Aelf (ELF) is no doubt one of the most interesting projects currently. It is a decentralised and self-evolving cloud computing blockchain network that is trying to develop a new operating system exclusively for blockchains.

The project has also just moved into test net phase in July with some positive improvements being made to the protocol. However, can Aelf really cut above the crowd and stand out among their competitors?

In this Aelf review, we will take an in-depth look at the project including the technology, competition, team and token prospects.

A Blockchain Operating System

Blockchains have brought us apps, and even app platforms, but not a full-blown operating system like Windows or Linux. But now there’s Aelf, which does promise to be an operating system designed for blockchains. In fact, the team has said it is creating the “Linux system” of the blockchain ecosystem.

Can Aelf Become a "Linux" of Blockchains?

Can Aelf Become a "Linux" of Blockchains?It just highlights how quickly innovation occurs in the blockchain space. First we had Bitcoin, a peer-to-peer digital currency that could also be considered a simple app. Then Ethereum came along and made it possible to code decentralized apps (dApps) with smart contracts. That’s basically an app platform. So, the next logical step is to create a blockchain operating system.

This is needed because existing operating systems can’t effectively run dApps and blockchains come with their own disadvantages. Blockchains still need to solve the scalability problem, they’ve seen problems executing smart contracts, and there’s no consensus protocol that is flexible enugh to smoothly adapt to new technologies. These are the problems Aelf is looking to solve.

How Aelf Works

The Aelf team is focused on two main innovations in their search to solve the problems with existing blockchain technology. The first is the creation and use of side chains, and the second is the creation of a new and unique governance system.

Aelf plans on segregating smart contracts and other resources by using side chains, which will also help the scalability issue. Additionally, they will be using a Delegated Proof of Stake consensus method to give more flexible governance.

Aelf Side Chains

Aelf will have a main chain and many side chains that are used to run smart contracts. The main chain is of course the backbone of the entire network, but it is also able to interact with each side chain. The side chains are individually dedicated to a specific smart contract, and they cannot interact with each other. Instead they transmit information by communicating through the main chain.

The side chains connect to the main chain using an index system that categorizes chains into two groups:

- External chains of high importance (Bitcoin, Ethereum, etc..)

- Internal side chains in the Aelf OS

Internal use of sidechains on Aelf. Source: Twitter

Internal use of sidechains on Aelf. Source: TwitterAs you can see the main chain can have side chains with many purposes. Bitcoin and Ethereum could each get their own side chains, another side chain could be created for insurance and for another for digital assets. Then these sidechains could even branch further into sub-chains. For example, the digital assets side chain could have a sub-chain for each type of digital asset, and those chains could be subdivided even further still.

This strategy isn’t completely new as it is similar to the sharding idea in Ethereum. It should work to improve scalability dramatically on the network. By separating functional areas into side chains Aelf ensures that any issues in one area won’t impact the entire network.

Aelf’s Token Ecosystem

The ELF token will be used by side chains to pay a transaction fee to the main chain for indexing. The fee structure has also incorporated a system where side chains pay smaller transaction fees as their contribution to the network grows. Side chains can also charge fees to their sub-chains.

Aelf’s Consensus Method

Aelf isn’t able to use a traditional Proof of Work or Proof of Stake consensus method because it needs to record information from a variety of side chains as well as the main chain. Instead, the Aelf network uses a Delegated Proof of Stake consensus mechanism.

Each Aelf token holder can vote on which nodes will become the mining nodes. Then, the mining nodes determine how to distribute mining bonuses to all the other nodes and stakeholders.

Aelf determines the number of network miners by the equation:

Miners = 2N + 1

Where “N” starts at 8 and increases by 1 each year. These mining nodes are responsible for relaying and confirming transactions, packaging blocks, and transferring data.

It’s recommended that side chains merge their mining with the main chain, and that they also develop their own consensus protocol. This allows the side chains to customize the consensus protocol to meet their own unique needs.

The Aelf Token (ELF) Supply

Aelf held its private token sale in December 2017, distributing 250,000,000 tokens, or 25% of the 1 billion total supply of ELF tokens. The remaining 750,000,000 tokens are distributed as follows:

- 25% or 250,000,000 to the Aelf Foundation, 3 year vesting period;

- 16% or 160,000,000 to the Aelf Team, 2 year vesting period;

- 12% or 120,000,000 for Marketing/Air Drops, 3 year period;

- 12% or 120,000,000 to Mining, 100 year period;

- 10% or 100,000,000 to Advisors/Partnerships, 2 year vesting period.

Mining rewards are designed to decrease in a linear fashion over a 100 year period. As of August 2018 only the ELF tokens from the token sale are in circulation.

Aelf Team, Advisors and Partners

The Aelf project was founded by Ma Haobo, who previously founded Hoopox as well as being the CTO of GemPay and AllCoin. Haobo was an early blockchain adopter and is considered an expert in the field. He is joined by a number of technical and finance professionals to create a well rounded team.

