Aragon (ANT) Review: The Mother of All DAOs

Aragon is one of those cryptocurrency projects that is trying to build something so ambitious that it seems impossible.

While the name might appear like a misspelling Aragorn, the famous Lord of the Rings character, the Aragon project is named after an autonomous region in Spain which once sustained a completely stateless form of governance for a period of roughly 6 years in the 1930s. Aragon is trying to recreate this sort of cohesive and functional community governance using cryptocurrency.

Aragon considers itself to be to governance what Bitcoin is to money. While it is itself a decentralized autonomous organization (DAO), Aragon offers templates for anyone to create a DAO of their own within 5 minutes. Aragon powers Decentraland’s DAO and even the DAO of the famous DeFi project, Aave.

Not only that, but Aragon is also creating a digital jurisdiction within which all DAOs (and individuals) will be able to resolve disputes and achieve consensus without a centralized authority.

Origins of Aragon

The story of Aragon begins with its two co-founders, Luis Cuende and Jorge Izquierdo. To say that both are prodigies is not only an understatement, it is an insult. Cuende began dabbling in open source code to build an operating system when he was just 12 years old.

At the age of 16, he was the tech advisor to the vice president of the European Commission. By the age of 18, he had launched nearly half a dozen startups and was awarded the title of Best Programmer in Europe by HackFWD. In 2016 he made it onto the European list of Forbes’ 30 under 30 – he was 20 years old.

Izquierdo became friends with Cuende over Twitter in 2011 after reading Cuende’s impressive resume online. While Izquierdo may not have the same flashy titles as Cuende, he open-carries the same degree of cognitive firepower. The pair have worked together on many startups in Spain and the United States.

While in Silicon Valley, they attempted to acquire funding to develop an AI company which would automatically file for patents. This was to fight patent trolls, entities which would file patents for commonly used technologies and attempt to extort money from businesses using those technologies.

After their AI patent startup fell flat, Cuende and Izquierdo turned to crypto related ventures and even started a small Zcash mining farm. They were in the middle of developing another startup in 2016 when Donald Trump was elected president of the United States.

Cuende saw this as a failure of the democratic system and called Izquierdo upon witnessing the election result. He proposed developing a cryptocurrency project which could restore the transparency and accountability which Cuende believes has been lost in modern political and economic institutions.

Aragon was founded in November 2016 just days after the presidential election. In the span of a few weeks, the pair had relocated back to Spain and had already created a useable prototype of Aragon’s decentralized governance system. This made their project very popular within the space, because in Izequierdo’s words “we had developed a functioning product”. The alpha version of the Aragon platform was released to the public by February of 2017.

During that same month, Cuende and Izquierdo were presenting Aragon at a conference in Paris with Ethereum (ETH) creator Vitalik Buterin in the front row. Vitalik subsequently tweeted that “decentralized companies are stupid if you don’t have a decentralized court to stop 51% attacks”.

Upon reading this, the team realized they needed to go further than just creating a DAO with Aragon. Izequierdo considers this to be one of the most valuable opinions about the project since its inception.

The Aragon (ANT) ICO

Aragon’s ICO took place in May of 2017 with a token price of roughly 0.90$USD per ANT, an ERC-20 token built on the Ethereum blockchain. Investors were able to buy ANT tokens using ETH, and US investors were excluded due to the terms of the ICO.

