PlusToken Scam: The Biggest Crypto Fraud in History

Just as there are millions of people across the world investing in cryptocurrencies, so too is there no shortage of others looking to fleece them.

The last few years have thrown up numerous scams and scandals which have seen billions of dollars worth of crypto disappear. Sometimes the missing funds are recovered and their owners reimbursed; often they’re not. Cautionary tales abound.

Background

Just as there are millions of people across the world investing in cryptocurrencies, so too is there no shortage of others looking to fleece them. The last few years have thrown up numerous scams and scandals which have seen billions of dollars worth of crypto disappear. Sometimes the missing funds are recovered and their owners reimbursed; often they’re not. Cautionary tales abound.

In 2014 the Mt. Gox exchange collapsed, following a hack which saw 844,408 Bitcoins (over $9 billion at today’s prices) lost. In 2019 two Israelis were arrested for stealing over $100 million in crypto through phishing schemes and a hack of Bitfinex.

The QuadrigaCX scandal is a murky tale of deception and intrigue which saw $190 million in crypto assets vanish, along with the exchange’s founder. These are three of the biggest and most well-publicised debacles to have rocked the world of crypto, but there are numerous others. Each time it happens, lives are turned upside down, life savings are lost and innocent people suffer.

There is a more recent scandal still playing out, which has not attracted as much attention as those above, at least here in the West. The numbers involved are so huge that last year it was thought the price of BTC was being affected by the fraudsters dumping their ill-gotten gains onto the markets.

This was PlusToken - a crypto wallet which originated in China and promised investors returns of up to 30%, but which turned out to be a Ponzi scheme. Nearly $6 billion is thought to have been lost and just yesterday more arrests were made by Chinese police investigating the case.

But before we take a closer look at PlusToken itself, it’s worth examining in a bit more detail exactly what Ponzi schemes are and how they work.

False Promises & Diminishing Returns

Ponzi schemes have been around for a century, ever since Charles Ponzi, an Italian who moved to America, set up one involving the US Postal Service in 1919. The concept is thought to pre-date him, but the scope of his operation was enough to tie his name to such scams forever.

The premise is simple: the scheme’s originator attracts investors with the promise of high and regular returns, with little or no risk attached. The investment strategy itself is often portrayed as secret or too complex for anyone but schemesters themselves to understand. All the scheme’s efforts are focussed on attracting new investors, whose money is then used to reward those who invested earlier.

A core of ‘satisfied customers’ helps to attract more investors to prop up the scheme and keep the payouts flowing. Most of the money is of course going to those at the top of the pyramid, with only a fraction being paid to those lower down.

The scheme can only last as long as new investors can be found and their money eked out to provide evidence of returns. Once the flow of new investors dries up, the scheme comes crashing down and the originators - along with most of the money invested - are nowhere to be found. Ponzi schemes are much like pyramid schemes, though there are some subtle differences.

Charles Ponzi

Ponzi’s initial scheme involved arbitraging international reply coupons (IRCs). These coupons were included in letters sent overseas to cover the cost of the recipient’s reply. Ponzi spotted that IRCs could be bought cheaply in places such as Italy and then exchanged in the United States for postage stamps of a higher value. These stamps could then be sold at a profit.

There was nothing illegal in doing this and Ponzi began seeking investors for his scheme. He promised some eye-catching rates of return: 50% profit on investments within 45 days, rising to 100% over 90 days.

Sure enough, money began to flow in and Ponzi was as good as his word regarding those returns. The problem was that the money being paid out wasn’t coming from the re-sale of IRCs (the logistics of which soon became impossible) but from subsequent investors. Ponzi himself was pocketing millions and living the high life.

So much money was poured into Ponzi’s scheme that it was bound to raise questions. The Boston Post began investigating and Ponzi was eventually revealed as a fraudster. It was estimated that his scheme had cost investors around $20 million (nearly $200 million today). Many lost everything they had, having remortgaged their homes to invest. Ponzi wound up in prison and eventually died - broke and unrepentant - in Rio de Janeiro in 1949.

