The European Central Bank released a new report on the state of cryptocurrency, saying that the “stellar growth” of the space emphasizes the importance of understanding its risks.

The report, titled “Decrypting financial stability risks in crypto-asset markets,” while mostly a critique and warning of the industry, does reveal some bullish metrics.

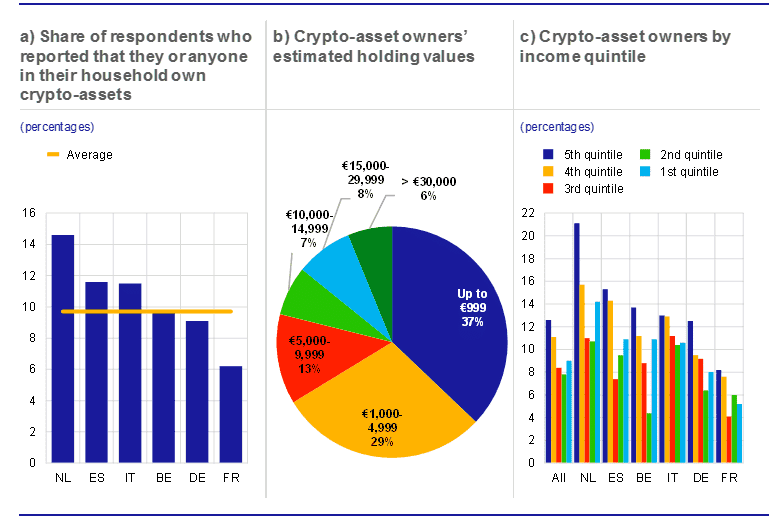

For example, the ECB says that based on results from its recent Consumer Expectation Survey (CES) from six larger eurozone countries, as much as 10% of households may own crypto-assets

“Most crypto-asset owners reported holding less than €5,000 in crypto-assets, with a slight predominance of smaller holdings (below €1,000) in this group,” they said. “At the other end of the spectrum, around 6% of crypto-asset owners confirmed that they held more than €30,000 in crypto-assets.”

“Looking at the income quintiles of the respondents, the pattern is largely U-shaped: the higher a household’s income, the more likely it is to hold crypto-assets, with lower-income households more likely to hold crypto than middle-income households.”

Image via ecb.europa.eu

Image via ecb.europa.euAccording to the report, young adult males and “highly educated” respondents were more likely to invest in crypto-assets from the countries surveyed. It also found that respondents were either at the top level of financial literacy or at the bottom, similar to the “U-shape” found in their income disparities.

On the other hand, the ECB says:

“Crypto-assets lack intrinsic economic value or reference assets, while their frequent use as an instrument of speculation, their high volatility and energy consumption, and their use in financing illicit activities make crypto-assets highly risky instruments. This also raises concerns over money laundering, market integrity and consumer protection, and may have implications for financial stability.”

The government body reiterated that crypto assets “are not suitable for most retail investors,” either as an investment or store of value, warning that they could lose a large amount of the money they have invested.

The ECB also listed all the usual alleged risks associated with crypto, including “misleading information, the absence of rights and protections such as complaints procedures or recourse mechanisms, and product complexity with leverage sometimes embedded.”

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.