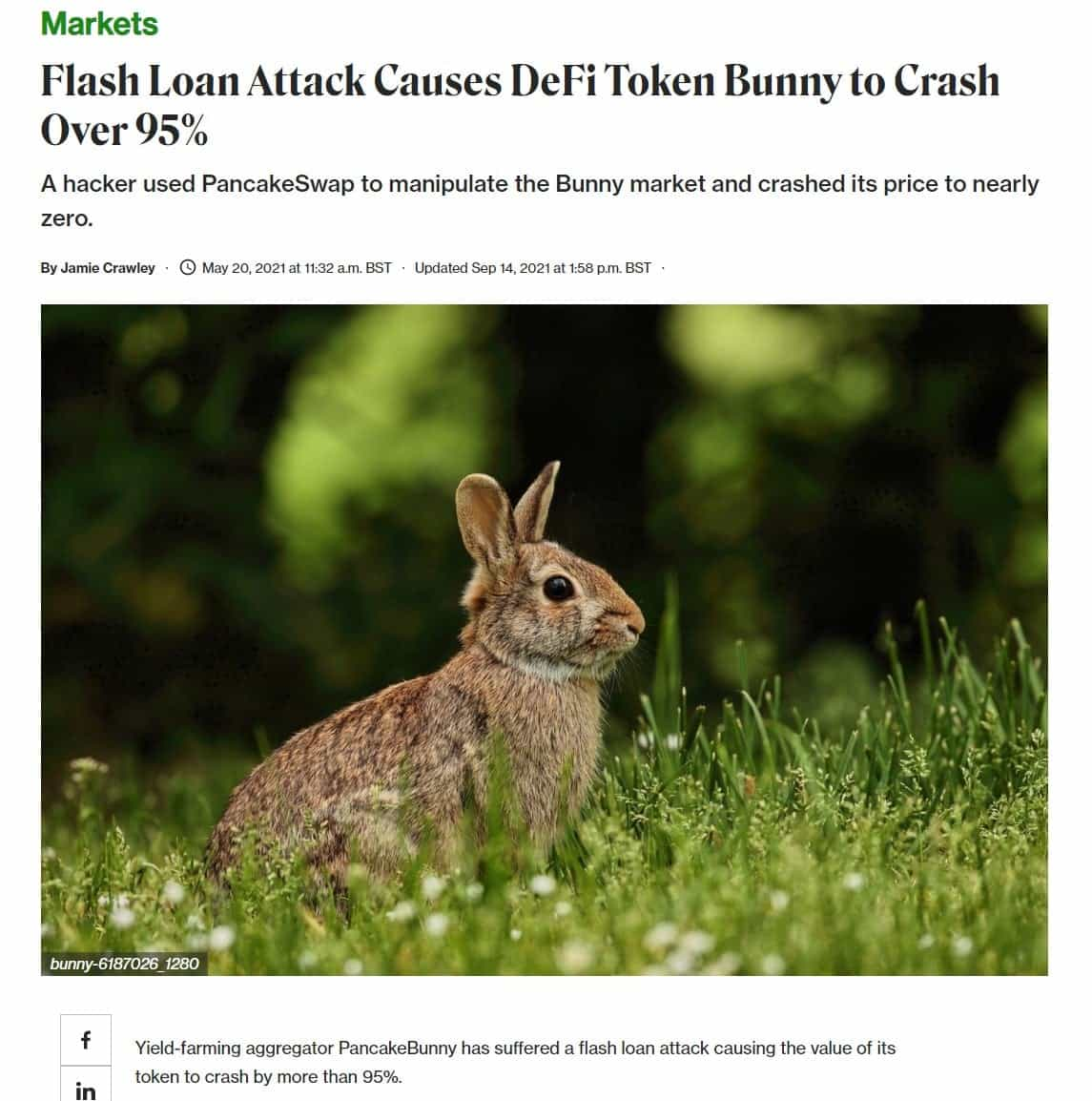

The attack comes when bad actors borrow massive sums of money and uses it to manipulate the market or exploit DeFi protocols to their own personal gain. This recently happened against the yield farming aggregator PancakeBunny as attackers flooded the protocol with capital causing the value of the PancakeBunny’s token to rise, then sold it all at once dumping the price resulting in a drop of 95%, crashing the price and leaving investors at a massive loss as the attackers walked away with about 3 million in profit.

