Stablecoins are seen as some of the best alternatives for traders to Hodl their CryptoCurrency gains in times of extreme market volatility.

However, the stablecoin market has become quite saturated recently as a number of competing projects and issuers have released their own alternative versions. Each of these stablecoins are able to maintain a fiat peg using their own unique mechanisms and incentives.

In this post, I will give you an overview of some of the best stablecoins as well as the pros / cons of each. I will also give you some top tips when it comes to using them.

What is a Stablecoin?

Before jumping into the top stablecoins, let's just start with a bit of basics behind these singular function cryptocurrencies.

As the name would suggest, stablecoins are meant to be stable in price. They are usually fixed or "pegged" to the price of some other asset. This asset can be anything but currently they have only been pegged to a fiat currency.

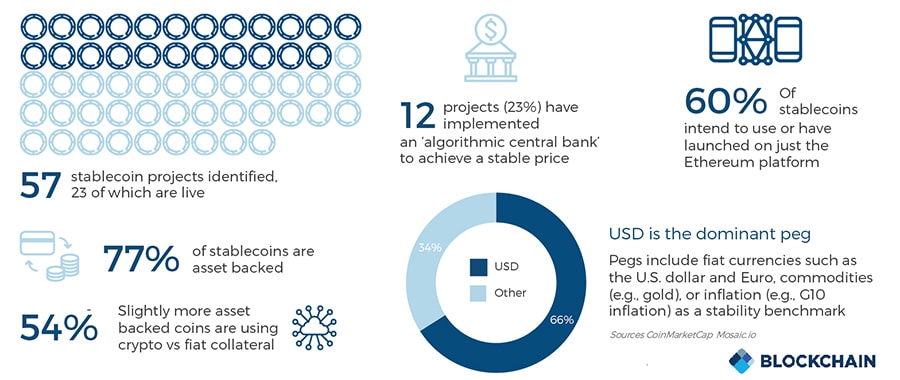

Overview of the Stablecoin Ecosystem. Image via blockchain.com

Overview of the Stablecoin Ecosystem. Image via blockchain.com"Pegged" means that they hold their value 1:1 with a unit of the fiat currency. In most cases this is the US dollar with 1 unit of the coin worth $1. There are, however, other stablecoins that have been pegged to currencies such at the Euro.

The benefit of having a coin that is fixed to a Fiat currency is that it will hold its value irrespective of the crypto markets. You can be certain of the amount of dollars / euros that you are likely to cash out when you do convert it.

Top 8 Stablecoins

Now that you have a rough idea what stablecoins are, we can take a look into some of the most well known stablecoins on the market. This is a pretty diverse mix of them and include centralised & decentralised as well as different fiat pegs.

There may be coins that we have not covered here that you could be considering. If this is the case you just have to make sure that there is a reputable organisation that is behind them as well as an established track record.

Tether (USDT)

Tether (USDT) first stablecoin and it remains the most popular, currently sitting in the number 8 position in terms of market capitalization. The area where you can truly see the power of Tether though is in the 24-hour volume, which is far greater than any cryptocurrency except for Bitcoin.

It’s interesting that Tether remains in such a prominent position, given that it’s been the subject of quite a bit of controversy related to its cash reserves, and to the lack of transparency and conflicts of interest of the companies involved with Tether.

There are also a number of questions that are swirling around the connection between the Bitfinex exchange and Tether. For example, many of the founding directors of the Tether company are themselves directors at Bitfinex.

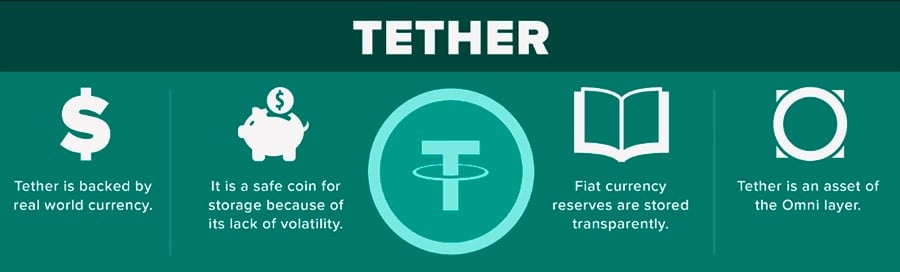

Overview of the Tether Stablecoin

Overview of the Tether StablecoinFinally, there are the numerous theories that "Tether prints" are being used in order to manipulate the price of Bitcoin. These traders order large batches of Tether before they are printed and will dump them on the market.

