Bitcoin and Crypto Currency Markets Tumble

China is back at it again. They are spooking Crypto currency markets and creating a great degree of uncertainty. This time the shock came in the form of a cryptic (pardon the pun) comment on social media that was tied to the Caixan news outlet. The rumours were that they were banning local crypto exchanges. Indeed, we also had an official tweet from peoples daily China (Communist party mouthpiece), the news seemed to be confirmed.

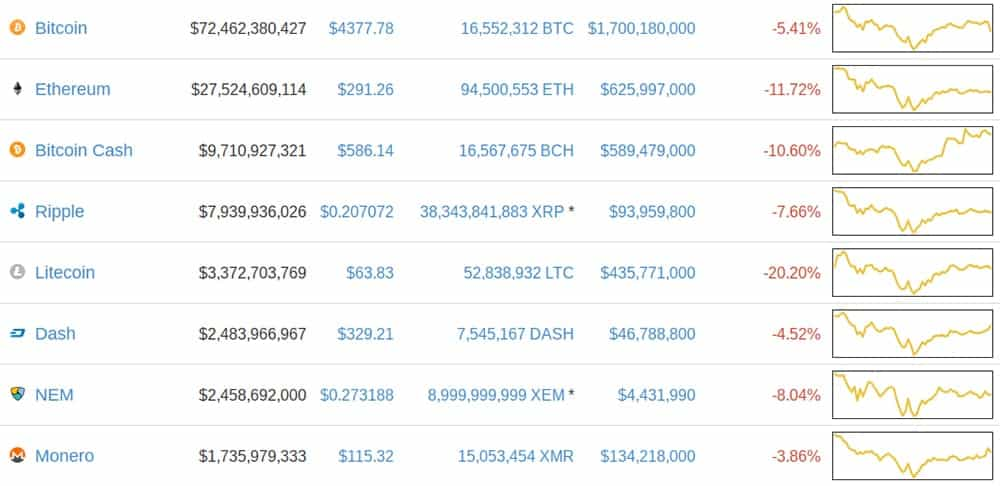

The results were immediate. The crypto currency markets saw a sea of red with most falling by about 25% on the news. This comes off of recent statements that the Chinese regulators were banning ICOs as they viewed them as a violation of the Country's security laws.

When the news started to make the rounds, Bitcoin fell be over 9% with other currencies such as Litecoin following which was down by over 15%. The hardest hit of the crypto currencies was NEO which is directly impacted by Chinese regulations. It fell by 25% to land back below $25.

Although this is not necessarily something new, the idea that China could ban the trading on a more permanent basis sent chills through the market. As we may know, China place a temporary ban on a number of exchanges in January. This temporary ban was eventually removed when the required guidelines were brought into place.

For may this may be more of a general theme of a very skittish market overreacting to nearly everything that they hear. Others labelled it a great opportunity to pick up more coins while the markets would eventually correct.

Either way it was quite a dramatic end to an even more dramatic week in the crypto markets. On Monday we saw the Chinese ban ICOs and force those who raised funds reimburse funds which caused all crypto coins fell to monthly lows. Then on Tuesday we heard rumours that the South Korean's could follow suit.

Most crypto currencies were able to make a reasonable recovery in the latter part of the week as they were trying to reach the levels that they had tested by the end of last week. Of course, the People's Bank of China had other plans.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.