The Ethereum Network is the central platform for blockchain innovation. It pioneers new use cases and provides a secure and decentralized bedrock over which smart contracts power can create decentralized applications. These apps range from finance, games, and Defi services like liquid staking to NFTs and games. This piece will take a new look at the Ethereum ecosystem to find new and unique Dapps in 2024.

Join us as we explore the 10 best Ethereum DApps.

What are Ethereum Dapps?

While the blockchain is an immutable ledger, Ethereum has taken the blockchain further through the creation of smart contracts that allow developers to create open-source software built on the back of the blockchain to leverage its many advantages.

Because the blockchain is decentralized, the applications built on top of a blockchain are also decentralized, meaning they have no central authority or ownership. Once a Dapp is deployed even the developers no longer have control over it.

Common features of an Ethereum Dapp are:

- Open Source: DApps should ideally be open-source software with the code able to be examined and proven free of malicious code.

- Decentralized: Ethereum DApps are built on a decentralized blockchain, and any changes should be determined by the consensus of user votes.

- Incentivized: Users who act as validators of transactions on the blockchain should be provided incentives in the form of digital tokens for their activity.

- Protocol: The community of application developers and users must agree on the cryptographic algorithm used to show proof of value. In the case of Ethereum, this is currently Proof-of-Stake (PoS).

Types of Ethereum Dapps

While there are many types of applications running on Ethereum these days, the list focuses on the following sectors:

Liquid Staking / Restaking / Liquid Restaking

Liquid staking emerged with Ethereum's complete transition to Proof-of-Stake following the merge. Liquid staking tokens are derivatives of staked Ether that accrue staking rewards while staying liquid, enabling the holder to use the token in DeFi. After the growth of liquid staking, EigenLayer pioneered Restaking, which leverages staking Ether to assume additional slashing requirements and provide Active Validated Services (AVS) to new protocols, earning additional staking rewards over staked Ethereum.

Liquid Restaking takes a similar business logic a step further by minting a liquid token to represent a user’s deposit in a restaking layer like EigenLayer. Liquid restaked tokens earn rewards from - The Ethereum Staking Layer, and the Restaking Layer.

Lending / Collateralized Debt Positions

In DeFi, lending protocols enable users to lend and borrow cryptocurrencies in a decentralized manner, typically without intermediaries. Users can deposit their assets into liquidity pools and earn interest, while borrowers can access these funds by providing collateral. Examples include Aave and Compound.

Collateralized Debt Position (CDP) protocols, on the other hand, allow users to lock up their crypto assets as collateral to mint stablecoins or other synthetic assets. The collateral must exceed the value of the minted assets to ensure solvency. MakerDAO is a well-known CDP protocol where users lock up ETH to mint the stablecoin DAI. If the collateral's value drops too much, the position can be liquidated to maintain the system's stability. Both lending and CDP protocols are key components of DeFi, offering liquidity and leveraging opportunities while promoting a trustless financial ecosystem.

Yield Aggregators

Yield aggregator protocols in DeFi optimize the returns on users' crypto assets by automatically reallocating funds across various yield farming opportunities. These protocols pool assets from multiple users and deploy them into the most lucrative strategies available, such as staking, lending, or liquidity provision, to maximize yields. By automating this process, they save users time and effort while achieving higher returns than manual management. Examples include Yearn Finance and Harvest Finance. These protocols continually adjust positions based on changing market conditions and yield rates, ensuring optimal performance and efficient capital allocation across DeFi platforms.

Real World Asset Protocols

Real-World Asset (RWA) protocols are decentralized finance (DeFi) platforms that bring traditional financial assets onto the blockchain. These protocols tokenize assets like real estate, commodities, bonds, and other financial instruments, allowing them to be traded, lent, or used as collateral in DeFi applications. By integrating RWAs into the blockchain ecosystem, these protocols enhance liquidity, accessibility, and transparency of traditional assets. Examples include Ondo Finance, which tokenizes U.S. Treasury bonds, and Centrifuge, which focuses on bringing real-world invoices and loans on-chain. RWA protocols aim to merge the stability of traditional finance with the innovation of DeFi.

In no particular order, here is an updated list of new Ethereum Dapps spanning different sectors in Decentralized Finance.

