In 2009, Satoshi Nakamoto first introduced Bitcoin and blockchain to the world of FinTech and, ever since its inception, this intricate monetary architecture has come to utterly disrupt the process of wealth creation. In fact, throughout the last decade, blockchain has generated a plethora of diverse and innovative economic value propositions that are reshuffling the way in which money is produced and conceived.

Among these blockchain-enabled value propositions is Decentralised Finance (DeFi), a movement that is spearheading an attractive, alternative financial ecosystem and has firmly established itself as a true powerhouse in the digital asset space.

Decentralised Applications (dApps) constitute one of the most notable developments to come out of DeFi technology and their uniqueness lies in their ability to be disintermediated from third party actors and permissionless, meaning that anyone with an Internet connection and a supported wallet can interact with them.

Contrary to traditional financial applications, dApps typically do not rely on trust and they do not require custodians or middlemen to function, which essentially makes them ‘trustless’. These inherently decentralised qualities allow dApps to perform a wide selection of use cases, including decentralised trading, lending, borrowing, staking, liquidity provision and, more importantly, yield farming.

Yield farming is one of the newer liquidity concepts to emerge from the DeFi ecosystem, and it entails a process of generating capital and earning rewards through crypto asset holdings using DeFi liquidity protocols. Yield farming allows anyone to earn passive income using the decentralised ecosystem of ‘money-legos’ built on Ethereum.

Because of this, yield farming may very well change the way crypto investors HODL their assets in the future, as it enables them to leverage the built-in high APYs and staking models of many DeFi protocols, as opposed to just leaving their assets lying idle in a wallet somewhere.

The Origins Of Yield Farming

Bitcoin can be considered the first deployment of DeFi as it enabled people to execute trades and financial transactions without the presence of intermediaries. Thus, Bitcoin and a few other early cryptocurrencies arguably initiated the first DeFi wave. The second wave, however, was led by the Ethereum blockchain as it added another layer of programmability to the technology.

To this day, the majority of crypto assets and blockchain-based projects are built on Ethereum because it provides the openness, infrastructure and liquidity required to implement dApps and perform asset swaps efficiently, despite the fluctuating, high gas fees

Some of the advantages of DeFi include transparency, immutability, programmability with smart contracts and, most importantly, self-custody of funds, meaning that DeFi participants are the sole custodians of their capital and they are not required to rely on centralised crypto exchanges to store their assets.

Thus, given the immense potential that DeFi brought to the space, several projects began experimenting with DeFi functionalities in traditional financial applications, and looked to essentially create a DeFi-TradFi cross-over infrastructure.

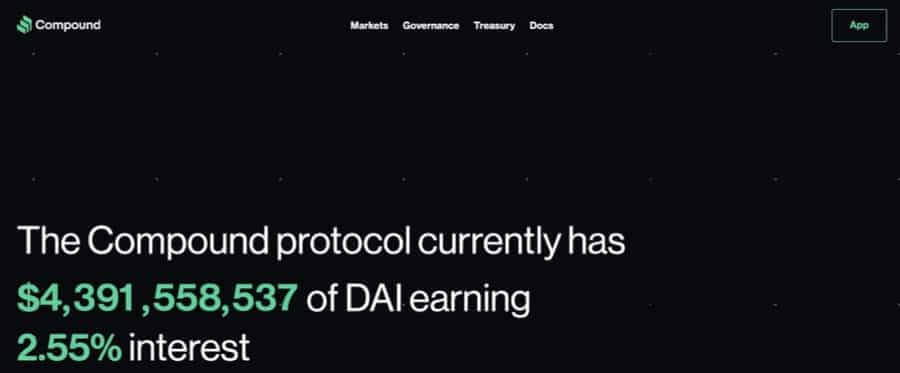

In fact, when the Ethereum-based project Compound began offering its decentralised lending and borrowing protocol, it opened the door to a completely new world in Decentralised Finance and attracted large quantities of investors looking to maximise their ROI.

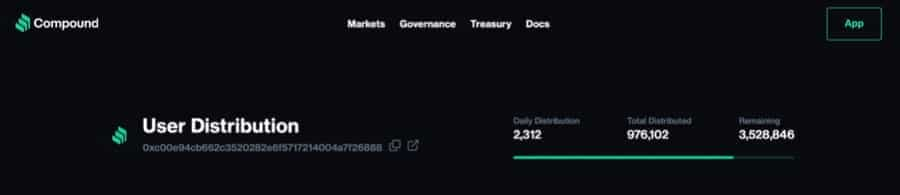

In June 2020, Compound started to distribute its governance token, COMP, to the protocol’s user base. With the way the distribution process was structured, demand for the token initiated a craze and moved Compound into the leading position in DeFi.

This is primarily due to the fact that this Ethereum-based project allows users to stake and lend their tokens to the Compound protocol and earn interest on their assets for doing so. Consequently, this mechanism ignited a new trend in the DeFi space, and led investors to embark on a journey to find the protocols offering the highest APYs across the industry.

The term Yield Farming was coined as a result of the process of actively searching for the best ROIs in the space whereby users, known as ‘farmers’, are on a constant lookout for the most profitable ‘yields’ in DeFi protocols on mainly Ethereum and the Binance Smart Chain.

How Yield Farming Works

Yield farming, also referred to as liquidity mining, is a way to generate rewards with cryptocurrency holdings. Put simply, it implies locking up crypto assets and receiving staking rewards and interest on those assets. In a sense, the yield farming process resembles that of staking, but with a few extra added complexities.

In most cases, yield farming requires users, called liquidity providers (LPs), to add funds to a protocol’s liquidity pool. Liquidity pools are basically smart contracts that store and preserve users’ funds, and they reward users for providing liquidity in the first place. These rewards may come from fees generated by the underlying DeFi protocol, or from some other sources.

