Many of us were indoctrinated into the age-old adage of "put in a solid day's work and you will be rewarded with a good life in time". But a character in a Hong Kong TV show once retorted: "I see plenty of cows and buffalos working their asses off. I don't see them getting rich." The problem? Wealth doesn't happen to living beings through hard work alone. It's not us or the animals that need to be pulling all-nighters. It's our money that needs to be doing that. The best thing about money? It never complains about overtime, take smoke or pee breaks, and doesn't require extra pay during the holidays. Not only that, it doesn't have any intelligence so we don't need to be concerned about "The Rise of the Money King" and escape from our control. Crypto assets are the same. They are the best labourers in the world and their sole job is to make our lives easy. In this article, not only will we look at ways to put our crypto assets to work, we will also look at how we can use our money to invest in companies using blockchain and crypto technology to change the way we do things.

The thing about passive income is that it's a long-term game. For most of us just starting out, it might be just a few drops that you get from your investments. With the magic of auto-compounding, those few drops can slowly build up to a trickle, then a stream. With this in mind, the suggestions presented here are for cautious investors. The returns aren't spectacular, especially if measured through the lenses of exponential crypto gains in 3-digit percentage points and more. However, they will still beat anything you can get from a bank these days. Investing in something new can be a daunting prospect. The fear of "what if I lose everything I invested?" is a very valid concern. That's why preserving capital is the most important thing, followed by growing profit. Alright, let's see how we can get started in a relatively safe way.

Staking on the blockchain

How it works

You get what you put in. Whatever token you deposit into a stakepool or with a validator, you get the same type of token back. There may or may not be a lock-up period involved. This depends on the blockchain project.

What are the risks?

The biggest risk is the project falls over, whether because it's falling behind in competitiveness or the people in the project lost interest in it. There's also the risk of a rugpull, ie someone running away with all the money. The more established a project is, the least likely this will happen though.

What sort of APY can I expect?

Depending on the project you decide to stake on and where you stake them, APY ranges anywhere from 4.6% to 14%. If you're interested to find out which are the best tokens for staking in terms of APT, check out this page for the most updated rates.

Which projects are worth looking into?

When it comes to deciding which projects to stake on, I see there being two types: Layer-1 blockchain projects and everything else. For the purpose of keeping things simple, the focus in this section is on the Layer-1 projects. They are the least riskiest ones because lots of applications are built on it. There's a huge reliance on the blockchain to be in good shape. It may not look like it, but decentralised projects are quite competitive too. If it's even slightly behind, there's always something snapping at its heels, ready to take over its spot anytime.

Within the Layer-1 projects, there are also major and minor players:

Ethereum

There's a Chinese saying "Women hold up half the sky". Substitute "women" for Ethereum" and "sky" for "crypto world" and that's pretty much the state of things now. Thanks to Ethereum and smart contracts, we get DeFi, NFTs and who knows what else coming down the road. It's undergoing growing pains now as it transitions from a PoW to PoS consensus mechanism. As part of this change, it's looking for people to stake ETH tokens on its platform.

Risk of falling over: next to zero. With the amount of institutional interest in it, not to mention all the existing dApps relying on it, it's the 400-pound gorilla next to the 800-pound one that is Bitcoin.

Lock-up period: Yes, all ETH tokens staked cannot be withdrawn until after the migration is over, which could be another 1-2 years away.

Solana

Touted as the next "ETH killer", Solana has made great progress since its inception in 2017. Born later than Ethereum, it's got serious VC money invested in it. Boasting a theoretical throughput of 710,000 transactions per second, its ecosystem has also grown by leaps and bounds within the past year, not to mention its impressive price gains of 600% in the past 5 months.

Risk of falling over: very small. There is a small but growing institutional interest in it. The ecosystem is thriving, ie people are using the dApps in its ecosystem. It also has an active team of developers that are itching to chomp away at Ethereum's share of the market.