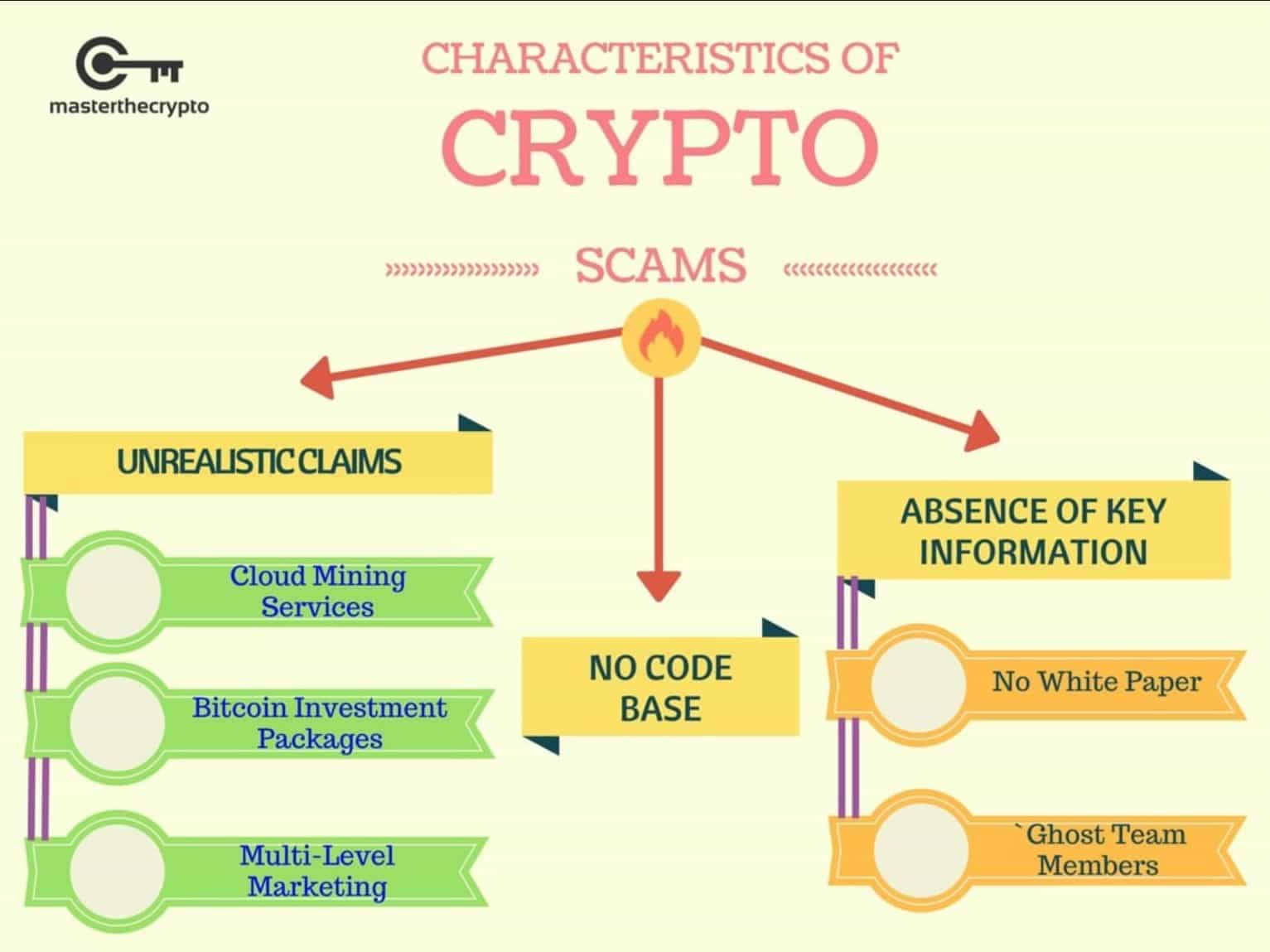

Rug Pulls

A rug pull is a type of exit scam where users create a crypto token, pair it to a leading cryptocurrency such as Tether or Ethereum and entice people to buy the token by promising some utility in a DeFi protocol or high yield returns. The people add the funds to the liquidity pool expecting high returns and once enough wealth is generated into the pool, the DeFi developers take advantage of a malicious back door that they intentionally coded into the smart contract and sell the popular cryptocurrency that the new token was paired with, leaving millions of worthless tokens in the pool.

Asset Risk

When borrowing funds on a DeFi application, users need to put up crypto as collateral and lock it in for a period of time, which is normally the duration of the loan. As cryptocurrencies are inherently volatile, if there is a sharp and significant downturn in value of the token that was put up as collateral, DeFi users can see their funds get liquidated.

Well, all that was depressing, but fear not, there are some ways to make the world of DeFi a safer place.

How to Minimize DeFi Risk

Stick to Tried and Tested DeFi Platforms

There are many DeFi platforms out there that have withstood the test of time and are still standing after an onslaught of hack attempts. This is always a good sign and it shows how robust and comprehensive the code is behind the platform.

