Bitcoin Cash Pump and Dump, or Optimism on SegWit2x Failure?

From Friday, November 10, to Sunday, November 12, Bitcoin Cash (BCH) had an astounding weekend price performance—surging all the way up past $2,400 in the early hours of Sunday before settling back down in the $1,200 price range at press time.

Many in the community pointed to the Bitcoin scaling debate in the wake of the SegWit2x update being called off on Wednesday, November 8, as the source for the acute migration from BTC to BCH.

But, as is the case with almost everything in life, there’s a lot more to this story than first meets the eye. Let’s walk you through it.

SegWit2x Canceled – BCH’s run begins

Not long after the SegWit2x call-off was announced, Bitcoin whales like Roger Ver apparently began moving massive amounts of BTC into BCH.

This flight dynamic caused a depression in BTC’s price while BCH surged to new all-time highs.

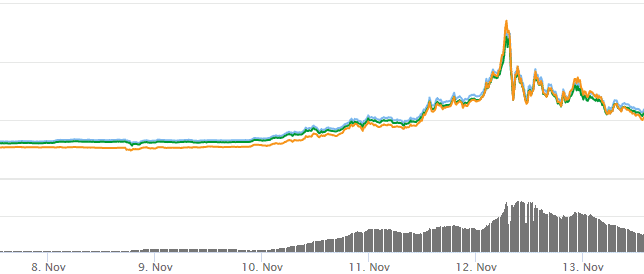

Notable, though, was the volume pattern of this latest BCH run – it at least resembled the general structure of a pump-and-dump formation.

Indeed, P&D patterns are marked by a rapid and extremely high uptick of volume that then fairly quickly dissipates. BCH’s surge from over the weekend certainly looks similar:

A very acute – and thus suspicious – BTC volume surge | Image via CoinMarketCap

The counterargument is that the Bitcoin markets were just responding to the unexpected SegWit2x cancellation.

More realistic is that the surge was a combination of the both the post-SegWit2x scaling drama and pump-and-dump elements of some kind; who’s responsible for the latter is a matter for debate.

What BCH has going for it

As murmurs of the “flippening” began, Bitcoin Cash supporters began pointing to the acute superiorities of the BCH chain over BTC at present.

First among these was the fact that the incumbent Bitcoin network is and has been enduring a backlog of unconfirmed transactions in recent days. At the writing of this article, the number of these unconfirmed transactions stands upward of 109,000.

That means over the weekend BTC traders had nightmarish confirmation times, with transactions taking hours to complete. This dynamic also contributed to a panic sell-off for some BTC traders who were able to get their coins to exchanges.

The BCH community also pointed to their chain’s low fees, as well as the fact that the BCH chain continues Bitcoin’s genesis block and that raising the block size like BCH did appears to have been the scaling solution Bitcoin creator Satoshi Nakamoto supported.

Not so simple – miners apparently begin spamming BTC network

One of the “acute superiorities” BCH had on BTC over the weekend – speed – appears to have been the result of a coordinated effort from some faction within the Bitcoin Cash community.

That’s because it appears miners were spamming the incumbent Bitcoin network with low-value transactions in an apparent effort to create congestion. This ensuing congestion resulted in acutely inflated transaction fees in an attempt to rally more BTC users to BCH.

Now that the dust is beginning to settle so it seems, Bitcoin has once more regained the upper hand, surging back up above the $6,500 price point and becoming more profitable to mine than BCH again thanks to its schedule difficulty readjustment.

The fireworks are only just beginning to fly, so it seems, and as the interactions between the BTC and BCH communities seem more and more like war, the Bitcoin community’s scaling debates surely won’t be settled anytime soon.

Featured Image via Fotolia

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.