The holy grail of crypto is mass adoption: a future in which people across the world use digital currencies to pay for goods and services on a daily basis. However, there’s a lot that needs to change before we see people regularly paying for their morning coffee with XRP or using ETH to pay for their weekly grocery shopping.

If we all simply sit around and hodl our crypto, then mass adoption is never going to happen. We need to spend it - and be able to spend it - if we want to see it mount a meaningful challenge to the fiat status quo.

The emergence of crypto debit cards is starting to play a key role in this respect, enabling users to spend their crypto easily and safely. Many also offer some enticing perks and incentives, making them an attractive alternative to the old guard of fiat debit cards used across the world.

More crypto debit cards are appearing all the time and it can be difficult to choose which one may be right for you. Each has its own benefits and rewards and some will only be suitable for those living in certain countries or regions. There’s a lot to consider when deciding which card to go for.

So, to help you make that decision and start putting your crypto to work, we at the Coin Bureau have drawn up a list of the seven best crypto cards available right now.

Best Crypto Debit Cards

Here are our top picks:

1. Crypto.com

Starting off with the biggest, and often credited as being the best of them all, is the massively popular Crypto.com card. There’s a card to suit every lifestyle at Crypto.com, from those who treat themself to an iced latte every so often, right through to the type who has their chauffeur pull over outside Van Cleef and Arpels.

The Crypto.com card was an instant hit in the crypto community thanks to its solid metal material, beautiful design, and impressive cashback + rewards. This card is perfect for anyone who wants to flex and gain some attention when it comes time to pay the bill; slapping that 10-gram metal card down on the table turns some heads.

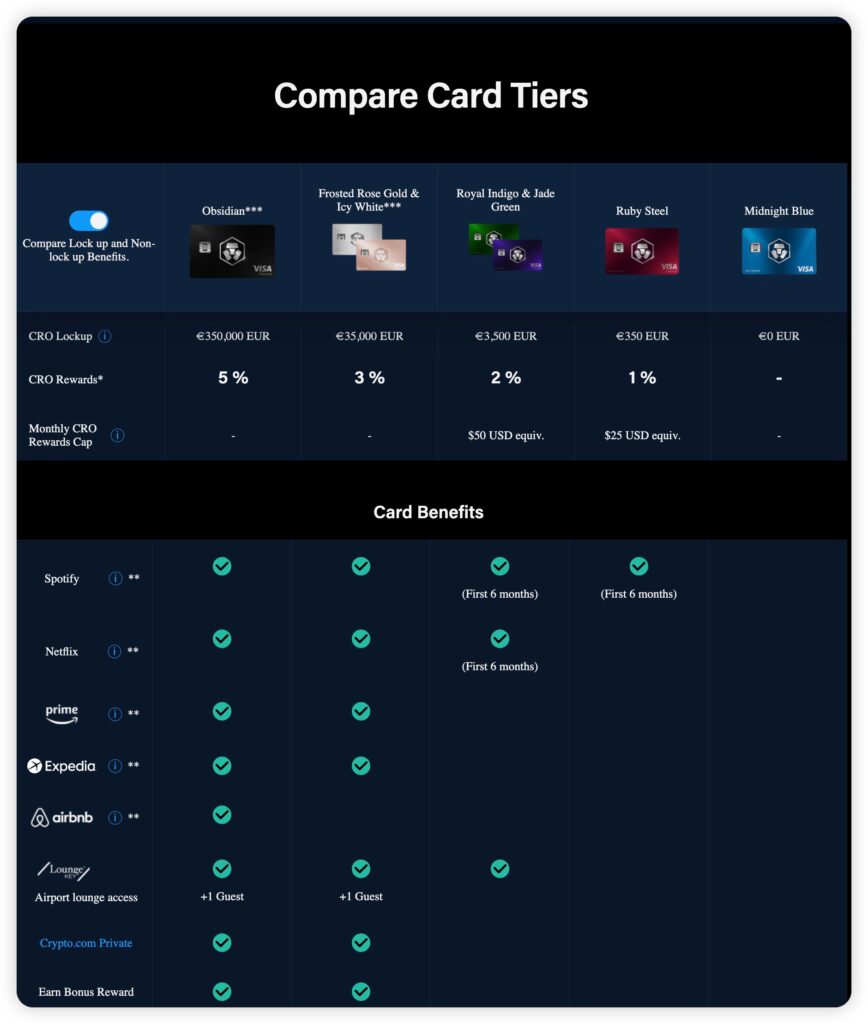

Most Crypto.com cards require you to stake a certain amount of their native CRO token to qualify for higher levels and greater perks. If you want the top-tier Obsidian card, then you’ll have to front up about 350k worth of CRO... No small feat. That is a bucket load of cash, but one of the perks is a private jet partnership, so yeah, this card tier is for the high-rollers out there.