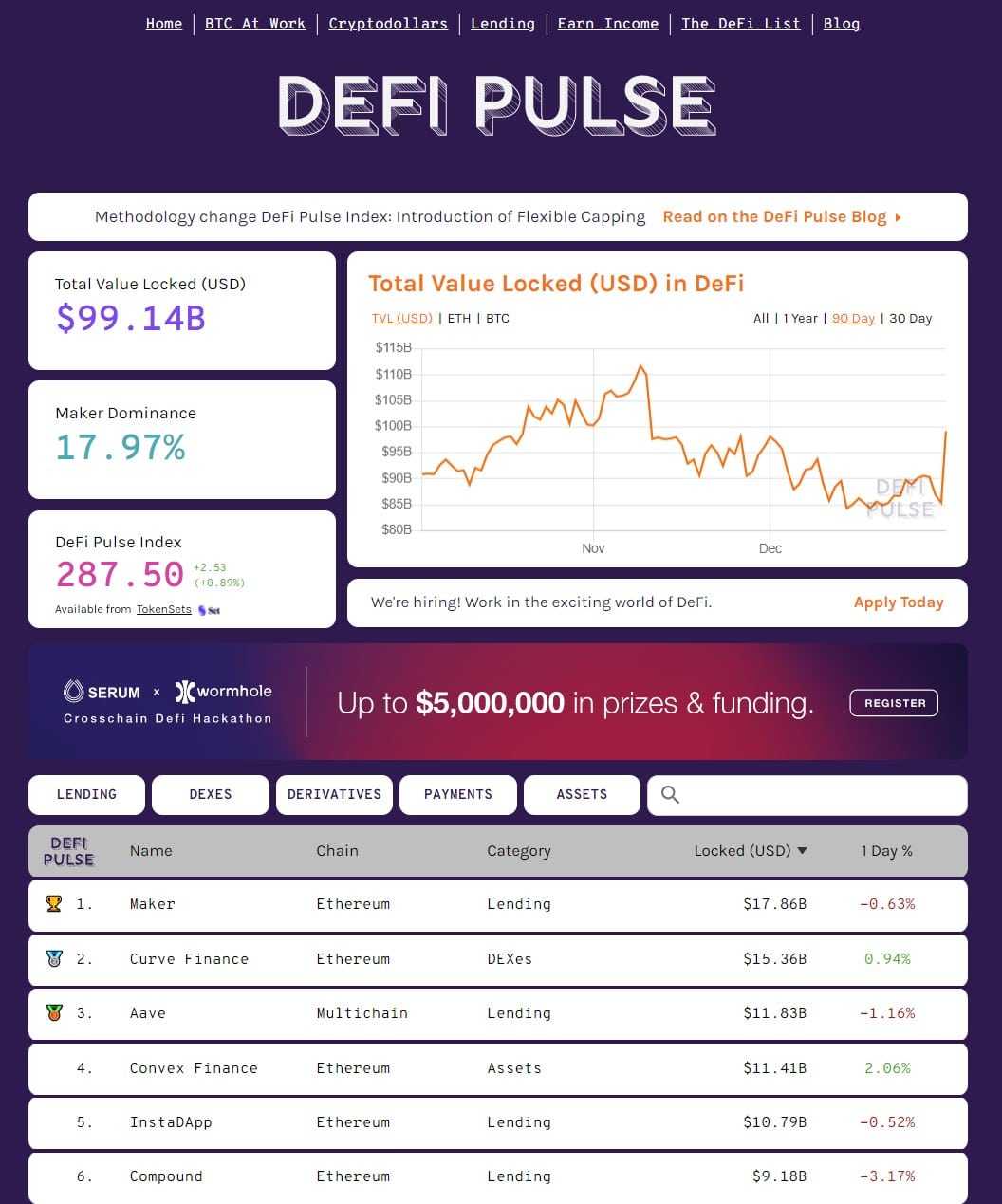

A good place to check is DeFi Pulse and stick to the top DeFi protocols as it is easier to be confident in the “blue chips,” of DeFi Platforms. This is comparable to thinking: what is a safer investment? Putting your funds into Bitcoin or some meme or food inspired coin that doesn’t even appear on Coinmarketcap with no whitepaper or information about the team? Blue chips and highly reputable projects are always the safer bet.

Look for Independent Audit Checks

There are many Blockchain security companies that offer audit services for crypto companies and platforms. These guys are essentially super-nerds, true coding experts who will meticulously comb through the programming code that make up DeFi protocols and ensure that there are no weaknesses that hackers could exploit or malicious back door clauses. When I am considering a DeFi platform, or any crypto platforms to park my funds, I always check to make sure they have passed external audits.

