It’s hard not to look at the Bitcoin price graph and lapse into daydreaming. The lines don’t lie: If you’d only sunk a few hundred in during Bitcoin's early years, you’d be laughing all the way to the bank right now. As the price surges past price points that early hodlers likely deemed unimaginable, you imagine what it must be like for those who got in early. Somebody - anybody - hurry up and build that time machine!

Hindsight is a beautiful thing, of course, but it’s nothing compared to a bit of foresight. We’re probably all familiar now with the story of the Norwegian guy who invested $27 back in 2009 and promptly forgot all about it until four years later, after which he hastily checked back to find out his investment was now worth $886,000. Or how about the guy who threw out his hard drive that had 8,000 BTC on it and later offered $11 million to anyone who could help scour the landfill to find it.

Most digital assets we trade today are pre-mined, meaning a good chunk (if not all) of their supply is minted and allocated to the community or the project’s promoters at launch. Conversely, Bitcoin went through a fair launch where every Satoshi (smallest denomination in BTC) was mined by validators participating in its Proof of Work consensus.

So, who are the Bitcoin big hitters? Who bought low and can now sell very, very high? This list contains the richest Bitcoin Billionaires we know of.

Top 9 Bitcoin Billionaires

Here is a list of the top individuals with the highest BTC holdings. Since Bitcoin is a pseudonymous network, anyone with an internet connection can create a Bitcoin wallet and hold BTC. Therefore, any knowledge we have about the owner of specific Bitcoin addresses is derived from their public statements where they claimed their ownership.

Here is a list of the top individual BTC hodlers. The list includes publicly claimed holdings and some anonymous addresses which we can only speculate as individuals:

#1 Bitcoin Billionaire- Satoshi Nakamoto

Number one on our list is none other than the legendary and mythical Satoshi Nakamoto himself. Satoshi Nakamoto is the alias of the creator (or creators) of the Bitcoin network. As one of the first miners of Bitcoin, Satoshi did not face the intense competition for hashing power the Bitcoin network is known for these days. Today, every block of Bitcoin yields 6.25 BTC. Dialling back to a time before the first Bitcoin halving, the Satoshi era blocks yielded 50 BTC before the first halving cycle.

It is believed that Satoshi holds as high as 1.1 million BTC spread across 22,000 wallet addresses. Satoshi’s BTC net worth peaked at about $76 billion when BTC was exchanging hands at $69,000 in 2021. The good news is that these addresses have been dormant since 2010 and are effectively considered out of the circulating supply.