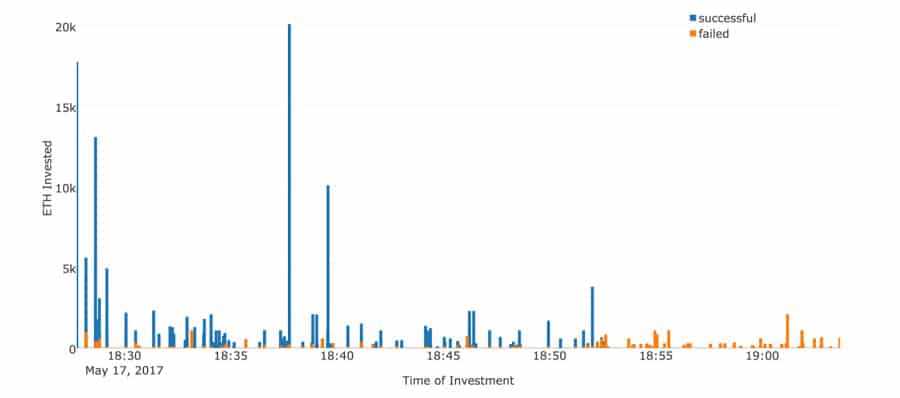

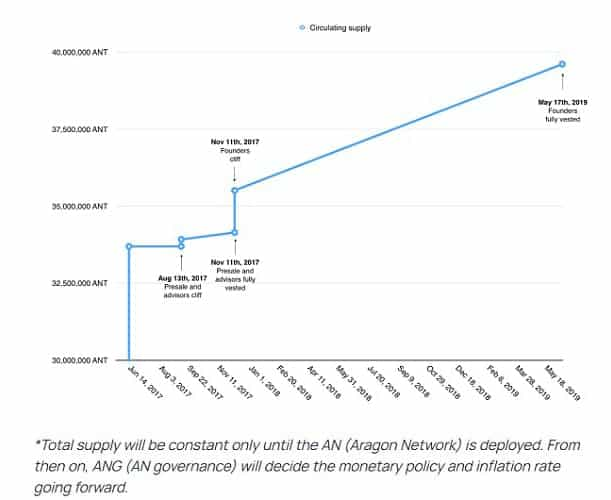

The ICO had a “soft cap” of 25 million in USD which was reached just over half an hour. Consequently, an additional 8 million USD of pending ETH transactions could not go through. The total number of tokens sold was just under 28 million, 70% of the ANT’s token’s total supply of 39.6 million. ANT stands for Aragon Network Token.

15% (or roughly 6 million ANT) was kept for the Aragon Foundation and the other 15% went to the early contributors and founders. One interesting thing to note is that Aragon’s ICO was designed to prevent any single party from buying too many ANT tokens as this would jeopardize the integrity of the network.

Roughly 2400 unique addresses purchased ANT tokens, and Cuende has remarked that the Aragon team has “literally no idea” who purchased the ICO tokens. A subsequent analysis of the ICO done by an Aragon fan found that the very first investor somehow clinched over 3 million ANT tokens.

What is Aragon?

Aragon is a decentralized autonomous organization (DAO) which allows third parties to easily create their own DAOs using a toolbox of pre-programmed smart contracts. Aragon also offers DAO templates depending on whether the DAO is intended to function like a corporation, charity, etc.

The backbone of the Aragon protocol is something called the Aragon Court, a decentralized digital jurisdiction which is used for the governance of the Aragon network and to resolve disputes between DAOs and individuals on the network. ANT token holders govern the Aragon network.

Aragon sees governance as the top of any given human structure. Recognizing the ambiguity in many existing governance protocols and even projects such as Bitcoin, all decisions, developments, and disputes within the network are made in accordance with the core values of the Aragon Manifesto.

These are: the freedom of choice (self-sovereignty), the disincentivization of violence (non-aggression), the decentralization of power, long term value over short term profit, and inclusion (the ease of usability and user experience of average person interacting with the Aragon network).

Rather than imposing a single governance structure to the entire network, Aragon envisions a world that is made up of thousands of Aragon DAO communities each operating off their own unique governance structures with the Aragon network as the medium through which they interact.

The goal is to foster a sort of ‘governance capitalism’ wherein the most robust governance mechanisms achieve maximum viability through competition. As such, Aragon is frequently referred to by its founders as an experiment which seeks to uncover the most effective governance structure(s) in public and private institutions.

How Does Aragon Work?