Some liquidity pools pay their rewards in multiple tokens, and these reward tokens can then be redeployed to other liquidity pools to earn additional rewards there as well. Thus, it is quite simple to see how some incredibly complex farming strategies can emerge from this, but the basic idea is that liquidity providers deposit funds into a liquidity pool and earn rewards in return.

Yield farming is most commonly done with ERC-20 tokens on Ethereum and BEP-20 tokens on BSC, so naturally the rewards are usually in some kind of ERC-20 or BEP-20 format. This, however, may very well change in the near future as yielding protocols develop further and start implementing cross-chain bridges more efficiently.

Yield farmers will typically move their funds around quite a lot between different protocols in search of the highest yields. As a result, DeFi platforms may also provide economic incentives to attract more capital to their platform as in fact, just like on centralised exchanges, more liquidity tends to attract more liquidity.

Getting Started With Yield Farming

Now that we have defined and clarified what yield farming is, let us now discuss how a new user can get started with yield farming.

Firstly, as a disclaimer, it is only reasonable to list the Pros and Cons that come with a yield farming strategy.

The Pros include:

- dApp Availability: Up to this point, a variety of yield farming-centric applications have come to life, and they give farmers the benefit of tracking their investments and percentage yields from a simple, all-in-one interface.

- Easy and Fast Implementation: To become a yield farmer, one needs only two required elements which are Ethereum, or BNB in some cases, and a crypto wallet. The barrier of entry to yield farming is relatively low, which draws immense attention from crypto investors looking for higher returns on their assets.

- Incredibly High Annual Percentage Yield (APY): While in staking protocols 8-10% APY on stablecoins such as USDT, USDC or DAI is the norm, yield farming can boast as much as 100% APY!

The Cons include:

- Short-Term Rewards: It cannot be denied that yield farming is growing strongly in a fast-paced market, but it is still rather unstable so there is a risk of inconsistent returns. More than that, given its ease of entry, profitable strategies are hard to figure out.

- High Gas Fees On Ethereum: Put simply, gas is defined as the fee for each transaction performed within the ETH blockchain. Gas fees have been on a steep uptrend as of late, and this is one of the downsides of yield farming. Thus, farmers should be conscious not to pay gas fees that are higher than the expected reward.

- Benefits For Those With Greater Capital: DeFi allows anyone to participate in yield farming, but the rewards will be considerably higher for those users with a lot of initial capital. This is essentially because the more crypto you own, the more you can deposit in high APY strategies, naturally resulting in a higher ROI.

- Impermanent Loss Risks: This refers to a temporary loss suffered by a liquidity provider (LP) due to the volatility in a trading pair. Impermanent loss is one of the major hurdles of AMM protocols and it occurs when the price of tokens inside an AMM diverge too quickly in any direction, causing a token imbalance.

Yield Farming Platforms

In this section we shall discuss the most reputable yield farming platforms and take you through the process of getting started with yield farming on Ethereum, with Compound and Uniswap, and on the Binance Smart Chain, with PancakeSwap. For simplicity, we have selected these DeFi platforms as they offer perhaps the most straightforward and ready-to-go approach to yield farming.

The Importance Of Total Value Locked (TVL)

Total Value Locked (TVL) is the sum of all funds locked in a protocol’s liquidity pool. This is a very important metric to measure how healthy a yield farming platform is. An increase in the Total Value Locked leads to an increase in the yield farming on a platform. The current TVL for DeFi is approximately $64 billion, and these metrics can be tracked on DeFi Pulse.

As previously mentioned, there are various platforms where you can farm tokens. They all operate in a similar fashion, but the rewards system might be different and specific to the farming platform. Below are some of the yield farming platforms running on the Ethereum blockchain and the Binance Smart Chain (BSC).