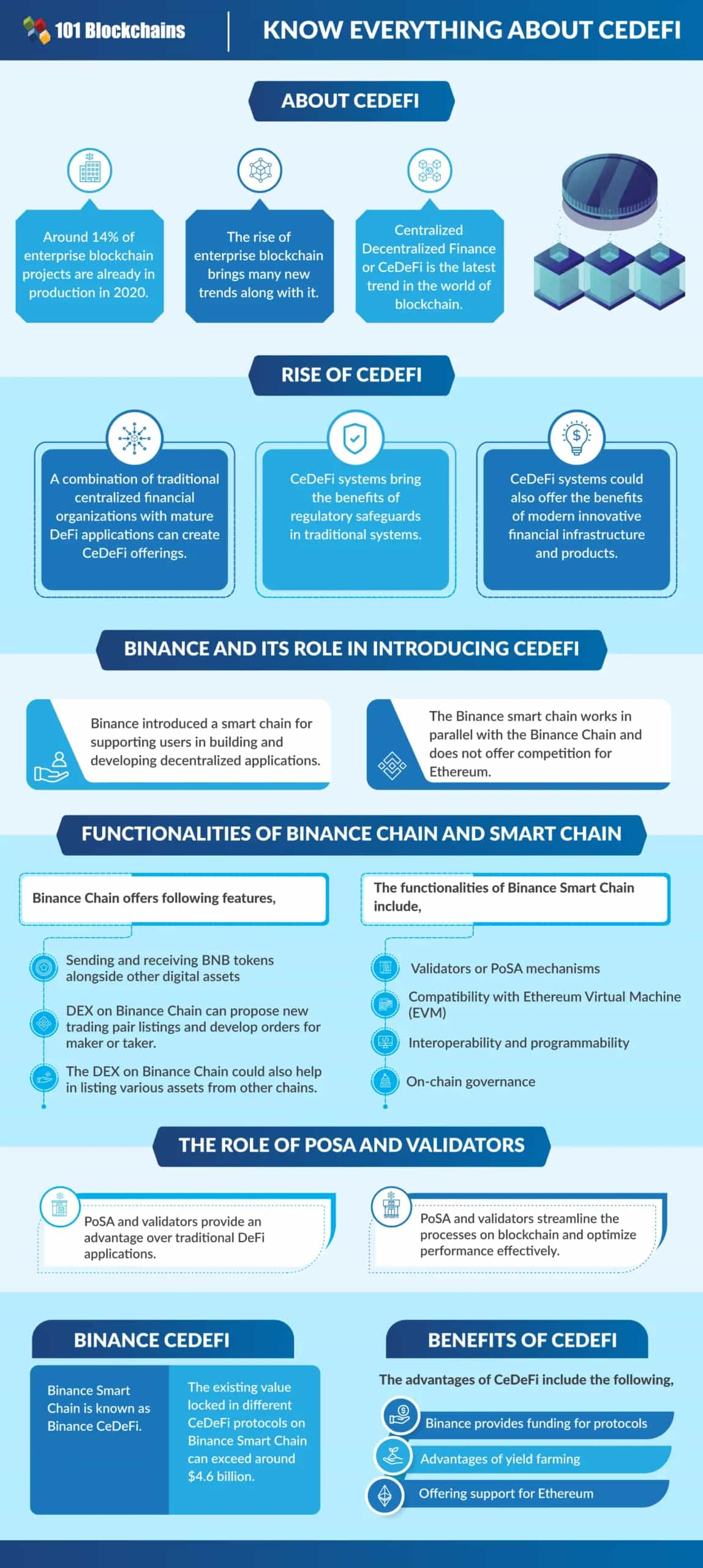

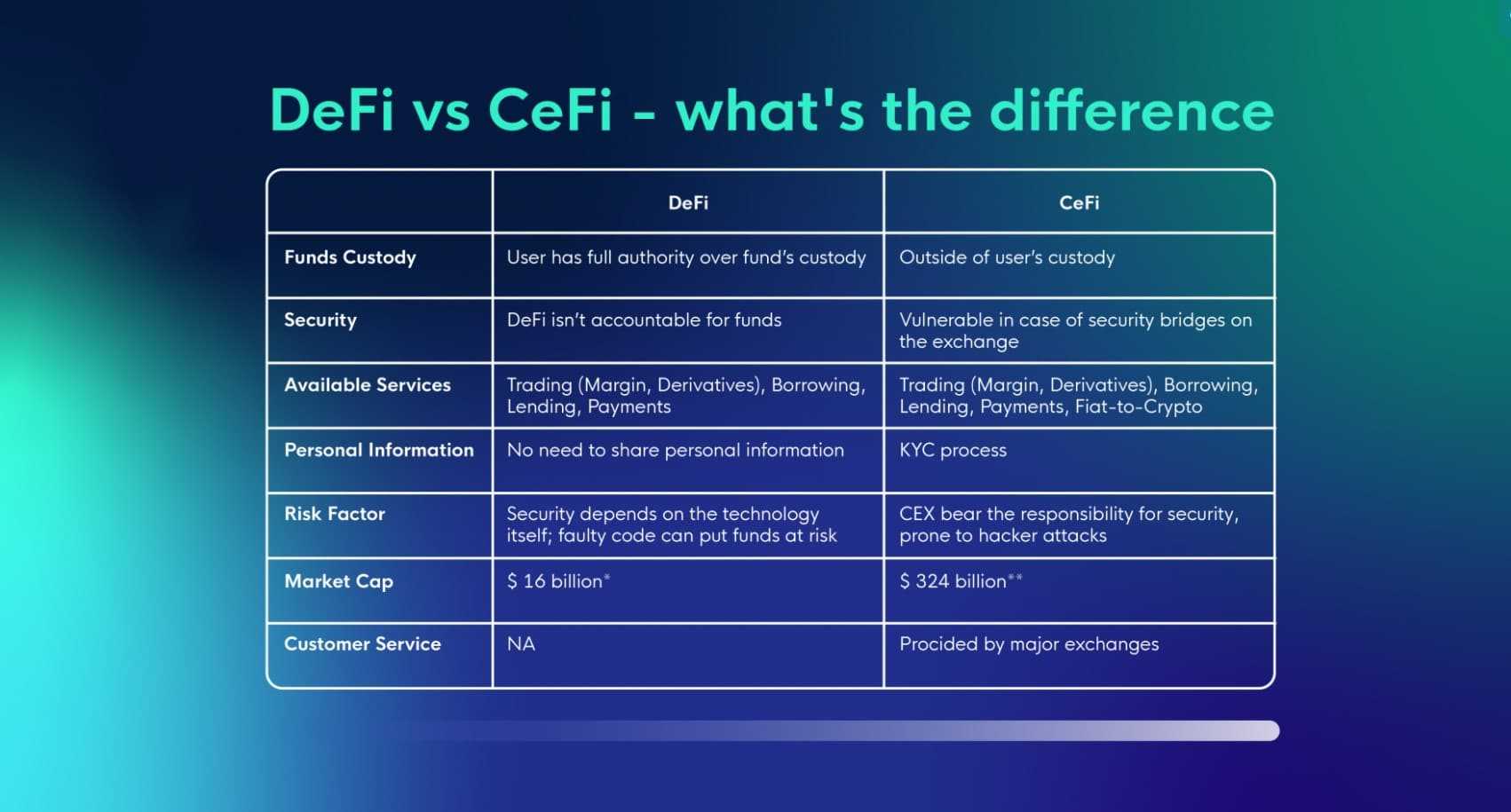

Consider Centralized Decentralized Finance (CeDeFi) or Centralized Finance (CeFi)

Huh? I know it is a bit of an oxymoron, centralized decentralized finance has caught the attention of many enterprises, investors and crypto enthusiasts. The primary goal for CeDeFi focuses on bringing together the best that centralized finance and decentralized finance has to offer. This model allows for traditional financial institutions to offer the same benefits as DeFi, while also providing the safeguards of traditional finance such as consumer protection, verified regulation, and insurance.

The most prominent example of this is the world’s largest crypto exchange Binance offering DeFi services on their platform and the introduction of the Binance Smart Chain network. Binance