Accointing Review 2024: Crypto Tax Simplified!

Accointing crypto tax software offers comprehensive portfolio management and accurate tax reporting, simplifying the process of calculating crypto gains, losses, and ensuring tax compliance. With its user-friendly interface and robust features, Accointing provides a reliable solution for cryptocurrency investors to efficiently handle their tax obligations and optimize their tax strategies.

Navigating crypto tax can be a nightmare, especially if you don't tackle your taxes for a few years. Trying to determine what is and isn't taxable is the biggest headache on the planet if you try to do it manually. This is exactly where crypto tax tools come into play and why we are happy to be bringing you this Accointing review today.

Suppose you have accounts with half a dozen crypto exchanges, have bought and sold NFTs on various platforms, and have been involved in DeFi transactions. Where do you start? One transaction on a DeFi platform can show up as dozens of transactions. Imagine wading through that lot.

Crypto tax software to the rescue!

The beauty of crypto tax software is that it connects to all your wallets and exchanges and populates the transactions, which it classifies into taxable and non-taxable transactions.

Accointing Crypto Tax Software: Image Source: Shutterstock

Accointing Crypto Tax Software: Image Source: Shutterstock

Accointing Review: Summary

Accointing is a popular crypto tax report generation software and award-winning crypto portfolio tracking software, founded in 2018 and based in Baar, Switzerland

The Accointing software helps businesses and individuals populate crypto transactions and file their crypto taxes. Users can also track their crypto portfolios, and Accointing has a mobile application.

In October 2022, Glassnode acquired Accointing for an undisclosed sum.

The Key Features of Accointing Are:

- Crypto Tax Collector: Helps you to file your taxes legally for crypto transactions

- Crypto Tracker: Track your crypto portfolio in real-time

- Mobile App: Available on iOS and Android

Accointing Pros and Cons:

Pros of Accointing:

- Accointing supports DeFi and NFT transactions: These transactions can be complex and challenging to track manually

- Customer support is included in all levels of pricing: For the Day Trader and Whale package, Accointing provides premium support

- Easy-to-use, beginner-friendly interface: Ease of use makes Accointing stand out from the competition as one of the best for novice users

- 400 exchange integrations: Accointing crypto tax software certainly covers the leading cryptocurrency exchanges and beyond, such as Binance, the largest crypto exchange globally by volume

- Can track 20,000 cryptocurrencies: That's almost the entire crypto market, though check if you have transactions with a relatively new coin

- Can support up to 50,000 transactions: Only relevant to high frequency traders in the crypto industry, but it's a lot

- 30-day money-back guarantee: If you genuinely loath Accointing crypto tax software, the company will return the annual fee, no questions asked

Cons of Accointing:

There are very few cons to using crypto tax software like Accointing, but the following are a few to consider:

- Missing data sources: It's super important to ensure you correctly link all your exchanges and wallets. Otherwise, your numbers will be inaccurate. Occasionally, crypto tax software may incorrectly label non-taxable vs taxable transactions, which can be tricky to address.

- Potential unsupported chains: With the exponential speed of blockchain development, some chains might not be supported by the crypto tax software. You can solve this problem by manually completing transaction details and uploading them with a CSV file.

- Missing calculations from previous years: Suppose you have traded or invested in crypto for multiple years and only just realised you must file a tax return. This situation is challenging because you need records of every transaction since you began. Yes, leaving your tax filing too long can be a giant headache.

- Unrequested Airdrops to your wallet: Not all airdrops are legit, and there are plenty of spam coins. The issue with crypto tax software is that it cannot tell if an airdrop is legitimate. Hopefully, you don't have thousands of airdrops to wade through, but be aware of this possibility.

- Shifting legal grey areas: The multiple potential crypto transactions can present murky legal areas about what constitutes as taxable. Don't wing it. If in any doubt, consult with the crypto software support team or contact an expert in crypto taxes. Accointing helps you classify transactions, but be on the lookout, just in case.

