Raoul Pal Predicts Q1 Institutional FOMO for Crypto Markets

Former Goldman Sachs executive Raoul Pal thinks Q1 of 2022 will see financial institutions start to FOMO into crypto markets.

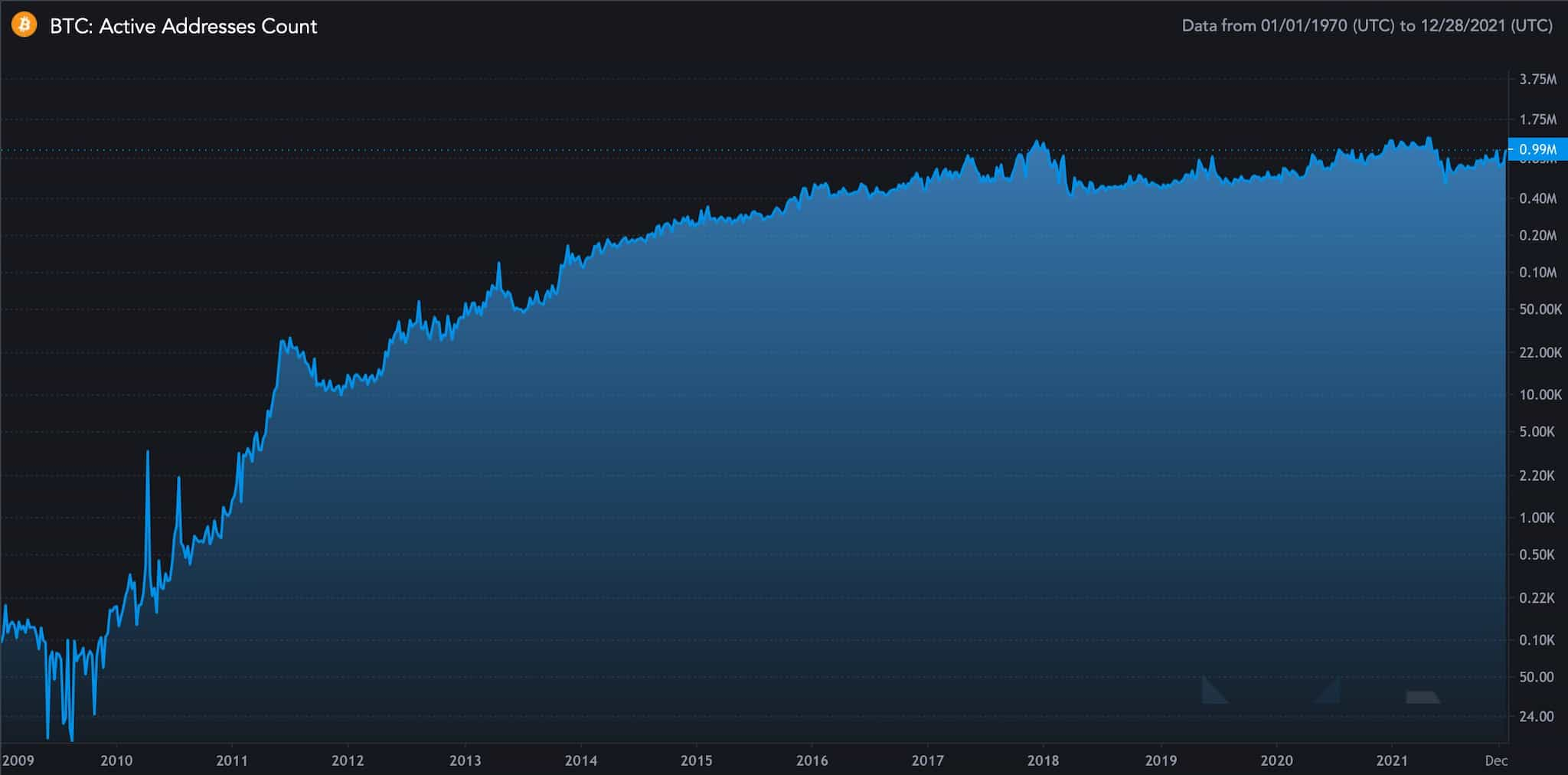

Pal, who previously had way higher hopes for Bitcoin’s performance in the latter half of 2021, thinks BTC’s lackluster price action may have something to do with retail traders having less disposable income to throw into the markets. He shares data of sluggish on-chain growth to show the stalling of crypto adoption in recent months.

“My view is that the key reason the market has seen less retail activity is that wages are rising slower than CPI. The cost of living has gone up dramatically and that has removed the marginal investor from crypto. They just can't afford the disposable income.”

Pal says he doesn’t see stable economic growth or lower inflation coming anytime soon, which may mean that retail traders could be sitting on the sidelines for a while. With smaller traders lacking influence, Pal says crypto markets will have to rely on institutions and hedge funds to “allocate meaningful capital.”

“I think that is coming, and Q1 should confirm that, indeed maybe January, but we have to wait and see…”

With that said, the Real Vision founder says that most of the investors he speaks with who are “on the fence” about investing in crypto feel that way because of regulation. It’s this reason that Pal thinks that larger investors who enter the market will likely stick to the larger crypto assets.

“That is going to be a feature for a while now too. That will keep institutions out of anything but the larger protocols. It's been easier to allocate to VC to avoid market to market and regulation fears…”

Eventually, Pal predicts institutions will start allocating, pushing up price and consequently attracting retail traders in a “reflexive loop of” of FOMO.

“But for the bigger market cap tokens to appreciate, they need new money. This is a market to HODL a broad mix of quality names on top of main core positions and don't try to chase returns unless you know what you are doing…

New capital will flow in over time and a broader rally, when it arrives, will bring retail investors and a reflexive loop of institutional investors FOMO'ing in.

That day will come. You just have to not over extend yourself, don't use leverage and sit tight. Play the long game”

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.