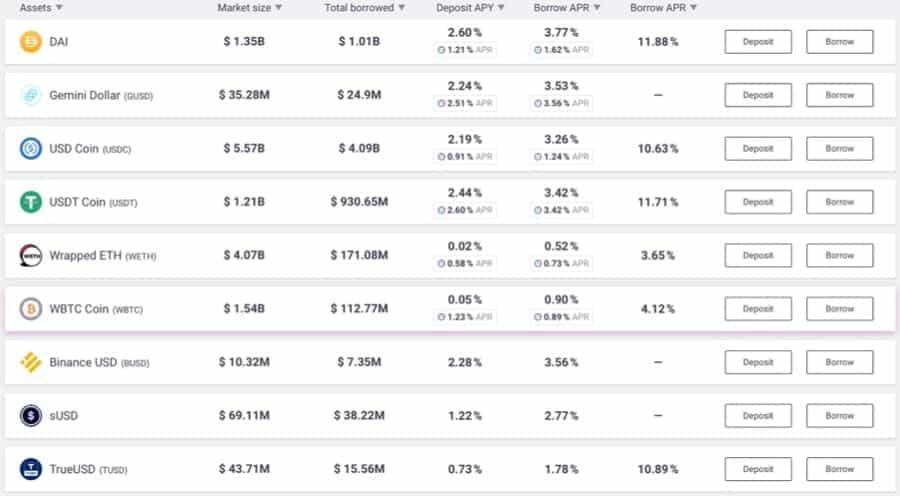

Farming On Compound

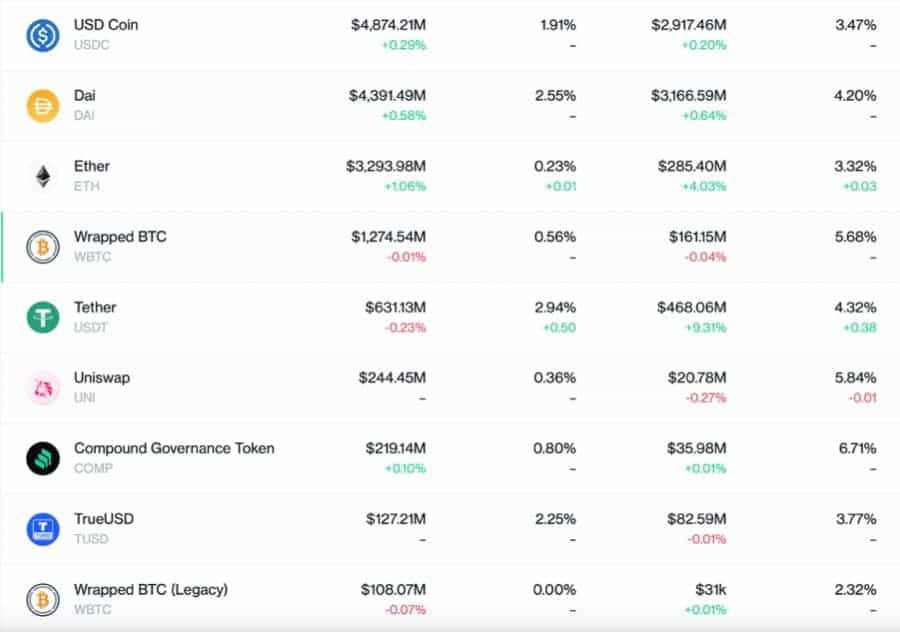

Compound is an Ethereum-based protocol that allows lending and borrowing of crypto assets. The lender offers a loan by providing liquidity to the Compound platform, and then gets an interest on the loan supplied. The lender’s interest is then calculated based on the ratio of supply and demand for the crypto assets they provide, which may of course fluctuate from time to time.

Lending capital on DeFi money markets such as Compound and Aave constitutes the easiest way to earn returns in Decentralised Finance. You can deposit stablecoins such as DAI or USDC to either of them and start earning yield instantly!

Aave generally has better rates than Compound because it gives borrowers the ability to choose a stable rate of interest rather than a fluctuating, variable rate. The stable rate tends to be higher for borrowers than the variable rate, which increases the marginal return for lenders.

However, one of the most appealing additions made by Compound is the new incentive mechanism for farmers through the issuance of its native governance token COMP. In fact, anyone who lends or borrows on the Compound platform can farm a certain amount of the COMP token.

At present, 2,312 COMP tokens are distributed daily across the Compound user base meaning that, at approximately $400 per COMP token, this results in more than $920,000 in additional rewards each day. These COMP farming rewards are of course diluted across the platform’s 294,000 suppliers/farmers and 8600 borrowers and, despite the relatively low APYs, the incentive for users to farm on Compound remains incredibly high.

In addition, Compound has its own native interest-bearing tokens called cTokens, which are used to pay farmers for supplying liquidity to the protocol. When farmers provide and lock 5ETH on Compound, for instance, the protocol automatically generates 5cETH tokens, that earn farmers interest and can be redeployed on other DeFi platforms as well. Farmers can then redeem their cETH for ETH at any time, plus their staking rewards.

To participate in yield farming on Compound, as well as most other farming platforms, users will need to:

- Acquire crypto that is used on the particular farming platform. Widely accepted crypto assets are ETH, BTC, and stablecoins such as DAI, USDT, USDC and BUSD (for BSC farming).

- Download a decentralised wallet such as Metamask, Trustwallet or Wallet Connect. Register as prompted, and make sure that private keys and the seed phrase are secure and kept somewhere safe. You may follow Guy’s step-by-step guide on how to do this.

- After installing the preferred wallet, send funds to the wallet.

- Go to the dApp section of the wallet to start farming.

- For beginner farmers, it is advisable to start farming with the Compound platform because of the COMP incentive and its ease of use.

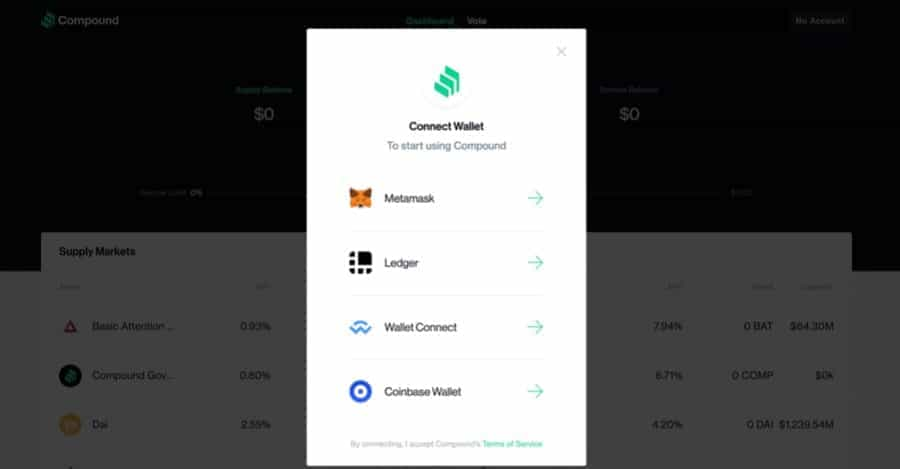

In Compound’s case, users looking to farm should:

- Go To Compound.Finance

- Click on ‘App’.

- Connect Wallet through the Metamask icon.

