With over $28.5 billion AUM, OKX is one of the largest cryptocurrency exchanges in the world, second only to Binance (per DeFiLlama). It’s a platform with global reach, particularly strong in markets like Asia, Europe, and the Middle East, serving millions of traders and investors. Beyond spot and derivatives trading, OKX offers staking, DeFi integration, a self-custody wallet, and its own Web3 ecosystem, making it a hub for many in crypto.

But scale alone doesn’t make an exchange safe. Centralized exchanges operate very differently from decentralized exchanges. DEXs are on-chain, heavily audited, and secured by decentralized blockchains. CEXs, on the other hand, are private companies. Users must trust them not only to execute trades but to hold, manage, and protect their assets, often with little direct visibility into how those protections work.

That’s why security on a CEX is as much about transparency and process as it is about technology. In this article, we’ll examine the publicly available information on OKX’s security framework, from its storage systems and risk reserves to wallet architecture and proof of reserves, and understand how the exchange protects user funds.

Is OKX a Safe Exchange in 2025

OKX offers all the standard security measures you’d expect from a well-run global exchange: cold and hot wallet storage, mandatory two-factor authentication, backup systems, and phishing protection, along with extra layers that elevate its protection beyond the average CEX. The exchange enjoys strong adoption worldwide and consistently receives positive reviews from its users. Market perception suggests a high level of confidence in OKX’s ability to keep assets safe.

General Risk Assessment of OKX

Independent evaluations show that OKX performs strongly in most security metrics. Security ratings from third-party sources highlight its advanced protections, and recent audits have found no active critical risks. Adoption figures support this positive risk profile. OKX reports over 50 million registered users across 100+ countries, according to DeFiLlama. This scale, combined with sustained trading activity, demonstrates user confidence and the operational maturity of the platform.

OKX also stands out for its incident history, or lack thereof. No major public breaches or hacks have been recorded, which is unusual for an exchange of its size. When vulnerabilities have been discovered internally or via independent audits, OKX’s handling has been swift. For example, a 2023 security review found a critical flaw in its cryptographic library; the issue was patched quickly, with additional safeguards implemented to prevent recurrence. This response shows that while no system is immune to flaws, OKX has demonstrated the processes and willingness to address them effectively.

