Verge (XVG): A Privacy Coin Worth Considering, Or Just Another Crypto?

2017 has been a smashingly successful year for the cryptocurrency space’s larger “privacy coins.” Consider how Dash (DASH) just became the second crypto ever behind Bitcoin to reach the $1,000 USD price point, or how Monero (XMR) is now above $300 in its own right.

Not bad at all, we say. But where there’s a lot of chatter really picking up right now is around privacy coin underdog Verge (XVG).

Underdog, in the sense that XVG just underwent a rebranding and so is aiming to gain serious ground in the upcoming year with new users and a newly honed mission.

So let’s get into Verge, and the things you should consider with this particular coin as we go into the new year.

What is Verge?

Verge was originally launched as DogecoinDark, a cryptocoin that forked from PeerCoin back in 2014. So it’s safe to say Verge isn’t a new kid on the block, as it were.

XVG aims to protect users’ privacy while sustaining an open blockchain, a necessary dynamic for businesses wanting to use a given cryptocurrency. How does Verge protect privacy, then?

By connecting users’ to its blockchain via TOR – the anonymizing router network. But it’s already possible to connect to Bitcoin through TOR, which is a common complaint against XVG, but we’ll speak more on that later.

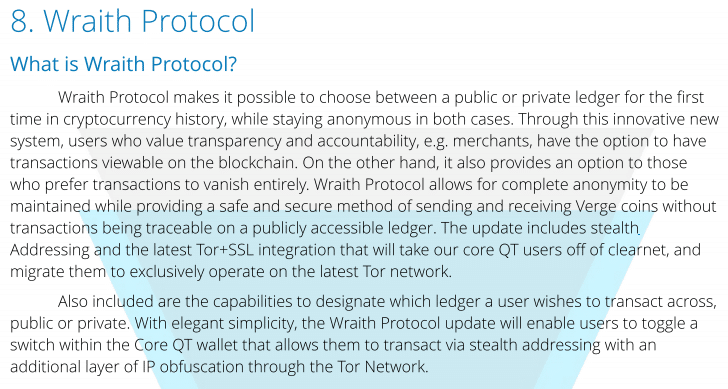

Furthermore, Verge is in the process of implementing its new Wraith protocol. This protocol will allow users to choose between a public or private distributed ledger at will when transacting – an apparent first-mover functionality for the entire cryptocurrency space.

How does XVG compare against other privacy coins?

When it comes down to privacy, the other top privacy cryptocurrencies take the cake.

For instance, Monero doesn’t have a public blockchain like Verge does. It’s impossible to know how much XMR any given address holds. That’s airtight privacy.

Verge, on the other hand, wants to try and hide IP addresses which helps with privacy. This is possible given that Verge transactions take place over the TOR network. There have been questions as to whether IP leaks were indeed occurring in the past.

But you don’t even have to get into technical details to make an argument for why Dash and Monero are inherently wiser investments than Verge.

That’s because, as coins that are already in the top 10, Dash and Monero are already dominant and have name recognition. That means they will continue to siphon the majority of new users and money that settle into privacy coins in the cryptocurrency space.

It’s the same dynamic as investing in altcoins vs. Bitcoin. You can invest in altcoins and try to “win big.” But sometimes, the charts end up proving that you would’ve made a lot more by just sitting tight in Bitcoin instead.

This kind of dynamic could materialize in the privacy coins marketplace. Will Verge see gains in 2018? Surely! But it’s possible you might make more just by betting on Monero and Dash for now.

That’s up for you to decide.

Common complaints

Just so you know what you’re dealing with, if you peruse the online crypto forums, you’ll see many common complaints against XVG.

These complaints are good to keep in mind so you can make a critical judgment that’s not overpowered by FOMO (“Fear on missing out”). There are many people who are critical of the cryptocurrency but there is also quite a dedicated community pushing the prospects of the project.

Of course, which side is right will eventually be determined. The marketplace will speak for itself in 2018, and it would be surprising if the XVG price didn’t go up to some degree in the coming year.

Your best bet with Verge is to keep an eye on it. It’s not the sexiest project ever right now, but let’s see how they continue development in the months ahead.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.