The tail end of 2018 saw the entire cryptocurrency market experience a sudden surge in both media exposure and public participation.

The end of year Bull Run saw Bitcoin and cryptocurrencies take centre stage and Coinvest is a project looking to tap into the public’s continued interest in cryptocurrency investing and aims simplify the entire process.

What is Coinvest?

Coinvest is an emerging start-up based in Dallas, USA that came to life in 2017. The team behind the project are promising to bring forward the world’s first decentralized stock market for cryptocurrencies that is built on blockchain technology and is able to fulfil the company’s mission of:

Creating decentralized tools for the world to seamlessly, securely, and safely invest and use cryptocurrencies

Coinvest is led by founder and executive director, Damon Nam, who has 16 years of experience at Microsoft and heads a team that has amassed plenty of experience at the software giant. Technology director Byron Levels, and business development director Taylor Rieckens, also worked for Microsoft and the team also have experience working for companies such as American Airlines, IBM, and Verizon.

Overview of the Team at Coinvest

Overview of the Team at CoinvestThe Coinvest team are also able to call upon the knowledge and assistance of advisors Peter Cashmore, the founder and CEO of Mashable as well as Tony Scott, who is the founder and CEO of the Tony Scott Group.

Senior Advisers at Coinvest

Senior Advisers at CoinvestThe team are focused on producing the world’s first decentralized stock market for cryptocurrencies and aim to empower anyone to invest in individual assets or a personally curated index of cryptonized assets via the use of one coin.

Coinvest is working to create a platform that allows it members to utilize an ecosystem that seamlessly integrates a token (COIN), wallet, and exchange and enables anyone to invest in a variety of cryptocurrencies and to create a portfolio of digital investments.

What Problem Does It Solve?

Coinvest aims to simplify the process of investing in cryptocurrencies and provide a simple and efficient solution for new entrants to the market looking to be “on boarded” and integrated into the world of cryptocurrencies.

For those new to the sector, getting acquainted with all the various wallets, exchanges, and currencies that currently exist can be an intimidating experience and Coinvest aims to solve the problem of users not being able to easily invest in cryptocurrencies via the use of a single currency and wallet application.

The Coinvest team aim to reduce the cost, risk, and complexity currently associated with digital currency investing and to provide a decentralized alternative to the various centralized exchanges and investment funds that are currently in operation.

The current market still heavily relies on centralized third parties that are able to retain control of users’ assets and/or charge large commission fees, these third parties are replaced by smart contracts on the Coinvest platform that act as autonomous agents and automatically compensate all the active members within the ecosystem.

Coinvest also completely does away with third party or human interaction and there is no KYC or AML verification required when using the platform.

How Does it Work?

Coinvest aims to benefit the community by providing investors with simplicity, and new users can input their details into the app and transfer funds into their accounts, these funds are transferred into COIN tokens and users can then move on to purchasing cryptocurrencies or creating portfolios.

By using the app, users can trade and withdraw investments directly via smart contracts and spend their COIN tokens by using their debit card account. Users can also create index funds and earn rewards when their funds are tracked by other users, or choose to participate in the index funds created by other users.

Overview of Coinvest Decentralised Exchange

Overview of Coinvest Decentralised ExchangeIn addition, Coinvest members will also have the ability to initiate buy, short, and limit orders through the Coinvest app for individual assets, with options, margin, and futures trading scheduled to be unveiled on the platform.

Benefits include COIN rewards with every trade made on the platform, and a 50% trading fee revenue that comes from the users that track and invest in any personally created index funds.

On top of this, users have the ability to profit from trades made in their virtual investment portfolios, and as the platform becomes more popular and transaction volume increases there is expected to be a natural appreciation in the value of the COIN token, as increased demand drives up the price, as do a number of buybacks by the Coinvest team.

How Viable is the Project?

These features should prove to be enticing to users and Coinvest may attract a variety of different types of investors, however, the platform may prove to be best for anyone looking to get into cryptocurrency investing with as little fuss as possible.