Having said all this, there are a number of reasons why traders still choose Tether:

- Track Record: The main function of a stablecoin is to maintain a price peg and to that end, Tether has managed to consistently keep that 1:1 ratio. This is even through some of the most volatile trading environments in 2017 and 2018.

- Liquidity: There is no doubt that Tether has the highest liquidity amoung the stablecoins. It is the only stablecoin that is currently sitting in the top 100 in market cap. This means that it is easy for you to trade massive blocks of Tether with very little slippage.

- Exchange Support: Slightly related to the above point, the exchange support for Tether is unrivaled. No other stablecoin is listed on this number of exchanges.

- Fiat Conversion: When it comes to converting your USDT back into fiat, it can be done easily at Tether. They can wire you the funds through traditional banking means.

So, you will have to weigh up the pros and cons when it comes to Tether. If you do decide to use Tether then you will probably want to keep them off of the exchanges. We have a list of the best Tether wallets if you are hodling.

USD Coin (USDC)

The USD Coin is the second largest stablecoin by market capitalization, sitting in the 32nd position overall.

It’s not too surprising that since its launch in September 2018 it has grown so quickly since it was created by the Centre Consortium, which is a collaboration between Coinbase and Circle Internet Financial.

Coinbase should be familiar to you, and Circle is a blockchain holding company backed by Goldman Sachs which also owns the Poloniex exchange.

The USD Coin Consortium. Image via Coinbase Blog

The USD Coin Consortium. Image via Coinbase BlogThe USDC is also backed on a 1:1 basis by fiat currency reserves and the escrow accounts are regularly audited to ensure the proper reserves are being held. And of course, being issued by Coinbase it is quite easy to redeem the USDC for fiat and have that transferred to your bank account.

Technically, the USDC was issued on the Ethereum blockchain. This means that these are ERC20 tokens and can therefore be easily integrated with any Smart Contracts coded on the same blockchain.

While the coin seems trustworthy it does remain centrally controlled and you have to put your trust in Coinbase and Circle, but with the transparency they’re giving the coin it seems easier to trust here than it does with Tether.

The main benefits of the USD Coin include the following:

- Strong Backers: With Coinbase and a Goldman Sachs based company backing this stablecoin, it has some pretty reputable issuers.

- Fully Backed: The USD Coin is fully backed by fiat deposits and also has regular audits conducted.

- Conversion & Withdrawal: For those with US based Coinbase accounts, you can easily just convert the USD coin into USD in your dashboard. Then you can cash out using Coinbase's traditional fiat banking systems.

- Exchange Support & Liquidity: You have strong support for the token on a number of exchanges. This means that liquidity is unlikely to be a concern.

- Wallet Support: Given that this is an ERC20 token, there are a number of wallets that support it.

TrueUSD (TUSD)

The TrueUSD was launched in January 2018 and has rapidly become one of the most trusted stablecoins. The reason is the complete transparency of TrueUSD and its parent company TrustToken. Like Tether & the USDC, TrueUSD keeps fiat currency in a 1:1 ratio of reserves to digital coins.

Unlike Tether, TrueUSD provides complete disclosure of the amount of USD being held in reserve. TrueToken is in partnership with accounting firms and banks, and these third-parties provide regular audits and reports on the reserve balances. And soon traders will be able to access a dashboard that gives a real-time snapshot of USD reserves for TrueUSD.