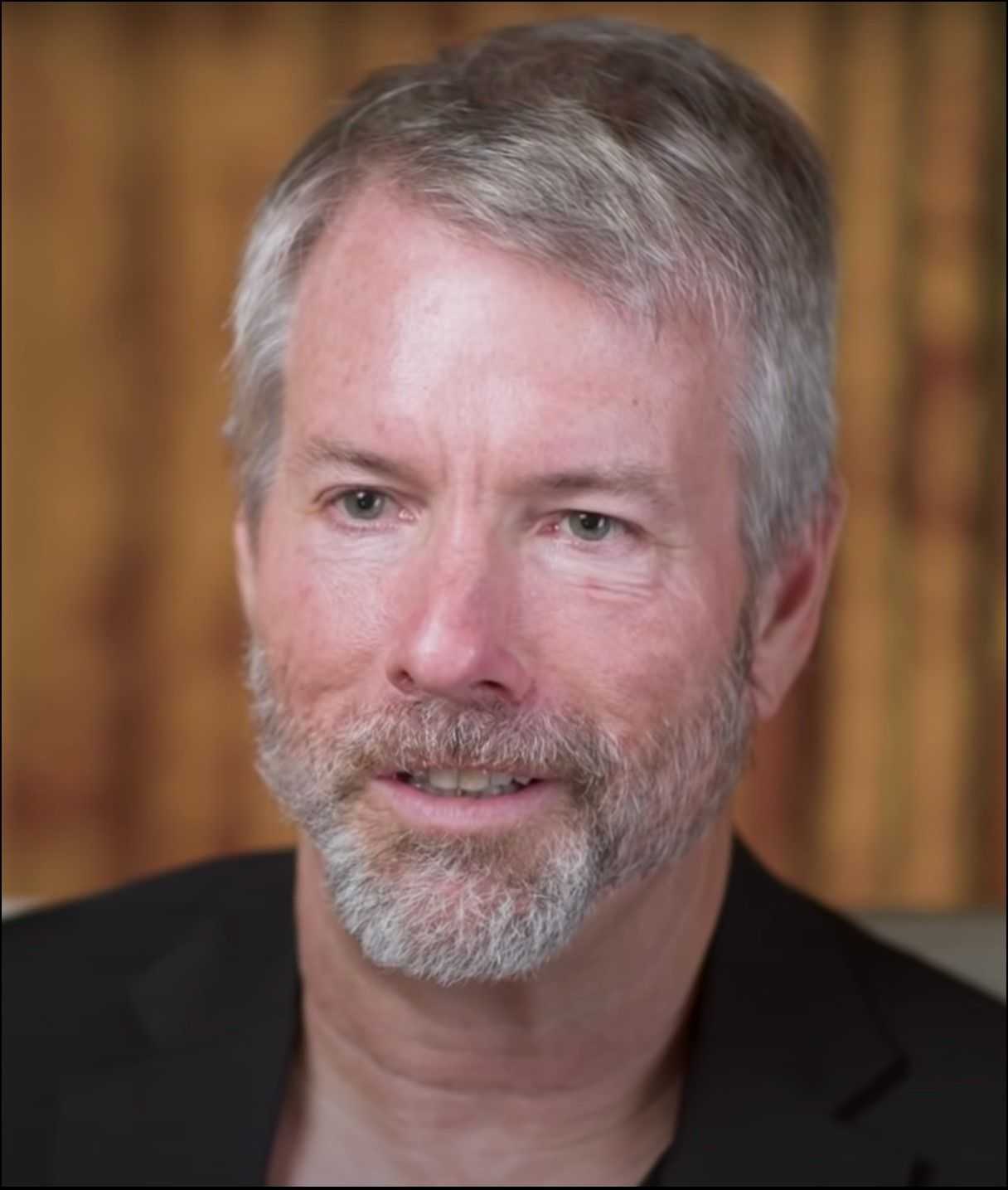

2. Michael Saylor

Michael Saylor is the founder of the business intelligence and analytics company MicroStrategy. Saylor is an MIT graduate with a double major in aeronautics, astronautics, science, technology, and society. His company has been amassing Bitcoin since July 2020.

Michael Saylor is one of the strongest advocates of Bitcoin in the United States and has expressed his belief about Bitcoin as a store of value and a hedge against inflation on multiple accounts on the internet.

With statements such as “you can never have too much Bitcoin,” his massive hoards of the digital asset are not surprising. In an October 2020 tweet, Saylor claimed he held 17,732 BTC. It is reasonable to speculate that he might have acquired even more since then. With a 24.2% ownership in Microstrategy, he is one of the company’s major shareholders, which passively adds even more BTC to his holdings.