Lock-up period: No. However, tokens withdrawn may need to wait for the end of an epoch, which would be anywhere from a few minutes to a few days, depending where you are in the epoch when the withdrawal request was made. One epoch lasts for two days.

Cardano

Cardano started before Solana but got caught up by it in terms of progress. The verdict is still out on the future prospects of this project. As a peer-reviewed blockchain, it is a solid method, perhaps a tad bit too solid, ie it needs to get reviewed faster. There were high hopes for the Alonzo update but judging from the reaction of the community and onlookers, it did not go as well as expected.

Still, it was the no.3 project on the blockchain before being dethroned by Solana. It is also actively making inroads into Africa, one of the least-banked (and more corrupt) continents in the world. If, through the usage of cryptocurrency, it is able to help governments realise that corruption is not the only way to get profits, that would be one of the biggest blessings indeed.

Risk of falling over: Small. The community support is strong and many believe in the founder Charles Hoskinson's vision. The developers are presumably working hard to get things back on track.

Lock-up period: No. Tokens can be withdrawn anytime.

Minor Players

A number of smaller players are jostling for space in this territory and gaining adoption fast like Fantom, Avalanche, Terra to name a few. All of them are worth looking into with small to medium risks of failing (as of time of writing).

How do I get into it?

There are two ways to start staking: through a validator or stakepool that you get to select on your own or through the exchanges or a third-party that may or may not involve giving up custody on your tokens. The one-two steps are:

- Select a project you want to stake your tokens in.

- Choose where you want to stake them in.

- Sit back and go do something fun while your asset starts working for you. Some of them require your account to be on at all times. Check on it every few months or so to make sure it's growing at a happy and healthy pace.

Disclaimer: I stake on Cardano via the Daedalus wallet and I hold SOL and ETH tokens too.

Lending

One of the most common ways to earn interest on your crypto assets is to lend them out. There are plenty of lending platforms available. Most of them are separated into two types: centralised and decentralised. Both carry their own rewards and risks.

CeFi Platforms

How it works

Deposit your crypto assets into the platform and get the interest in either the original token or its native token. These platforms allow you to convert fiat to crypto, hence there is a KYC process in place to protect against money-laundering. These platforms work for those who are new to crypto and would like an easy way to get onboard.

⚠️Safety Notice⚠️- In light of the recent liquidity issues and bankruptcy faced by the lending platform Celsius, BlockFi, Voyager Digital, VAULD, and others, and the high risk of contagion that could result in further company failures during these difficult market conditions, we do not recommend users keep funds on any lending platforms or centralized exchanges until the markets recover. We suggest crypto holders self-custody during these uncertain times.

What are the risks?

The biggest risk associated with this method is custody issues. You are basically (temporarily) transferring ownership of your assets to them for them to do as they see fit. This is no different from having money in the bank. With banks, if they fall over, there is the government coming to the rescue. For the platforms, most of them are insured up to a certain amount, but there is not much recourse if things go pear-shaped for all parties involved, ie more than one platform asking for the insurance entity, thus the insurer itself running out of money.

There is also the issue of collateralisation. Some platforms require over-collateralisation, so that if there is huge volatility in the market, the collateralised assets get liquidated. This affects lenders because the liquidated assets acts as a kind of guarantee that you will get your deposits back. Therefore, when reviewing the platforms, also check out their Loan-to-value (LTV) ratio. The higher the ratio, the riskier it is for your deposits.