Lido

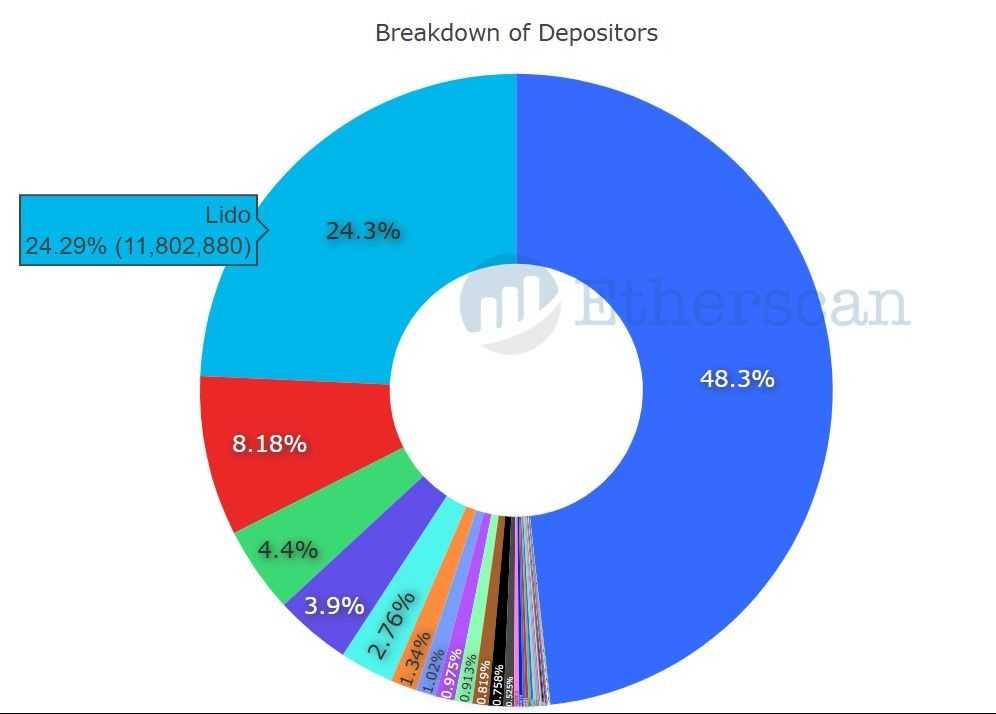

Lido is a decentralized liquid staking protocol with a total value locked $29.78bn in August 2024 (stats from DefiLlama). According to Etherscan, The ETH staked under Lido makes it the largest sole depositor in the Ethereum staking layer.

Lido boasts close to 450,000 stakers and 9.8 million staked ETH. The staking protocol applies a 10% fee on staking rewards split between node operators and the DAO Treasury. It offers an APR of 2.9% on Ethereum. Check the Lido website for the latest metrics.

