Ethereum Breaks All-Time Highs As Bitcoin Hangs Out Over $60,000

Ethereum (ETH) has officially broken all-time highs at the $4,430 level nearly 6 months after it's previous high in May.

With ETH potentially entering price discovery, and Bitcoin seemingly finding support at $60,000, positive market sentiment has reemerged.

Macro investor and former Goldman Sachs executive Raoul Pal took to Twitter today to announce that he's never been more irresponsibly long as he is now.

"Just so we are clear - I am more than irresponsibly long ETH right now. I now have leverage but via calls. This is by far and away the biggest personal position of my entire life by a factor of 10 (or more).

My view horizon for this part of the trade is 6 to 9 months."

Pal has previously asserted that ETH is the better trade over Bitcoin based on it being earlier in its adoption cycle and backed by booming network effects. He does however still hold Bitcoin and a selection of other more nascent cryptos as part of some "big future" plays.

"I obviously also own BTC and a whole bunch of other crypto (layers 1's, Defi and interoperability stuff). I think the most undervalued plays for the future (not now) are Rally.io (RLY), Chiliz (CHZ), Dapper Labs, The Sandbox (SAND), Decentraland (MANA), and other metaverse and social tokens."

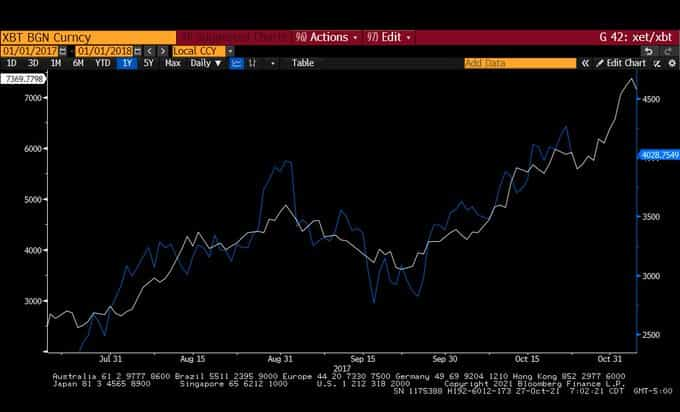

The Real Vision CEO has also suggested that Ethereum's current bull run is following that of Bitcoin's between 2013 and 2017, which implies ETH goes well past the $20,000 mark.

"The ETH 2021 vs BTC 2017 parallel continues its weird wizardry..."

Raoul Pal/Twitter

Raoul Pal/TwitterPal said earlier this month that he was guessing ETH would be somewhere near $15,000 at the end of the year and about $40,000 by the end of the current run.

The resurgence of bullish sentiment in the crypto is also reflecting in the derivatives market. Over on Deribit, BTC and ETH bulls can now buy calls options with strike prices of $400,000 for BTC and $50,000 for ETH by with September 22nd expiries. Anyone buying these calls is hoping for a 555% increase for Bitcoin and a 1062% rally for Ethereum.

https://twitter.com/DeribitExchange/status/1452705181469057025

The bull market briefly came into question yesterday when Bitcoin pulled off a classic "scam wick" that brought it from above $61,000, down to $57,600 (lower on some exchanges), and then back above $62,700 in less than an hour and a half, according to TradingView data. At the time of writing, Bitcoin is $61,274, and Ethereum is $4,353.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.