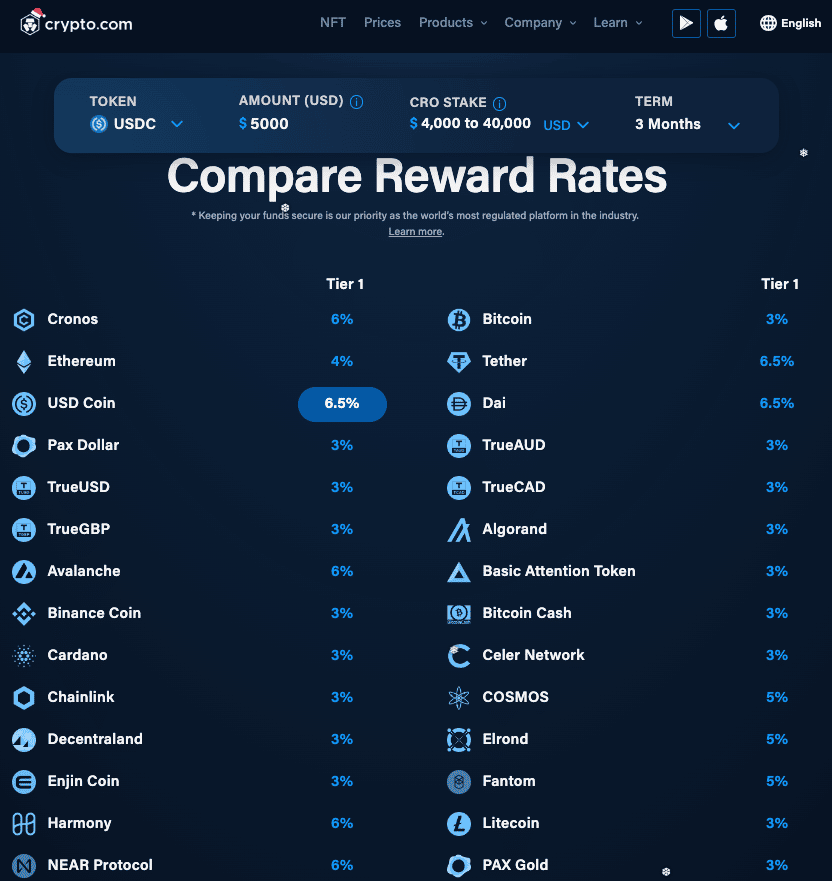

What sort of APY can I expect?

A brief comparison of the diagrams above show that APY can range anywhere from 5% - 12%. These are still fairly conservative numbers compared to serious yield-farming. However, they're still nothing to sniff at.

Which projects are worth looking into?

Nexo

The Nexo platform was deployed in 2018 but is a subsidiary Credissimo, which has been around since 2007. Nexo has paid over $200 million in interest, gathering over 2.5 million users in over 200 jurisdictions, and supports 27 different cryptocurrencies. Nexo offers both lending and borrowing as well as a crypto payment card. Nexo also has its own native token called NEXO.

**Notice**⚠️ In January 2023, Bulgarian authorities announced a raid on Nexo, with allegations of legal misconduct that are being actively investigated. We do not recommend users sign up for Nexo at this time until the investigation is complete and Nexo is cleared of all wrongdoings.

Nexo has extremely good rates and offers higher interest than most platforms. For example, the interest on your Bitcoin and Ether can be as high as 8% if you opt for a fixed term and get paid in Nexo tokens. Other interest rates are also extremely high, DOT at up to 15%, and then AVAX and MATIC have limited time boosted rates 17% and 20% respectively.

Crypto.com

Crypto.com has become a massively popular platform for users with various different crypto needs. This powerhouse platform supports just about everything crypto-related such as trading, an NFT marketplace, a self-custodial DeFi wallet, their own blockchain network, one of the most popular crypto cards, and an attractive Earn program

With Crypto.com, users can earn interest on their crypto holdings up to 12.5% APY through the Earn program. Interest rates will vary depending on how many of the platform’s CRO tokens a user stakes as that determines their loyalty level. Users can earn passive income on a pretty impressive list of 37+ crypto assets, making this one of the best Earn programs available.

You can learn more about Crypto.com and find out why they are considered one of the top crypto platforms in the industry in our Crypto.com Review.

YouHodler

Slightly less well-known is YouHodler, an up-and-coming platform in the crypto lending space. Headquartered in Switzerland and Cyprus, this platform offers a unique product called MultiHODL for lenders. It basically allows depositers to allocate a small percentage of their deposits to something risky with the potential to earn more while keeping the majority of the deposits safe. This is based on the Barbell Strategy introduced by Nassim Taleb, he of the "The Black Swan" book fame.