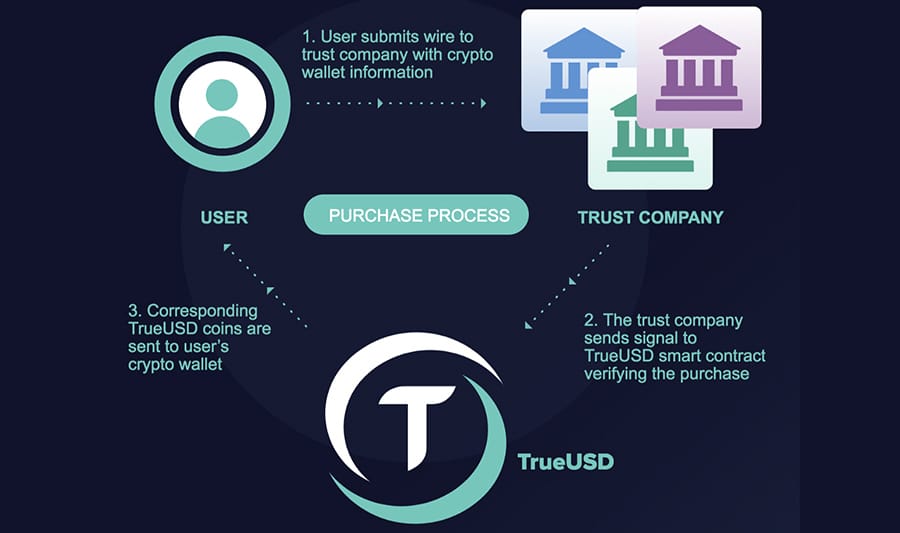

How TrueUSD works. Image via Trust Token Blog

How TrueUSD works. Image via Trust Token BlogAll of this has led to a ranking of 38 in terms of market capitalization for TrueUSD, making it the third most valuable stablecoin. There are also reasonable levels of liquidity and a pretty decent team behind the project.

Two unique features that make the TrueUSD stand out for me are the following:

- One Click Redemptions: This allows users to exchange TrueUSD for fiat with just one click. TrueUSD can also be invested at several platforms for a healthy annual return.

- Fiat Support: Apart from just supporting US Dollars, Trust Token also has TrueAUD, TrueCAD and TrueGBP, with other currencies and gold being planned in the future.

The TrueUSD is also an ERC20 standard token which means that you can store it in a number of compatible wallets once you have it off of the exchanges.

Paxos Standard (PAX)

Paxos has been around as a company since 2012, and they began as an exchange, and still run the itBit exchange based in Singapore.

In 2015 they have issued a limited-purpose trust charter in the state of New York, thus establishing it as the first company approved and regulated to offer crypto products and services there. Thus followed the launch of the PAX coin in September 2018.

Like the others discussed Paxos Standard holds fiat currency in a 1:1 ratio to PAX coins. It has monthly audits of its reserve balance to ensure it matches the amount of PAX in circulation. PAX is the 56th largest cryptocurrency by market capitalization and the fifth largest stablecoin.

Main Benefits of Using Paxos Standard. Image via Paxos Website.

Main Benefits of Using Paxos Standard. Image via Paxos Website.PAX is listed on over 70 exchanges so it is easy to use, and of course, since Paxos owns the itBit exchange you can always trade there and are then able to withdraw other cryptocurrencies into PAX instantly and without fees. Paxos also offers users the ability to create an account at Paxos and instantly convert PAX to fiat.

Like TrueUSD and the USD Coin, this was issued on the Ethereum blockchain and the tokens were also audited by Nomic Labs who are a respected smart contract auditor. This means that not only are the coins fully backed but they are also secure.

The downside to PAX is the recent reports that the company has made it difficult for some users to cash out their PAX, even going as far as shutting down accounts. So, consider the risks and remember that like the USDC the PAX is a centralized stablecoin and your fate is in the hands of Paxos.

Gemini Dollar (GUSD)

Just like the Paxos Standard, the Gemini Dollar was launched in September 2018. It was created by the Gemini Exchange but hasn’t seen the same level of popularity as PAX or other stablecoins. It is currently in the 283 spot based on market capitalization.

The GUSD is regularly audited, so they have provided transparency for the coin, which is backed 1:1 by fiat currency held at State Street Bank. The Gemini Exchange also provides FDIC insurance on the product within specified limits.

