Rug Pull Epidemic Intensifies As ‘Squid Game’ Crypto Goes to Zero In Less Than a Second

As excitement in the crypto market accelerates, bad actors have taken advantage of it with less-than-legit altcoin projects that ultimately fleece investors for everything they're worth.

The latest high profile "rug pull," or crypto project that deliberately vanishes with all their investors' funds, was "Squid Game" (SQUID), inspired by the popular Korean Netflix series. According to its whitepaper, SQUID was supposedly meant to be a "play-to-earn" token on the Binance Smart Chain (BSC) for a game that ultimately ended up never existing.

"We present to you the first Game Token on the Binance Smart Chain Network. Squid Token is inspired by the famous Netflix Series "Squid Game", the way that the game will happen is simple and easy to follow, all you have to do is participate in the presale, the top 10 presale holders (based on amount of holdings) will be given VIP entrance to our game application. The Squid Token application will have a price pool, the price pool will be 2% of the amount raised on the presale and 10 of you will be able to participate in the games in the application and 3 of you will split the price pool. All you have to do is play and survive."

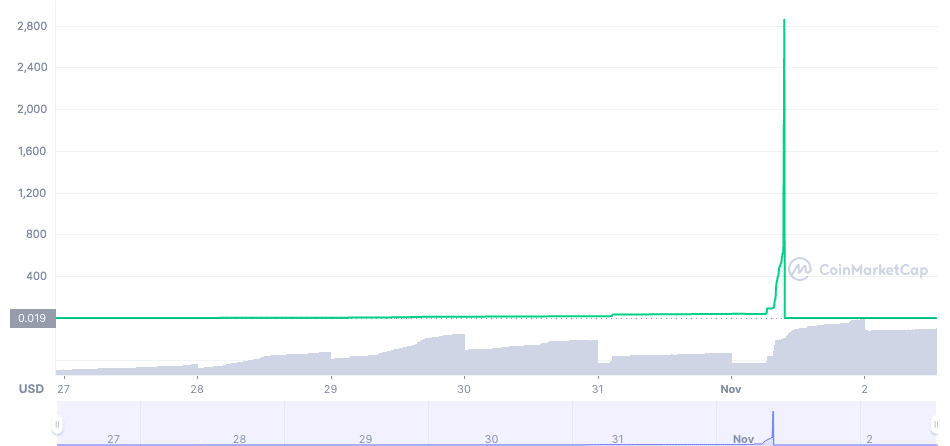

Hitting the market at $0.01 last Tuesday on decentralized exchange (DEX) PancakeSwap, SQUID rapidly skyrocketed roughly 75,000% to $2,861 in less than a week. Following some reports of investors not being able to cash out on on PancakeSwap, the price of SQUID went to zero in literally less than a second.

SQUID is still technically live, trading at around $0.003, according to CoinMarketCap where its chart says it all.

CoinMarketCap now has a banner over the coin warning investors that it was rugged, and has zero affiliation with the real Squid Game franchise.

"There is growing evidence that this project has rugged. Please do your own due diligence and exercise extreme caution. This project, while clearly inspired by the Netflix show of the same name, is NOT affiliated with the official IP."

Bobby Ong, a cofounder of CoinGecko, told Insider that "The scam has completed its cycle, and the price has just dropped significantly..." adding that the "Website and social media accounts being deleted is a very obvious sign that it is a scam."

Earlier in the week, investors were likely rugged in another crypto project called Anubis DAO, a fork of the OlympusDAO. After raising nearly $60,000 worth of Ethereum for its ANKH token, all funds were suddenly drained out of the liquidity protocol and sent to a series of unknown wallets. Etherscan has now labeled the address responsible for taking the funds as a "Heist" and involved in the "AnubisDAO liquidity rug."

Speculation surrounding the cause of the AnubisDAO incident varies from a potential phishing attack, to a member on the inside of the project going rogue. There is no explaination as of yet and some developers are reportedly cooperating with police.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.