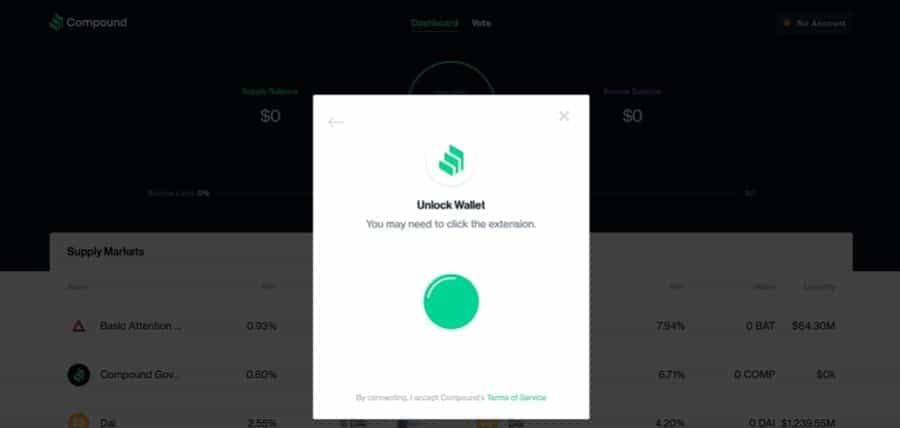

- Approve Connection Via Password and Unlock Wallet.

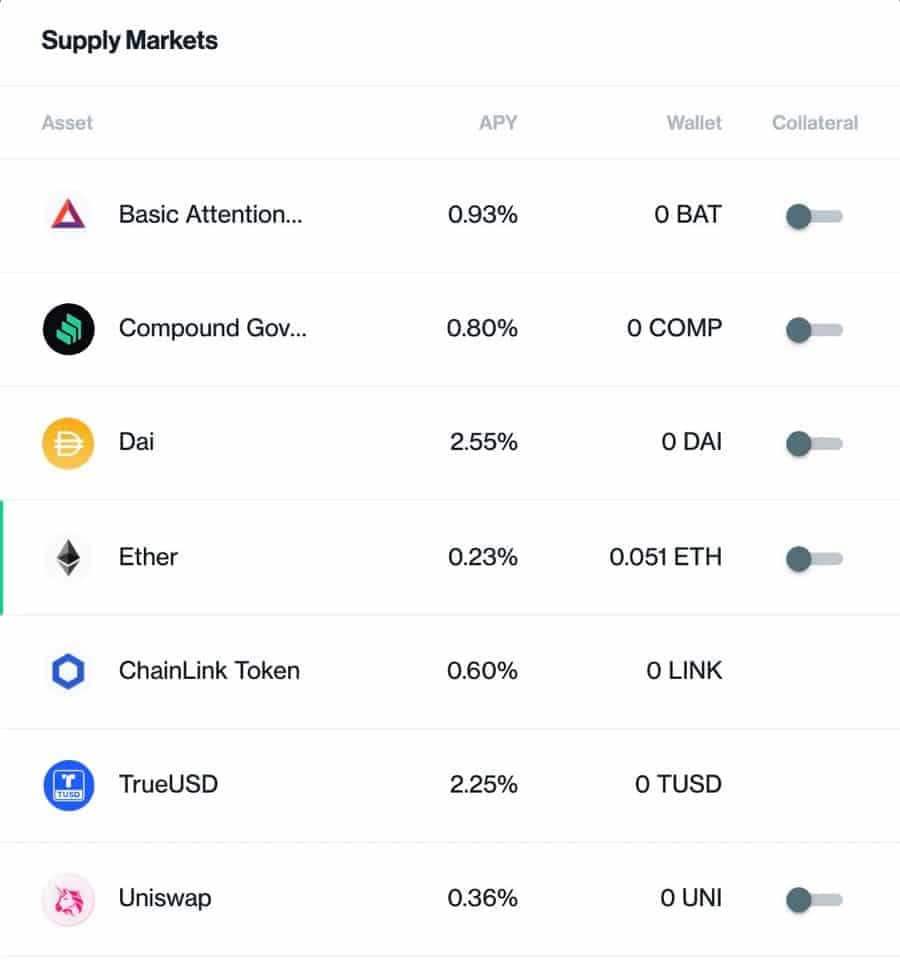

- Once the connection is approved, users can choose from a selection of assets that they want to supply in order to start farming COMP.