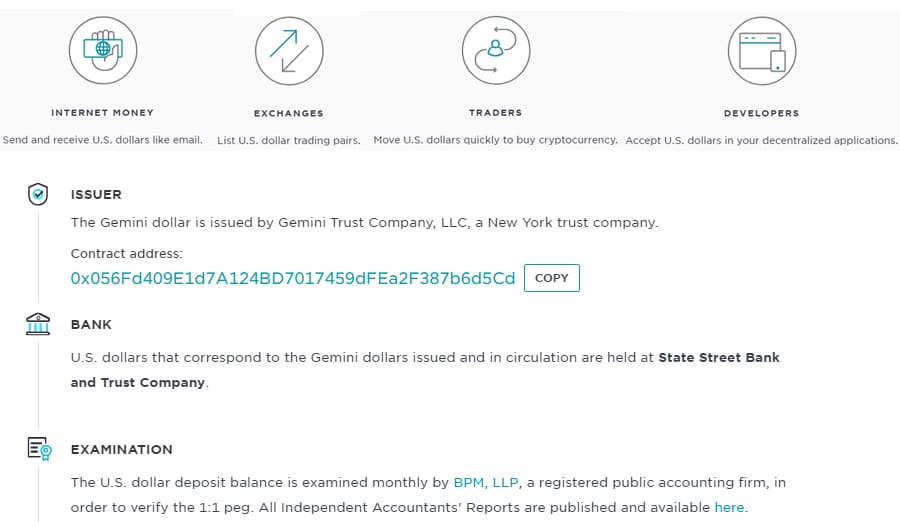

Use cases for the GUSD & Main Characteristics.

Use cases for the GUSD & Main Characteristics.GUSD has also been audited by BPM LLP, a well regarded firm based in New York. The benefit of this is that it will ensure that the funds on balance in their accounts will always equal those of the amount of outstanding GUSD.

GUSD is listed on several dozen exchanges, but nearly all the volume occurs on ten exchanges. Of course, you can always use the Gemini Exchange to quickly exchange GUSD for fiat, but redemptions are completely in the hands of Gemini.

In fact, there have been reports here, similar to the ones at Paxos, that redeeming GUSD has been difficult for some users, and that there have been cases where accounts have been shut down.

MakerDAO Stablecoin (DAI)

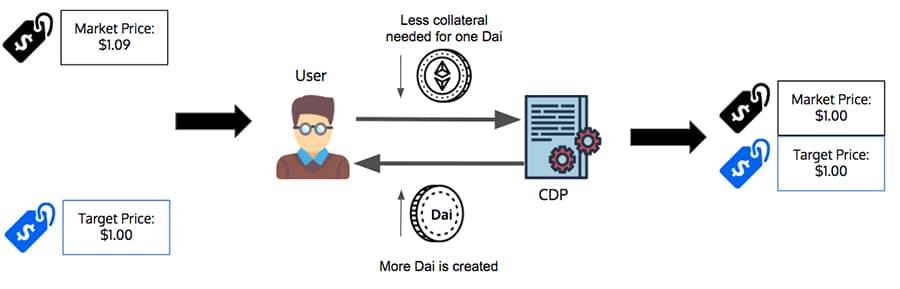

This is no doubt one of the most interesting stablecoins currently on the market. This is because of the fact that it is the only "decentralised" stablecoin on offer. It is not issued by a central authority that has control over it.

Perhaps even more surprisingly, the DAI stablecoin does not even use fiat currency to back the stablecoins. It uses smart contracts and is backed by collateralized cryptocurrency debt.

DAI is created by locking Ethereum in a Collateralized Debt Position, which is a smart contract that holds your stake, creates the DAI and can be unlocked later with DAI. If you wanted more of an overview of how it works the you can read our complete DAI stablecoin overview.

The DAI stablecoin was built by MakerDao team on the Ethereum blockchain and as such, is decentralised, secure and verifiable. You do not need to rely on any audits or statements to confirm that the DAI is backed. This can all be confirmed on the blockchain.

How DAI Maintains the Peg. Image Source

How DAI Maintains the Peg. Image SourceGiven the volatility of Ethereum, there were doubts about how well this would work, but so far it has worked very well and even though the price of Ethereum fell more than 80% in 2018 DAI was able to hold its peg. And this all happened with a completely decentralized and trustless stablecoin.

Apart from all of these benefits, DAI is also liked by traders and is quite popular. There are decent levels of volume across a number of exchanges including the likes of Coinbase Pro and Fatbtc. Once you have your DAI, then it can easily be stored in any ERC20 compatible wallet.

So, sounds great, but are there any downsides?

Well, given that DAI is not issued by a centralised authority, there is no quick and easy way for you to convert it back to fiat currency. You will first have to trade it for Bitcoin or any other cryptocurrency and then sell the crypto and withdraw fiat. This could of course incur trading fees.

Top Tip: 💯 Given that Coinbase Pro lists DAI as well as USDC, why not trade one for the other and cash out from the coins on Coinbase?