Ponzi's Legacy

That figure of $20 million doesn’t begin to adequately quantify the misery that Ponzi left in his wake. Yet despite this, others would adopt similar tactics down the years, often with greater levels of success.

The most notorious of these is undoubtedly Bernie Madoff, the New York financier who defrauded investors of anywhere between 18 and 65 billion dollars through his own vast and complex Ponzi scheme. Madoff was sentenced to 150 years in prison for his crimes and is incarcerated in North Carolina. So far, less than $1 billion has been returned to his victims.

What Ponzi, Madoff and others like them have shown is that gullible investors can be milked for incredible sums. People can be relieved of their money with promises of high returns and low risk, with a notable absence of detail offered by way of explanation. This is as true in the crypto sphere as it is anywhere else and perhaps to an even greater extent.

Boom and Bust

Crypto’s 2017 bull run is still fresh in the memory and many still associate Bitcoin, Ethereum and all the other altcoins with insane gains and easy money. It’s hard to blame people for this sense of optimism, however misplaced it is in many cases.

Wages are stagnating, interest rates are close to zero, the world is entering another recession and many young people are facing up to the fact that they may never be able to own their own home. Fear, uncertainty and doubt hover over the horizon. For many people, there doesn’t seem to be much hope of enjoying the same advantages that their parents did.

All this makes crypto one of the few opportunities for many people to boost their income. We probably all know someone, or know of someone, who cashed in back in 2017. Those people who bought three Bitcoin for $50 a pop, resisted the urge to spend them on the darkweb, and subsequently found themselves with enough money for a deposit on an apartment.

Yes, there are those of us who know the risks involved with crypto and are careful with what coins and projects we invest in. However, there are still plenty who want to make a killing and make it quickly. Just as there were in Ponzi’s day and will be forevermore.

Crypto Ponzis

There have been several crypto-based scams which have resulted in staggering losses over the last two years. There was the BitConnect Ponzi scheme in 2018 which saw losses of over $2 billion. Then, just last year, the founders of the BitClub Network were indicted for fraud that involved crypto mining pools. It’s estimated that investors lost $722 million.

Both of these pale in comparison to the scale of the PlusToken scam. The targets were mainly investors in China and South Korea, although others were affected across East Asia and there were reports of victims from places as far afield as Germany and Canada. Investors were lured in with promises of returns of 9-18% if they bought PLUS tokens using BTC or ETH.

They were told that these PLUS tokens would gain in value up to $350 and that the scheme would derive its profits from crypto mining operations, affiliate programs and exchange profits. The mooted PlusToken wallet was also touted as a potential game-changer in the space. It is estimated that the project sucked in nearly $6 billion worth of crypto, including 180,000 BTC, nearly 800,000 ETH and 26 million EOS.

Most of this has never been recovered. PlusToken turned out to be a scam worthy of Madoff or Ponzi himself. Early investors did see returns, but they were funded by other investors queuing up behind them. It seems that the scheme’s masterminds were a canny bunch.

They lured investors through social media, most notably WeChat, but also took pains to hold public salons and workshops where investors were taught how to recruit more people to the platform. Adverts also appeared on billboards and in grocery stores. These public measures gave the project an air of legitimacy that it seems confounded the doubts of many sceptics.

Then there was the PlusToken app, an apparently sophisticated platform where users could deposit Chinese yuan and then convert it into a range of cryptocurrencies. Rewards were paid out in PLUS tokens and the developers appealed to users’ vanity by assigning them to one of four tiers depending on the size of their investment.

These PLUS tokens turned out to be worthless and those who had invested enough to qualify for ‘Big Boy’ or ‘Great God’ status found themselves feeling anything but great or godlike. It is estimated that PlusToken had attracted somewhere between three and four million users by the time things started to go wrong.

‘Sorry, we have run’

In June 2019 PlusToken users began reporting difficulties in getting their funds off the platform and talk started to grow of an exit scam. PlusToken staff spread rumours that a hack had taken place in order to throw users off the scent, while at the same time beginning to move funds out of reach. As an added slap in the face to panicking investors, some transactions carried notes which read, ‘sorry, we have run.’ PlusToken was starting to unravel.