Puffer Finance

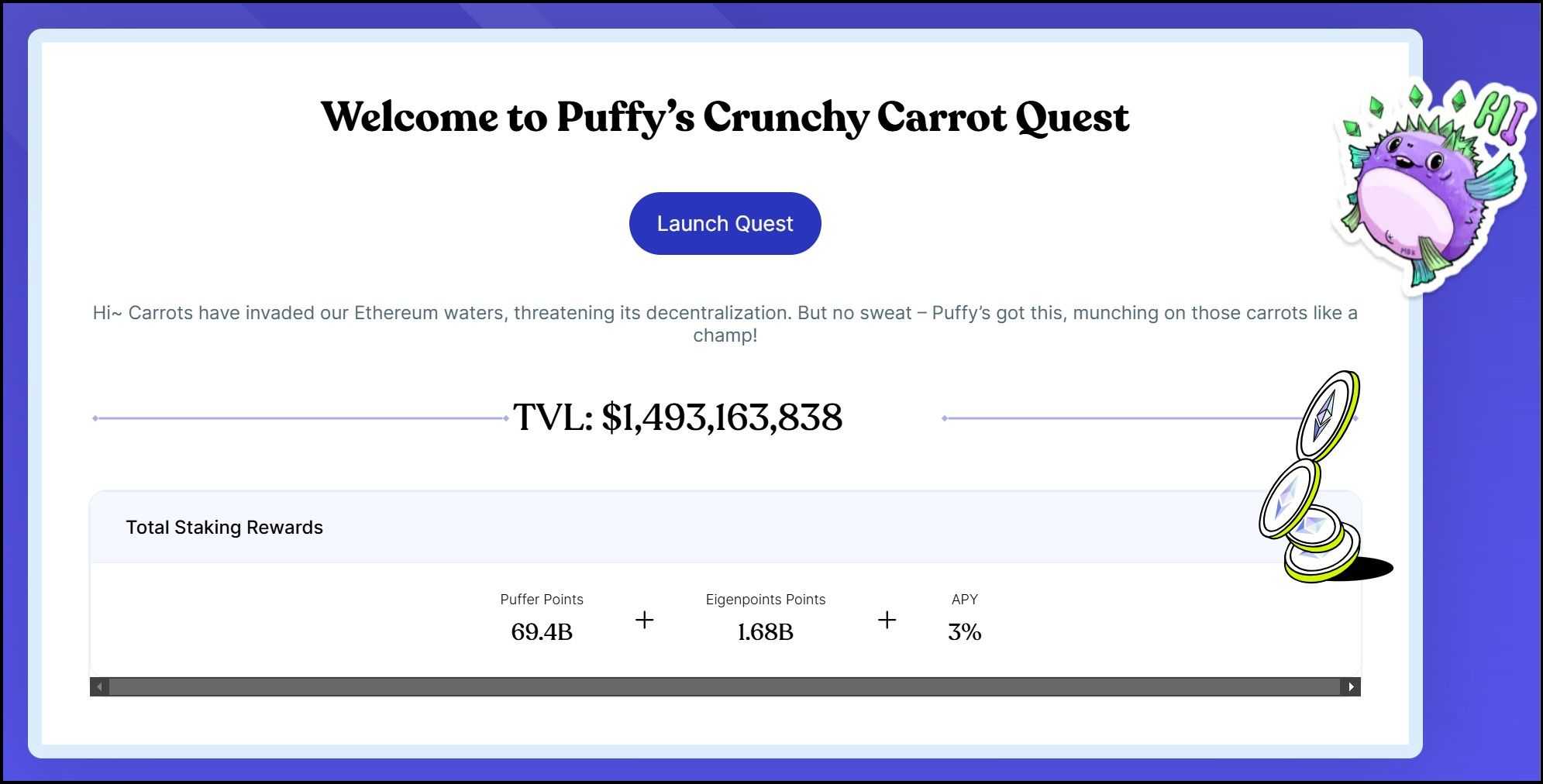

Puffer finance is an Ethereum-native liquid restaking protocol. It enhances return on staked ether by restaking it on EigenLayer with an integrated restaking mechanism. The protocol allows participation with as low as 1 ETH and mints liquid pufETH to represent the user’s deposit, allowing a dual-source reward system for depositors.

Puffer Finance boasts a TVL of $1.49bn in August 2024. It offers a APY of 3%, along with additional Eigen points and Puffer points. Learn more about the protocol on the Puffer Finance Review.

Renzo

Similar to Puffer, Renzo Protocol offers liquid restaking services by minting $ezETH, a liquid restaking token representing the user’s ETH or LST position at Renzo. $ezETH secured Actively Validated Services (AVS) to generate both staking and restaking rewards.

According to Renzo, in August 2024, Renzo's liquid restocking token, $ ezETH, has $1.5 bn in TVL and offers an APR of 3.3%.

Pendle Finance

Pendle Finance is a permissionless yield-trading protocol that empowers users to manage their yield through advanced strategies. Key components include:

- Yield Tokenization: Pendle wraps yield-bearing tokens into Standardized Yield Tokens (SY), which are then split into Principal Tokens (PT) and Yield Tokens (YT). This process allows for the separate trading of the yield component.

- Pendle AMM: PT and YT can be traded via Pendle’s Automated Market Maker (AMM), facilitating liquidity and yield management.

- vePENDLE: This token brings traditional finance's interest derivative market into DeFi, enabling strategies such as fixed yield, long yield, and risk-free yield enhancement by providing liquidity.

