Softfork for Siacoin? Obelisk Threaten Bitmain over Antminer A3

Yesterday, we brought you the news of the release of the Bitmain Antminer A3. This was an interesting release as the ASIC miner was designed to mine Siacoin and not Bitcoins.

This is because the new miner will be able to mine cryptocurrencies using the Blake(2b) algorithm. This is the hashing algorithm that is currently in use with the Siacoin protocol.

Of course, the timing of the release of this ASIC miner was not coincidental. Many had pointed out that this was done in order to undercut one of their competitors before they are able to deliver their batches.

This also appears to be a general pattern from the world's largest ASIC mining manufacturer. They have tried to grab the mining market for Bitcoin, Dash and Litecoin with their S9, D3 and L3+ miners.

The device will go on sale for $2,375. They are also limiting it to limited batch releases in order to prevent resellers from stocking up.

Treading on Obelisk

The mere fact that this release was not announced and that it specifically mines with the Blake(2b) hashing algorithm led many to conclude that it was an anti-competitive tactic. In this case, they were targeting the Obelisk miners.

The Obelisk miners are produced by Nebulous Labs who are the same team behind Siacoin. They had developed mining chips for the Decred cryptocurrency called the DC1 and then the Siacion miner called the SC1.

These went on sale last year in a presale which was quite successful with 3,598 of them being sold in the first batch and currently 1,585 in the second pre-order. They announced that the orders would be shipped in June of this year.

Now that Bitmain has announced that they too will be offering a miner that people can purchase for delivery "within 10 days" it is likely to throw a lot of potential Obelisk buyers off.

Obelisk Fights Back

The founder of Obelisk was not too happy with the attempt by Bitmain to squeeze them out of their market. He subsequently took to the Obelisk Subreddit to make issue his veiled threat to the team at Bitmain.

We prepared for something like this by adding an extra feature to the SC1. We can do a soft-fork that slightly changes the PoW algorithm which would invalidate the Bitmain ASICs, but allow the SC1 units to continue working. In the event of an attack from Bitmain, we can activate this soft fork

Of course, this is not something that the developers can implement themselves. This would have to be a User Activated Soft Fork (UASF) that is agreed by most of the community.

The developers also said that this would be a "last resort" if Bitmain continued their anti-competitive behaviour, the user community could react implement the hard fork.

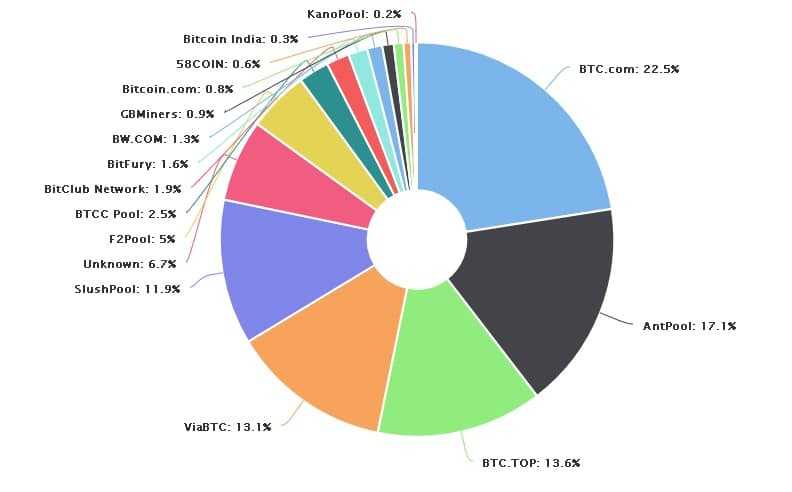

Indeed, many in the user community have unfavourable views of Bitmain given their stance last year to the Bitcoin SegWit2X hardfork. Bitmain's BTC.com and Antpool mining pools control a massive 39% of global hashrate (image below).

Apart from this monopoly that they have in the mining pools and hashrates, they also produce at least 70% of the global ASIC chips used to mine cryptocurrency. Many are hoping that the Chinese ban on mining could adjust remove their control in the industry.

Not All Agree

While many may think that a soft fork could be a good idea to remove Bitmain from the picture, there are unintended consequences to these actions. In a post on Medium, Oliver Reid makes the case against a fork.

Firstly, blockchain technology is supposed to be open source and by this definition, the decisions that are made cannot come from a centralised authority. By siding with Obelisk and implementing a fork, the users are giving Obelisk control of the network.

Moreover, there is the possibility that by allowing Obelisk to fork the codebase based on this, they could be creating a precedent for future changes. Obelisk may take the opportunity at some other point if they disagree with another party.

Lastly, people should not forget about the poor people who have now already placed orders for the Antminer S3. If the code is soft forked and the Antminers cannot be used then those buyers will be left with the bag. Bitmain would have already sold them and made a considerable profit.

Time Will Tell

It is clear that in a capitalist society, what Bitmain did was not illegal and is mostly encouraged. They are after profit maximisation and an opportunity presented itself to do just that.

Whether they did the calculations on the likely response from an open source community, no one can really tell. Users should, however, not have a knee jerk reaction and implement network changes just because they dislike certain tactics.

The Sia community should have an open debate and discuss the benefits in the long term of any network change. If a soft fork meets those ends then this is something the community should decide and not the developers.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.