BTC Global: Another Cautionary Tale of a Typical Ponzi Scheme

When most people think of cryptocurrency Ponzi schemes, the Bitconnect saga usually comes to mind. They laugh at the ridiculous characters and scratch their heads at the numerous investors who lost despite countless warnings.

Yet, down in South Africa there was another Ponzi scheme in the works.

While there were many who doubted whether Bitconnect was a Ponzi scheme, there should have been no doubt when it came to BTC Global. If scams were rated out of 10 for their power to convince, BTC Global should have failed.

And yet, despite all of the obvious signs that were clear to see, the operators managed to run away with over $50 million in client funds.

Let us take a deeper look at the cautionary tale of BTC Global.

The BTC Global MO

From the get-go, the way that the operators claimed that BTC Global made money, should have set alarm bells ringing. According to the website, they managed to find an illusive Binary Options trader by the name of "Steven Twain". The original homepage was changed but here is how it appeared.

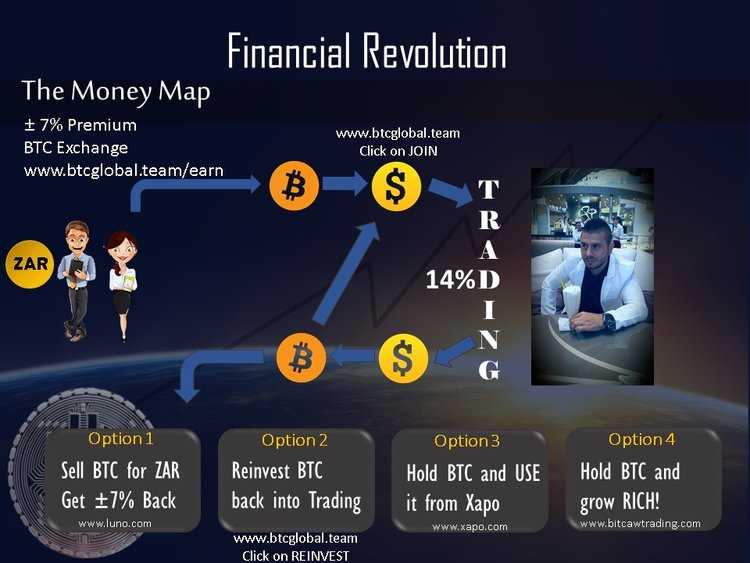

This trading Wunderkind is pictured right drinking a milkshake. Apparentely, he had over 6 years of experience trading these instruments for a whole host of high net worth individuals.

However, today the admin team has managed to secure a lucrative trading agreement with him! They stated:

Through our partnership with Steven, BTC Global have secured access to guaranteed 14% WEEKLY returns from as little as $1,000 invested. We have also secured extra returns to pay out as referral commissions should you decide to share this opportunity with others!

Now, let's take a quick step back and analyse this...

Steven Twain, who looks like someone from MTV's Jersey shore, is offering to trade his clients Binary options and make them fantastic returns? While Bitconnect claimed that they were a "lending" platform, Steven Twain actually makes money trading instruments that are known to be scams.

Then there is the promise of "14% WEEKLY" returns that the investors could get as well as "referral commissions". These are the typical buzzwords that are associated with MLM type pyramid marketing schemes.

Not only were the operators relying on the suckers to believe the Ponzi, but they were encouraging them to refer their friends. They were creating this feeling of an "exclusive invite" club that could get access to Steven Twain's trading services.

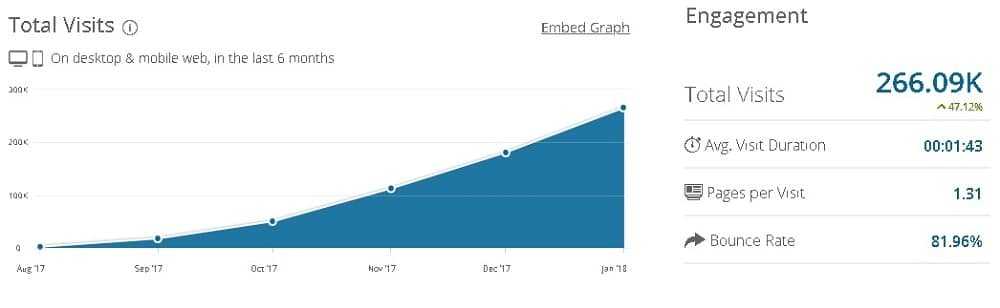

Such was the demand for access to this exclusive club that BTC Global's website ranking and traffic increased exponentially. In the image below, you have the similar web rankings which shows the statistics on BTC Global.

