Ethereum Price and Congestion Woes: Putting It Into Perspective

The sky certainly isn't falling by any stretch of the imagination, but the Ethereum community is digging in. The ETH price is hitting a mild, acute sag, congestion on the network is high, and fees are climbing.

So what to do and what to think?

No worries, we'll help you wrap your head around the ongoing episode.

The state of congestion

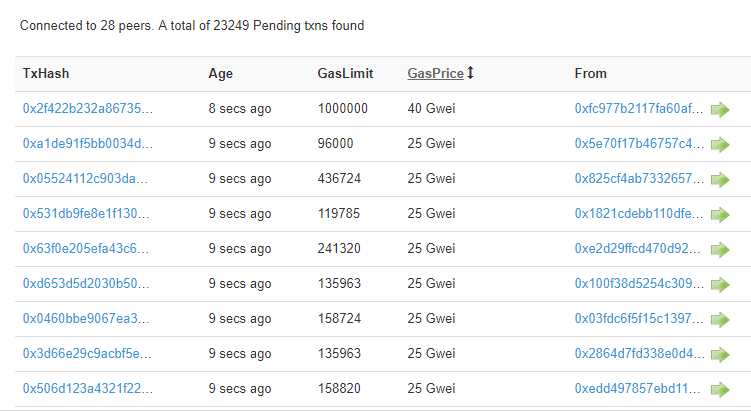

At press time, the ether backlog is hovering above ~23,000 transactions:

Accordingly, the congested dynamic is driving up fee prices, as users are paying higher "gas" fees in order to push transactions through faster.

The launch of the explosively popular CryptoKitties game played atop Ethereum-based ERC-721 tokens has had transactions on the network breaching upwards of 6,000,000 and 7,000,000 per day over the last week.

This high level of traffic has made it so that ETH's recent blocks have been consistently full. The ensuing strain on the network has had many Ethereum enthusiasts frustrated, while Ethereum's competitors simultaneously cheer on the conundrum.

Is ETH's price slump related?

At press time, ether's price of $440 is down ~5 percent from yesterday. Hardly a slump to write home about, right?

Regardless, newcomers and casual investors in the community wondered if the congestion from CryptoKitties was shaking out the small price slip.

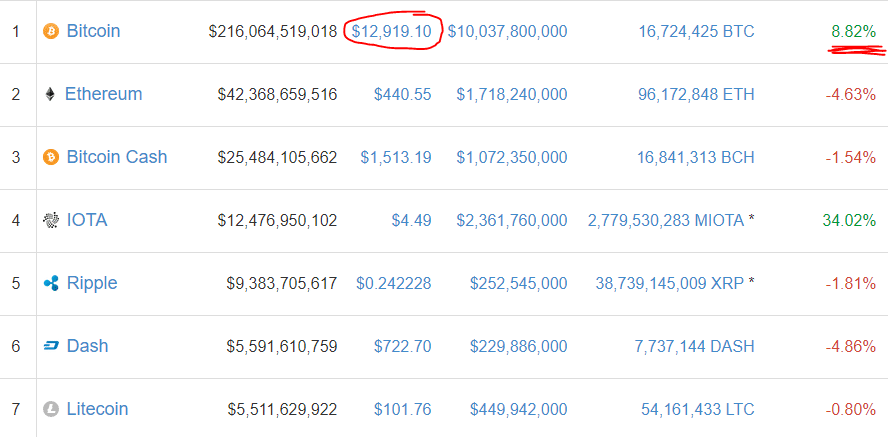

However, a closer examination of the current crypto market provides a much likelier explanation: the bitcoin price nearing $13,000 USD.

For those of us who've been around the "block" once or twice, we've seen this dynamic dozens of times before. As the bitcoin price surges, investors dump out of their altcoinss and into BTC as FOMO ("fear on missing out") sweeps through the market.

Note above how bitcoin is up nearly 9 percent and is hovering just under $13,000 while the other top alts (except IOTA) are all slightly down.

To this end, Ether's acute price sag looks like a classic case of FOMO migration into bitcoin. As it stands, it doesn't look like anything more systemic is going on.

On the bright side: Ethereum scaling solutions on the way

Back on the issue of scaling, Ethereum's ongoing congestion woes have everyone eyeing the horizon for fixes.

The good news is that there are numerous solutions on the way.

These various impending scaling measures include:

- the switch to Proof-of-Stake (PoS)

- the implementation of sharding, Plasma

- state channels (e.g. Raiden)

Once these updates go live in the coming months, Ethereum enthusiasts won't have to worry about congestion again for the foreseeable future.

Silver lining: cryptocollectibles and gaming

Ethereum is still premature. The community coming up against these usage tensions gives Ethereum's developers tangible data to act on in order to fine tune the project and meet future usage demands.

But already before us we can see an inkling of what the future might look like. The explosive popularity of CryptoKitties is a great development for Ethereum, as it shows that the future might be brimming with cryptocollectibles and games given life to through Ethereum.

It's a good thing that users are flocking to the network. And more will come in the future as the possibilities of ERC-721 assets broaden.

Featured Image via Fotolia

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.