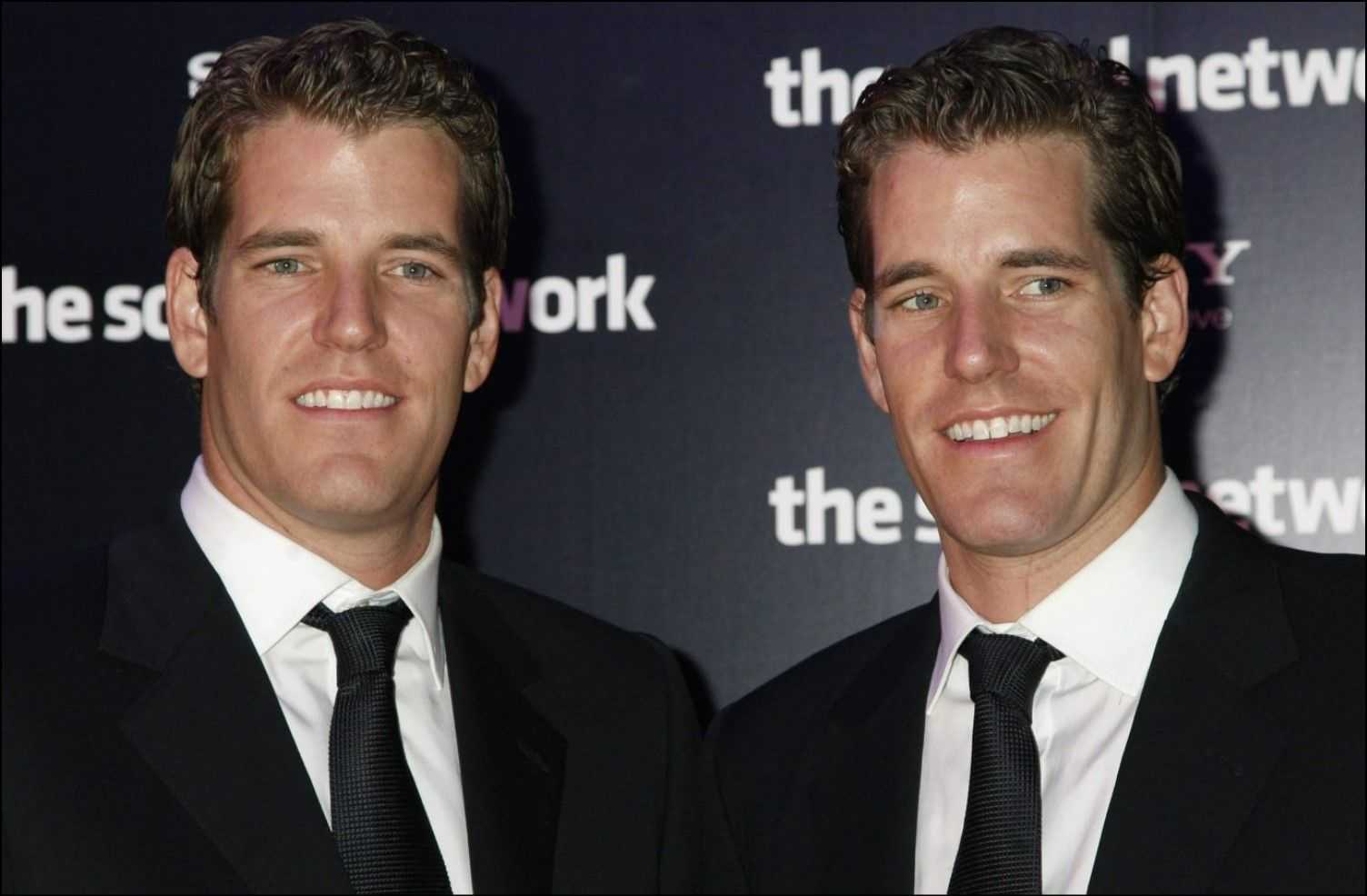

3. Winklevoss Twins

Cameron and Tyler Winklevoss are American cryptocurrency investors and the founders of Winklevoss Capital Management and Gemini Trust Company, LLC, an American cryptocurrency exchange and digital assets custodian. The twins are famous for accusing Mark Zuckerberg of stealing their social network idea by illegally stealing the source code for ConnectU, a website he was hired to create.

The allegation led to a lawsuit against Facebook (now Meta), which settled in 2008 at $65 million. The twins used a part of this settlement to buy Bitcoin. They stumbled upon Bitcoin while on a summer holiday in Ibiza, Spain, and quickly realized its potential and started buying when Bitcoin was exchanging hands at just $10. While the exact estimates of their BTC holdings are unknown, the billionaire twins claimed in April 2013 that they owned over 1% of the Bitcoin supply.

4. Tim Draper

Timothy Cook Draper is an American venture capital investor with hands in several prominent tech giants such as Tesla, SpaceX, Hotmail, AngelList, Twitter, Coinbase, Robinhood, and many more.

In 2014, Draper paid the US government about $19 million for nearly 30,000 BTC seized from the Silk Road, an infamous online black market, during an auction by the US Marshals Service. Tim has long advocated for Bitcoin and praised its future value potential on multiple public accounts.

