Litecoin (LTC) is an altcoin that was created in 2011 by Charlie Lee as a faster alternative to Bitcoin. Where Bitcoin blocks are verified roughly every 10 minutes, Litecoin blocks are verified every 2.5 minutes, making the network four times as fast.

Litecoin has often been called the silver to Bitcoin’s gold. While Litecoin uses a different algorithm than Bitcoin, it is still a proof-of-work coin, and as such it can be mined to be awarded Litecoins.

Below I’ll talk more about mining Litecoin, and the top Litecoin mining pools. With so many options available, choosing from a sea of the best Litecoin mining pools isn't easy, but we'll make it just that for you.

Litecoin Mining Pool Criteria

Just as I suggested in my guide to Ethereum Classic mining, one of the first things you’ll want to look at is the fees charged by the mining pool. The lower the fees are, the more Litecoin you get to keep for yourself, so choosing a low-fee pool is an obviously good choice.

You’ll also consider the minimum payout level. One of the reasons for choosing to mine through a pool is the steady payments at regular intervals, and if these intervals are kept shorter, that’s better too.

And finally, you’ll want to look for a mining pool that’s close to you geographically. You don’t want a pool with servers in China if you’re mining in New York. The closer you are to the pool servers, the better your mining performance will be.

Below I’ll take a closer look at several popular Litecoin mining pools, as well as discuss the P2Pool option for mining. Beyond that is a short discussion regarding the recent addition of ASIC Litecoin mining hardware, and what that can mean for Litecoin miners.

How to Pick the Best Litecoin Mining Pool

There’s no “best” LTC mining pool, there’s only a best Litecoin mining pool for your needs. For example, the top three Litecoin pools are Antpool, F2Pool and LTC.top, but they would never be the best for me because their servers are located in China and their websites are predominantly in Chinese.

That’s ok though because there’s not too much difference between the various mining pools. Simply choose a pool that has servers close to and a fair fee structure and you’ll see payments that are similar pretty much across the entire selection of Litecoin mining pools.

See, choosing a Litecoin pool is actually pretty easy after all. Simply make sure the pool servers are close to your location to maximize your mining rewards and find one with low fees to minimize your expenses.

You can also go to other forums and articles to read up on what others think of the various Litecoin mining pools, but I don’t think you’re going to hear much different than what you’ll learn here. So, unless there’s someone you know who’s mining Litecoin and you want their opinion, I don’t think it’s going to be necessary to get the opinions of others.

Top Litecoin Mining Pools

To get you started, here’s a list of three mining pools, and a fourth suggestion that’s like a pool, but not exactly like a pool. Confused? That’s OK, you soon won’t be.

LitecoinPool.org

This is one of the oldest and largest LTC mining pools. It’s a pay-per-share (PPS) pool and a merged mining pool as well, which can yield the best results at times thanks to the mining of the secondary coin. Plus, with the PPS system you get paid even if a block gets orphaned by the Litecoin network.

There are eight geographically diverse servers, making this a good pool from nearly any location on the globe, and there are no fees for either automatic payouts or manual payouts.

LitecoinPool.org was started in 2011 by one of the main Litecoin devs, who goes by the name Pooler. Because of this the pool has been highly trusted since its earliest days. At one point in 2012, the pool controlled over 40% of the Litecoin hash power.

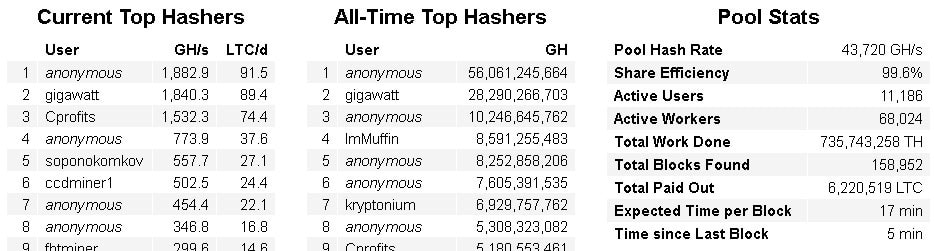

LitecoinPool.org Statistics

LitecoinPool.org StatisticsBecause of that registrations were closed for several months, and since then it has required approval to get accepted to the LitecoinPool.org pool. The pool was also the first to offer secure mining over TLS-encrypted Stratum connections, protecting miners from potential man-in-the-middle attacks.