Unlike the other two platforms, YouHodler doesn't differentiate between small and large balances. Instead, they have a flat rate based on tokens deposited:

Insurance Risk YouHodler uses Ledger Vault as its custodian, providing up to USD150million in pooled crime insurance. This is the same company that creates Ledger cold wallets for consumers, the Vault being the enterprise-version. They safeguard the keys so that only select people have access to them.

DeFi Platforms

How it works

When you deposit your crypto onto a DeFi platform, you get interest-bearing tokens generated by the platform. For example, depositing ETH, you get xETH back. As the interest grows, you get more and more xETH. When you surrender the xETH back to the platform, you will then get more ETH than what you put in in the beginning.

Unlike centralised platforms, there is no KYC process involved. This is also because there is no way for you to convert your fiat into cryptocurrency on these platforms. You'd need to have some other way of getting your hands on the crypto beforehand. These platforms also utilise a non-custodial approach, which means the assets always remain in your hands, or rather, wallets.

What are the risks?

Smart Contract risks These are essentially computer programs written by humans, which means that there is a potential for errors to occur, sometimes intentional, sometimes not. The worst-case scenario is that you lose what you put in.

No insurance The platform itself doesn't offer any insurance but there are other blockchain projects that allows you to buy insurance up to a certain amount.

Systemic risks This is basically the entire blockchain project going pear-shaped due to various reasons. One of them can be due to poor liquidity. This means not enough people borrowing from it, thus you're earning very little interest.

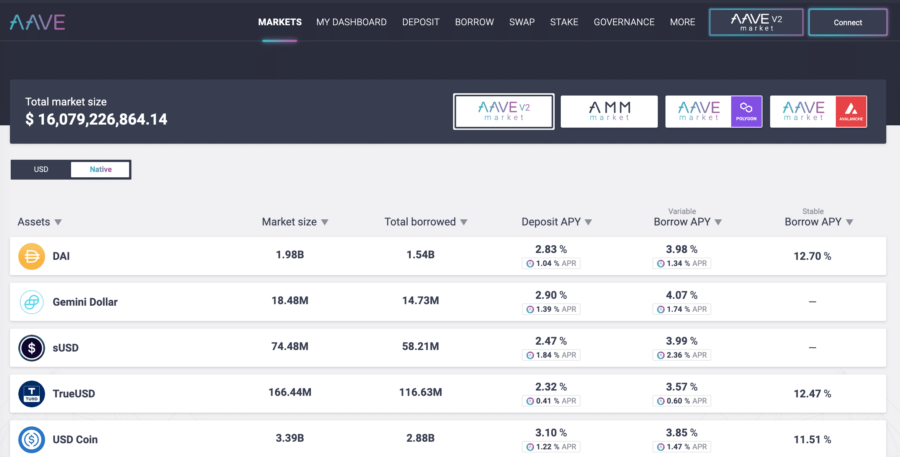

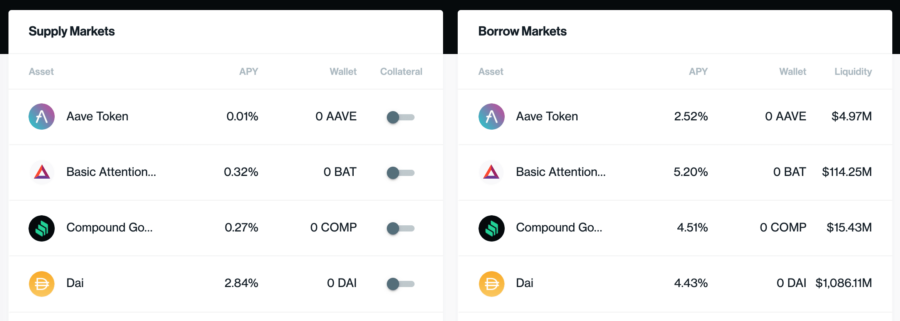

What sort of APY can I expect?