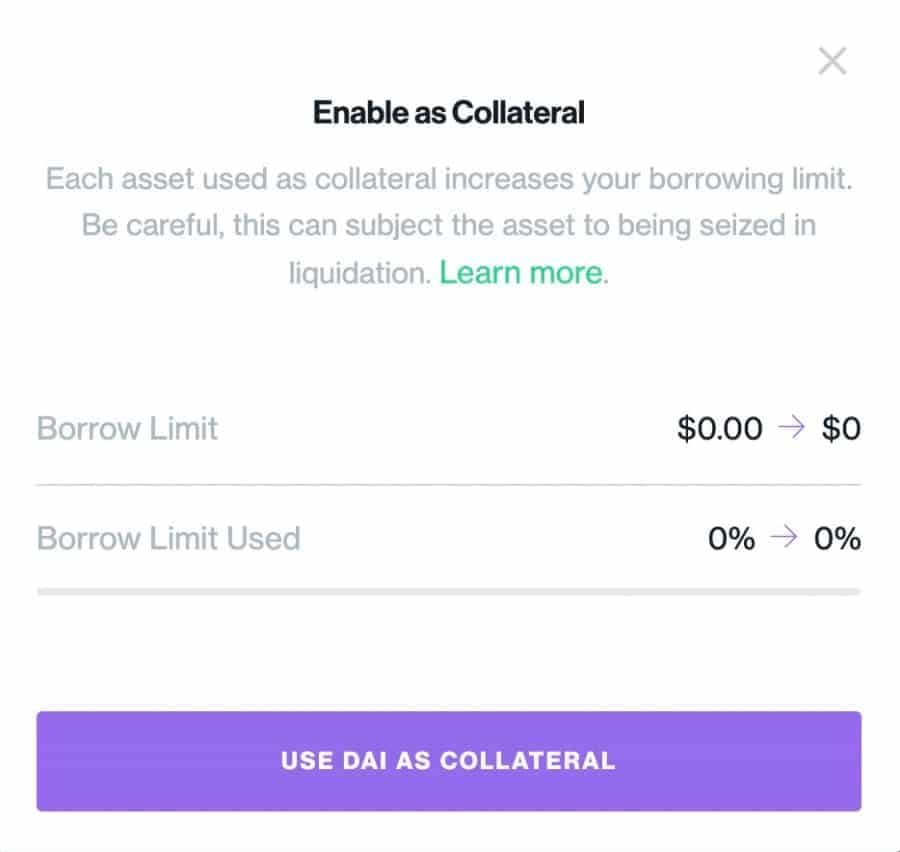

- If users want to supply the platform with a stablecoin such as DAI, for example, they will need to first click ‘Collateral’ and then ‘Use DAI As Collateral’.

- Users will then need to enable DAI as collateral and pay a small ETH transaction fee.

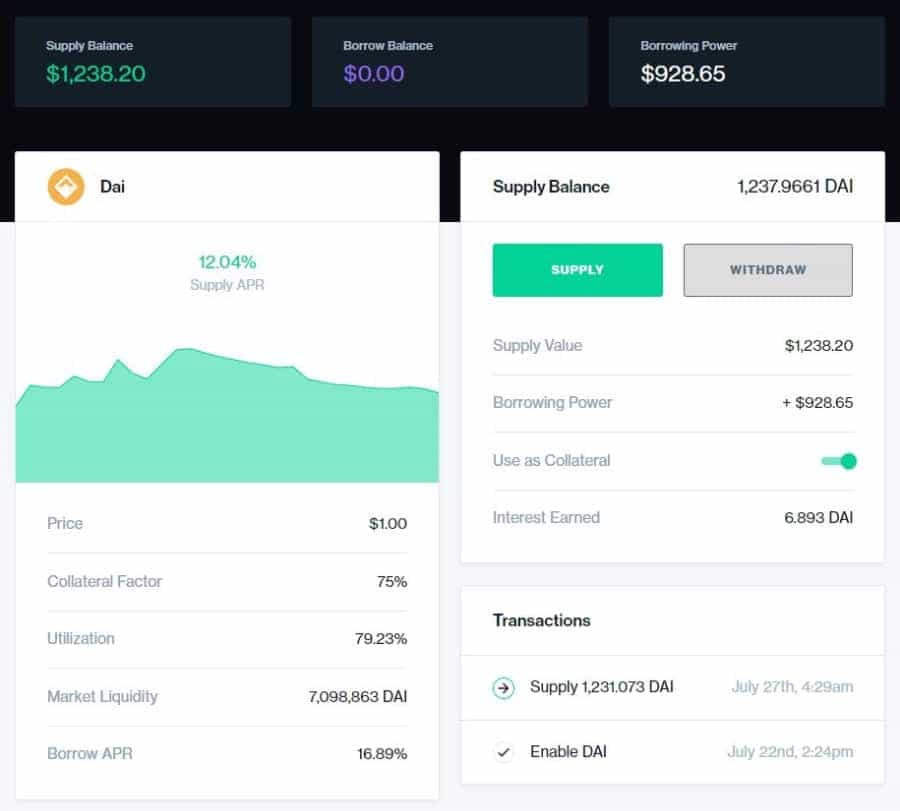

Once the transaction is executed, users will be able to deposit their DAI into the Compound platform and start farming COMP. The User’s APY will be displayed in the ‘Dashboard’ section together with their ‘Supply Balance’ and their ‘Interest earned and paid, plus COMP’.

It is also important to note that the more assets a farmer supplies, the more potential borrowing power they have. Using the image above as an example, a user could provide liquidity with 1,237 DAI and potentially borrow $928. In this scenario, DAI would be held by Compound as collateral, and the user could borrow $928 for additional farming on other DeFi protocols, for instance.

Farming On Uniswap

Uniswap, one of the most well-established Ethereum-based AMM protocols in the space, is arguably the largest liquidity pool in DeFi. Uniswap allows Liquidity Providers (LPs) to earn fees as a reward for adding their capital to a pool. On Uniswap, liquidity pools are structured between two assets in a 50-50 ratio, a model typical of Automated Market Makers (AMMs).

LPs are of vital importance to Uniswap’s functionality as a DEX, as they provide the liquidity and collateral necessary for the protocol to execute trades in a decentralised manner. In fact, every time someone executes a trade through a liquidity pool, LPs that contributed to that pool earn a fee for facilitating the transaction. The exchange has a trading fee of 0.30% for every token swap but, instead of going to Uniswap, these fees are given to Liquidity Providers as a reward for providing capital.

Adding Liquidity On Uniswap v.3

Unlike most DEXes, Uniswap doesn’t contain order books and its liquidity is maintained through liquidity pools. This means that anyone can become a liquidity provider (LP) for a token pair on Uniswap by simply depositing equal amounts of each token in exchange for token pools. For instance, if a user wanted to add liquidity to an ETH-DAI pool on Uniswap, they would have to add the exact same amount of each token.

Currently, at the time of writing, 1 ETH equates to approximately 2,270 DAI. So, if the LP wanted to provide liquidity to the pool with say 3 ETH, the necessary 50-50 ratio would look something like 3 ETH - 6,810 DAI.