- DeFI & NFTs: Imagine one DeFi transaction appearing as hundreds. Accointing supports DeFi and NFT transactions, but not all crypto tax software covers this complex area.

| Company Headquarters | Switzerland |

| Year established | 2018 |

| Beginner-friendly | YES |

| Cryptocurrencies tracked | 20,000 |

| NFT support | YES |

| Exchanges: API Supported (API, Public Wallet Address, OAuth) | 400+ Exchange integrations |

| Countries supported | Austria, Australia, Germany, Netherlands, Switzerland, United Kingdom, United States |

| Countries supported for generic tax report | Argentina, Albania, Belgium, Brazil, Bulgaria, Canada, Colombia, Croatia, Czech Republic, Denmark, Finland, France, Greece, Guatemala, Hungary, India, Indonesia, Ireland, Israel, Italy, Japan, Luxembourg, Malaysia, Mexico, New Zealand, Nigeria, Norway, Pakistan, Philippines, Poland, Romania, Saudi Arabia, Slovakia, Slovenia, South Africa, Spain, Sweden, Thailand, Turkey, Ukraine, UAE |

| Used by: | Crypto investors, retail traders, professional accountants, and businesses. |

The Problem With Crypto Taxes

Paying crypto taxes is complex and confusing. The average crypto enthusiast is unsure how to go about it, and every country classifies cryptocurrencies differently.

For example, as crypto is a digital currency, does your country class it as intangible property? Crypto profits can be classed as capital gains in some countries, while some transactions are taxable as income or interest and are subject to the appropriate tax filing requirements.

The first thing to do is check the crypto jurisdiction in your country because once you understand the tax legalities, you can start working on a plan to manage your crypto taxes.

Crypto Tax Software

We've all hoped that cryptocurrencies would present a way out of the financial system. We hoped that decentralisation would rid us forever of much-hated taxes. Sadly, we cannot escape that the enormous income opportunities available with crypto also raise other unexpected problems.

For example, depending on your location, consider all the potential income-generating and taxable examples in crypto:

- Exchanging crypto for fiat currencies

- Selling NFTS (non-fungible tokens)

- Income earning from "play-to-earn" blockchain games

- In-game item sales

- Yield farming

- Income from staking

- Receiving airdrops

- Selling or renting out land or real estate in the Metaverse

- Commission or interest earned on lending platforms such as Aave or Compound Finance

- Exchanging digital assets on a centralised crypto exchange or DEX

Trying to figure out how to manage crypto taxes is a minefield, and it can be easy to miss out on essential tax information. We all need help navigating the complexities of crypto tax, and that's where crypto tax software like Accointing becomes an invaluable asset.

Don't risk trying to calculate your crypto taxes alone on a spreadsheet. It will fry your brain, and you could miss crucial details. The worst-case scenario is heavy fines or (gulp), even a spell in jail. It's not worth the risk. Thank goodness there are alternatives like crypto tax software like Accointing.

👉 Make crypto tax painless with our 40% Accointing discount!

How Does Crypto Tax Software Work?

Crypto tax software helps users classify crypto transactions. It simplifies everything, collects, calculates and populates data to produce accurate information for tax filing according to the tax laws of your location in the world.

Crypto tax software like Accointing is excellent for helping businesses and individuals report crypto transactions and activities at all levels. It involves a simple process of securely connecting to your wallet, exchange or DeFi platform, usually via API keys or by exporting the data into a CSV file and uploaded into the tax software.

After the data populates in the crypto tax software, you can file your crypto taxes.

Track Your Portfolio With Accointing Award-winning Crypto Tracking. Image Source: Shutterstock

Track Your Portfolio With Accointing Award-winning Crypto Tracking. Image Source: Shutterstock

How Accointing Solves the Crypto Tax Problem

Why spend hours, days, weeks or months trying to piece together your crypto tax reporting when you can eliminate the complexities and save time with Accointing?

Like preparing traditional business taxes, there are income and expenditure to calculate. The finer details may include things you haven't considered, like gas fees, transfer fees and protocol fees for decentralised exchanges (DEX). After all, it's not like any crypto company sends you detailed monthly statements.