Oddly enough, stablecoins and other more established tokens don't get as a good a rate compared with CeFi platforms. These are usually around 2% - 3%. However, the newer blockchain projects like Curve Finance fetch quite a decent 10%.

Which projects are worth looking into?

Maker

According to DeFi Pulse, a reference website for all things DeFi, Maker is currently the most dominant DeFi lending platform with almost 17% market share in a market worth USD108 billion and growing by the day. It is one of the earliest known projects in the crypto world with DAI being one of the first crypto-backed stablecoins.

The idea is for users to deposit crypto-assets and get DAI in return. As a stablecoin, DAI can be used to earn interest on other platforms. These crypto-assets are over-collateralized to counter the volatility of the market. If the value of the loan is greater than the value of collateral provided, liquidation occurs.

AAVE

The second spot for lending on DeFi Pulse is AAVE. It's a "system of lending pools" where depositers can lend their crypto assets into pools, governed by smart contracts, in exchange for earning interest. Starting life on the Ethereum blockchain, it has branched out to be available on the Polygon and Avalanche blockchains.

AAVE in its current incarnation was launched in 2020, but it has origins from 2017 when it was known as ETHLend. Back then, it was a peer-to-peer lending platform, which required someone else on the other end. After it switched to smart contracts, it was a success last year, even going head-to-head with Compound, the then-no. 1 DeFi lending platform.

Compound

Compound is one of the first projects in the DeFi space. It pioneered the idea of issuing a ERC-20 version of the token deposited, so that the ERC-20 version can then be put to further use, acting as a foundation block for "money legos" commonly seen in yield-farming strategies. Other DeFi projects also adopted this method of generating yield upon yield, doubling or tripling the potential rewards, with a certain level of risk, of course.

Holding dividend-paying tokens

If staking isn't really your cup of tea, there is another way to earn passive income in a relatively safe manner, which is holding dividend-paying tokens. These are projects that share their profit with users who hold their native tokens. A few of these are tokens issued by crypto exchanges.

How it works

Buy the platform's tokens, hold it in an assigned space, and just wait for the dividends to come trickling in.

What are the risks?

The stability of the platform or blockchain project is the key thing to consider. As long as it's getting used with gradual adoption, your investment will be safe.

What sort of APY can I expect?

Taking into account the variables of each token, a range of 5% - 15% APY is not unheard of.

Which projects are worth looking into?

KuCoin Shares (KCS)

KuCoin is one of the more popular crypto exchanges around despite the centralised approach. The platform has lots of promotions going on, mainly related to margin and futures trading, which I don't do. What I did do was buy KCS tokens to trade. Regardless of the amount of tokens you hold, whether in the Trading or Main account, KCS gives out bonuses on a regular basis. At the time of writing, its price has reached all-time highs. If you forget to collect your bonus, the platform notifies you to do so, which is a nice touch.

The biggest risk to look out for is the platform keeling over. Since it is a centralised exchange based in Hong Kong, here's to the Chinese government not trying to do any funny business with it. The platform also performs upgrades every now and then. Sometimes it makes tings better, other times, I wonder.

VeChain

The VeChain blockchain project is one of the projects that have gained a lot of adoption from enterprise companies. It started out as a blockchain for supply management. By combining a physical tracking component, such as RFID (radio-frequency ID), QR codes etc and adding that information to the blockchain, each step of a product's manufacturing steps and standards are clearly visible for all in the supply chain to see.

From PwC (Big 4 auditing firm), LVMH (Louis Vuitton), Walmart China and BMW to many others, VeChain also works with governments in China and Cyprus to manage records. It was selected by the Chinese government to provide a system for storing tax and business registrations, certificates and audits for the Gui'An New Area. Meanwhile, a Cypriot hospital used the Vechain blockchain to record the first 100 vaccine records for Covid-19.

