0x Review: The Protocol Powering Decentralised Exchange

0x is a trusted exchange infrastructure for the DeFi ecosystem. Developers can use 0x to add flexible, multi-chain exchange functionality into their applications and create new markets for all tokenized assets, including cryptocurrencies, DeFi tokens, and NFTs. 0x Connects developers to Web3 markets, empowering them to build financial products on crypto rails, enabling a more seamless trading UX for their apps.

0x is the foremost decentralised exchange protocol currently on the market. They are also one of the first having launched back in 2017.

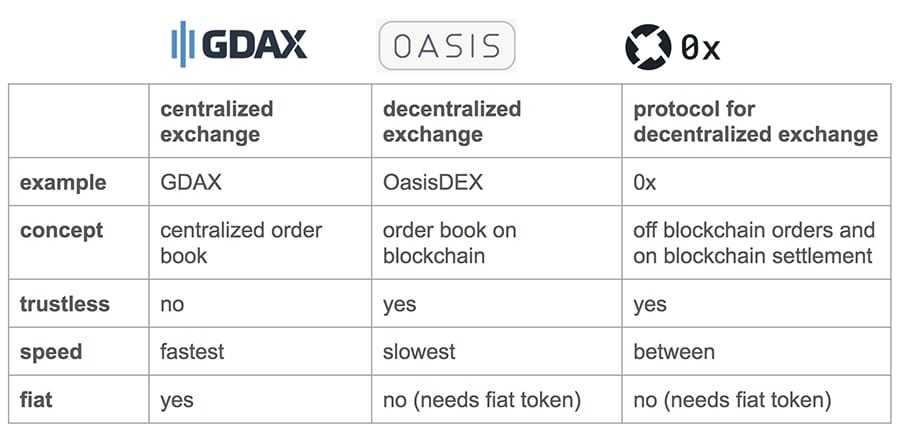

Many in the cryptocurrency space are convinced that the era of centralised cryptocurrency exchange has to come to an end. This has led to a flood of decentralised exchange protocols that have launched over the past 3 years.

So, with so much competition, is 0x still worth it?

In this 0x review, I will give you everything that you need to know. I will also analyse the long term use cases and price potential of the ZRX tokens.

What is 0x?

The 0x protocol website is pretty clear on the overarching goal of the project as it immediately states:

Powering Decentralized Exchange, 0x is an open protocol that enables the peer-to-peer exchange of assets on the Ethereum blockchain.

Back in 2016 the founders of 0x, Will Warren and Amir Bandeali, had a strong belief that blockchain technology was going to be a disruptive force. They saw a future where any asset at all would be tokenized and traded publically on blockchains.

With the versatility and scope that Ethereum brings to the table, they decided that the Ethereum blockchain would be the perfect medium for hosting this type of asset exchange and they set to work on creating the 0x protocol.

Basics of 0x

The decentralized trading offered by 0x is based on an off-chain relay that acts to keep network bloat minimized, and gas prices as low as possible.

For those familiar with the increase in gas prices and bloating that can occur on the Ethereum blockchain (think Crypto Kitties or Ether Delta), you can probably imagine the benefits realized by using an off-chain relay.

For those less familiar with the workings of Ethereum, here’s an explanation of why off-chain is the way to go for decentralized exchanges.

Most decentralized exchanges use Ethereum’s smart contracts to power all of the order functions and trades on the exchange. Using smart contracts in this way keeps user funds within their control, rather than needing to send funds to a third-party (such as Coinbase or Bittrex) and hope that the funds remain safe.

Using smart contracts also means a transaction needs to be executed on the blockchain for everything done on the exchange. That includes deposits and withdrawals, as well as placing, modifying, canceling, or filling an order. And every single transaction costs gas to ensure the transaction is processed.

When you consider how many trades a day trader might make, the number of orders being placed, modified and filled would mean gas fees could add up quite quickly. That’s a good part of the downside with decentralized exchanges. They are far ahead of centralized exchanges when it comes to security, but fall behind the centralized exchanges when you consider costs and accessibility.

The 0x protocol addressed these shortcomings of the decentralized exchange by using an off-chain relay together with on-chain settlement. In this scenario, any user is able to broadcast their order off-chain.