Fortunately, there are cheaper options available and these still offer some great value. It’s worth noting that the staked CRO tokens are returned after a lockup period and can be sold back to cash if you decide you don't want the card perks anymore.

The two cards we’ve picked out are the entry-level Midnight Blue card and the Ruby Steel. The Blue card doesn’t require you to stake any CRO and is free, making it perfect for anyone who just wants to be able to easily convert their crypto to cash and spend with no perks and own a cool metal card.

The Midnight Blue allows for a free €200 ATM withdrawal per month, €2,000 daily limit, and a 25k limit for PoS purchases.

The Ruby card is the next step up and is the most popular in the range. This card comes with 1% cashback paid in CRO tokens and a free Spotify subscription for the first 6 months. To get this card, users need to stake €350 worth of CRO for 6 months.

The Ruby card comes with a €400 ATM withdrawal limit for free, and like all the Crypto.com cards, there are no monthly or annual fees, or any fees at all assuming you don't go over the spending limits.

With these cards, you definitely want to be careful not to lose them as there is a hefty €50 fee to have a new one issued. Along with perks like free Spotify and Netflix and cashback, these cards are also great for travelling within the EU and UK as users get to enjoy the interbank exchange rate so there are no horrendous fees for currency exchanges. The Crypto.com card is also available to Americans located in 49 states, offering the same perks and benefits.

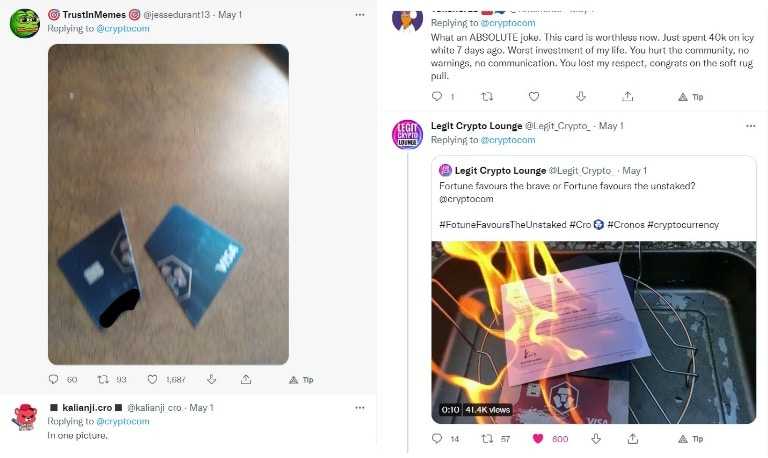

It is worth noting that the card perks used to be far better than they are now. Unfortunately, as the crypto markets took a turn for the worse in 2022, the Crypto.com team had to significantly reduce the rewards and perks people were receiving. To put it lightly, the community was a little more than upset as you can see from these Tweets:

The reduced perks even affected Guy and some of our staff here at the Coin Bureau as we were heavy users of the cards and many customers felt they were treated unfairly, accusing Crypto.com of spending too much money buying arenas and paying for sports partnerships to take care of their customers.

Even with the nerfed perks, I still feel the Crypto.com card is the best on the market, and being able to do all your crypto trading, buying and selling crypto for fiat, and spending with the card, all controlled from one app is a real game changer. You can learn more about what makes Crypto.com a great "all-in-one" platform in our Crypto.com Review.

