Investor Conviction At All-Time Highs As Bitcoin Smashes Through $68,000 Level

Bitcoin has shattered another all-time high, and while not a dramatic break (so far roughly 1.5% depending on the exchange), on-chain metrics look strong, according to blockchain insights firm Glassnode.

In a new report, Glassnode suggests that Bitcoin investors have a higher conviction rate than ever before. On top of high prices, the firm says Bitcoin is boasting highs in other metrics like hash-rate, and the proportion of mature coin supply.

“Long-Term Holders have distributed a very small fraction of their holdings, as is typically observed in all prior cycles. However, despite hovering just below ATHs, on-chain activity remains only marginally above bear market levels. Additionally, exchange balances continue to deplete, and miner hashrate and USD revenue are approaching new highs.

This combination of strong supply dynamics, mining network recovery, and relatively low network activity points to a fairly constructive outlook for Bitcoin over the coming weeks.”

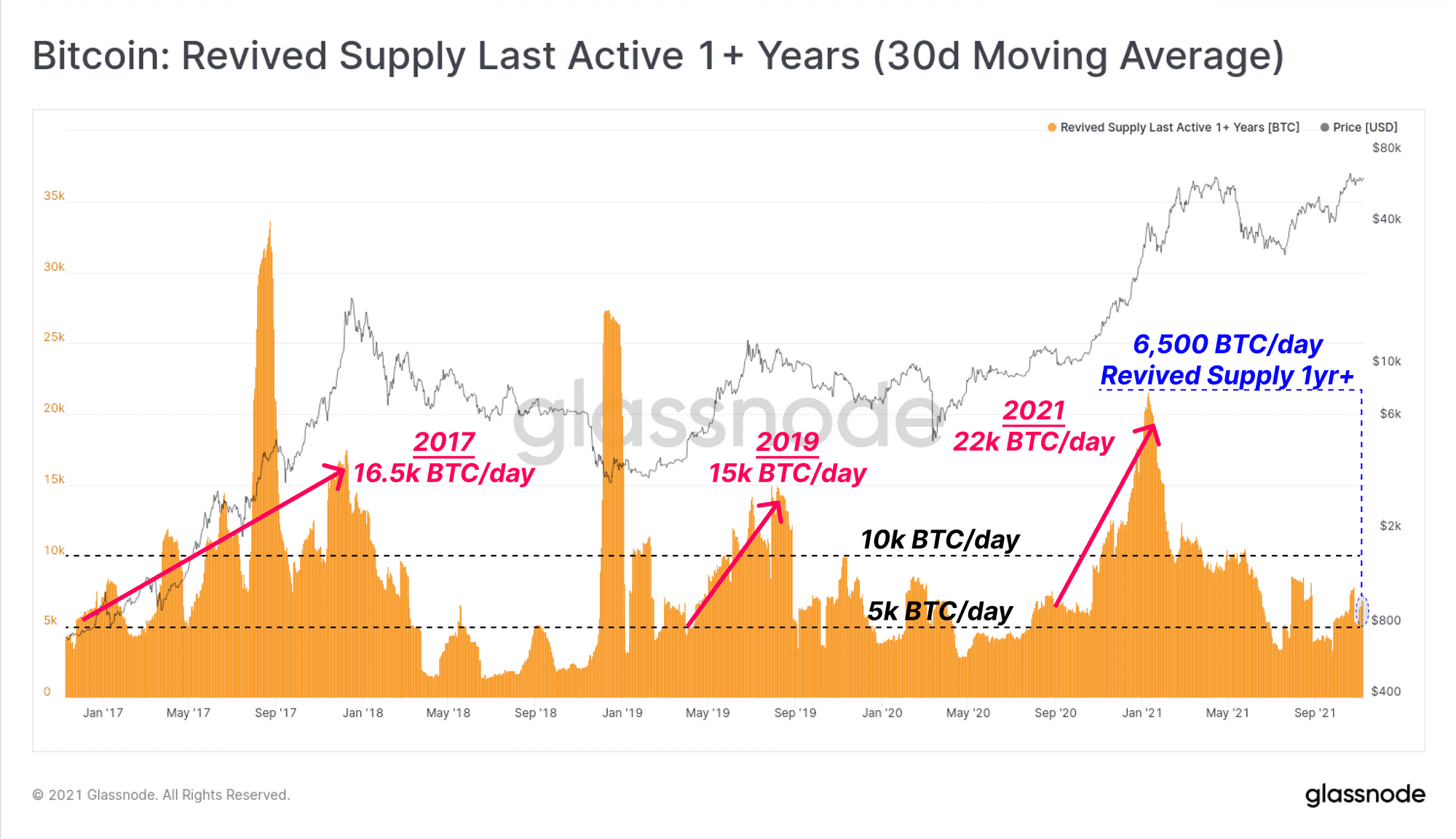

Glassnode also shines a light on a metric known as the revived supply. Revived supply refers to coins that have come back to life after sitting dormant for over one year. The analytics firm notes that a BTC investor who is able to hold their coins for more than a year have a better-than-average gauge of market risk, and what is considered expensive vs cheap coins. The condition of this metric is currently characteristic of early bull runs or late bear markets, according to Glassnode’s data.

“What we can see is that around 6.5k BTC are being revived on a daily basis at present. What is also apparent is that this is a relatively low level compared to the 2017, 2019 and 2021 bull runs where over 20k BTC were revived per day. In fact the current levels of revived supply are similar to the spending patterns throughout late 2019 to 2020 which are mostly considered a late stage bear market.”

The firm says that these supply dynamics paint a "compelling picture" that suggests long-term investors of Bitcoin are preferring to hold onto their Satoshi stack, only taking strategic profits rather than exiting the market completely.

Further supporting a high conviction rate amongst investors is the relative lack of selling over the last three months. Glassnode points out that over 85% of the coin supply has remained dormant since August 2021.

"Investors are just not spending their coins."

While the cryptospace may feel a bit lively, Glassnode says that on-chain activity is suggesting that “hype and euphoria” is drastically below the levels seen in 2017 and Q1 of 2021, and that transaction volumes are also consistent with late-stage bear markets.

Bitcoin is currently trading at $67,113, according to CoinMarketCap.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.