Cryptocurrency Dark Pool Trading: Mass Liquidity Hidden from Sight

Cryptocurrencies have been hailed as a means to increase transparency in Financial markets. The whole notion of a decentralised blockchain was meant to reduce the opaque nature of some transactions.

Enter Cryptocurrency dark pools, large masses of liquidity that is floating around beneath the surface ready to be exploited by whales and large hedge funds. This has become a reality thanks to a company called Republic Protocol (REN).

This is essentially a large and decentralized dark pool that investors can use to trade their tokens. It makes use of atomic swaps which allow for two different cryptocurrencies to be exchanged off of the blockchain.

Through an ICO, the project raised over 35,000 ETH in exchange for the propreitary REN Tokens. The technology behind the project will create a dark pool that will allow large cryptocurrency traders to swap their Bitcoin, Ethereum and other ERC20 tokens.

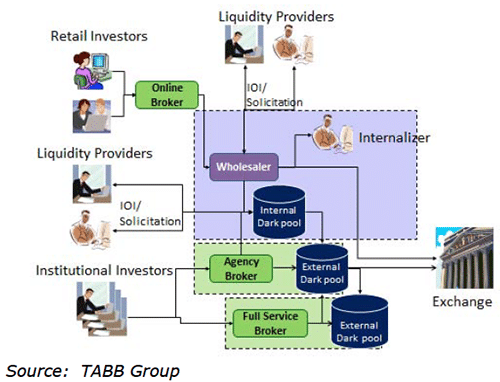

Before we delve into the impacts of dark pool trading on the cryptocurrency markets, lets take a look at how traditional dark pools actually function.

What are Dark Pools?

Dark pools have been around in the equity markets for sometime and have helped to facilitate Over the Counter (OTC) trades of large blocks of shares. They are mostly used by large institutional investors such as hedge funds to trade off of exchanges.

This form of trading has increased substantially in use over the years. In fact, in 2014, off exchange trading accounted for almost 40% of all trades in U.S. stocks. This is compared to the 16% that is was only 6 years prior.

Why the need for dark pools?

There are many purposes that investors may have for dark pools, and not all of them are nefarious. For one, privacy can be important when you are buying / selling large positions as a money manager. This is because these positions are your edge and you don’t want your competition to copy you.

If you were to transact on a centralized exchange, your competition could easily see the trades you were placing. If they are able to see this, they could either try and block your acquisitions (on control grounds) or they could try and front run your positions.

Moreover, when you trade such large volumes of stocks on the market, your actual order could have an impact on the price of the stock. When an equity transaction is placed through a centralized exchange, large orders could lack liquidity.

When there is a lack of liquidity, the individual that is trying to buy / sell the stocks will either have to adjust the price or accept orders that will not be filled. The technical term for a large order on the market impacting price is “slippage”. Moreover, it is likely that really large orders could spook the market and make the price unstable.

There are also several different types of dark pool operations for the investor to make use of. There are broker dealer dark pools, electronic market places as well as agency operated or exchange owned.

While dark pools have been viewed as a great way to source liquidity, they have also been blamed for the role they have played in some market flash crashes. As the trades are off exchange they don’t impact market sentiment. However, when they are reported they can have an outsized impact on the market prices as traders realise how much has changed hands.

Dark Pools in Cryptocurrency

There is also a large demand for underground liquidity in the cryptocurrency markets. Hence, dark pool trading in these markets is no doubt an attractive alternative. This has also been around prior to Republic protocol.

For example, the Kraken cryptocurrrency exchange started offering dark pool cryptocurrency trading. Although this was interesting at the time, there was a fee attached to the trading. Moreover, Kraken has suffered a great deal of technical outages.

There have also been other options from the large cryptocurrency exchange, Bitfinex. While this exchange would no doubt have had the liquidity, there are still many rumors and concerns around tether.

Crypto vs. Equity Dark Pools

While the dark pools in cryptocurrencies perform the same function as their equity brethren, they are executed in different ways and for a different client set.

When it comes to buying large amounts of cryptocurrency, institutional as well as large individual “whale” investors have had to source the liquidity themselves. Given the size of the orders, they would try to avoid centralized exchanges as slippage could hamper their order.

Prior to the introduction and adoption of atomic swaps, cross chain transactions would have had to being facilitated by a centralized broker. For example, one counterparty will indicate their interest for selling a large amount of ETH for BTC.

Then, the broker would source the liquidity in the dark pool and match the buyer and the seller. This is how the Kraken and Bitfinex dark pools had operated prior to cross chain atomic swaps.

Enter Republic Protocol

While cross chain atomic swaps were developed as a simple way for users to exchange their cryptocurrency for low fees, Republic protocol was one of the first companies to see the huge potential for their use in dark pool transactions.

This means that the buyer and seller in the cryptocurrency transaction will deal directly with the opposing party in a completely anonymous yet trustworthy way. This will also make the transaction cheaper as there is no centralized broker to facilitate the sourcing.

Execution of the orders with Republic are also much more advanced. With prior models, there would be a direct match between the buyer and the seller for large blocks of the assets. However, the republic protocol will make use of a matching engine as explained in their whitepaper.

More technically, it makes use of multiparty computation protocol (MPC) engines. It will take the large cryptocurrency orders and break them down into a bunch of smaller orders. This is then matched with a range of different buyers in the pool.

These smaller orders will then execute and once all completed, they would be recompiled back into the state they were in prior to being broken down.

Apart from easing the liquidity, MPC and order fragmentation serves another really important function. It further ensures security and anonymity. As the orders are split, it can be hard to identify the initiating transaction.

Hence, the protocol has similar properties to bitcoin tumblers in that it hides the transaction and the corresponding swap. This is a great solution for those large hedge funds and whales who do not want other participants to know of their crypto swaps.

What Impact will This Have?

Given the impact that Bitcoin futures trading has had on the markets recently, many in the community are concerned about the impact of dark pools on prices. Although this is warranted, the impact is likely to be limited.

Firstly, the transactions are all off chain and done through atomic swaps. Market participants do not know what is being exchanged in the dark pools. They do not have to be brought to the centralized exchange post trades.

Moreover, the estimates of the volume that will be executed through the Republic dark pools is only about $9 billion per month. This is compared to the c. $9bn volume that Bitcoin has had over the past 24 hours.

So while the dark pools are unlikely to have a marked impact on pricing, the added liquidity will provide a great alternative for those of us lucky enough to have millions in Bitcoin we want to swap.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.