2. Nexo

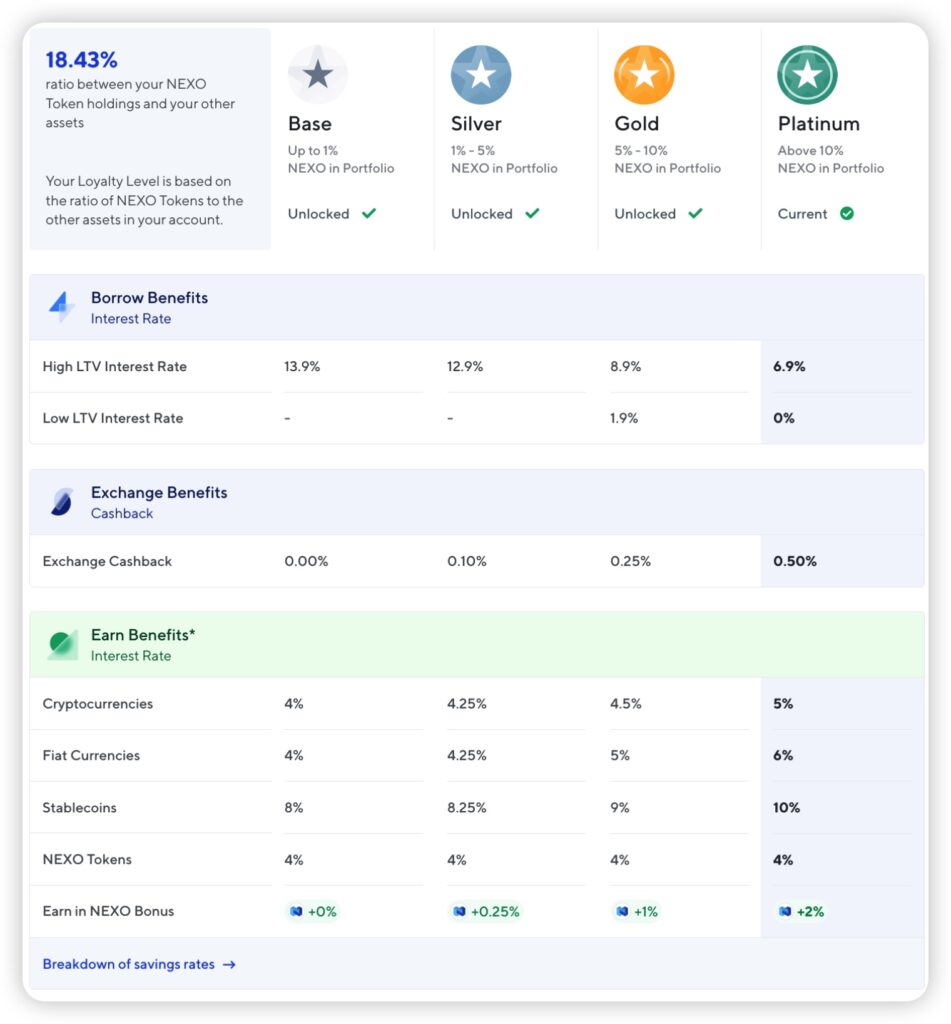

Nexo is the only card I am aware of that allows you to spend your crypto without selling it. How is that possible? Well, by collateralizing your crypto, Nexo offers card users a credit line in which they can spend. It's like having your cake and eating it too, pretty sweet!

The Nexo card will give you credit in over 45 fiat currencies, based on the value of your crypto holdings. There’s an impressive list of supported coins here too, so most portfolios should have access to credit.

The card itself is a MasterCard, so using it almost anywhere shouldn’t be a problem. There’s instant cashback on all purchases and you can make payments in local currencies, avoiding those pesky foreign exchange fees with limits depending on loyalty tier. Another great thing about the cashback on this card is that you can choose which cryptocurrency you want your cashback paid in. If you opt for the NEXO coin, you can earn 2% cashback, or go for 0.5% cashback in BTC.

There are also no monthly or annual exchange fees to worry about, and credit line rates start from 0% APR depending on tier level.

As far as limits go, basic users can enjoy 1 free ATM withdrawal per month, while platinum users get 10. There are also no monthly, annual, or inactivity fees in sight. As for transaction limits, those can be found here:

Transaction limits:

- Monthly: up to €60,000 / £54,000

- Daily: up to €10,000 / £9,000

- Per single transaction: up to €10,000 / £9,000

ATM withdrawal limits:

- Monthly: up to €10,000 / £9,000

- Daily: up to €2,000 / £1,800

- Per single withdrawal: up to €600 / £540

Getting your hands on a card is easy, as there are no credit checks or long application processes. Nexo itself is a subsidiary of Credissimo, so it has backing from an established fintech player. Note that the NEXO card is not available to US-based users.

3. Monolith

Time for the first mention on the list that DeFi lovers will appreciate. The Monolith card is one of the very few non-custodial crypto debit cards on the market. If your bank or custodial card provider goes bust, there's a good chance your funds go bye-bye. Look at what happened with FTX.