Anything constituted as a reward or income is subject to taxes. Suppose you're having a heap of fun making a bit of income from play-to-earn games and selling a few in-game items to your gaming buddies. In the excitement of the game, the last thing on your mind is taxes. Still, how fantastic that you now know how to manage every bit of income by utilising crypto tax software like Accointing.

Accointing solves the crypto tax problem, not by eliminating tax (in our dreams) but by helping you to manage your crypto earnings easily.

Best Crypto Tax Software

The best crypto tax software enables you to track your crypto portfolio accurately and effortlessly file your taxes. Job done.

There are many tax professionals who trust Accointing as it is 100% compliant with HMRC, the IRS, and many other tax authorities in supported jurisdictions. You don't need a credit card to access the crypto tax and portfolio tracking user-friendly platform.

You can generate a free tax report for up to 25 transactions, and the Accointing app is available on the Google Play store and Apple Store.

What is Accointing and How Does it Help with Crypto Tax Solutions?

Accointing is easy-to-use crypto tax software that helps you quickly manage your crypto taxes. In addition, Accointing also provides a valuable portfolio tracking service.

If you don't want to spend weeks trawling through multiple crypto transactions and checking every crypto debit card transaction for taxable items, save yourself the mind-boggling nightmare and sign up for a crypto tax tool like Accointing.

Alternatively, you could move to a crypto-tax-friendly country, but that seems an extreme option. However, if you consider it better than tackling your taxes, contact the team at Offshore Citizen, who can help with permits, residency, bank accounts and more.

Accointing Key Features & Benefits

Crypto Tax Calculator

Accointing applies "generally accepted crypto tax principles" to tax reporting, whether you work with a tax expert or file your crypto taxes without professional help. Accointing is the most comprehensive and accurate crypto and Bitcoin tax calculator on the market.

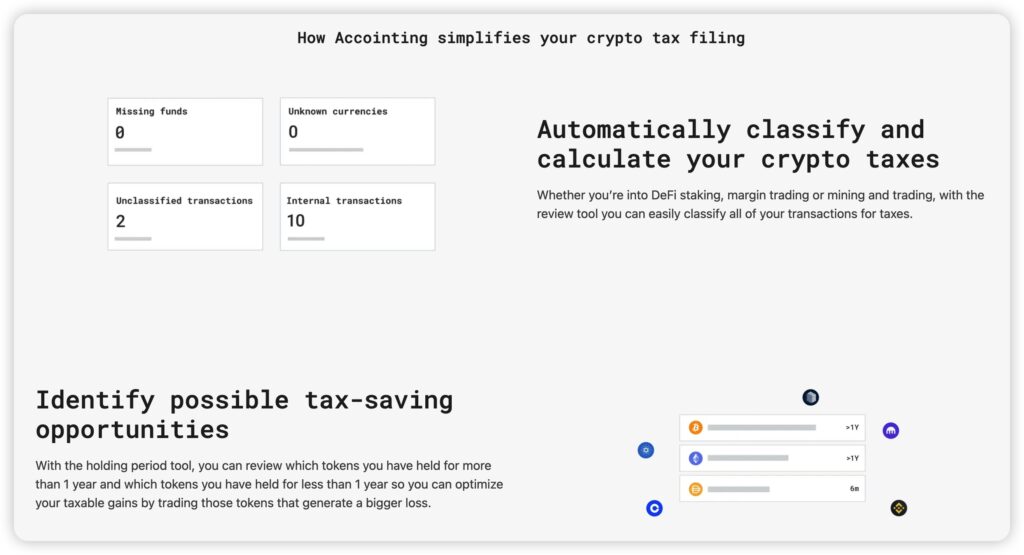

Automatically Calculate And Classify Your Crypto Taxes

Accointing makes classifying and calculating your crypto transactions easy, whether you're mining, margin trading or DeFi staking.

Identify Possible Tax-Saving Opportunities

With Accointing's holding period tool, you can review the tokens held for over or less than a year. That enables you to optimise taxable gains by trading the tokens that generated more loss.