User Trust & Market Perception

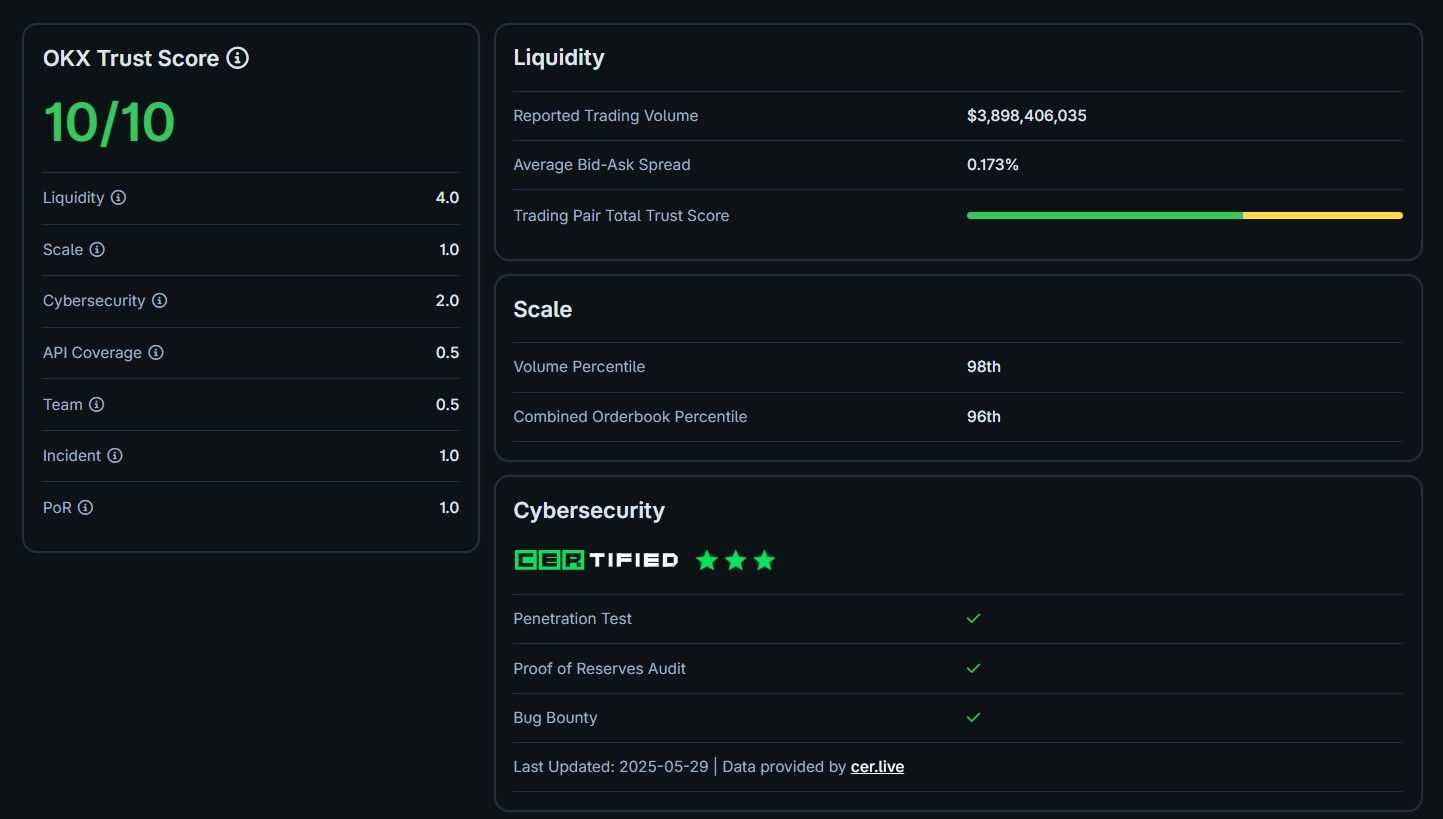

Community sentiment around OKX is generally positive, reflected in high ratings on independent tracking sites and sustained global adoption. On platforms like CoinGecko, OKX holds a perfect 10/10 Trust Score on CoinGecko, which factors in liquidity, transparency, and operational stability. This isn’t solely a measure of security, but it reinforces the perception that the exchange is well-run and dependable.

Transparency plays a key role in maintaining this trust. OKX publishes regular Proof of Reserves reports, offers tools for users to verify holdings independently, and maintains a public leadership profile, elements that help close the trust gap between centralized exchanges and their users.

Compared with other large exchanges like Binance, Bybit, and KuCoin, OKX is consistently ranked among the top in trust ratings. While each platform has its own strengths, OKX’s combination of strong operational track record, proactive vulnerability management, and open communication has helped it earn and keep a solid reputation among traders and long-term holders alike.

Security Features of OKX

OKX offers all the standard security measures you’d expect from a well-run exchange: a combination of cold and hot wallet storage, mandatory two-factor authentication, backup systems, and phishing protection, but also layers in extra safeguards that place its security profile above the industry average.

Data Encryption and Storage

The majority of customer funds are stored offline in air-gapped cold wallets (95% of the funds), protected by encrypted private keys generated and stored entirely offline. Multiple off-site backups and secure bank vault storage add redundancy. Any movement of these funds requires semi-offline multi-signature approval and risk checks before signing.

Hot wallets, which handle withdrawals and day-to-day liquidity, hold 5% assets for handling settlements quickly. These are protected with strict access controls, continuous monitoring, and layered network defenses. Private keys are stored in volatile memory (RAM) rather than permanent storage, reducing the risk of theft through physical compromise.

Two-Factor Authentication (2FA)

OKX enforces mandatory 2FA for all accounts, rather than leaving it as an optional feature. Users can set up authenticator apps such as Google Authenticator or Microsoft Authenticator, with SMS verification as a secondary option. This extra layer of verification significantly reduces the likelihood of unauthorized logins.

Withdrawal Protection Features

Users can enable address whitelisting, restricting withdrawals to pre-approved addresses. Any new address requires confirmation before use. This creates an additional barrier against unauthorized fund transfers, even if account credentials are compromised.

Device & IP Whitelisting

OKX offers robust device management tools, allowing users to monitor all active sessions and immediately revoke any suspicious logins. Real-time alerts are sent for sensitive actions like withdrawals or password changes, helping users respond quickly to potential threats.