5. Anonymous Whales

The names listed above have made their Bitcoin holdings by choice. Some anonymous Bitcoin wallets out there completely dwarf these public Bitcoin A-listers. For instance, the third largest Bitcoin wallet alone holds 118,300 BTC. Five of the top ten largest Bitcoin wallets are anonymous, controlling more than half a million BTC between them.

So far, we covered some individual Bitcoin A-listers. Now, let's review some institutions holding the most considerable sums of Bitcoin. The top institutional holders of Bitcoin are typically large corporations, financial institutions, or investment funds that have invested a significant portion of their assets in Bitcoin. We have excluded cryptocurrency exchanges from this list, as they deploy their customer's capital to buy digital assets, allowing them limited control over their holdings.

6. MicroStrategy

The business intelligence company led by Michael Sayor purchased its first Bitcoin in August 2020. As of November 2023, the company owns 158,400 BTC, with an average purchase price of $29,609.65. MicroStrategy buys Bitcoin by raising debt with the idea that it would need fewer Bitcoins to pay back the debt in the future when the asset's price appreciates.

MicroStrategy’s Bitcoin buying strategy is a textbook example of Dollar Cost Averaging, where the company buys some amount of BTC occasionally, regardless of its price or the technical outlook.

7. Tesla

Elon Musk’s electric vehicle manufacturing company, Tesla, has somewhat of a love-hate affair, reflecting corporate involvement's complexities and the evolving nature of cryptocurrencies. Initially, Tesla embraced Bitcoin significantly, purchasing $1.5 billion in early 2021 and even accepting it as payment for their vehicles, signaling strong support for the cryptocurrency. This move was widely seen as a significant endorsement of Bitcoin's legitimacy and potential as a mainstream financial asset.

However, the love affair hit a rough patch when Tesla reversed its decision to accept Bitcoin payments, citing environmental concerns over the high energy consumption of Bitcoin mining. This move caused a stir in the cryptocurrency market and indicated Tesla's sensitivity to its business practices' environmental, social, and governance (ESG) aspects.

Despite this setback, Tesla still held a significant amount of Bitcoin as part of its corporate treasury, suggesting a continued belief in its value as an investment. As of September 2023, Tesla is reported to own 10,725 BTC as a part of its corporate strategy.

8. Marathon Digital Holdings Inc.

Marathon Digital Holdings is a digital asset technology company that focuses on the blockchain ecosystem and cryptocurrency mining. As one of the largest enterprise Bitcoin self-mining companies in North America, Marathon operates multiple mining operations, leveraging technology to produce digital assets. The company's strategy revolves around accumulating Bitcoin and optimizing its operations in the rapidly evolving cryptocurrency landscape, positioning itself as a significant player in the digital currency market.

Yahoo.com reports that as of September 2023, Marathon Digital Holdings held 13,726 unrestricted Bitcoin (BTC). This significant holding of Bitcoin showcases Marathon's investment strategy and commitment to the digital currency market. The company has taken steps to protect its investment by hedging 1,000 Bitcoin with short-term enhanced costless collars, a strategy aimed at mitigating downside risk while maintaining the potential for upside gains. Such actions indicate a strategic approach to managing their Bitcoin holdings, balancing risk management with pursuing growth opportunities in the cryptocurrency sector.

9. Hut 8 Mining Corp

As of September 30, 2023, Yahoo.com reports that Hut 8 Mining Corp., one of North America's largest and innovation-focused digital asset mining companies, said it holds 9,366 self-mined Bitcoin. These holdings were either in custody or pledged as collateral. This figure reflects the company's significant investment in and focus on cryptocurrency mining despite facing various operational challenges and fluctuations in the market.

Hut 8's strategy includes diversifying its operations, as evidenced by its high-performance computing business generating additional revenue and actively seeking growth opportunities while managing costs efficiently.

Why do HNIs and Institutions buy so much Bitcoin?

