Google Search Data Shows Cryptocurrency Interest Falling

If there is one barometer of how much general interest there is in a topic, it is the Google search volume that you get for it. If this is the case, it appears to show that interest in Cryptocurrency is waning.

Google trends display the search volume of particular search terms over time. You can also use Google trends to monitor location specific search queries. This is why they are a very good proxy for the general interest that the population has in crypto.

We took a look at the trends in search queries each year and also drilled down a bit more into the location specific search traffic. Not surprisingly, the interest in a range of different cryptocurrency search terms have trended lower ever since prices have taken a bit of a tumble.

Let's take a deeper look at the numbers.

Bitcoin and Ripple

"Buy Bitcoin" would no doubt have been one of the most searched terms in the massive run up of cryptocurrencies recently. When new people are getting into the market they are most likely to take in interest in cryptocurrencies that they have heard of before.

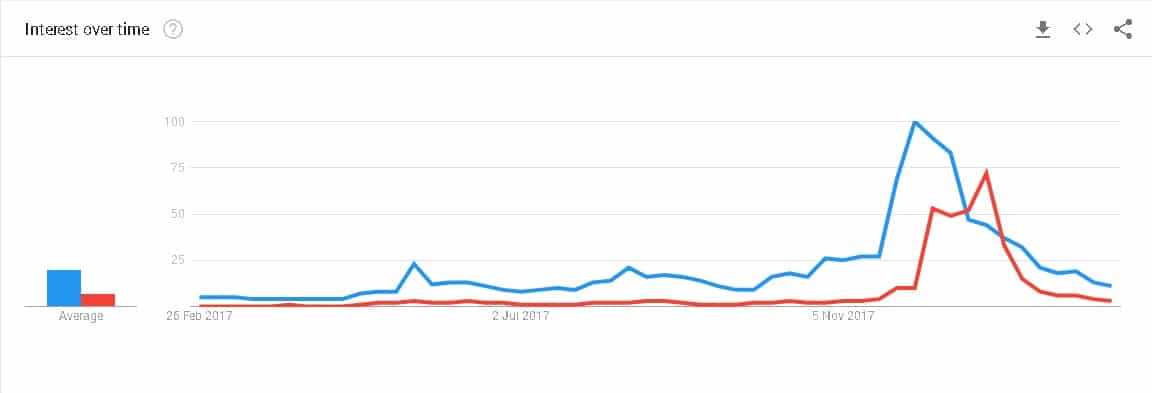

Below we have the search traffic for the term "buy Bitcoin" in blue. As you can see, it reached record highs in December between the 3rd and the 9th. The search queries peaked at 100 queries a day. It is no surprise that this was the time that Bitcoin was breaking new records at all-time highs.

In the graph above you also have the search traffic for the term "buy Ripple" in red. As you can see, this seemed to follow the traffic for the Bitcoin term but usually by a lag of a few days. Between the 31st of December and the 7th of January, Ripple peaked above Bitcoin.

What is even more surprising is how much this has mirrored the price of Bitcoin and Ripple. Below is the price chart of the two cryptocurrencies with Bitcoin in blue and Ripple in red. The relative price of Ripple peaked just after that of Bitcoin.

However, as the price of both of these cryptocurrencies continued to fall, so did the amount of search traffic that was related to it. They are now both at levels that were not see for about a year now.

"Buy Ethereum" Blues

Ethereum was also talked up a great deal last year as the value of a programmable blockchain became evident. Nearly every financial news outlet was covering the massive rise of this cryptocurrency and the price rally that accompanied it.

Hence, it would be interesting to see how well the search traffic for the term "buy Ethereum" (dark blue) followed that of the actual Ethereum price (light blue). In the below chart we have the two metrics with one superimposed on the other.

As you can see, there was a rally in the price of Ethereum in two periods last year. One of those was in the middle of the year in June. This was about the time of ICO mania which not only drove up the price but also drove traffic for the search term.

Then, towards the end of the year you had Ethereum rallying with the other crypto assets. This is because there is a strong correlation between the various cryptocurrency assets.

During this rally in price that we saw towards the end of the year, the search traffic for buying Ethereum also peaked at about 100 per day. What this demonstrates is how closely the interest in buying Ethereum follows the price of Ethereum.

Of course, it is hard to tell what is the driving factor as correlation does not imply causation. More demand will push up the price of an asset but an asset that is increasing in price will also lead more people to seek an exchange to buy it.

Similarly, the price seemed to have kept rallying as search traffic was falling in the middle of January this year. This may have been as a result of buyers already in the market rotating from other cryptocurrencies into Ethereum.

Implications Going Forward

While Google trends is by no means scientific, it is a great way to get a high level view of mass interest in a particular cryptocurrency. As such, it shows that general interest in cryptocurrencies is at a low point.

This could have been as a result of those traders who entered the market at the all-time highs and have now been burned by the recent sell off. As their losses have become known, the word has spread and it may have driven potential new investors away.

It could also be as a result of the increasing levels of FUD that is being flung at cryptocurrencies on a regular basis. Mainstream news outlets have also been feeding the frenzy and turned people off of the idea of investing in cryptocurrencies.

However, for those cryptocurrency investors who hodl their coins, cryptocurrency search trends are unlikely to affect their decision. They do not follow the follow the crowds and Google trends are the epitome of crowd opinion.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.