Pendle unlocks the full potential of yield in DeFi by enabling fixed yield, long yield, and enhanced yield strategies.

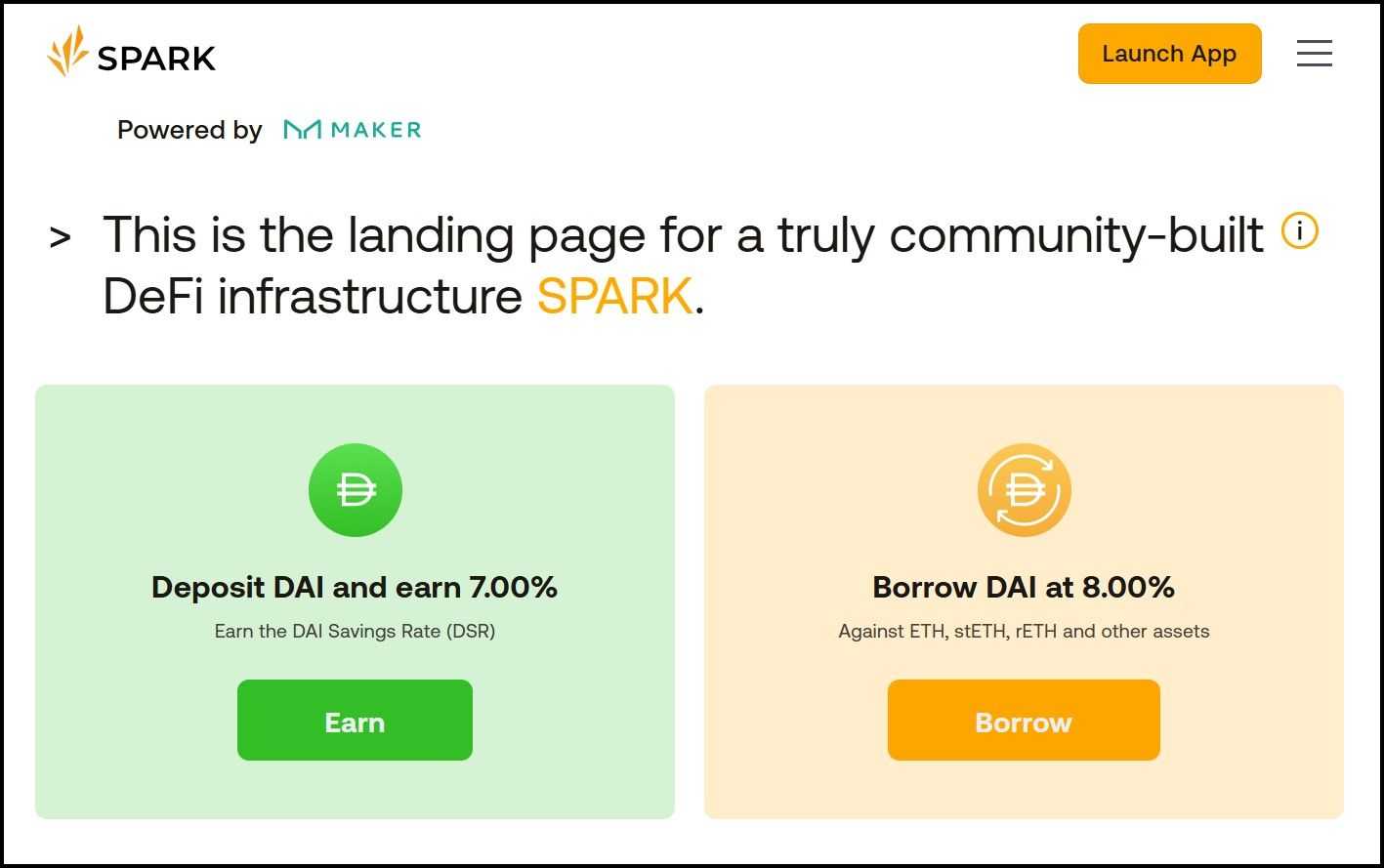

Spark Protocol

Launched on May 9, 2023, the Spark Protocol is a new addition to the Maker ecosystem, offering a front-end for lending and borrowing assets. It introduces the sDAI Yield Bearing Stablecoin, leveraging the DSR to create an ERC-4626 vault token called sDAI. Users deposit DAI into Spark, which is then placed in the DSR contract, minting sDAI tokens in return. These tokens accrue interest from the DSR, increasing in value over time. sDAI provides flexibility, allowing users to trade, stake, lend, or borrow with it, and offers immediate redemption for DAI, ensuring liquidity without lock-up periods.