The Monolith site states that the card is "Apocalypse Resistant." Because the card is attached to a user's self-custodial Ethereum wallet, there is no company that can go bust, blow up, or fall victim to a zombie outbreak, which will result in the user losing their crypto assets. This, my friends, is what crypto self-custody is all about.

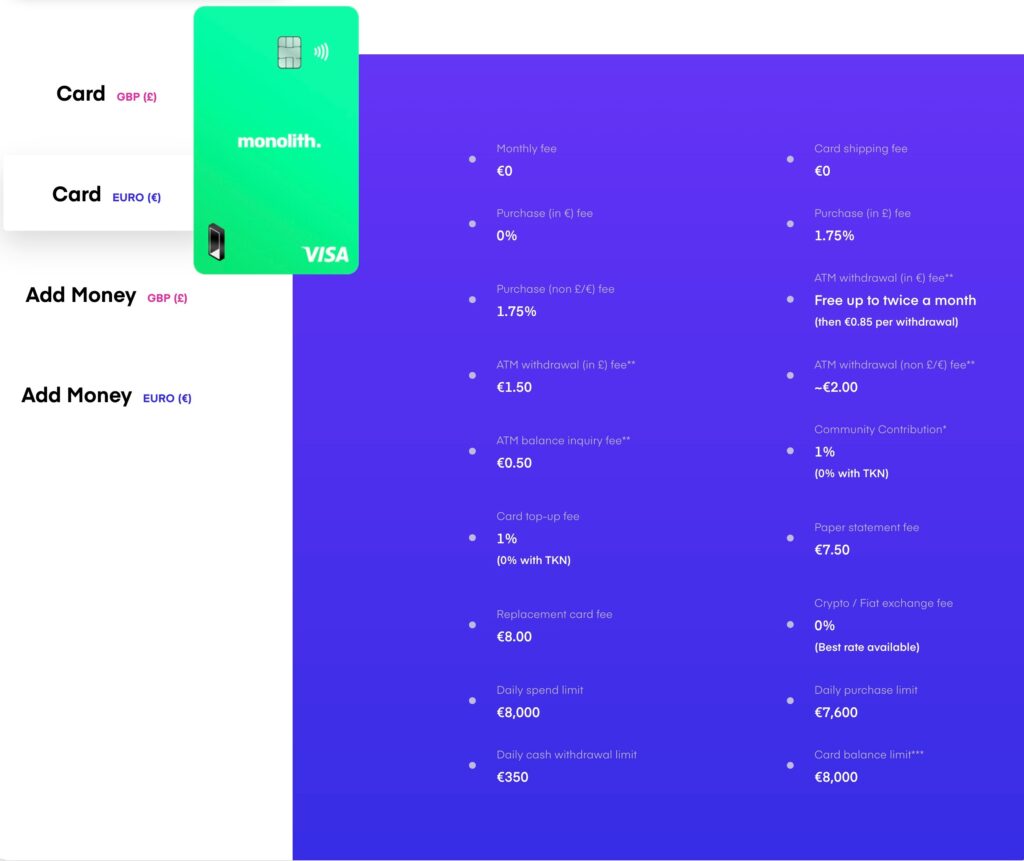

Monolith is a DeFi application built on Ethereum, so the card itself supports all ERC-20 tokens. You load the card with any ERC-20 token of your choice and then spend the funds through its Visa-backed fiat gateway.

This means it’s accepted almost anywhere, allowing you to spend your crypto wherever you please. The accompanying app helps you track your spending and the Monolith non-custodial wallet is open-source: great news for those who want to assure themselves that everything is above board.

The Ethereum tokens do need to be converted to fiat first within the app before they are spent, unfortunately, as most places are not equipped or ready to accept payments in ETH. The downside of this card is that there are no cashback perks or rewards, but that also means the fees are nice and low for anyone wanting to take the responsibility of being their own bank. Here is a look at the fees and limits breakdown:

Further drawbacks are that this card is not currently available to US customers and the fact that it’s Ethereum only, which means a lot of tokens (Bitcoin most notably) can’t be used with it. This card is a great choice for anyone wanting to "unbank" themselves. Another card to consider that works in a similar fashion is the Plutus card.

