It is no secret that China is in by far the most dominant position when it comes to Bitcoin mining. Currently, China accounts for about 71% of the mining hash power in the world. This comes down to simple economics and the incentives that drives these decisions. In a recent analysis by BitMex, China has some of the lowest barriers to setting up a mining farm as well as really cheap electricity costs.

Setting up a mine in China requires a great deal of local expertise. This is what allows miners to set up as quickly and efficiently as possible. Having the right technical expertise in the area can help when it comes to finding employees. Similarly, given that most of the mining chips are produced in China, it is easier to source the hardware that is required to run the miners.

The study also mentions the corruption that is present in the power industries of China. For example, some Bitcoin miners are able to make agreements with power plant owners to whereby the miners can set up an operation right near the point of supply. Given that electricity is one of the biggest costs in a mine, under the table agreements like this are advantageous.

China's Hydropower Boom

Electricity Costs in China are already some of the lowest in the world. This is mainly as a result of the abundance of coal that is used with very little in the way of regulatory barriers such as environmental protections. Yet , what may be bad for the environment is good for Bitcoin miners.

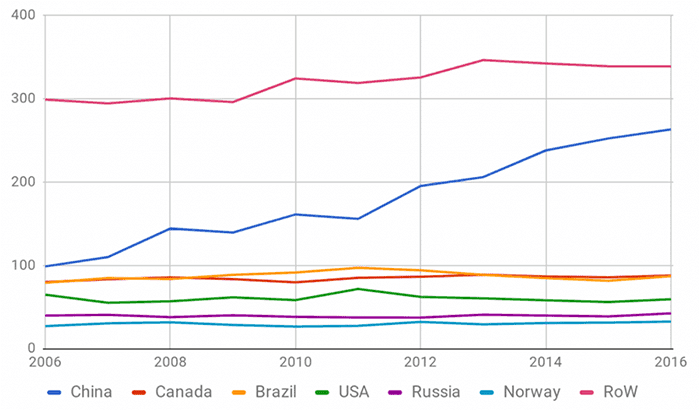

However, China has also been rapidly expanding their hydro power plants. This is something that was initiated when China launched the Three Gorges Project in 2003 which is able to produce 100 TWh of electricity. In the below image, you can see the growth in the share of Chinese hydropower production globally.

China is also building two more hydro power plants which could produce a combined 90 TWh of electricity. This will be produced in the Baihetan and Wudongde projects. Although this capacity vastly outstrips the total 15 TWh that the whole of the Bitcoin network takes up, it was mainly aimed at the expanding aluminium smelting industry.

Aluminium Smelting in China

Due to the process with which aluminium is smelted, hydropower makes for a really efficient source of power. For example, in Canada at least 80% of the power that is used to smelt comes from hydro power. This is substantially less than the 10% that it provides in China.

As aluminium production has picked up in China, so has the need for more power to smelt it. This was the reason as to the massive investment in hydro power plants over the past few years. However, as the demand for aluminium production in the country began to decline, the need for all of the power that was generated followed suit. The study takes a deep dive into the underlying numbers. They identified that there could be a possible overcapacity in terms of supply in the next few years.

Although many may think that this overcapacity can just be sent to China's bustling urban centres, it is also not the most efficient solution. This is because the hydro power plants are to the west in the interior of the country and are far away from the cities. This means that the electricity will have to travel long distances which could lead to loss of power. Therefore, it would be more economical for a power consumer to be closer to the source of the power.

Bitcoin Miners to the Rescue

Given that Bitcoin farms do not have to be located in large urban centres, they provide an interesting solution for the hydro power plants that have excess capacity that they would like utilised. They are able to move to the west of the country and set up their farms right next to the plants.

These miners are also able to enter into agreements with the electricity suppliers and local regulators to be able to get favourable rates for the farms. According to the conclusion of the study

In our view, the confluence of underutilized hydropower due to the over investment in subsidized loss making aluminium production, the construction of these facilities in the remote west of the country and a lack of strong UHV transmission infrastructure, have contributed to China’s Bitcoin mining success story

More Concentration Ahead?

Although this may be a natural side effect of the economic forces at work, there are many who would not appreciate further concentration in the hands of the Chinese mining firms and pools. Given that the power prices will be artificially low by international standards, it will mean that more miners will be able to hash out much more supply.

This could lead to lower prices and hence the exit of further competition from other places in the world. However, there are also concerns in China that the government is becoming a lot more proactive in Bitcoin enforcement. This means that they could demand more regulation in the field of Bitcoin mining and hence make setting up a farm much more cumbersome. Only time will tell…

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.