The breadth and scope of the scam had attracted the attention of Chinese law enforcement and six suspects were arrested on the Pacific island of Vanuatu in late June 2019. It is thought that they were running the scheme from an address in the island’s capital, Port Vila. These six (pictured below) were then extradited back to mainland China, where they are currently awaiting trial.

Dumping The Spoils

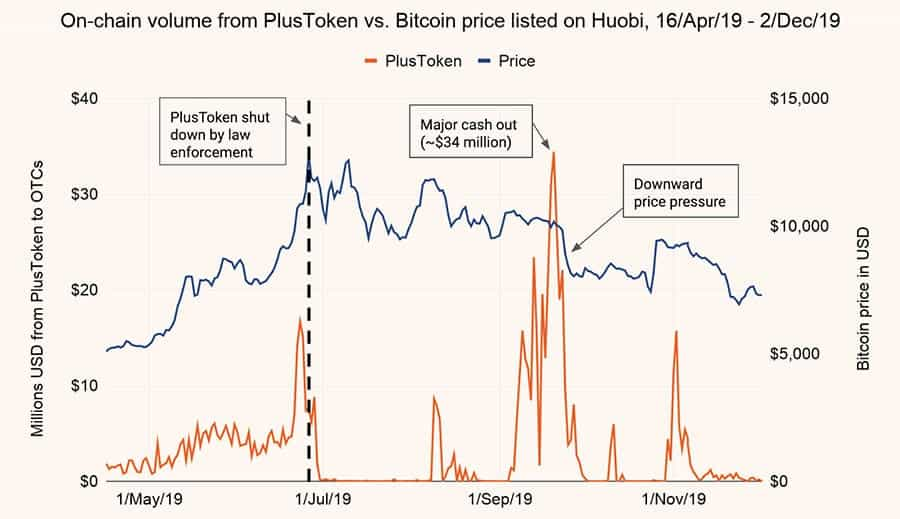

The Vanuatu raid may have netted six of PlusToken’s big players, but many more remained at large. They then began cashing out the scheme’s hoardings of BTC on various exchanges. It is this move that is thought by some to be behind the massive drop in crypto prices around that time: a testament to how much PlusToken had managed to reel in. Some estimates say that between one and two per cent of the total circulating Bitcoin supply might have been involved.

The group’s supplies of ETH and EOS remained in place until this year, as many of the wallet addresses where they were being held had been identified. Analysts are still keeping close tabs on these wallets and trying to identify others, but recent activity suggests PlusToken staff members may still be trying to liquidate funds. It seems that in many cases they have been able to bypass exchange KYC procedures and trade stolen funds on the open market.

The most recent round of arrests is thought to have netted over 100 people and so it will be interesting to see what happens to the outstanding funds now that so many more are in custody.

Investors must be hoping that they may be able to recoup some of their losses and the fact that so many wallet addresses have been identified may make this possible. History would suggest that this may be unlikely. Ponzi, Madoff and the PlusToken fraudsters all have one thing in common: the ability to make money vanish into thin air.

Conclusion

As the vast majority of PlusToken’s victims are from China and South Korea, the story hasn’t garnered as much attention here in the West as it has in East Asia. There are also conflicting views on the destination of the missing funds and their negative impact on crypto prices.

American blockchain analytics firm CipherTrace disputes the notion that PlusToken staff dumped BTC on exchanges and affected the price. This is in direct contrast to the claims made by the Chinese-run firm PeckShield.

There is also disquiet in the crypto sphere that this sort of scandal could easily happen again. Other scams are thought to be lurking and there is concern that investors in China are more susceptible to schemes that promise high yield returns than their Western counterparts.

The gulf between China and the West is growing and the pandemic crisis has done nothing to help the situation. Yet the crypto sphere presents opportunities for fostering unity that may not exist elsewhere.

One such opportunity should be the determination to co-operate on stamping out schemes like PlusToken and its future imitators. After all, Ponzi schemes and tales of fleeced investors only serve to harm crypto’s image and deter mass adoption.

The global crypto community needs to act as one where such scams are concerned: wherever they take place and whoever they affect, we should work together to stamp them out.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.