Bitcoin Fees Drop as SegWit Implementation Reaches 14.5%

SegWit transactions are taking hold. Last week the percentage of SegWit enabled transactions went from 9% to 14.5%. This had the effect of also decreasing the Bitcoin transaction fees as well as the size of Bitcoin blocks. You can see the current percentage of SegWit transactions at segwit.party.

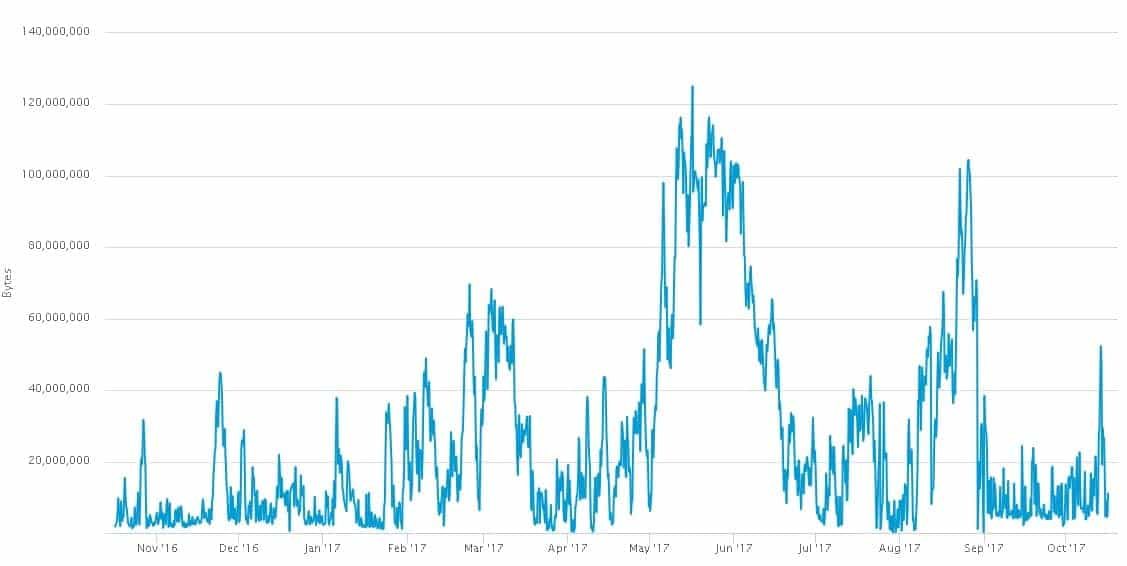

This also reduced the size of the Bitcoin mempool of transactions awaiting a miner to pick it up. These are essentially just a collection of unconfirmed transactions. Prior to the SegWit upgrade, this was considerably high but has since fallen to more reasonable levels. You can see this in the chart below:

Bitcoin Mempool Size, Source: Blockchain.info

A larger mempool and more unconfirmed transactions meant that transaction fees were also quite high. However, as more and more wallets and exchanges started implementing the SegWit transactions, the mempool size started to fall and so did the transaction fees.

As Segregated Witness strips out the witness portion of the Bitcoin blocks, it has also meant a decrease in the average size of a Bitcoin block and hence more space for the transactions. Average Bitcoin block size has fallen approximately 1MB prior to the upgrade to about 0.84 now.

Desired Results

The SegWit scaling proposal was meant to overcome the Bitcoin blocksize limit of 1MB. The implementation was part of a compromise between developers and business whereby SegWit would be implemented and then, 3 months later the blocksize would be doubled to 2MB. This was the basis for the hugely contentious SegWit2X proposal.

The "NO2X" camp are saying that the effect of the SegWit implementation is now fully playing out and having the desired effect. There would be no need to hardfork the network and upsize blocks now.

In terms of the impact for Bitcoin users, transaction fees have fallen which is no doubt one of the prime benefits. For example, a number of wallet providers have suggested a transaction fee of about 10 Satoshis (5 cents) per byte. This number stood at 400 Satoshis in late June.

Long Term Scaling Solution

Altough SegWit has had the desired effects currently, there still needs to be a longer term scaling solution. Hence, there is currently ongoing collaboration between developers to present scaling solutions both on and off chain.

For example, the lightning off chain swap solution that was successfully tested recently on Litecoin could greatly improve transaction speed and reduce fees. We are also likely to see a much larger increase in SegWit adoption as some of the larger exchanges such as Coinbase or wallets like Blockchain start implementing it.

An example of the cost savings one can achieve is given by the hardware wallet producer, Ledger. They give users the option to send a transaction via SegWit and they claim that the transaction fees could be lower by about 35%.

Featured Image via Fotolia

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.