viaBTC

This is the next largest Litecoin pool behind LitecoinPool.org, making it the fifth-largest LTC pool. It’s a combined pool and in addition to its Litecoin pool, there are also Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Dash and Zcash pools available at viaBTC. It’s a newer Litecoin mining pool, having started as a Bitcoin mining pool back in June 2016, and then adding Litecoin in January 2017.

At viaBTC you can choose a PPS payment method, or they also offer pay-per-last-n-shares (PPLNS), which is a very popular payment scheme at mining pools. Either way, there are no transaction fees, and miners are only responsible to pay a small maintenance fee of 4% for PPS payments and 2% for PPLNS payments.

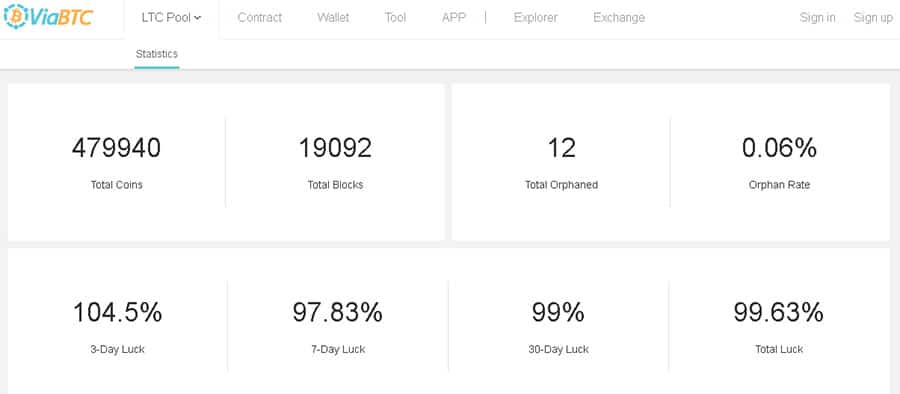

ViaBTC Litecoin Pool Statistics

ViaBTC Litecoin Pool StatisticsEven with the fees viaBTC can be quite profitable as it uses merged mining and pays out 800 DOGE for every 1 LTC mined. viaBTC also offers cloud mining for those that don’t want to deploy their own hardware.

ProHashing

ProHashing is the ninth largest Litecoin mining pool, and has been in operation since August 2014. It was started by three engineers, two of whom are brothers. In addition to Litecoin and other Scrypt coins, it also has mining pools for SHA-256, Equihash, and x11 algorithm coins.

It uses the PPS payment model, and is unique in that you can get paid in any coin you like. So, you could mine Ethereum, but get paid in Litecoin or Bitcoin if you like. You can even choose U.S. dollar payouts if you like, and unless you’re asking for very small payouts there are no payout fees at ProHashing. There are also no transaction fees charged. Instead, ProHashing aims to have a flat 4.99% fee that includes the use of all their features.

