Have You Seen This Bloomberg Report? Senior Commodity Analyst Says $100,000 Bitcoin This Year Would Be ‘Meager’

Bloomberg Intelligence senior commodity strategist Mike McGlone says that Bitcoin reaching the $100,000 level this year would be "meager" by BTC's standards.

In Bloomberg's October "Crypto Outlook" report, McGlone says that despite a tidal wave of bad press including China's crypto ban, Bitcoin managed to find stalwart support at the $30,000 level. He suggests that there are "similar underpinnings that resulted in the 171% gain" in the fourth quarter of 2020. Using that rally as analogy, McGlone posits that the $40,000 mark this year is the equivalent to the $30,000 level of last year.

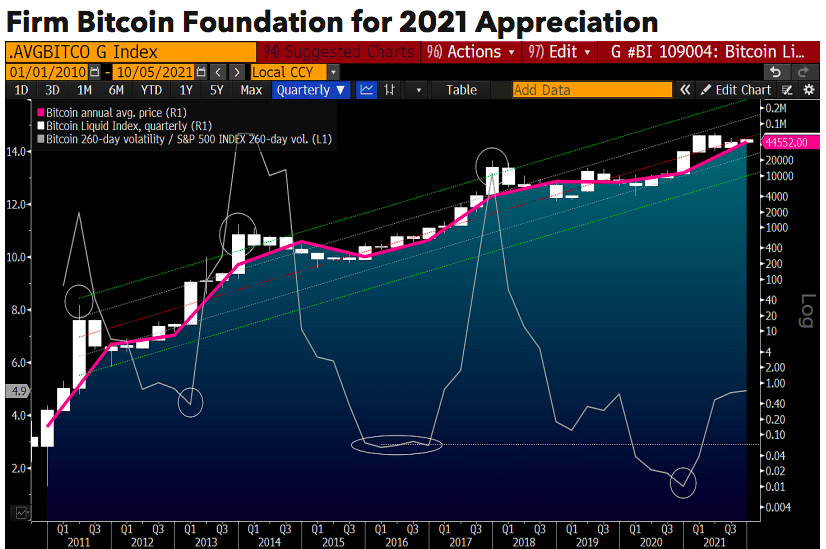

"We view the $40,000 mark as similar to the crypto's $10,000 launchpad from 4Q20. Parallels are visible from about 4x higher. The 2021 average price is $44,500, and adoption and demand are on the rise vs. diminishing supply."

By comparing Bitcoin's price to its 260-day volatility versus the S&P 500, the commodity strategist paints a picture that gives BTC at least a few more months of bullishness. This is what he calls a "firm foundation" for Bitcoin's appreciation this year, and also a sign that $100,000 may actually be an underwhelming performance.

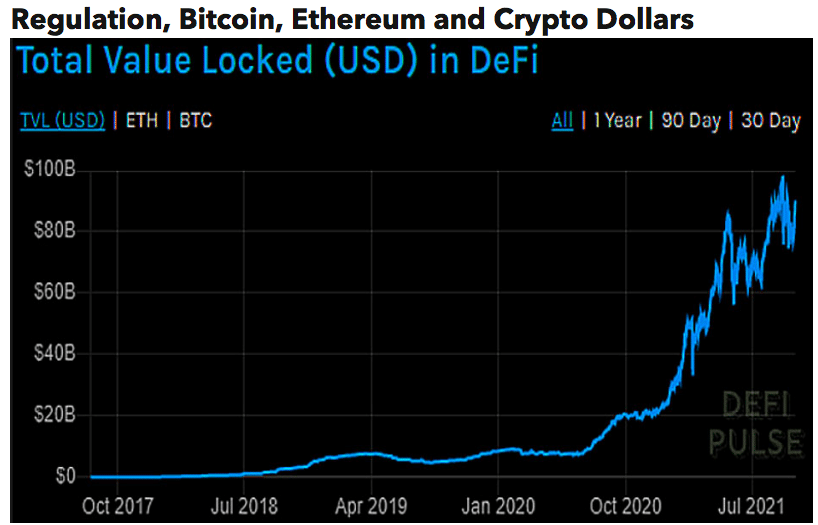

Beyond Bitcoin, the analyst is also fairly optimistic on Ethereum and its general decentralized finance (DeFI) ecosystem, noting an exponential rise in the amount of dollars locked in DeFi protocols.

"As revolutionary technologies are disruptive by nature, we see a sustainable course for the digitalization of money and finance, and rising demand for Ethereum. The value of assets in DeFi is approaching $100 billion vs. about $20 billion a year ago, according to DeFi Pulse. The chart depicts a familiar uptrend in most crypto assets and prices. The more significant question is what might cause an enduring reversal.

Ethereum futures trading on the Chicago Mercantile Exchange is part of the regulatory mainstream and the adoption path that cryptos are following in 2021. Interestbearing crypto dollars may follow eurodollars. Dollar deposits in crypto savings accounts may be akin to deposits at foreign banks."

According to McGlone, Etheruem closely resembles a "consolidating and discounted bull market," adding that demand and adoption are rising, but with a notable difference from a year ago: a plunging supply.

Ethereum's recent upgrade which began taking a portion of gas fees and burning the ETH instead of sending to miners has put considerable pressure on the asset. According to watchtheburn.com, 566,435 ETH have been burnt, or about $2,151,600,212. This, combined with Ethereum being "the go-to platform for

smart contracts, NFTs and decentralized finance," puts clear skies ahead for ETH, according to McGlone.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.