In 2025, OKX also rolled out AI-powered threat detection under its Eagle Eye program, which scans for deepfakes, fake profiles, and fraudulent activity. Combined with anti-phishing email codes, these features strengthen both account security and user awareness.

Regulatory Compliance and Licensing

OKX operates as a global exchange with a presence in multiple jurisdictions. While it does not hold a single, universal license that covers all markets, it complies with local regulations in the regions where it operates and adjusts its services to meet jurisdictional requirements. This approach allows OKX to maintain a wide footprint while staying aligned with relevant financial and compliance standards.

Is OKX Regulated?

OKX is headquartered in San Jose, California, with major regional offices in Dubai, Singapore, Türkiye, and within the EEA. The company is part of the OK Group, which also owns OKCoin, a separately licensed entity in certain regions. OKX tailors its operations to meet local requirements. In some jurisdictions, it offers full services, while in others, features may be restricted or unavailable due to licensing laws.

Although OKX is not licensed as a single, fully regulated exchange across all countries (like some smaller platforms that operate in limited markets), it ranks among the largest exchanges globally by volume and trust scores. This position is maintained through strict adherence to anti-money laundering (AML) requirements, active compliance monitoring, and transparent leadership operations.

KYC/AML Requirements

OKX enforces mandatory KYC verification at all account levels. Verification tiers determine trading, deposit, and withdrawal limits, with higher tiers requiring more detailed identification and proof-of-residence documentation.

The platform’s AML compliance aligns with international standards, designed to detect and prevent illicit activities. Measures include:

- Screening against global sanctions and watchlists.

- Transaction monitoring to flag suspicious patterns.

- Mandatory identity checks for new accounts before enabling withdrawals.

This structured compliance framework not only meets legal obligations but also acts as a security layer, reducing the risk of fraud, account misuse, and regulatory breaches.

Insurance & Asset Protection

Protecting customer funds goes beyond technology; it also requires strong financial safeguards and operational processes that limit the impact of unexpected events. OKX combines preventive measures with reserve funds and structural controls to keep user assets secure, even in the face of potential system failures or targeted attacks.

Fund Safeguards

OKX has implemented multi-layered safeguards that prevent unauthorized fund access and backup measures in case they are lost in any way:

- OKX Risk Shield – A portion of the exchange’s earnings is allocated to an internal risk reserve fund. This pool can be used to reimburse users in the event of specific security incidents, adding a financial backstop to technical protections.

- Semi-Offline Multi-Signature Vaults – The bulk of user funds are stored in cold wallets that require multi-party approval before any movement. These semi-offline systems keep private keys away from live networks and enforce a multi-signature process that prevents unilateral access to funds.

- Emergency Backups – Multiple secure backups of keys and critical systems are maintained in geographically separate, high-security facilities. This ensures operational continuity and rapid recovery if infrastructure is damaged or compromised.

- Anti-Phishing Code – Users can create a unique code that appears in all official OKX communications. Any message lacking the correct code can be identified as fraudulent, helping users avoid phishing attempts.