These orders can be picked up and filled by another user, and the only part of the entire transaction that occurs on-chain is the actual value transfer. This reduces the number of transactions being run on-chain, thus reducing the potential for bloat, and keeping gas fees from trading actions as low as possible.

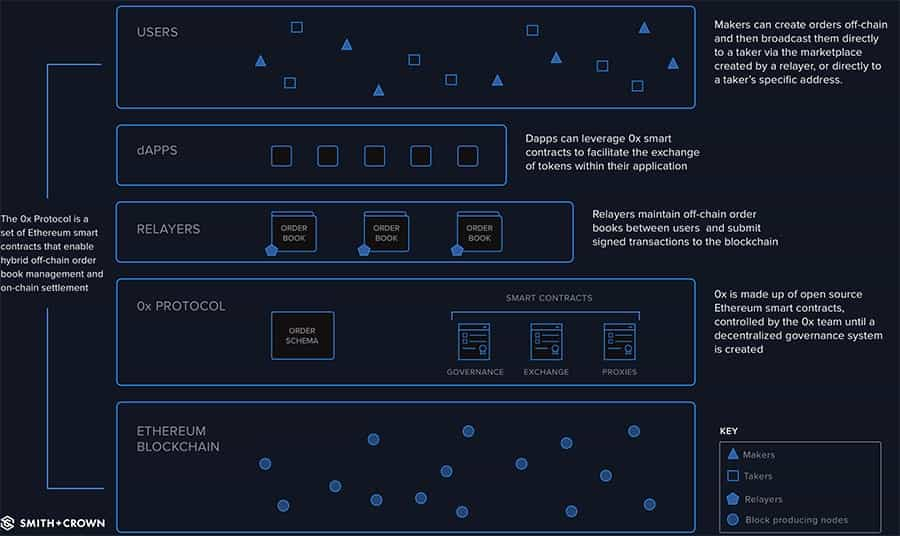

The 0x Relayer

The key to off-chain transactions for 0x is the use of what they call “relayers.” These relayers broadcast the orders placed across the public or private order books, as well as bringing liquidity to the network by hosting the order books.

While this function is similar to an exchange, the relayer differs from an exchange because it is unable to provide trade execution. It’s more like a bulletin board that presents maker orders to the network.

In order to fill an order, a taker must submit their own signature along with the makers to the exchange’s smart contract. Relayers are compensated for providing this service with the 0x currency ZRX.

When a trade is sent through a relayer they are called “Broadcast Orders.” This allows anyone to submit orders to the network easily, and it also allows anyone to see the orders as they are broadcast and then fill them.

The 0x solution can also accommodate point-to-point orders in which the maker specifies a taker when the order is broadcast. With this type of order, users can directly transfer funds using a variety of communication channels, including email and various messaging programs.

When an order is specified as point-to-point in this manner only the specified taker can fill the order, thus protecting the transaction from hijacking by malicious actors.

Additional 0x Features

Besides being a basic decentralized exchange, the 0x project has included several other features and products. These include a governance mechanism, open-source smart contracts, and a token registry.

0x Governance

In addition to being used as compensation for relayers, the ZRX token is also used to facilitate the decentralized governance of the 0x platform. Stakeholders of the ZRX token can vote on proposals that will affect the blockchain, thus affecting the future development of the 0x protocol.

0x Update Structure

One huge benefit to 0x is that the smart contracts are open source, and the protocol itself is application agnostic.

This means any developer can build on 0x to create an exchange function, which allows the protocol to serve as a plug-in for other Ethereum dApps. There are already a number of projects being built on 0x because of this, including Publish0x, Augur, Gnosis, district0x, and more.