Institutions and HNIs (High-net-worth individuals) buy large amounts of Bitcoin for various reasons, reflecting their investment strategies and views on the cryptocurrency's potential. Here are some key reasons:

- Diversification: Bitcoin offers a diversification benefit to traditional investment portfolios. Its price movements have historically shown a low correlation with traditional assets like stocks and bonds, which can help reduce overall portfolio risk.

- Inflation Hedge: Some institutions view Bitcoin as a hedge against inflation. Like gold, Bitcoin is seen by some as a store of value that can retain its worth in times of monetary inflation due in part to its capped supply of 21 million coins.

- High Growth Potential: Bitcoin has grown substantially over the past decade, attracting investors looking for high returns. Despite its volatility, its potential for high rewards draws institutions seeking to maximize profits.

- Increasing Mainstream Acceptance: As Bitcoin gains acceptance in the mainstream financial world, more institutions are comfortable including it in their portfolios. This is further supported by the developing of more regulated and sophisticated crypto investment products.

- Innovative Technology Investment: Investing in Bitcoin is also seen as investing in blockchain technology, which could have significant implications across various industries, from finance to supply chains.

- Public Demand: For investment funds and trusts like Grayscale, investment in Bitcoin is driven by client interest. As more individuals and institutions seek exposure to Bitcoin, these funds grow their holdings to meet the demand.

- Corporate Strategy: For companies like MicroStrategy and Tesla, buying Bitcoin is part of a broader corporate strategy that might include adopting digital currencies for business transactions or simply holding them as treasury reserve assets.

- Speculative Investment: Finally, some institutions engage in speculative investment, buying Bitcoin with the expectation that its price will increase, allowing them to sell it at a profit in the future.

Each institution's rationale for buying Bitcoin can vary based on its investment philosophy, risk tolerance, and outlook on the future of digital currencies.

Bitcoin Billionaires- Parting Thoughts

Given all the hype surrounding Bitcoin at the moment and the intense interest it’s generating from tax authorities across the globe, you won’t be surprised to learn that many of the leading Bitcoin holders out there are none too keen on having their identities widely known. Anonymity (or in Bitcoin's case, pseudonymity) is one of cryptocurrency’s main attractions, after all, and there’s not much to be gained from having everyone know about your carefully curated stash.

Coupled with this is the fact that anyone holding large numbers of Bitcoins will almost certainly have them distributed across a number of different wallets, making it impossible to know who holds exactly how many unless they’re willing to make the information public. This brings us to perhaps the wealthiest Bitcoiner of them all.

Yes, the one individual thought to hold the most Bitcoin of all is none other than the very person who came up with it – Satoshi Nakamoto. Of course, nobody knows for sure who Satoshi is, as he (if it is a ‘he’) has yet to reveal himself. But experts reckon that whoever and wherever he is, he’s likely to be sitting on roughly 5% of all the Bitcoins in existence. At today’s prices, I could daydream about those numbers for weeks.

Frequently Asked Questions

The top Bitcoin billionaires include figures like Elon Musk, Michael Saylor, and the Winklevoss twins. Elon Musk, for instance, invested heavily in Bitcoin through his company Tesla, contributing to the surge in Bitcoin's value. Michael Saylor, CEO of MicroStrategy, made strategic investments in Bitcoin as a treasury reserve for his company. The Winklevoss twins, early Bitcoin adopters, accumulated a significant amount through their cryptocurrency exchange, Gemini.

Bitcoin has been a key driver of wealth for these billionaires through strategic investments, early adoption, and innovative ventures. The cryptocurrency's substantial price appreciation over the years, coupled with their timely and substantial investments, has played a pivotal role in their financial success. Additionally, their involvement in the crypto space, whether through businesses or personal investments, has further enhanced their Bitcoin-derived wealth.

Despite their successes, Bitcoin billionaires face challenges such as market volatility, regulatory uncertainties, and security concerns. The highly volatile nature of the cryptocurrency market means that their wealth can fluctuate significantly. Regulatory changes and interventions can impact their investments. Additionally, securing their substantial Bitcoin holdings requires robust cybersecurity measures to prevent hacking or unauthorized access. These factors make managing their cryptocurrency wealth a complex and dynamic task.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.