Proof of Reserves

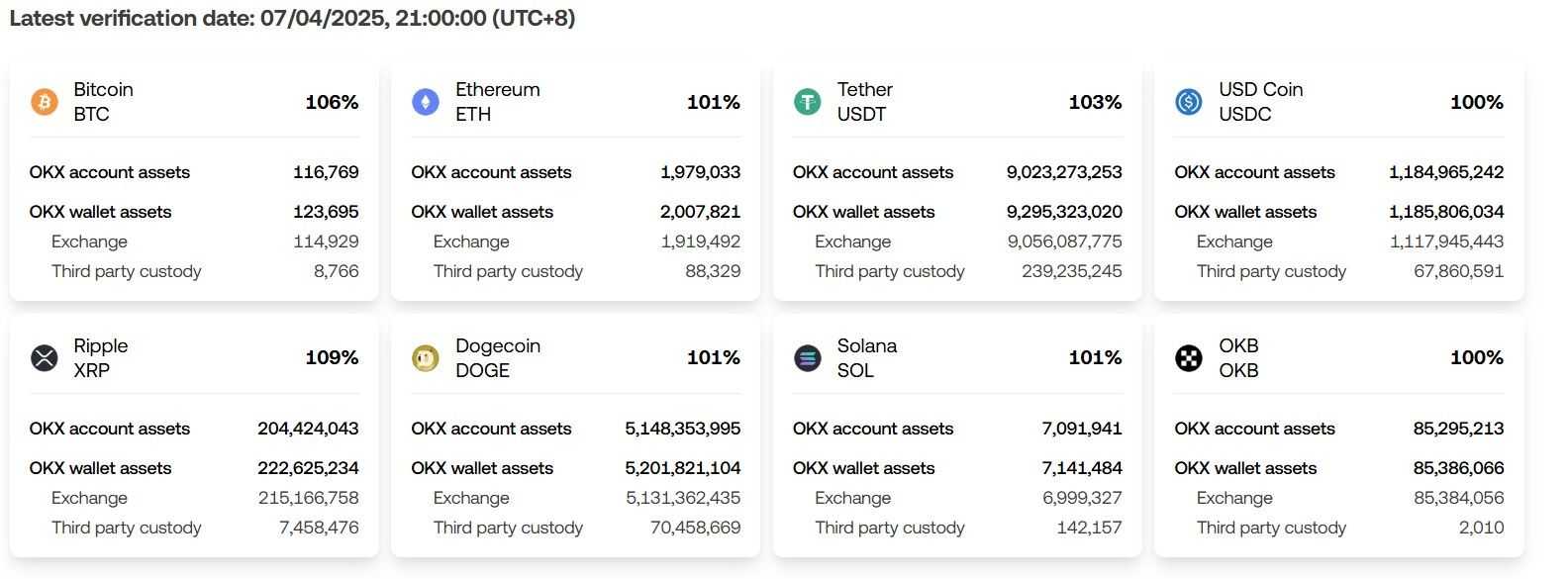

OKX publishes regular Proof of Reserves (PoR) reports to verify that customer assets are fully backed. This process allows anyone to confirm, via cryptographic methods, that the exchange holds reserves matching or exceeding user balances.

According to CoinGecko’s security evaluation (updated May 2025), OKX reports $28.35 billion in exchange reserves. The PoR system covers major assets, including BTC, ETH, and USDT, and allows users to independently verify their holdings through a Merkle tree audit tool on the OKX website.

While OKX scores a perfect 1.0/1.0 in the PoR category under CoinGecko’s Trust Score methodology, CER.live notes that full certification in its framework requires third-party audited proof of liabilities alongside reserves. The available data confirms that OKX meets the reserves requirement, but the liabilities attestation is not explicitly stated in CER.live’s latest listing.

Even so, the combination of public reserve data, cryptographic verification, and ongoing PoR updates makes OKX one of the more transparent major CEXs in this regard.

Customer Support & Dispute Resolution

When things go sideways in crypto, knowing that help is just a click away offers peace of mind. OKX provides 24/7 support, including live chat, email support, and a detailed self-service Help Center with FAQs, guides, and troubleshooting tools. Users can find ready answers to common questions like deposit issues, authentication setup, or account freezes, without needing to open a ticket.

User Dispute Handling

Community sentiment on OKX support is mixed; some users find it efficient, others less so. Here's a snapshot of real-world feedback:

- On Reddit (r/OKX), one user described a support experience as frustratingly repetitive.

- Another case involved an account freeze with a confusing experience, but a successful resolution.

- One user on Trustpilot reported having funds frozen with vague explanations and a shifting unfreeze date.

Industry-wide reviewers note that while OKX support is functional but not flawless, customers reported frictions in the process, but in most cases reached a resolution.

General Summary:

- Strengths: 24/7 availability, self-service options, live chat for urgent matters.

- Weaknesses: Delays or vague replies in complex cases, especially around KYC and frozen accounts.

- Key Win: In several instances, users eventually regained access or funds, thanks to persistence or escalation through the right channels.

Recent Security Audits & External Ratings

OKX’s security posture has been independently evaluated by multiple third-party organizations, earning it high marks across the board. These external ratings provide an additional layer of confidence, as they reflect assessments made outside of the company’s own marketing claims.

CER.live Rating – OKX holds an AAA rating (90/100) on CER.live, reflecting a “very high” level of security. The breakdown includes perfect scores in:

- Server Security (100/100) – Implementation of SSL/TLS, Web Application Firewall (WAF), Content Delivery Network (CDN), DNSSEC, strong HTTP security headers, and zero blacklisting in spam databases.