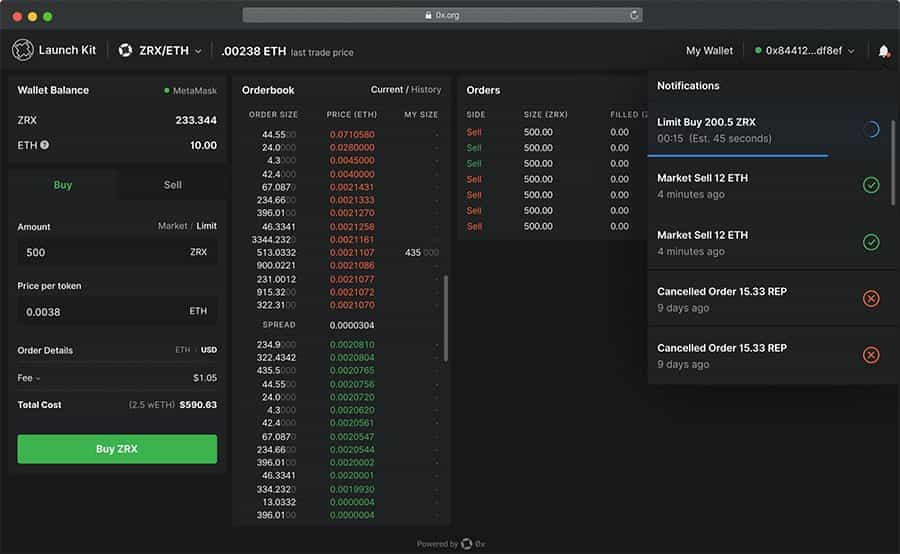

0x itself has improved on this even further by releasing the 0x Launch Kit, which enables anyone to launch their own exchange or marketplace in minutes. The Launch Kit removes the complexities of building a relayer. The codebase allows any user to connect to wallets, wrap ETH, make and take orders, and get notified of order state changes.

0x Token Registry

Not least of all 0x includes a token registry contract which stores a list of ERC-20 tokens and the associated metadata for each, such as the token name, symbol, contract address and other details. This is the official on-chain reference that can be utilized to verify address and exchange rates.

It has also been used to create the 0x Asset Swapper and the related 0x Instant. With the Asset Swapper, any digital asset can be programmatically exchanged. This was the base for 0x Instant, which allows anyone to offer simple crypto purchasing as a widget on any website.

0x Social Proof

You would think a project that began in 2016 would have a fairly large following on most social media sites, especially the big three for cryptocurrencies – Twitter, Telegram, and Reddit.

You’d be mostly right too, except for one change. The 0x team uses Discord, not Telegram. On Twitter, they have a massive 151,000 followers. That’s huge even for cryptocurrency projects. They’re also active on that Twitter account, not only posting their own stuff but also re-tweeting interesting bits from others.

On Reddit, the 0x sub-Reddit has over 15,000 followers, which is a pretty large following too. Things are a bit quieter over here though. Sometimes a few days will go by without any new posts, and most posts only have a few comments and replies. Good, but not great.

I would also say the Discord server is just good, not great. Actually, with just over 2,500 members I was surprised because I would have expected a larger following. However, there was quite a bit of interesting discussion going on with a range of different topics.

The 0x team is also on Facebook, with just over 2,000 followers. The account has regular posts, but they are several days apart, and there isn’t a whole lot of interaction.

Finally there is a forum created specifically for the 0x protocol. That has activity similar to Reddit. Posts are spread several days apart, and there are usually just a handful of replies to posts. The good news is it looks as if the more recent posts are gaining the most traction, meaning adoption of the forum may be growing.

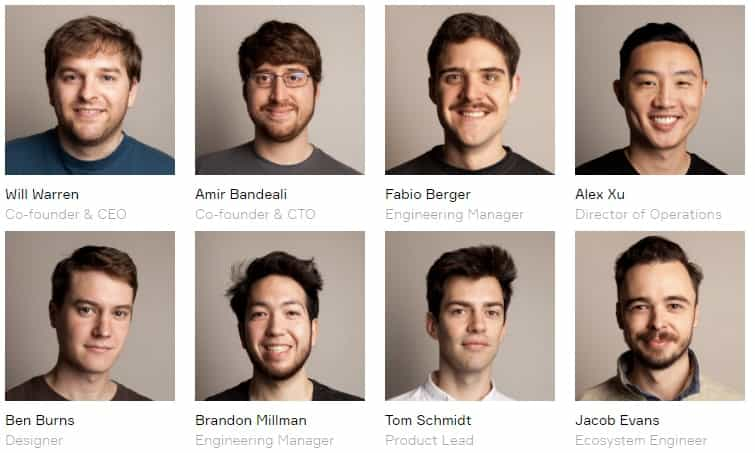

The 0x Team

The 0x team is led by co-founders Will Warren and Amir Bandeali, who serve as CEO and CTO respectively. The team has grown to 38 core members located in San Francisco, but there are dozens more assisting with the project globally.