To add liquidity to a Uniswap pool and start yield farming on the platform, users will need to:

- Go To Uniswap.org.

- Click ‘Launch App’.

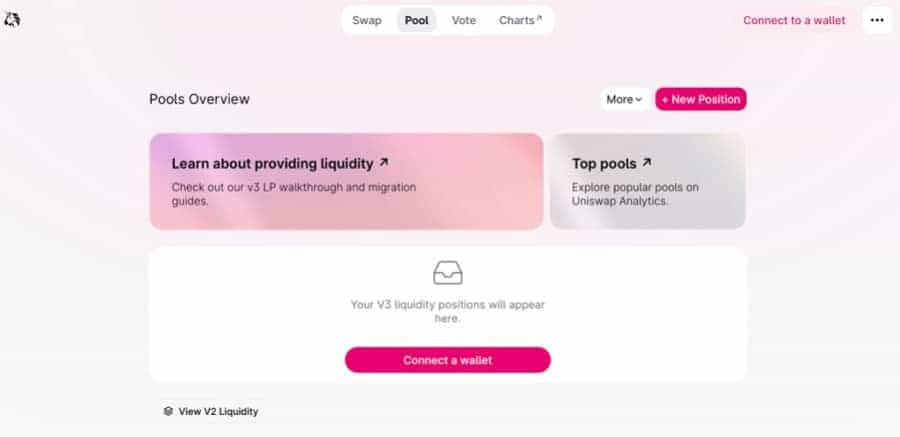

- Click ‘Pool’.

- Click ‘Connect Wallet’ to connect with Metamask.

- Once connected, users can either browse through popular liquidity pools by clicking on ‘Top Pools’, or click on ‘New Position’.

- After having clicked on ‘New Position’, LPs can select their preferred token pair.

- They must then review their preferred Fee Tier.

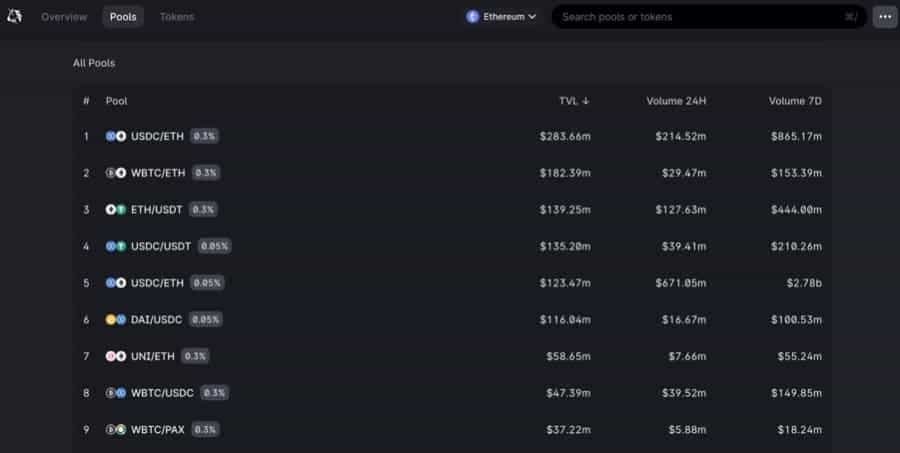

It is important to note that Uniswap v.3 offers 3 different Fee Tiers for every token pair: 0.05%, 0.3% and 1.0%. The 0.05% Fee Tier is ideal for assets that trade at a fixed or highly correlated rate, such as stablecoins. Thus, this Fee Tier is most suitable for liquidity pools such as DAI-USDC or USDC-USDT, for instance.

The 0.3% Fee Tier is best for most pairs, and the ones that undergo price fluctuations, such as ETH-DAI for example. This higher Fee Tier is more likely to compensate LPs for the greater price risk that they take on relative to stablecoin LPs. The 1.0% Fee Tier is primarily used for exotic pairs, and it is implemented to reward LPs for taking on major price risks on their assets.

- Set Price Range

Uniswap v.3 allows LPs to select a specific price range in which they can provide liquidity, which is one of the perks of the recent Uniswap upgrade. This means that if prices move outside the selected range, the user’s position will be concentrated in one of the two assets and will not earn any interest until prices come back into the range.

- Deposit the desired token amounts.

- 'Add', 'Preview' and Approve Transaction on Metamask

Farming On BSC: PancakeSwap

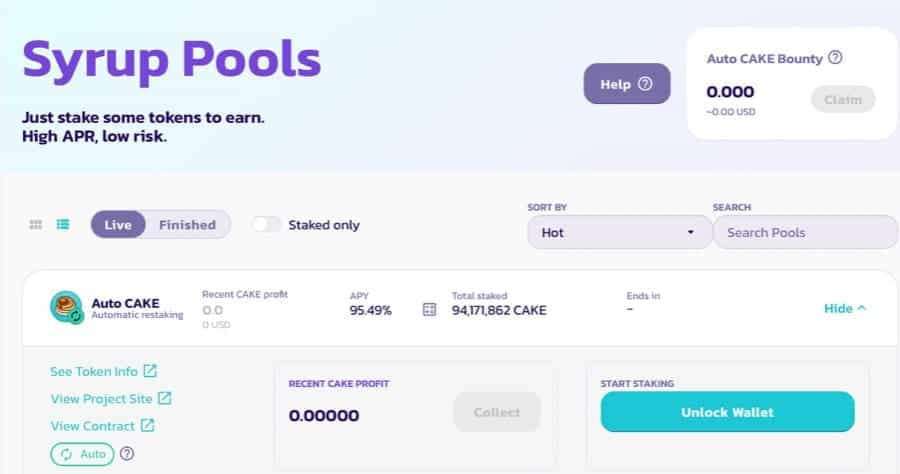

Launched in September 2020, PancakeSwap is a Binance Smart Chain-based DEX and AMM protocol running primarily on smart contracts and permissionless liquidity pools. Similarly to Uniswap, PancakeSwap allows any two tokens to be exchanged, but with a few extra gamified additions.