By staking VET, stakers get VTHO which is used to pay for all transactions related to writing data to the blockchain. Rewards occur every 10 seconds when a new block is created. Atomic Wallet is about to offer 1.63% APY for staking VET through its platform. Exodus Wallet is also offering VET staking at 1.5% APY.

Risks The project has offices in Singapore and China. While I don't see the Singapore government doing anything underhand, especially if it's trying to position itself as the cryptocurrency hub of the world, I can't say the same for China due to its track record. How much that will have an effect on the Chinese team is hard to tell. Let's hope no undue influence is involved.

Other Players

Aside from these projects, there's also NEO, Nexo (security token) and Wink (online casino) to name a few. As with everything else, please exercise caution and do some research by looking at the pros and cons.

Tokenized Home Loans

While DeFi is the standard way for most crypto users to make money, the economy can't purely be based on money making money all the time. At the heart of things, there is still a level of pragmatism and productivity involved. Blockchain technology together with smart contracts are well on its way to disrupting many sectors of the economy. One of the most likely sectors to face change is in the area of mortgages and real-estate.

How it works

Instead of investing in a real-estate index fund or buying shares of a real-estate company to get exposure to the real-estate sector, the general public now has the option of buying a tokenized version of a specific property. It doesn't mean that you are the actual owner of the property. It's that you own a share of the company that issues the bond that finances the property. The rental income generated will be shared amongst the token owners in proportion. These tokens can also be resold in secondary markets.

What are the risks?

This is an emerging sector, so it's fair to expect a certain amount of risk involved. Some of these risks are not specific to blockchain technology. These include:

- renters not paying rent

- bad real-estate properties - when you don't live there, how do you know if it's a good property or not?

- the company financing the property falls over

- the owners of the property become insolvent and you are last in queue to get your investment back. Sometimes, there might not be anything left for you after all the creditors have been paid.

What sort of APY can I expect?

The APYs depends on the property you've decide to invest in, which could be from 20% - 50% and above. That sounds really yummy but as mentioned previously, it carries its own set of risks.

Which projects are worth looking into?

The companies offering this are based in the US, thus all properties are located in the US. However, this does not preclude overseas investors from buying into those properties. This adds a layer of risk because you'd have to trust the evaluators who provide evaluation for the property. Either that or do your own research before jumping in.

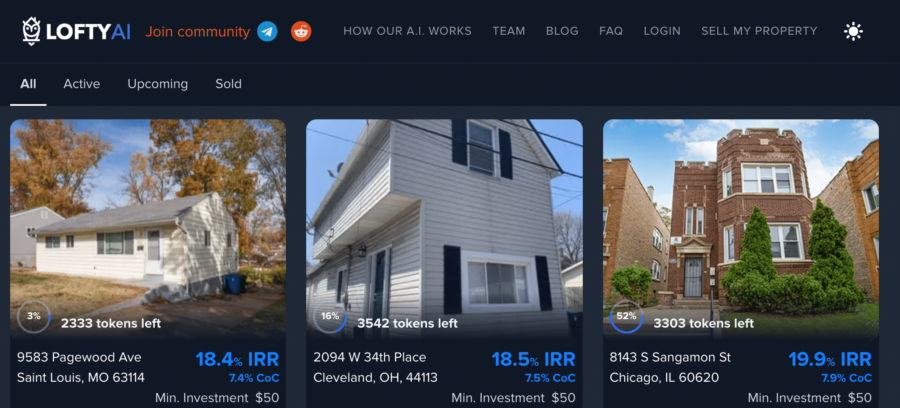

Lofty AI

As the name implies, Lofty AI uses AI technology to vet properties for investors to invest in. The long and short of it is that:

- It accumulates raw data from the real-estate market.

- Applies statistical methods to look for features that may correspond to future real-estate price changes.

- Extract these features and group them, applying a label to them.

- Train a Deep-Neural Network (DNN) to identify and predict future prices.

If you would like to learn more about the methodology in details, here is the link for it.

To get started:

- Register and open an account with them with KYC details.

