China Officially Bans ICOs: What you need to know

It has now become official, the Chinese government has decided to outlaw ICOs or Initial Coin Offerings.

It was issued as a joint statement by 7 of the country's regulators in which they detailed why they viewed the new funding mechanism to be illegal under the country's law. In a translation of the statement, the following was noted

ICO financing refers to the activity of an entity raising virtual currencies, such as bitcoin or ethereum, through illegally selling and distributing tokens. In essence, it is a kind of non-approved illegal open fund raising behaviour, suspected of illegal sale tokens, illegal securities issuance and illegal fund-raising, financial fraud, pyramid schemes and other criminal activities.

The end result of this statement by the Chinese authorities is that as of today, 4th September 2017, all currency issuance and financing activities within the ICO space should cease. They also went one step further be demanding that those individuals who had raised funding in this way should return the capital to investors.

In an indication of just how serious the new laws are, the statement also threatened that those who did not comply risked being severely punished. This includes those who continue to raise funds and those who do not refund the money that was raised.

The statement also mentioned that they would be tightening regulations on all of the trading platforms and exchanges. They claimed that all trading platforms should not allow for the exchange of FIAT money for crypto currency. They should also not provide any pricing for the digital currency.

The regulations also prohibit financial institutions such as banks who wish to do business with any organisation that wants to raise funding through an ICO.

Swift Reaction

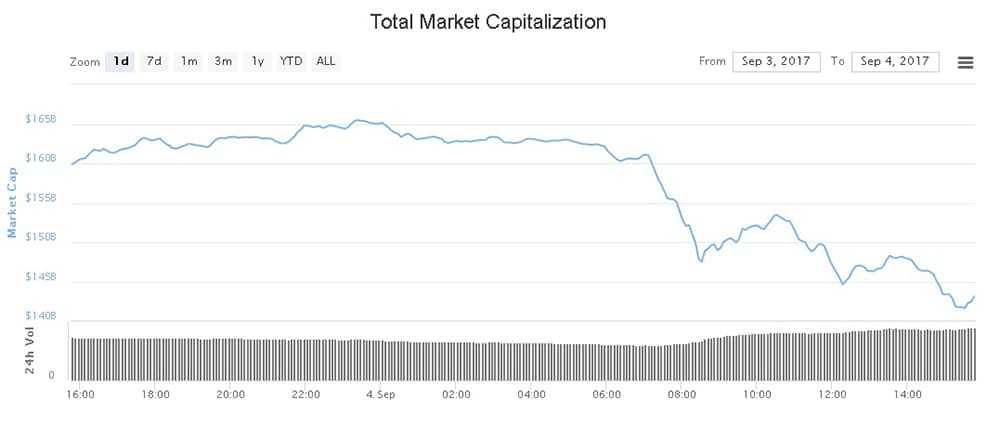

It was indeed a swift and large reaction across crypto currency markets. The total value of all assets that were issued by ICO declined by over 25%. It was also particularly acute for those currencies that are used in ICOs. Ethereum was down over 18% and other currencies such as Neo and OmiseGo down 35% and 22% respectively.

This was not restricted to these currencies but was felt across the board. The total market cap for all crypto currencies was seen falling from just over $165bn to $140bn now. This is clearly evident in the chart below from Coinmarketcap.

Looking Ahead

Although this may be quite a sharp pullback for the crypto currency markets, many were expecting some sort of short term correction. This will assuage many fears that some of the more seasoned investors and pundits have had. Things are considerably less "bubbly" than they were over the weekend.

The extreme rise in the price of these crypto currencies has created a large amount of retail interest among ordinary investors. This means that they see the current prices as a great opportunity to buy at depressed levels. We may see this excess demand coming into the market pretty soon.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.