The Spark protocol has about $3.5bn in TVL in August 2024 and earns 7% interest for depositors.

Aave

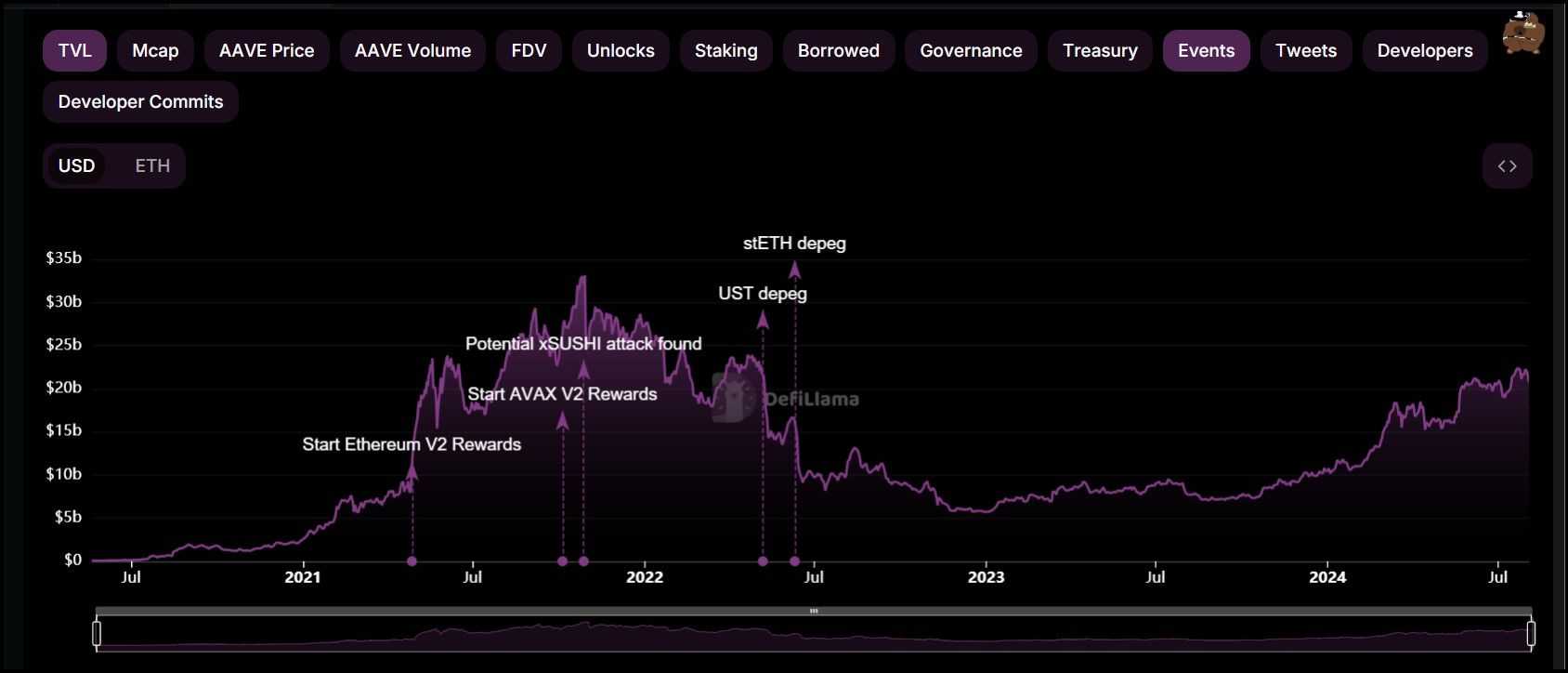

The second-largest Ethereum DApp by TVL is Aave, an open-source, non-custodial protocol to earn interest on deposits and borrow assets.