4. BlockCard

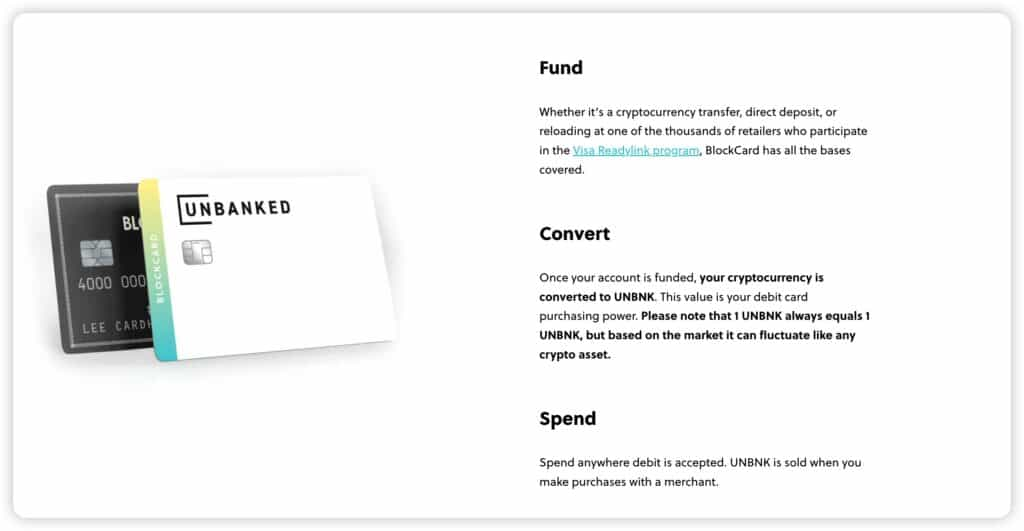

Back to US and global-friendly crypto cards. The Unbanked Blockcard is another great choice for those who want to spend crypto, and enjoy perks with low fees.

The BlockCard is essentially a Visa debit card, which is preloaded with crypto in much the same way as most of the other cards on this list. It supports an impressive list of crypto assets that is only growing. There are also no deposit exchange or withdrawal charges in sight.

There is one thing worth noting that makes the Unbanked Blockcard different to most of the other cards out there, and that is that a user's crypto remains as crypto right up until the point of sale. This means you can hodl your Bitcoin, and it will remain in BTC right up until you make the purchase. This is in contrast to most crypto cards where you have to mass sell crypto to fiat, then preload the card with dirty dollars or euros.

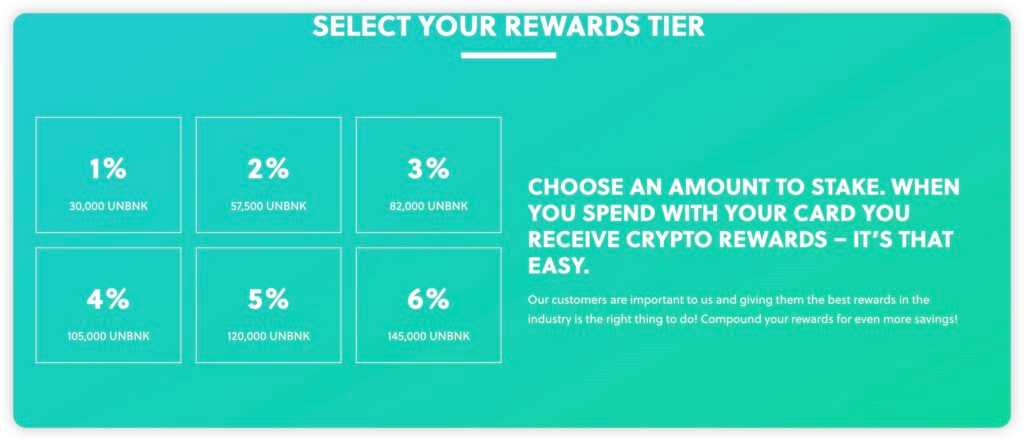

It’s also rare to find a crypto card that works with Apple and Google Pay, so this integration is a big plus for BlockCard and should make life that little bit easier for users. You’ll need to complete KYC procedures in order to get your card and there are rewards available too, although you’ll need to stake UNBK tokens in order to qualify. Here is a look at the staking limits and cashback you can earn:

The top rate is a whopping 6% which isn't bad at all, but for that, you will need to stake 145,000 UNBK, which is currently worth approx. $630.

This is one of the best staking returns out there for the lowest entry point, so if you feel Unbanked has a future, it may be well worth getting in at this level, especially for our US-based readers.