The Binance Smart Chain has grown exponentially over the course of the last year, as investors, traders and yield farmers started to accumulatively reject the inefficiencies of the clogged-up Ethereum blockchain, and looked to more sustainable DeFi options. BSC is fast, cheap and easy to use, and its community is one of the strongest in the DeFi space.

Let us now discuss how you can get started with yield farming on PancakeSwap and also farm its native token CAKE. To farm on PancakeSwap, users will need to:

- First create a BSC compatible wallet, such as Metamask or Trustwallet.

- Purchase some BNB tokens and send funds to the BSC compatible wallet. It is important to note that native BNB purchased on centralised exchanges cannot be utilised for DeFi applications on BSC. To yield farm on PancakeSwap, users will need to convert their native BNB tokens into BEP-20 BNB. This can be done directly on the Binance centralised exchange through the Binance Bridge or, alternatively, on Trustwallet.

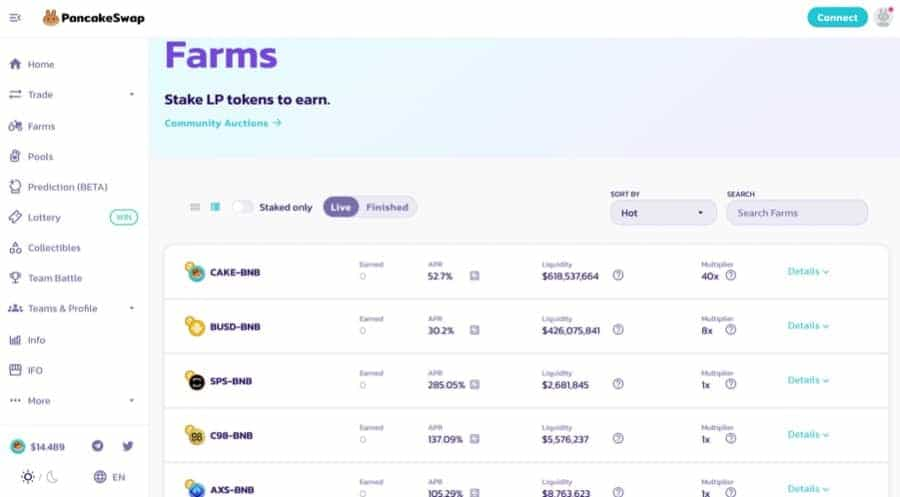

- Head over to PancakeSwap.Finance. Once there, users will encounter various tabs such as Trade, Farms, Pools, Lottery and Collectibles. The Trade tab allows users to swap between tokens on the Binance Smart Chain mainnet, and constitutes the heart and soul of the PancakeSwap DEX.