One notable aspect of the 0x team is the advisors of the project. Fred Ehrsam (Coinbase co-founder), Joey Krug (Pantera Capital Co-CIO), and Linda Xie (Co-founder Scalar Capital) all advise the project.

CEO Will Warren has a Bachelor’s degree in Mechanical Engineering from the University of California – San Diego. He went on to pursue a Ph.D. in Structural Engineering from the same university, but never completed the degree, moving on to the founding of 0x instead.

CTO Amir Bandeali graduated with a Bachelor’s degree in Finance from the University of Illinois at Urbana-Champaign. He went on to work as a trader for four years prior to joining the 0x team in 2016.

The ZRX Token

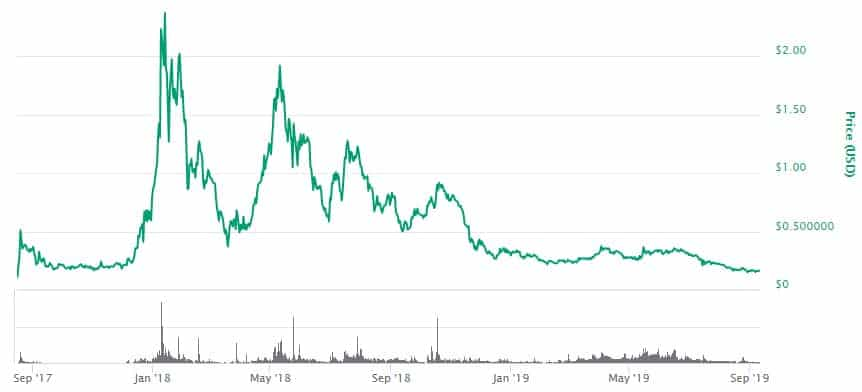

The 0x team held an ICO in August 2017, selling 500 million ZRX tokens for $0.07 each and raising $24 million in just 24 hours and 10 minutes.

The ICO was somewhat unique in that there was no marketing performed, and once the sale began registered buyers were only permitted a total of 6.77 ETH ($1,893) worth of ZRX tokens. That cap was put in place to encourage wider distribution of the ZRX tokens, and following the sale the team determined that ZRX tokens were spread across more than 13,000 Ethereum addresses.

ZRX has had a number of spikes and drops during its trading history, but it is notable that the all-time low for the token was $0.103962 on August 16, 2017. That’s notable because it is almost 50% above the ICO price and it occurred the day the ICO ended.

Unlike most altcoins that fell throughout most of 2018, ZRX saw three more significant peaks throughout the year. The first was in late April and May when the price briefly moved above $2 again. It fell quickly from that height, trading below $0.70 by June, but then jumping back above $1 in conjunction with the 0x v2 testnet launch.

It dipped back below $1 but remained in the $0.70 to $0.90 range over the next few months as enthusiasm over the mainnet launch of 0x in September kept price elevated. Surprisingly the price began falling in October after Coinbase announced it was listing ZRX.

Since then the price has been steadily retreating and as of September 9, 2019, the price of ZRX is down to $0.160732.

As we’ve seen from the historical movements in ZRX the token seems to get a healthy boost when the team meets major milestones. With that in mind, it could be good to keep an eye on the project’s roadmap to determine when the next major announcement might occur.

Buying & Storing ZRX

If you’re interested in buying ZRX you’ll be pleased to know that it is available from a huge number of exchanges. The greatest volume is at MXC, followed by HitBTC and BitMax. It’s also available from Coinbase Pro, Binance, OkEx, Bittrex, Poloniex and many others.

The volume is well spread out across these exchanges which means that ZRX is not dependent on a singular market. There is also strong liquidity on the individual order books. For example, on Binance the ZRX / BTC books are deep and there is high turnover.

Once you have your ZRX in hand (so to speak) storing it is easy. It’s an ERC-20 token, so it can be stored in any wallet with ERC-20 support. That includes MyEtherWallet and MetaMask, as well as the hardware wallets Trezor and Ledger. There are also a number of software wallets that can be used such as the Exodus desktop wallet.