5. Wirex

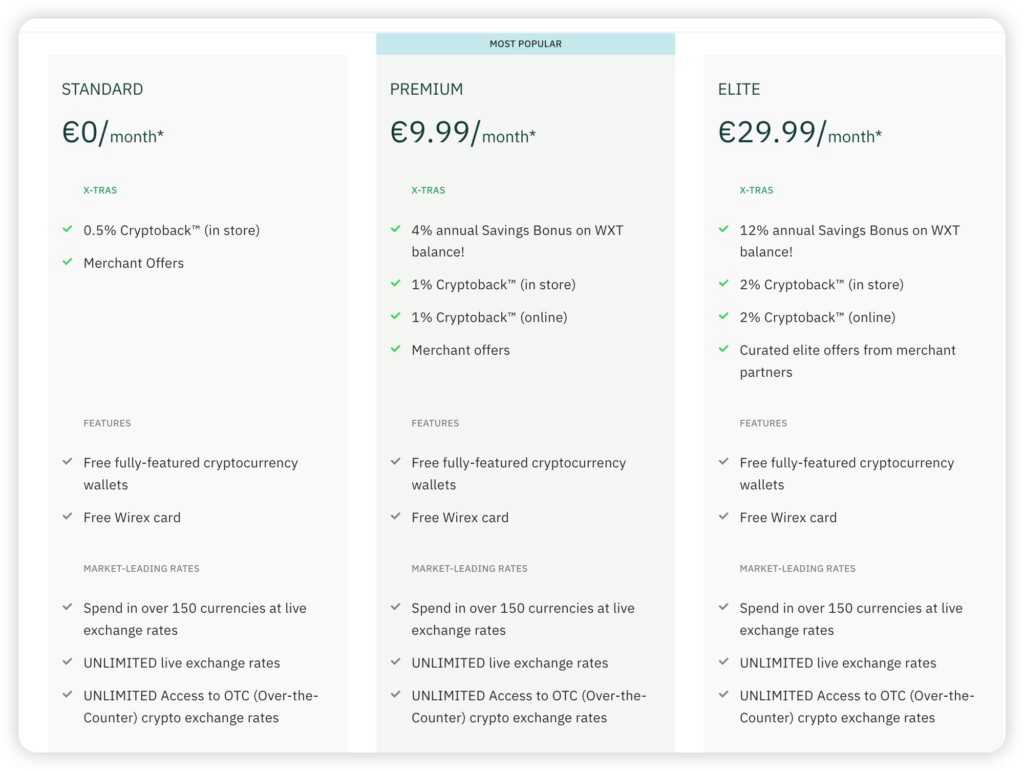

Here’s another Visa-backed card that you preload with your crypto. It supports a great list of supported assets, fiat currencies, and is available in dozens of countries around the world. Wirex is a great card for anyone interested in travelling or holding currencies other than their national money. The cashback rewards are also quite good, though it's only paid back in the platform's WXT token.

Wirex also offers a decent crypto cashback return of up to 2% in WXT for spending with the card, and X-Accounts, another cool feature, which are Wirex's versions of savings accounts that can earn up to 12% APY.

Wirex is a pretty robust app that allows users to exchange crypto, put funds in savings accounts, and apply for credit lines.

The card fees are pretty good too. There are no card issuance or replacement fees, topping up your account up has a 1.99% fee, there is no fee for fiat exchange services, no ATM fees up to €400 for the free plan, and the other perks and bonuses will depend on your monthly subscription. You can see the plans below:

If you don't mind the hefty monthly fees, Wirex is a great pick for anyone interested in juggling multiple different fiat currencies, swapping for crypto, spending crypto, and being able to earn a fantastic savings APY all in one place. If you have enough to deposit into the savings products that 12% APY may more than be enough to cover the monthly costs of the subscription.

6. BitPay

Here’s another option for those of you in the US - and soon for Europeans as well.

The BitPay card is backed by Visa and, as above, you preload with your crypto and get spending. As with Wirex, the limits allow you to live the high life, should you so wish. You can hold a maximum balance of $25,000; the daily spend limit is $10,000 and if you like to make it rain then you can withdraw up to $3,000 per day.

ATM withdrawals cost $2 in the US and $3 abroad and if you spend outside of the US then there’s a 3% fee for every transaction. Just be sure to keep spending regularly though: there’s an inactivity fee of $5 per month if you don’t use the card for 90 days.