was arguably the first platform to offer CeDeFi, but it opened up a world of possibilities for traditional financial systems to also be able to get involved and offer their clients DeFi comparable products and features.

Check out our article on the Top 5 CeFi Lending platforms if you feel that may be more your speed.

This is a good alternative as Binance offers a level of protection to investors and are willing to pull from their own treasury to reimburse clients who suffer hacks, and there is always a customer service rep available 24/7 to help users get back into their accounts if they forget their password. This is beneficial for anyone who does not trust themselves with all the responsibility involved in taking self-custody of their funds and managing their own private keys as is the case with non-custodial wallets and traditional DeFi.

Though, of course, the biggest downside being anytime there is a centralized entity involved, they ultimately have full control of your funds and what the user holds is essentially an IOU from the exchange.

Another advantage of CeDeFi is that the exchange will vet the projects to ensure authenticity, there is no need for complex integrations between wallets and DeFi protocols, the DeFi benefits are more easily accessible, and there can often be lower transaction costs and faster transaction speeds.

Using CeFi platforms like Nexo or Crypto.com and CeDeFi can also often help reduce liquidity risk as there are often millions, if not billions of dollars revolving around the ecosystem meaning that trying to unload and sell crypto positions will likely not be a problem. And that Segway leads us into the next way you can reduce some risk.