Contributing To The CAKE-BNB Liquidity Pool

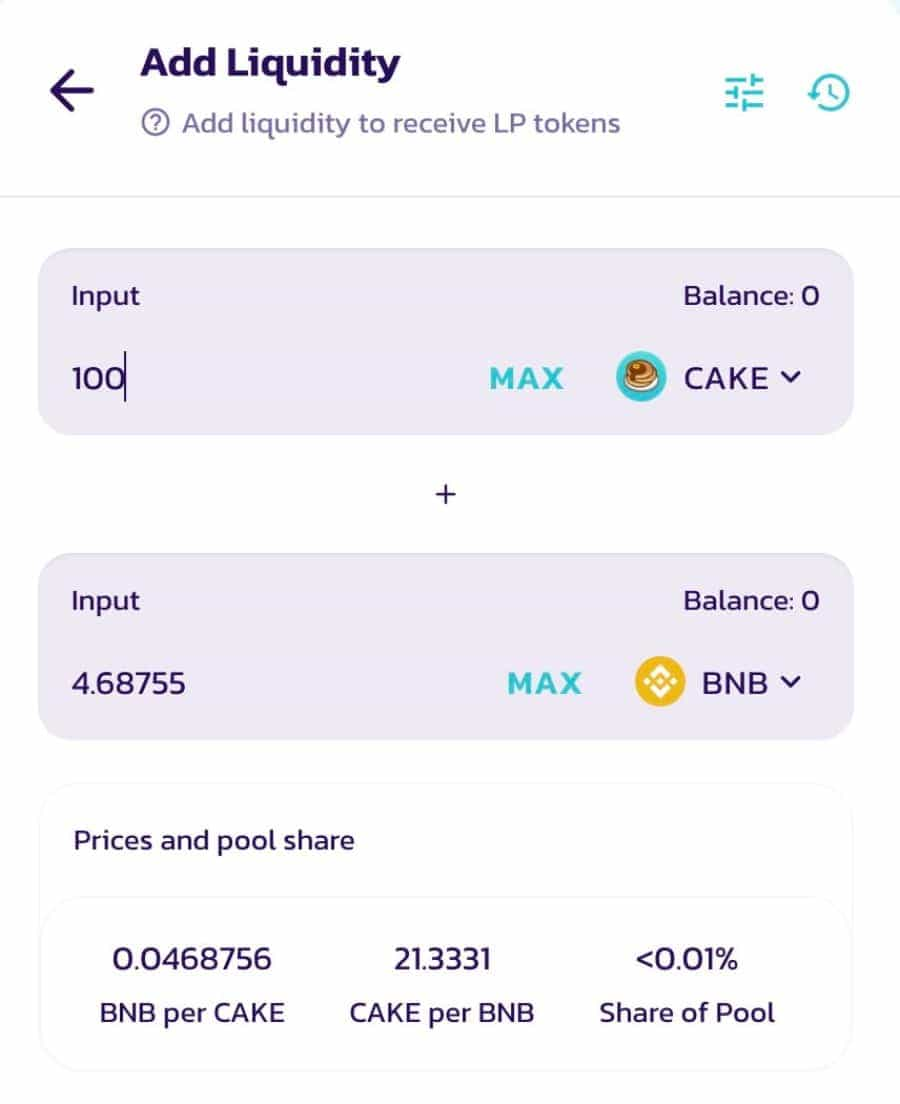

If farmers want to provide liquidity to the CAKE-BNB liquidity pool, the first thing they will need to do is acquire an equal value amount of CAKE and BNB tokens, which they can purchase on Binance first and then send to their Metamask wallet. It is also important to remember that, similarly to Uniswap, PancakeSwap utilises a 50-50 token ration in liquidity provision in order to maintain funds balanced and incentivise trading.

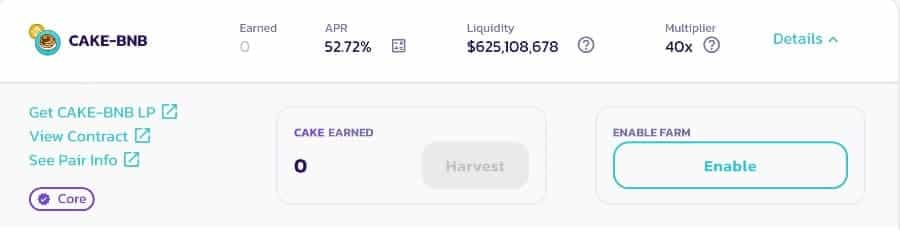

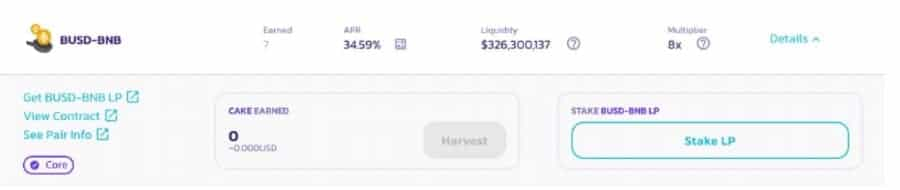

Users will then need to interface their Metamask wallet with the PancakeSwap platform by clicking on ‘Connect’ in the top right corner. Once they’ve successfully connected Metamask with PancakeSwap, they can head over to ‘Farms’, click on CAKE-BNB liquidity pool and then ‘Enable Farm’.

In order to enable a farm, PancakeSwap charges a very small transaction fee, currently around $0.07, which users will need to pay in BNB token. After having completed and signed the transaction on Metamask, the option to add liquidity to the farm becomes open.

Alternatively, farmers can head over to the ‘Trade’ tab, then click ‘Liquidity’, ‘Add Liquidity’ and select their desired input tokens, in this case CAKE and BNB.

- Add liquidity in the amount you want to contribute, but you can also use the ‘Max’ button to contribute up to your maximum in your wallet.

- Then Click ‘Supply’ and pay the liquidity provision transaction fee on Metamask with BNB, which will be considerably lower than Uniswap on the Ethereum network.

In return for supplying liquidity, you’ll receive CAKE-BNB LP tokens which represent your share of the liquidity pool. These LP tokens are interest-bearing tokens and they allow LPs to earn rewards every time a trade is executed through that liquidity pool.

What Next?

Once you receive your LP tokens, you may head over to ‘Farms’ and redeploy your LP capital through staking. The process of doing so is exactly the same as the one mentioned above.

- Click on ‘Stake LP’ and approve your LP tokens for staking.

Once the transaction has been approved and the LP tokens are inserted into the PancakeSwap smart contract for staking, you will essentially start earning CAKE immediately. Farming on PancakeSwap can be incredibly beneficial for investors as it allows them to generate yield while maintaining their position open on their assets.

It is clear that farming offers some inherently optimal ways for crypto investors to yield high returns on their investment, as we have seen with the CAKE-BNB liquidity pool. Therefore, because of its qualities and growing adoption across the space, yield farming is proving to be quite the innovation in the DeFi ecosystem and is set to potentially revolutionise the way crypto enthusiasts, investors and traders will HODL their assets from now on.

In Conclusion

Yield farming is one of the newer trends to come out of DeFi technology, and it is slowly establishing itself as a true powerhouse in the space. Yield farming entails the process of actively searching for the best APYs and moving assets across the ecosystem to essentially ‘farm’ the best crops and yield the highest returns.

Originally, the concept for yield farming started when Ethereum-based DeFi project Compound began incentivising participants to use its platform in return for its native governance token COMP. To this day, Compound is still distributing COMP tokens to anyone who lends and borrows crypto assets through the platform.

The COMP incentive, paired with the possibility to farm native tokens just by using the platform, spearheaded a craze across the digital asset space and inspired users to come up with intricate strategies to move assets around and look for the most profitable crops to farm.

Yield farming as a procedure is rather straightforward and requires users to hold crypto assets relevant to the specific farming platform, a decentralised wallet such as Metamask, and the will to make some serious gains in a relatively short amount of time.

If you’re just starting out with yield farming, Compound is perhaps the best solution for you. Once you’ve developed your skillset further, you can then start farming on protocols such as Uniswap, on Ethereum, and PancakeSwap, on the Binance Smart Chain.

A yield farmer’s gains can be very enticing indeed, however, it is advisable to always exercise caution and understand the risks prior to engaging in the intricate, fast-paced and highly profitable DeFi segment that is yield farming.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.