These fees aren’t too bad and the spending limits should allow you to have a good time, unless your tastes have gotten out of hand. However, BitPay is lacking in other areas. It supports a fairly limited range of coins and there’s currently nothing doing in terms of rewards or cashback offers.

The BitPay card falls a long way short of most of the other cards here, but it does at least offer some extra choice for those of you in the US.

7. Coinbase Card

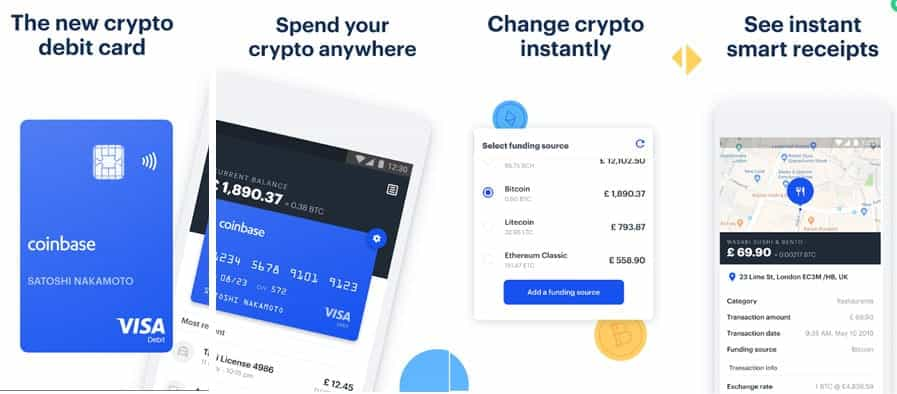

Ah, Coinbase: a name familiar to almost anyone with even a passing interest in crypto. It’s been the starting point for so many on their journey through the cryptoverse and it’s hardly surprising to see that they too offer a crypto card.

The Coinbase card supports nine different cryptos and is available pretty much anywhere in Europe. They are ‘working on expanding the offer to additional markets,’ so if you don’t live in Europe then you’ll just have to wait or go for another option.

However, it’s the fees that let this card down. The good people at Coinbase seem to have gone for the option of squeezing a fee out of their users wherever they can. If you withdraw more than £200/€200 a month from an ATM then you’ll be charged 1% on that excess. Use it abroad and it’s 2%. Foreign exchange fees are 3% and then there’s a crypto liquidation fee of 2.49% just to put the icing on the cake.

The daily spend limit is £10,000/€10,000, though these can be changed if desired and the daily ATM withdrawal limit is £500/€500. Domestic purchases don’t incur a fee, which is something. The GBP/EUR parity is rather strange but it does at least keep things simple.

Although Coinbase is a big player in crypto and has the sort of top security you’d expect, the fact remains that using the card is going to cost you a lot more than many of the others we’ve covered here.

Best Crypto Debit Cards: Conclusion

And there we have it, the Coin Bureau's top seven crypto cards. There are many different factors to bear in mind when choosing yours and we hope this handy guide has made that choice a little easier.

Spend those coins wisely (unless you’re an Obsidian card holder, in which please feel free to go bananas) and remember that every time you flex that plastic, you’re driving us that closer towards mass adoption. Bottoms up.

Frequently Asked Questions

Crypto debit cards are physical or virtual cards that allow users to spend their cryptocurrencies at merchants that accept traditional debit cards. These cards typically convert the user's crypto holdings into fiat currency at the point of sale.

Using a crypto debit card allows users to spend their cryptocurrencies for everyday purchases, bridging the gap between the crypto and traditional finance worlds. Some cards also offer perks such as cashback rewards, no foreign transaction fees, and compatibility with mobile payment systems like Apple Pay and Google Pay.

Crypto debit cards work by linking the user's cryptocurrency wallet to the card, allowing them to load their crypto holdings onto the card and spend them at merchants that accept debit cards. When a purchase is made, the card automatically converts the crypto into fiat currency at the current exchange rate.

Yes, there are typically fees associated with using crypto debit cards, including card issuance fees, ATM withdrawal fees, foreign transaction fees, and currency conversion fees. Additionally, some cards may have monthly or annual subscription fees, as well as fees for inactivity.

Yes, most crypto debit cards can be used for online purchases at merchants that accept debit cards. Users can typically enter their card details, including the card number, expiration date, and CVV code, to complete the transaction.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.