The most important ingredient for a Ponzi scheme is for it to actually pay out. This is exactly what BTC Global did. Despite being initially suspect, many who invested got weekly returns and were hence duped into investing more.

How BTC Global Worked

What is interesting about the coverage of BTC Global is that it has been labelled a "cryptocurrency" Ponzi scheme. This is not entirely accurate. While their name has BTC in it and clients invested in Bitcoin, there was no native token or "scam coin" such as BCC that was used in Bitconnect.

As is shown in the promotional image below, the trader converted the Bitcoin into traditional fiat currency and then traded on the financial markets. He would then convert his Fiat winnings back into Bitcoin to pay the investors.

There was no cryptocurrency trading and Bitcoin was most likely used as it was an immutable form of payment that was much harder to trace than other forms of funding. Investors were encouraged to buy the Bitcoin to fund Steven's trading.

Once the user had registered with the username of their referral, they were taken to an admin panel where they could monitor their "investments" and refer their friends and family. They also had a tiered structure for the referrals that were brought (sound familiar?).

The promoters on the website referred to themselves as the "admin team". They were a bunch of South Africans who were well known to have engaged in previous MLM type online marketing schemes.

One of these people was an individual by the name of Cheri Ward who ran the BTC Global facebook group and posted numerous videos. The rest of the local operators in this admin group were documented in this February Medium post.

Whether these individuals were the mastermind of the scam or mere cogs in the wheel of a larger criminal enterprise is uncertain. One would have to question the wisdom of knowingly promoting a Ponzi scheme with your real identity.

What Brought it Down

Just like Ponzi schemes before it, BTC Global worked until it did not work anymore. While the Bitcoin markets were rallying, they were able to constantly meet their weekly payments.

However, as the price of Bitcoin started to fall in early February, the payments started to slow. The clients started to wonder how safe their investment really was and why Steven was doing so poorly in the financial markets.

There were many contradictory stories that were given including that Steven had become a new dad and could not trade for a few weeks. Then, the story suddenly changed to Steven having suffered a house break in with the thieves taking off with all of his trading equipment.

These contradictory statements led many to believe that the admin team was in fact complicit and could have been much more than unwitting participants. Irrespective of the assumptions, the following has now been placed on the BTC Global site.

We are as shocked and angry as everyone. But we all knew the risks involved in placing funds with Steven. We all became complacent with Steven. And all of us funded him independently.

They then also claim that they are unable to locate Steven and they ask for anyone who has information as to his whereabouts to please get in touch.

What Was the Impact

It is sad to say that this Ponzi scheme has managed to ensnare thousands of people. The directorate of public prosecutions stated that they have received over 27,500 complaints from people all across the country. Investments had ranged from $1,000 up to $120,000.

As with many scams of this nature, those who lost the most tended to be the people who could not afford it. For example, a tree feller from Pretoria had taken a $10,000 from his home loan to invest in the platform.

In total, estimates say the Ponzi scheme was able to pull in about $50 million from the investors. While most of the victims appear to be South Africa, there are reports of victims in other countries including the USA and Australia.

Needless to say, many victims started to blame the local operators and "admin" team. Specifically, they targeted Cheri Ward and made numerous death threats. This prompted her to get a protection order. The website noted:

We call for the threats, harassment and violence on leaders and admin to stop. It is unfathomable that people can behave like this. If you feel you've had a crime committed against you, you need to follow the legal procedures to deal with the matter.

There are also investigations underway by both the local authorities and a private investigator. Unfortunately, it is unlikely the victims will get any of their money back. The Bitcoin that they sent to the operation has likely already been laundered and banked.

What Can be Learned

This is no doubt an upsetting example of investments that sound too good to be true. This was a well known scam in the South African cryptocurrency community. Those who invested in the scheme viewed sceptics with suspicion and ate up the tripe that was concocted by the admin team.

However, when it comes to online scams in the crypto world, the bar seems to get lowered every week. For example, we recently brought you news that people are being scammed by twitter bots offering free cryptocurrency as a promotion.

While no one wants to see innocent people getting scammed out of their money, personal responsibility must take precedent. From investing in ICOs to buying cryptocurrencies and taking part in airdrops, doing your own research is key.

Will justice take it's course?

Much like the Bitconnect promoters, the admin team are likely to face civil claims. However, if it is proved they were complicit, they could serve a substantial sentence in a South African prison.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.