- Minimum amount to invest: $50

- Deposit the amount you want to invest in into the property that piques your interest

- Tokens will be sent to a Algorand wallet as the project is built on Algorand. Future interest/income will also be deposited directly into this wallet.

The property itself is managed by a professional property management company to ensure it is in good condition at all times. They also offer the ability to sell a property through their platform.

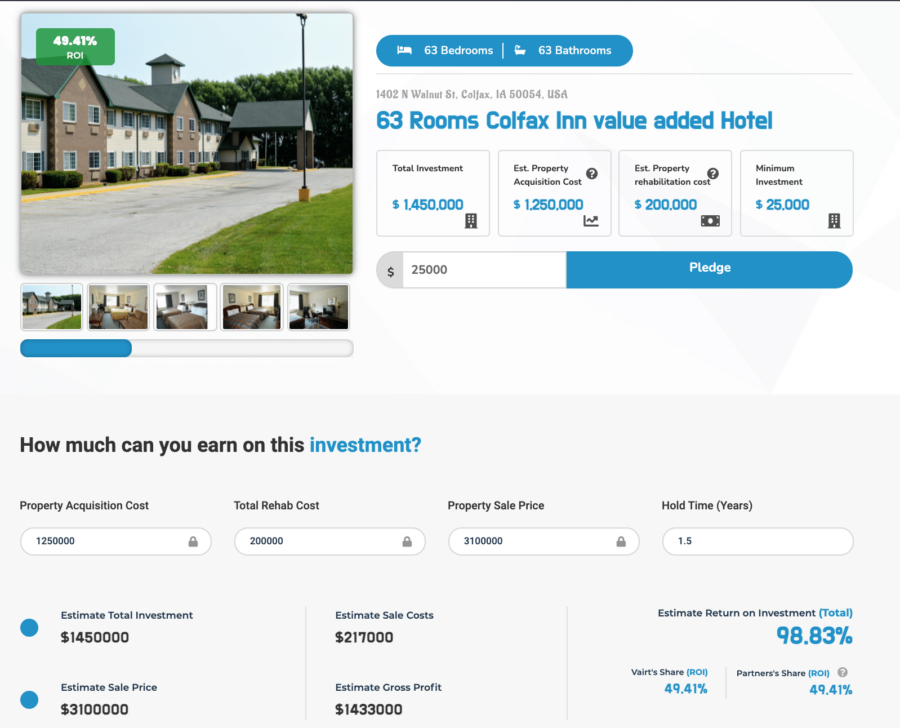

Vairt

What is offered at Vairt is similar to LoftyAI. The difference here is that they use their 100-point proprietary tool combined with third-party market data to evaluate the property. Also,

- The minimum amount to invest is $1500.

- The funds are in a separate custodial bank account for security.

- The properties are given 30 days to raise the funds needed. If the target is not reached, the money will be returned to the investor.

The important thing to note is that a Limited Liability Company (LLC) will be created for each property successfully funded. The investment, in the form of tokens are shares of the LLC, not the property itself.

Other players

These two are just examples of what's started happening in this space. To find out more, here is a list to consider if this is something that truly tickles your fancy.

Any other options for passive income?

Aside from the 4 main choices presented, there are still more ways to squeeze more money out from your crypto assets. Some of them carry higher risks than others but I thought it worth mentioning:

Play-to-Earn Games

While not exactly passive income, play-to-earn games are in the midst of starting a new trend, especially among the younger crowd. If you're going to play, why not earn some money on the side? Some of the games requires buying a NFT to get started, so there's your investment there. After that, the in-game assets can be sold on secondary markets, or you get points for playing which then translates into crypto etc.

Unlike the other types mentioned above, this method doesn't rely on you putting some tokens or money somewhere, so there isn't any kind of APY per se. The gains would primarily be measured by the gamer's ability and whether the NFTs are of value in the secondary market, which can be quite arbitrary.