Of its $20.76 billion TVL in August 2024, Aave drives the bulk of it through Ethereum, and the rest through Polygon and Avalanche, among others.

The protocol has a strong emphasis on security. It receives blockchain intelligence from TRM Labs, which combines on-chain data and real-world investigations to identify financial crime and other prohibited activities.

Ether.fi Liquid

Ether.fi Liquid offers automated DeFi strategy vaults that simplify token DeFi strategies. Users simply deposit tokens, and the vault is allocated across different DeFi positions. Seven Seas provides the strategy for these vaults. ether.fi Liquid currently offers the following strategies:

- King Karak LRT: Users can deposit wETH, weETH, wstETH, cbETH and other liqui staked assets that the vault invests in Karak and Veda.

- Super Symbiotic LRT: An automated vault that earns you Symbiotic, Veda and ether.fi points on your liquid staking assets.

- ETH Yield: An automated vault that earns you yields on your ether.fi assets.

- Liquid Market-Neutral USD: An automated vault that earns you yields on your stablecoin assets.

Ondo Finance

Ondo Finance bridges decentralized finance (DeFi) and traditional finance (TradFi) by offering on-chain access to real-world assets (RWAs). It focuses on providing low-risk, stable returns through regulatory-compliant financial products. Ondo Finance's key offerings include:

- OUSG Fund:

- Tokenized ownership of BlackRock’s iShares Short Treasury Bond ETF.

- Provides liquid exposure to short-term U.S. Treasuries.

- Attracted over $165 million in TVL with a minimum investment of $100,000.

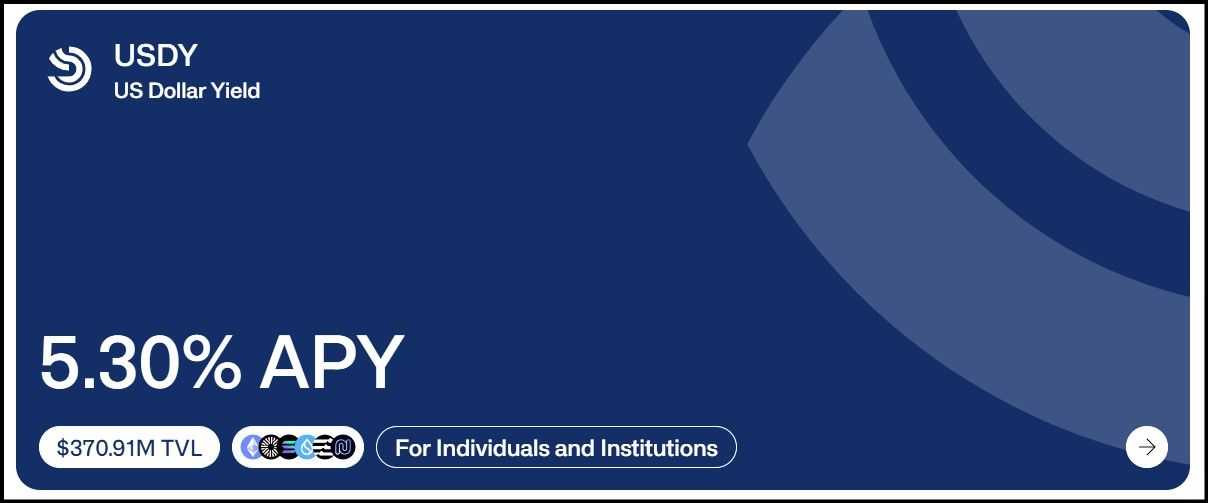

- USDY:

- An interest-bearing stablecoin backed by short-term U.S. Treasuries and bank deposits.

- Designed to pass the bulk of the yield to holders with daily redemptions.

- Accessible globally with a minimum investment of $500.

These products offer secure and compliant investment options, merging TradFi stability with DeFi innovation.

Evergreen Apps on Ethereum

Evergreen apps on Ethereum maintain their relevance and utility over time, consistently providing value to users through innovation, stability, and community support. Here are three such apps: Uniswap, Curve, and Compound Finance.