Check for Liquidity and Total Value Locked (TVL)

This brings us back to our friend DeFi Pulse where we can find out the financials behind DeFi platforms. The more money locked up and liquid floating around in a platform the better chances that you will be able to lock in profits when the time comes.

If you are a bit unclear on why this is important, say you and I are the only two people who hold dog coin number 54 on a DeFi platform. Elsewhere, a whale comes in and buys up dog coin 54, skyrocketing the price of dog coin to a kajillion dollars. Now you and I are both kajillionaires which is great!..... on paper. But who are you going to sell your coins to? I’m not buying your dog coin 54 at a kajillion dollars and you aren’t buying mine so neither of us can realize our profits.

That of course is a very dumbed down and simplified explanation of liquidity but you get the point. You can find out more about the importance of liquidity in this "what is liquidity and why is it important" article.

DYOR (Do Your Own Research)

Before putting money into any DeFi platform it is always a good idea to do your own research. A great place to start is by looking into the project, have a browse through its website, check the whitepaper, and this is just a personal opinion, but I do not invest in any platform that has an anonymous team. I want to know who the team is behind a project, ensure that they are qualified to make a great and safe DeFi platform and being known to the public makes the platform less likely to be a rug pull.

Check for community discussions and reviews on sites like Reddit and check out DeFi Safety which is an independent rating organization that evaluates DeFi products and platforms providing a security score based on transparency and adherence to best practices.

Open Source is a Good Sign

While you don’t need to understand programming code, one really positive sign of confidence is code that is open source, available for anyone to go in and verify. Open source code means that the team has used code to build a platform that anyone can go in, scour through and verify to ensure that there is nothing malicious hidden in there, and coding experts can verify for themselves that there are no holes that can be easily exploited or flaws in the program.

While this is by no means a bulletproof method, I would rather invest in a DeFi protocol that had its code criticized and combed through by thousands of programmers checking for authenticity and security as opposed to a project that doesn’t allow their code to be seen by anyone external.

Keep Your Wallet Safe

Of course, keeping your wallet safe is like crypto 101 and stands true with DeFi. It is very important that your private keys remain private, and your recovery phrase is written down, NOT stored online where hackers can get access, but written down and kept someplace secure. If a user loses access to their device, their computer or phone crashes or gets stolen or they are logged out of their non-custodial wallet, there is no force on earth that will be able to help get you back into your wallet nor recover your funds without your password and/or recovery phrase.

It is also important to be aware of scams such as sim swapping and airdrop scams that trick people into approving transactions on scam websites or falling for bad actors pretending to work as a member of customer support for a crypto company. Remember that nobody will ever ask for your private recovery phrase, aka secret phrase, aka seed phrase, nor password or private keys, make sure that information is always kept private. Check out Guy's comprehensive video on safe crypto storage.

Closing Thoughts

The world of DeFi is a wonderful place, providing people with opportunities to achieve a level of financial health not possible in the traditional financial system, and providing millions of people anywhere in the world access to a financial system where they have no access to banks.

Though, like any technological innovation, this revolution is not without its risks. While nothing in the financial world, traditional or decentralized is ever 100% risk-free and there are always risks present, by being careful, doing your research, being skeptical and using due diligence and not falling for things that are, “too good to be true,” you can take the reasonable steps necessary to navigate DeFi with as little risk as possible.

DeFi is enjoyed by millions of users every year, with the majority of people never falling victim to the risks that are present. I have been using DeFi without issues for a long time now and I am certainly no genius.

In fact, many who know me would laugh at the very concept as I am about as average as they come. Maybe even below average as I was well into my adult life when I found out that yoghurt was a diary product and I thought the word "height" was spelled "hight" for an embarrassing number of years, and one time I was walking around the house looking for my toothbrush....as I was brushing my teeth. If I have been able to navigate DeFi successfully for this long, I am confident that anyone can!

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.