Easily File Your Crypto Taxes

Five quick clicks and your tax reports are available in various formats, such as:

- FIFO

- LIFO

- HIFO

Crypto Tracker

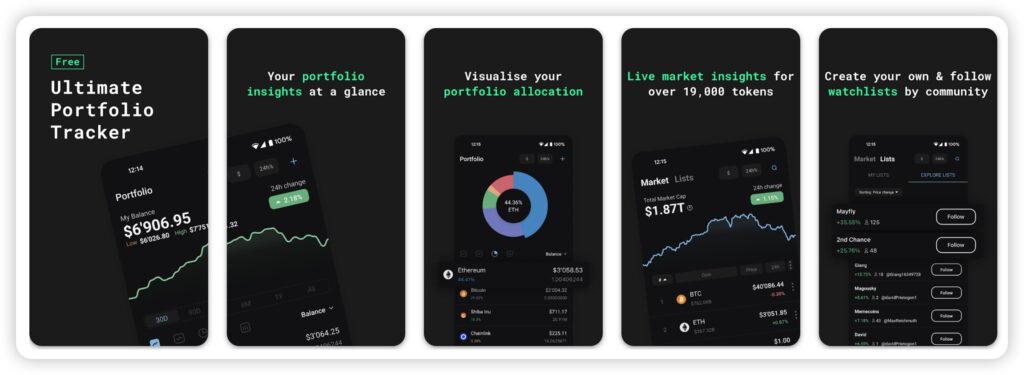

Crypto tracker is a portfolio tracking & insights tool you can access on desktop, Android or iOS.

The Accointing app crypto tracker gives you absolute control of your crypto data. It has access to 300 wallets and exchanges, and you can quickly connect to the Crypto Tracker dashboard from your laptop or phone. Other benefits include the following:

An Overview of Your Entire Crypto Portfolio

The user-friendly dashboard gives you an overview of your entire crypto portfolio, providing a summary of transactions like:

- Buy and sell dates

- Net profit

- Overall gains

Crypto Portfolio Gains Performance

See your entire crypto portfolio, gains and losses, at a glance. In real-time, you can track the total value of your crypto portfolio and monitor the most popular crypto tokens in the Accointing community.

Mobile App

The Accointing mobile app can track your crypto portfolio and "react to the market in real-time." The app also enables you to:

Track Real-Time Cryptocurrency Prices

Never miss an opportunity. The Accointing app enables you to create alerts and smart watchlists and follow popular watchlists.

Review Key Market Trends At A Glance

Get the most out of market trends by accessing a daily snapshot of the crypto market as a whole. See what coins are booming and which are bombing. The Accointing app tracks over 20,000 coins, including popular top-listed coins such as:

- Avalanche (AVAX)

- Bitcoin (BTC)

- Cardano (ADA)

- Dogecoin (DOGE)

- Ethereum (ETH)

- Litecoin (LTC)

- Ripple (XRP)

- Solana (SOL)

Review Your Transactions And Trades

Monitor every trade and transaction on the mobile app. Check your profit and loss, the net profit, average buy price and more, all in real-time and synced with your wallets and exchanges. Accointing makes it easy to file an accurate tax report when it's time.

Avoid Costly Mistakes of Calculating Crypto Tax Manually. Image Source: Shutterstock

Avoid Costly Mistakes of Calculating Crypto Tax Manually. Image Source: Shutterstock

Accointing Crypto Exchange Integrations

Accointing has over 400 Exchange integrations, including the following:

Binance, Bitfinex, Bittrex, Bitpanda, Bitpanda Pro, BitStamp, Bitvavo, Bybit, Celsius Network, Coinbase, Coinbase Pro, CoinJar App, CoinJar Exchange, CoinSpot, Deribit, Deversifi, Digital Surge, Etoro, Gate.io, Gemini, Kraken, KuCoin, OKX, Poloniex, Uphold.

Why Customers Love Accointing for Crypto Tax Reporting:

- Outstanding Customer Service: Accointing is proud of its rapid response times and happy customers.

- Best-In-Class Accuracy: Tax reports are tested continually for accuracy.

- Rare Currencies: You can edit all transaction details to ensure your tax report is accurate.

- Up-to-Date Tax Guidelines: Accointing has a team of CPAs to ensure tax codes are updated.