Development

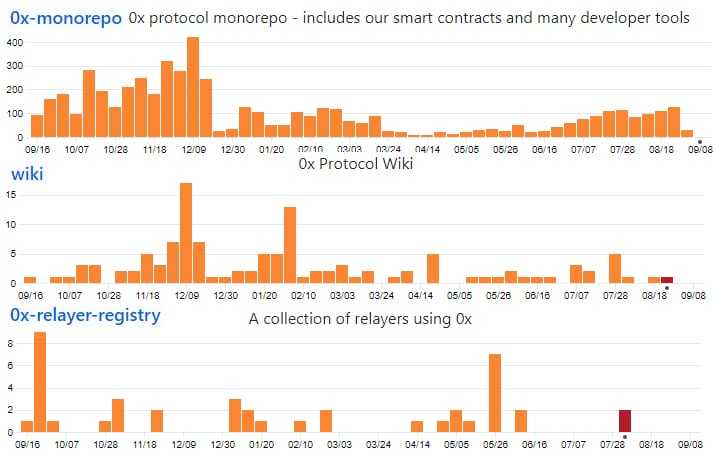

Often there can be a mismatch between the amount of development that a project claims that they are doing vs. the amount that is actually been done.

Therefore, I often like to dive right into their public code repositories and check out the amount of coding activity. Below are the top three most active repos in the 0x GitHub.

As you can see the developers are really active and have been pushing regular commits over the past year. These are also only three of the repos when there are a further 71 others with varying degrees of code commits.

This ranks 0x pretty highly when it comes to raw developer output. In fact, if we were to take a look at it compared to some of the other blockchain projects it is ranked at 13 in terms of code commits and 14 with overall activity.

Indeed this level of coding activity could make sense when viewed in the context of the broader roadmap. For example, in September of last year they released v2.0 of their protocol which required extensive testing and iterations.

0x Roadmap

Looking ahead, there are some really exciting projects and features that the 0x developers are working on. These include larger protocol upgrades as well as numerous 0x Improvement Proposals (ZEIPs).

There are a number of these so I won't go into them here but some of the most exciting include the 0x Mesh & networked liquidity. This is a a peer-to-peer network for sharing orders which will serve as an alternative to the Standard Relayer API

There is also some really exciting research that is taking place on coordinators. These are essentially a service that will enforce certain rules over the execution of trades. They combine the best features of Order matching and the Open Orderbook.

There is also the many strides that are being made on the launch of v 3.0 of the 0x protocol. This has currently been deployed on the Kovan testnet. One of the most interesting features of v3.0 will be the inaugural launch of 0x staking.

The 0x team keeps their community fully updated about their development in their official blog as well as their broader documentation.

Conclusion

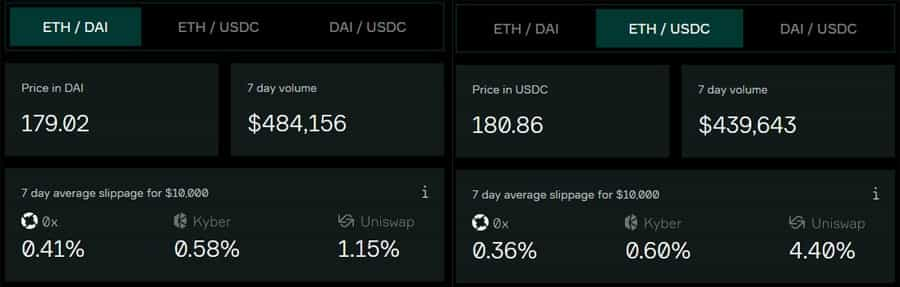

0x is attempting to bring the strengths of both decentralized and centralized exchanges to the crypto space while leaving the weaknesses behind. Decentralization provides security of funds, while the use of off-chain relayers gives users the same low-cost trading they’ve come to expect from centralized exchanges.

By keeping settlements on-chain users receive all the benefits of a decentralized exchange, with transactions cleared just once to keep fees at a minimum. Adding smart contracts to manage the entire process keeps everything as secure as possible.

When you consider the huge amounts that have been involved in so many different centralized exchange hacks, it’s clear that a good decentralized solution is necessary.

0x could be that solution, but we wonder if their first-mover advantage will be enough to keep them in the lead as Binance prepares to launch their own decentralized exchange, and other leading centralized exchanges explore the possibility of decentralization as well.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.