Uniswap

Uniswap is a decentralized exchange (DEX) protocol that facilitates automated trading of Ethereum-based tokens through liquidity pools. Its evergreen status is due to its pioneering role in DeFi, user-friendly interface, and continuous updates.

- Latest Milestones: Uniswap v3 introduced concentrated liquidity, allowing liquidity providers to allocate capital within specific price ranges, optimizing returns. In 2023, Uniswap's deployment on various layer-2 solutions, including Optimism and Arbitrum, reduced gas fees and enhanced scalability.

Curve Finance

Curve Finance is a DEX optimized for stablecoin trading, known for its low slippage and efficient stablecoin swaps. Its evergreen nature is driven by its specialized focus and integration with other DeFi protocols.

- Latest Milestones: Curve launched Curve v2, expanding its liquidity pool types to include volatile assets while maintaining low slippage. The introduction of the Curve DAO and CRV token has incentivized liquidity provision and governance participation, enhancing its ecosystem.

Compound Finance

Compound Finance is a decentralized lending protocol that allows users to lend and borrow cryptocurrencies. Its evergreen status is due to its role in pioneering DeFi lending and continuous improvements in security and user experience.

- Latest Milestones: Compound launched the Compound Treasury, targeting institutional investors by offering a fixed 4% APY on US dollars, bridging DeFi and traditional finance. The protocol's governance token, COMP, has facilitated community-driven upgrades and decision-making, ensuring its adaptability and growth.

These apps remain evergreen due to their foundational roles in DeFi, ongoing innovation, and robust ecosystems, continuously attracting users and developers alike.

Conclusion

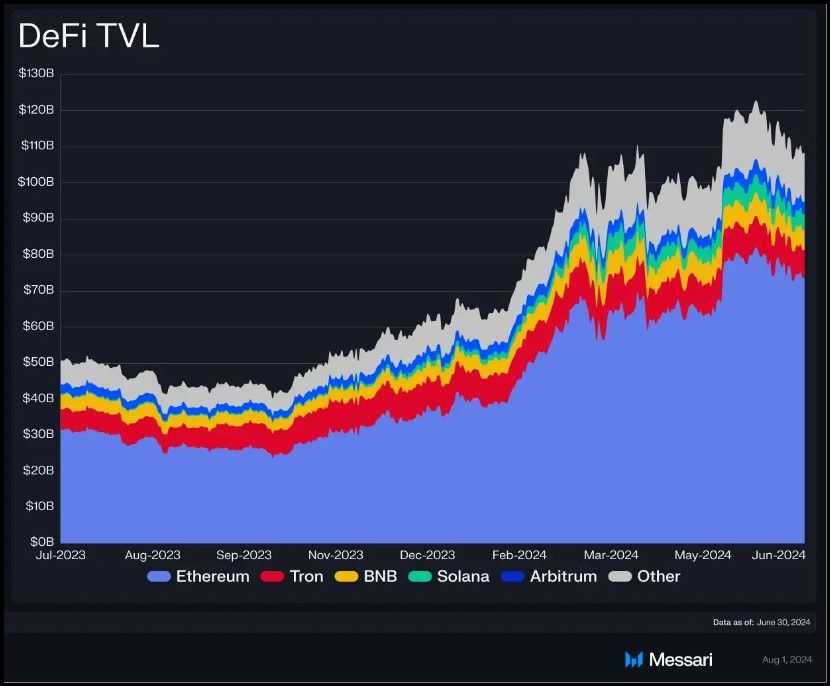

The number of DApps on the Ethereum blockchain has exploded in the past few years.

As the ecosystem grows and Ethereum scales, the number of DApps will likely explode even more. Blockchain and smart contracts can be used to create DApps around anything that has a centralized application or infrastructure.

In the coming years, centralization will give way to a more transparent and free decentralized world, and when that happens, DApps will be the norm rather than the exception.

Frequently Asked Questions

Everybody has a different definition of “best” Ethereum DApps, but the top 10 are related to DeFi.

Ethereum pioneered smart contracts, which revolutionized the industry. These contracts played a pivotal role in the rise of DeFi, NFTs, and many other DApps that have gained widespread adoption.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.