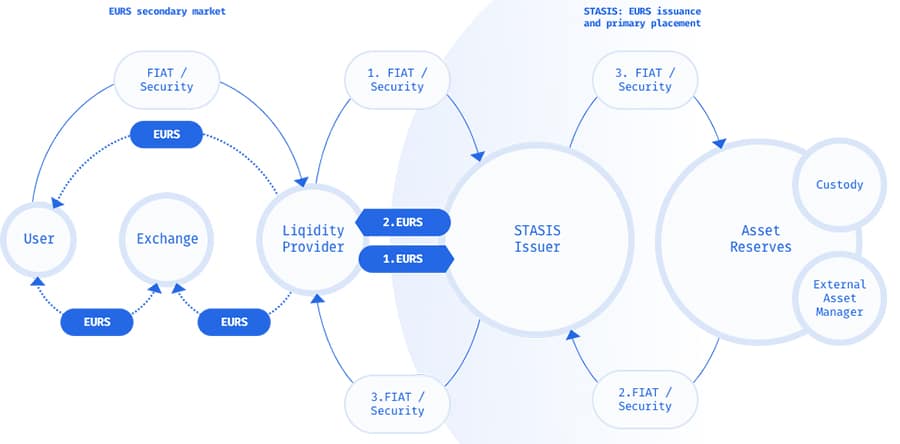

STASIS EURS (EURS)

Not all stablecoins are backed by U.S. dollars, and the STASIS EURS is one of them, being backed on a 1:1 basis by Euros. It is ranked number 150 by market capitalization, which makes it larger than the Gemini Dollar (GUSD).

EURS was introduced in September 2018 and has grown at a steady pace. It has complete transparency, with account balances checked daily by a third-party, along with weekly verifications and quarterly audits being performed by one of the big four accounting firms.

Mechanics of the Stasis Stablecoin. Image via Stasis

Mechanics of the Stasis Stablecoin. Image via StasisOf course, there is one drawback with this stablecoin and that is exchange support.

Currently, there are only three exchanges that you can trade this token on. These include HitBTC, Ethfinex and DSX (non of which are really reputable). This means that converting your EURS back into fiat will be quite a tricky affair.

Moreover, the volume across these exchanges is much smaller than those of the other coins that we have listed above. This means that you could struggle to execute large block orders of this token.

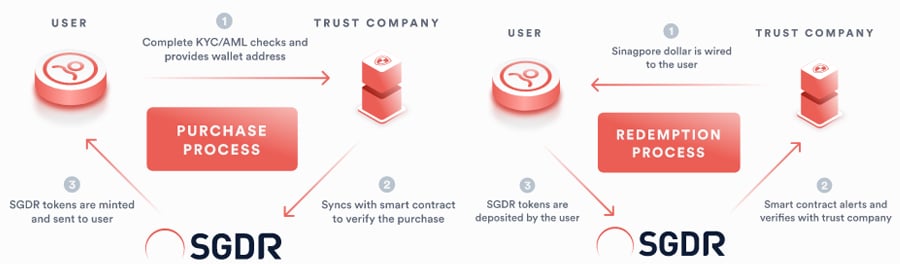

Singapore Dollar Rate (SGDR)

SGDR is a fairly new project that is digitizing the Singapore dollar. Like other stablecoins, it has a 1:1 backing, but in this case, the first currency being used to back the digital SGDR is Singapore dollars.

Given the large number of blockchain startups emerging in Singapore, it isn’t surprising to see a Singapore dollar backed stablecoin.

The coin was created by blockchain startup Rate and was launched in January 2019. Currently in alpha phase, the SGDR is only being sold to accredited investors. And since the backing company has made the decision to only list the token with Recognized Market Operators it is not listed on any of the cryptocurrency exchanges and has not been ranked by CoinMarketCap.

Purchase and Redemption of the SGDR Coin

Purchase and Redemption of the SGDR CoinThe stability of the Singapore dollar historically makes it a good choice for a stablecoin, but with no access for retail traders, we’re not sure what purpose the SGDR will serve.

We will keep an eye on this stablecoin and update you in the future of new developments.

Conclusion

There you have it, the list of 8 of the best stablecoins currently on the market. With most stablecoins being quite similar you might now be wondering which one you should use...

It really depends on your own preferences and your tolerance for risk. Some of the stablecoins seem to carry more risks than others. You might also choose based on the ease of converting from the stablecoin to fiat currency as well as the liquidity in that token.

All of the stablecoins listed meet the requirement of holding a peg and will work well for traders looking for a haven from volatility.

Tether remains the most popular stablecoin but has its transparency issues. The USD Coin from Coinbase and Circle is also popular, but you have to accept the centralization of the coin. For those who want to remain completely decentralized the DAI coin is an excellent option.