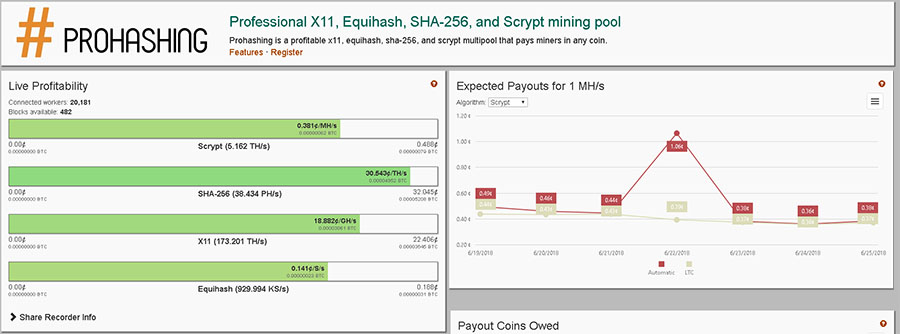

Prohashing Scrypt Statistics

Prohashing Scrypt StatisticsIf you like, you can set ProHashing to mine automatically, in which case it will use your hash power to mine the most profitable coin. That coin is determined by the ProHashing custom algorithm, with profitability recalculated by the algorithm multiple times per second. In addition, ProHashing will merge mine coins whenever possible, increasing profitability even more.

Large Mining Pools

While there currently aren’t any mining pools that are near 51% of the total hash rate of the network, it is recommended that you avoid using the largest mining pools to keep any one pool from growing to that 51% limit. Remember, bigger doesn’t mean better when it comes to mining pools.

Payments are determined by the payment scheme, and since most pools are PPS or PPLNS the payments at larger pools are not larger, nor do they come faster. You can see the Litecoin hash distribution rate here. Check that and avoid joining the largest pools.

Try P2Pool

Choose a smaller pool, or you could even consider using P2Pool, which is a peer-to-peer public mining network that can be joined by anyone without registration. The P2Pool nodes are completely decentralized (great for cryptocurrencies), and can be connected to using your Litecoin wallet address as the username and anything at all as the password. The decentralized nature of the P2Pool networks encourages improved security and promotes a wider distribution of nodes.

A P2Pool node provides connected miners with low-difficulty work. Upon completion of each portion of work, the miner is awarded a pool share. Shares are communicated among P2Pool nodes and assembled into a sharechain – just like the Bitcoin network assembles blocks into the blockchain.

Once the pool finds a block, all contributors are paid directly, according to their shareholding as reflected in the sharechain. Payment is issued by the sharechain and without third-party involvement. Below is a list of some Litecoin P2P Pools.

| Name | Fee % | Launched | Pool Node | Location |

| Carnth's | 1 | 2013-04-03 | sea.snicter.com:9327 | USA |

| Syari | 1 | 2013-04-05 | syari.net | France |

| Litecoin.tw | 1 | 2013-07-20 | litecoin.tw:9327 | USA |

| elitter.net | 1 | 2013-11-30 | www.elitter.net:9327/ | USA |

| Carnth's | 1 | 2013-04-03 | sea.snicter.com:9327 | USA |

| kyrio's | 1 | 2013-12-10 | ltc.lurkmore.com:9327 | USA |

| Qhor | 1 | 2014-02-04 | q30.qhor.net:9327 | Germany |

Is Litecoin Mining Profitable?

Yes, you can still make money by mining Litecoin, however doing so with a GPU is becoming increasingly difficult. In fact, you’ll need a high-end GPU to successfully mine Litecoin these days. The reason is that Bitmain released an ASIC Scrypt miner over a year ago. Simple GPU mining can’t come close to the raw power of the Bitmain Antminer L3+ units.

If you’re considering mining Litecoin or other Scrypt algorithm coins in 2018 and beyond your best bet is to go with one of these ASIC miners. The good news is that the cost of these ASIC miners isn’t higher than the cost of a good GPU, and with aftermarket markups, the ASIC Litecoin miner is actually less expensive. Even with the ASIC miner, you’ll be best served by joining a pool rather than going it alone.

Top Litecoin Mining Pools: Conclusion

If you’re confident that cryptocurrencies, and Litecoin in particular, are going to increase in value long-term now might be a great time to get started mining.

Because of the lower prices, the difficulty of mining is currently lower, and the cost of the mining hardware is also lower. If Litecoin recovers back to late 2017 prices by the end of 2018 you could be sitting on a valuable stash of coins.

And by using the Litecoin mining pools listed above you can be sure you’re getting reliability and safety from well-established mining pools. You’ll also be assured of low fees and the strongest hash rate when you choose a pool that has servers near your own location.