- User Security (100/100) – Mandatory 2FA, strict password requirements, device management tools, withdrawal whitelisting, anti-phishing codes, and CAPTCHA protection.

- Penetration Testing (100/100) – Full-scope penetration tests conducted annually to identify and patch vulnerabilities.

- Bug Bounty (100/100) – An active bounty program encouraging independent security researchers to report vulnerabilities.

- Additional points for ISO 27001 certification and the presence of an insurance fund for user asset protection.

CoinGecko Trust Score – OKX has a perfect 10/10 Trust Score, a composite metric that factors in liquidity, scale of operations, API quality, cybersecurity, transparency, and proof of reserves. Importantly, it also reflects the exchange’s clean incident record; OKX has had no major publicly reported security breaches.

CertiK Audits – Multiple security reviews have been conducted by blockchain security firm CertiK:

- Threshold Signature Library Audit (2023) – Identified a critical vulnerability (Lindell17 Abort) that could have exposed private keys under certain conditions. OKX immediately patched the flaw, implemented permanent bans for failed ECDSA requests, and added zero-knowledge proof safeguards.

- Wallet SDK and Mobile App Audit (2024) – Found no critical, major, or medium-severity risks. Minor issues included outdated crypto libraries and suboptimal random number generation; both are slated for resolution in future releases.

Across both audits, OKX demonstrated a proactive approach by resolving or acknowledging all findings and making structural improvements where necessary.

These ratings and audit outcomes paint a consistent picture: OKX meets or exceeds industry best practices in both infrastructure security and operational transparency, with independent verification to back those claims.

Final Verdict: Should You Trust OKX with Your Funds in 2025?

OKX has built one of the strongest security profiles in the centralized exchange market, backed by AAA-rated protections from CER.live, a perfect 10/10 CoinGecko Trust Score, ISO 27001 certification, and multiple clean third-party audits. Its layered defense approach, combining cold storage, multi-signature systems, mandatory 2FA, withdrawal whitelisting, and AI-powered threat detection, gives it a solid technical foundation.

Pros:

- Strong independent security ratings and trust scores

- No major public security breaches in its operational history

- Transparent proof of reserves with public verification tools

- Proactive vulnerability patching and an active bug bounty program

Cons:

- Mixed user experiences with dispute resolution in complex cases

- Not fully licensed in all jurisdictions

- Occasional delays or vague communication during KYC or account freezes

Who It’s Best For: OKX is well-suited for active traders, DeFi participants, and crypto users who want a mix of exchange trading and Web3 wallet integration, with strong security safeguards. Those in regions where OKX operates with full services will benefit most from its feature set.

OKX has proven it takes security seriously, but users should remember that even the best systems can be undermined by weak personal practices. Keep 2FA enabled, whitelist withdrawal addresses, store seed phrases offline, and regularly monitor account activity. In short, OKX will do its part; the rest is up to you.

Frequently Asked Questions

No major public hacks or breaches have been recorded in OKX’s operational history. When vulnerabilities have been discovered through audits, OKX has patched them promptly, often adding extra safeguards to prevent similar issues in the future.

Yes. OKX maintains a Risk Shield reserve fund that can cover certain losses from security incidents. It also has an insurance fund for derivatives markets and follows asset segregation policies, keeping customer funds separate from operational funds.

The majority of assets are kept in air-gapped cold wallets with semi-offline multi-signature approval required for any movement. A small portion is stored in hot wallets to handle day-to-day withdrawals and liquidity needs, secured with strict access controls and real-time monitoring.

Withdrawals can be restricted to whitelisted addresses for added security. Processing times are generally fast, often within minutes but may take longer if risk checks or manual reviews are triggered. Larger withdrawals or those from new devices may require additional verification.

User feedback is mixed. Many praise OKX’s security features and 24/7 support, while others report delays or vague responses in complex cases like KYC reviews or frozen accounts. Positive cases often involve eventual resolution, especially when users escalate through the correct channels.

OKX ranks alongside Binance and Bybit in global volume and trust scores. It holds a AAA CER.live rating, a 10/10 CoinGecko Trust Score, and has passed independent audits, giving it one of the strongest verified security profiles among major CEXs.

For active trading, keeping assets on OKX is generally safe given its security measures. However, for long-term holding, best practice is to withdraw to a self-custodial wallet where you control the private keys, reducing reliance on any single exchange.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.