Despite the benefits on offer, there are a number of risks that surround this kind of project and by choosing to operate as a decentralized exchange, wallet, and index fund portfolio manager; Coinvest is entering into a sector of the market that is rife with completion.

The market is arguably close to being saturated with projects that combine exchange, wallet, and fund management features. There are new projects just hitting the market such as Blockport and CoinLion which combine similar features.

Also, projects like CoinFi and Signals aim to attract intermediate users by building a community of like-minded traders that actively share trading information. In addition, there are already existing projects such as Waves, Iconomi, Eidoo, and Ethos that look set to grow in stature this year.

There are also a large number of decentralized exchanges scheduled for this year, and as a result, there is a possibility that the platform struggles to gain traction and never takes off due to a lack of public interest. Without proper marketing, it will be easy for Coinvest to get lost in a sea of similar projects.

It is also possible that any significant changes in market conditions or regulations could severely affect the platform before it is able to establish itself. As the project is based in the USA, the team will have to adhere to the SEC and swiftly adjust to any new legislation drawn up by the Commission. As Coinvest appeals to new users it is also dependant on the market undergoing a prolonged bull run, as new entrants are easier to come by when the market is doing well.

However, as cryptocurrency investing seems to be catching the public’s imagination, there should be more than enough room for projects like Coinvest to thrive. It was only recently that the majority of major centralized exchanges had to turn away new users and disable new signups due to a sudden influx of new members.

Coinvest aim to be the largest single destination for new cryptocurrency investors and if the team deliver on their promises and achieve everything set out in their road map, in addition to focusing on marketing themselves heavily, then this project looks set to succeed.

Crowdsale Details

Coinvest is selling COIN tokens through a crowdsale. The crowdsale began with a pre-sale that started in December, 2017 and ends with a public sale that commences in March 2018.

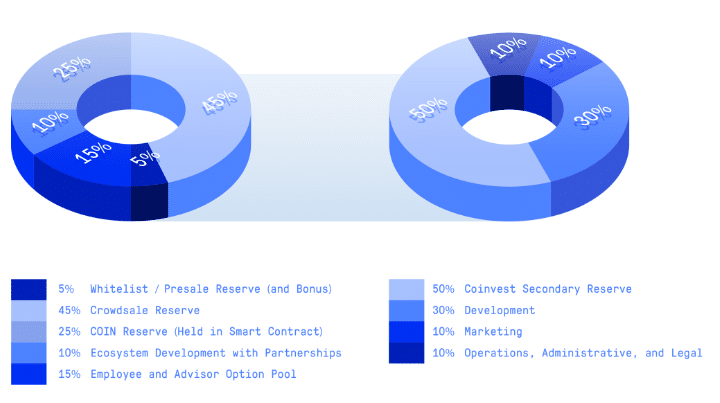

Coinvest is creating a total fixed supply of ~107 million (107.142.857) COIN tokens, distributed as follows:

- 5%: Private Whitelist Reserve (Including Bonus)

- 44%: Crowdsale Reserve (Including Bonus)

- 25%: COIN Reserve (Held in Smart Contract)

- 10%: Ecosystem Development and Partnerships

- 16%: Employee and Advisor Option Pool to Recruit and Retain Talent

Token Supply: Fixed supply of ~107 million (107.142.857)

Distributed in Crowdsale: 52,500,000 million (49%)

Symbol: COIN

Value: 1000 COIN = 700 USD

Blockchain Platform: Ethereum ERC20 / ERC223

Source: coinve.st

Source: coinve.stPrivate Whitelist

Sale Period: January 2018

Maximum Cap: $3 million

Bonus: 25%

Value: 1250 COIN = 700 USD

Crowdsale

Sale Period: March 2018

Maximum Cap: $30 million

Bonus: 10%

Value: 1100 COIN = 700 USD