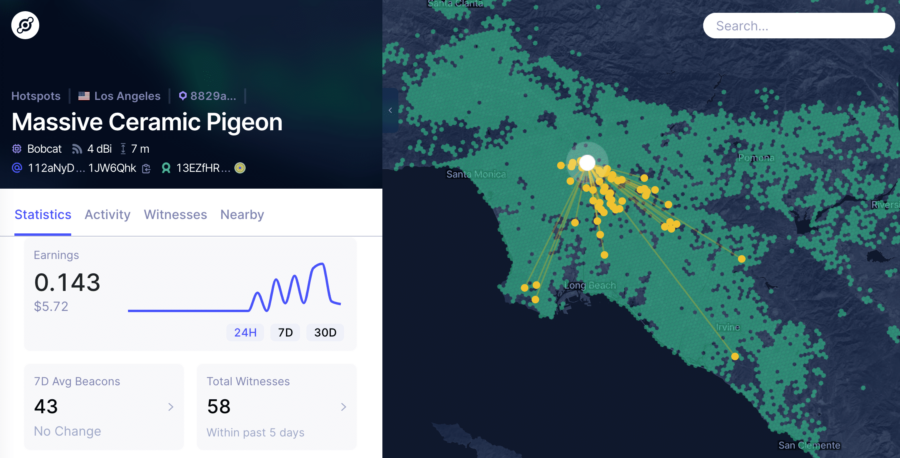

HNT Mining

A blockchain project called Helium Network (HNT) aims to provide coverage for IoT through short-wave radio frequency. To be a miner, purchase one of the modem-like devices to be a coverage provider. After that's set-up, you can check, through an interface, how many tokens you can get. Be warned: due to the popularity of these devices, there is quite a long waiting period for one to show up at your doorstep.

There is a balance between the number of miners and the number of users in an area to generate the optimum amount of return. Miners act as either Witnesses, Challengers, or Transmitters at any given time. Here are some stats for reference:

- 3-5 Witnesses > 150 HNT per month

- 5-15 Witnesses > 500 HNT per month

- 15< Witnesses > 800 HNT per month

(source)

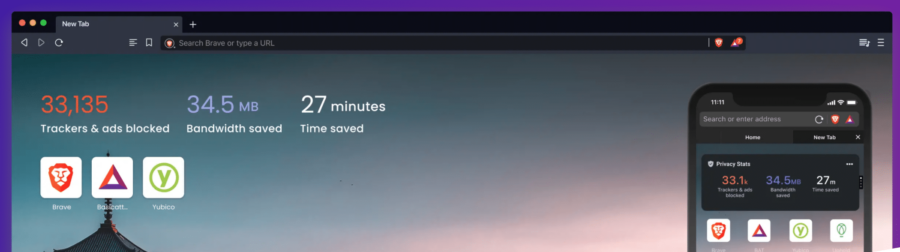

BAT Airdrop

Brave Browser offers BAT tokens if you opt-in to receive ads from them. They also do ad-blockers if you don't want to see any ads. It's a crypto-friendly browser in the sense that the ads are usually for blockchain projects. What they give isn't much but it's better than nothing. The tokens are directly deposited into the Uphold wallet for safekeeping. You can also check out this link to get a list of airdrops coming soon. Most of them require that you hold one type of crypto token beforehand or do an action as proof of participation.

Looking at my own history of receiving BAT, I'm getting anywhere between 3-4 BAT a month. Of course, I can further stretch that by depositing the BAT tokens into one of the crypto lending platforms and earn an extra 3% interest on average. For something I'm getting free, it's quite a good deal!

Conclusion

The world of crypto offers many opportunities for everyone to make some extra money. While crypto is seen as a high risk asset, due to the volatility in pricing, as more and more industries are affected, the utility and use-cases expand so that it's not hard to imagine a world where tokenization of real-world items is the norm, just as we have generations of people growing up unable to imagine a world without the internet and fibre connections.

Blockchain projects is all about network effects and group participation. Unlike web2.0 social media where the maximum value is in reaching the most number of users, the biggest value for blockchain projects is for early adopters. Do you have the foresight to become one?

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.