Aelf Team Members. From Left: Ma Haobo, Chen Zhuling, Rong Peng, Yang Yalong

Aelf Team Members. From Left: Ma Haobo, Chen Zhuling, Rong Peng, Yang YalongOn the advisory side of Aelf, J. Michael Arrington, founder and CEO of TechCrunch, and Zhou Shouji, founding partner of FGB Capital, support the team as members of their advisory board.

It’s also worth noting that the Aelf project has received backing from a number of top-tier venture capital firms. Draper Dragon, Blockchain Ventures, FGB Capital, and over 10 other investment firms participated in the token sale. The private token sale reached its hard cap of 55,000 ETH within two weeks, and had to turn away many interested investors at the time.

Aelf is still a young project and as such is in the midst of building out their product, but even so they’ve attracted a good bit of attention and have formed partnerships with U Network, Theta and Decent among others.

ELF Token Price

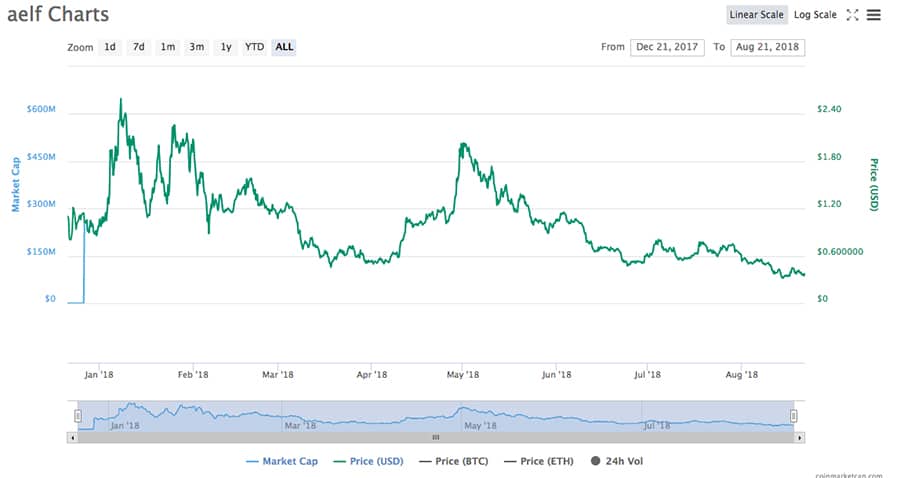

With the token sale occurring in December 2017 the ELF token began trading during quite a tumultuous time in cryptocurrency markets. The price rocketed from its opening price of roughly $0.87 to its all-time high of $2.61 within weeks, but then quickly fell again as the entire cryptocurrency market came under pressure.

ELF Token Performance on CoinMarketCap

ELF Token Performance on CoinMarketCapSince then the token saw another spike to just over $2 at the end of April 2018. Since then it has slowly and steadily been falling along with the broader market and as of August 21 is trading at just $0.35 a token.

Where to Buy ELF

The ELF token is available on quite a few different exchanges. The most popular are the Binance Exchange, OKEx and Huobi. Binance only allows BTC and ETH exchanges, but OKEx and Huobi also accept USDT.

Register at Binance and Buy ELF Tokens

Register at Binance and Buy ELF TokensThere’s also a reward system that Aelf launched several months ago called Candy. In the Candy system you earn points that are convertible to ELF by doing simple tasks each day. These tasks include inviting new people to the Telegram channel, retweeting Aelf tweets and other promotional activities. Sign up for the Candy program here.

Storing ELF

Currently ELF tokens are ERC-20 tokens and can be stored in any ERC-20 compatible wallet, including MetaMask, MyEtherWallet, and the secure hardware wallet Ledger Nano S.

Once the main net for Aelf launches the ELF tokens will switch from ERC-20 tokens to native Aelf main chain tokens. There’s no indication how you will exchange the ERC-20 tokens at this time, and there’s also nothing about a wallet for storing the native ELF tokens. I can only guess that information will be forthcoming once the main net is close to launch.

Conclusion

Aelf is a pretty new project and competitor in the dApp ecosystem, but that hasn’t stopped it from gaining good support from the venture capital arena. It’s also getting good partnerships to support it as development moves forward. This shows that its unique governance model and the use of side chains to control resource usage on the block chain are being accepted a suitable for a blockchain operating system.

Of course the project is behind other more developed similar projects, but that doesn’t mean that its solution could end up being the best choice for the development of a side chain based operating system. Plus, Aelf could see great benefits from the flexibility and scalability of its network.

The drop in the coin price could be disappointing to those who got in when the token was launched, but it’s not out of line with losses being seen across the cryptocurrency markets since the start of the year. It’s certainly too early to say it’s too late for this ambitious project.