- Detailed Explanatory Guides: Access Accointing Crypto tax guides

- Award Winning: Accointing won Global Fintech Awards 2022 and SourceForge Top Performer Summer 2022 award. Both awards were for the best portfolio tracker.

How to Use Accointing

You can use Accointing with a desktop or download the mobile app with iOS or Android.

After that, you can file your crypto taxes and monitor your crypto portfolio in real-time.

How to Set up Accointing

Register for an account with Accointing. You have 25 free transactions before you require an annual membership.

Step 1: Import your data/wallets to Accointing

Step 2: Thoroughly check that you select the correct tax method and country

Step 4: Follow the 4-step review process to ensure that the data is 100% accurate

Step 4: Eureka! Generate your tax report

Who is the Best Fit for Accointing?

Whether you are a novice crypto-enthusiast, a budding Hodler, a crypto investor, a day trader, a tax professional, or a crypto whale, Accointing has you covered. The software is suitable for businesses and individuals.

The Pros & Cons of Using Accointing vs Other Crypto Tax Software

Many crypto tax software firms are on the market, such as Koinly, a respectable crypto tax software provider that does a similar job to Accointing. Both are established and recognised as go-to options for crypto tax filing.

Accointing vs Koinly

Accointing was established in 2018 and already has two awards under its belt for best crypto portfolio design. It is comparable for services, integrations etc., with Koinly, CoinLedger and other crypto tax software providers. Koinly has a specific section for accountants, which Accointing does not.

Koinly's pricing is similar to Accointing. The primary difference is that Koinly offers a free version of up to 10,000 transactions, a newbie (100 transactions), Hodler (1,000 transactions and Trader (10,000+ transactions). So, Accointing's number of transactions is more generous at the Whale level (see below Accointing fees).

Accointing Fees

Accointing has a range of packages to suit every level, whether you're an experienced crypto trader or getting started with crypto investing. You can file up to twenty-five free transactions before paying for membership.

All membership levels come with a 30-day money-back guarantee if you are unsatisfied with the crypto tax software.

- Hodler: File up to 100 transactions

- Investor: File up to 1,000 transactions

- Day Trader: File up to 10,000 transactions and receive premium support

- Whale: File up to 50,000 transactions and receive premium support

Prices range from £49 a year to £499 a year (2023)

Accointing Review: Conclusion

Accointing crypto tax report generation software can save you time and money. The risks of doing it yourself are tenfold because if you make a mistake, the tax office is not known for being lenient.

There's no point trying to tie yourself in knots, searching for every crypto transaction across multiple exchanges and wallets and figuring out what is taxable and non-taxable. Why bother when it is so much easier to use crypto tax software like Accointing?

Accointing is low cost, has a good reputation and won awards for its crypto tracker design. You can download the app to your Android or Apple device or, if you prefer, use a desktop application.

If you haven't tried Accointing yet, remember you can get started for free. When you become a member, you have a 30-day money-back guarantee if you are unhappy with the Accointing crypto tax software.

👉 Make crypto tax painless with our 40% Accointing discount!

Frequently Asked Questions

You can generate 25 tax transactions for free.

Accointing is an excellent tool for calculating tax imports and generating tax reports for DeFi exchanges.

Every country has different tax implications, so there isn't one rule you can apply for calculating crypto taxes. It is easy to make mistakes due to the complexities involved, and tax authorities aren't known for their generous and forgiving natures. Before you know it, they've slapped you with a fine or worse.

Accointing and Koinly are two that I recommend for cryptocurrency tax, as they are the most user-friendly and comprehensive crypto tax solutions. However, the concept of what is best is a personal choice.

Accurate reporting using crypto tax software is the most effective way to manage your crypto taxes.

Yes, Accointing is fully compliant and used by tax professionals across the globe.

A few countries are tax-exempt for cryptos, but not many. Check the crypto tax-friendly countries article to see if your country is tax-exempt.

You can print unlimited tax reports for each tax year as a paid member.

For API keys Accointing explicitly asks for read-only access. This data is encrypted and user-specific. Users can delete their accounts, including all collected data.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.