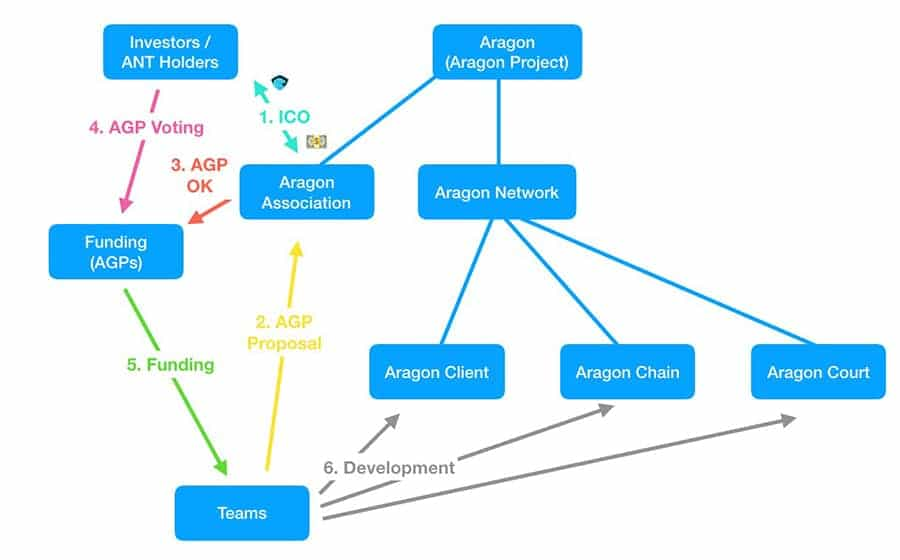

To understand how Aragon works, it is important to briefly explain Aragon’s structure. The Aragon Foundation is responsible for the Aragon network and is a Swiss non-profit organization. Aragon One is the for-profit development team which is contracted by the Aragon Foundation to maintain the Aragon network.

There is significant overlap in the teams found in the two entities, with Luis Cuende and Jorge Izquierdo simultaneously being the leaders of the Aragon Foundation and the lead developers of Aragon One. Both the Aragon Foundation and Aragon One are based out of Zug, Switzerland (Crypto Valley).

Aragon governance

Since Aragon is a DAO, all proposed changes to the network are voted on by the community and implemented by the Aragon Foundation which commissions Aragon One to do the work. Until March of this year, 1 ANT token was equal to one vote and a minimum of 1% of total ANT supply had to be deposited either for or against the proposal.

At least 51% of the votes had to support the proposal for it to pass, at which stage a smart contract would unlock funds from the Aragon treasury. Although the treasury is custodied by the Aragon Foundation, funds can only be unlocked by community vote.

A minimum of 1000 ANT had to be deposited to table a proposal which “must be made in good faith with the intention to improve the Network's operational efficiency, quality, or breadth of service, and benefit all ANT holders in equal measure”.

As noted in the previous paragraph, this governance structure was recently paused to make way for the Aragon Court, which would not only provide the ‘legal’ framework for DAOs and individuals to interact on the network, but also eventually introduce a more robust governance mechanism to the Aragon network itself.

Aragon Court

The Aragon Court can be conceived of as the judicial branch of a government made up of smart contracts. This government has the Aragon Manifesto as its Constitution. Proposals to the Aragon network will also be voted on within the Aragon Court but the exact process for this has yet to be detailed. The technical structure of the Aragon Court is quite complex and outside of the scope of this article but is quite easy to understand from a bird’s eye view.

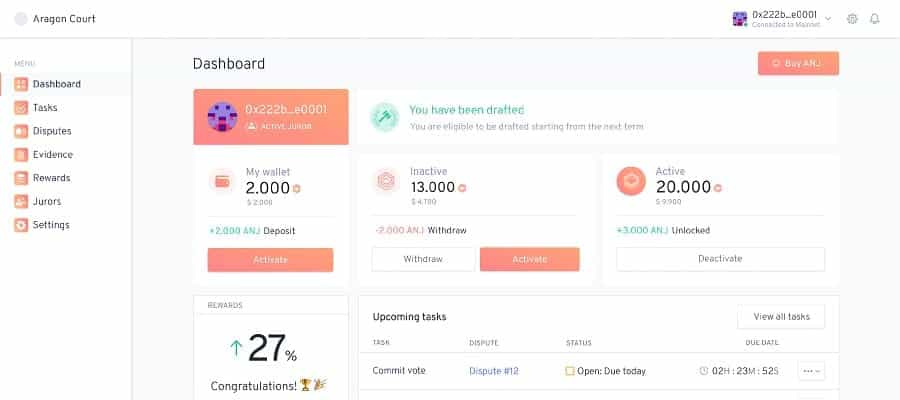

In the Aragon Court, all parties who want to participate as jurors, plaintiffs, or defendants must put down a minimum stake of 10 000 ANJ tokens (more on this in the next section). A plaintiff must wager stake to take an issue to ‘court’. If the defendant does not respond within a certain timeframe, the plaintiff automatically wins, and the defendant loses his or her stake.

Jurors are pseudo-randomly selected from the pool of ‘activated’ participants (those who staked funds) of the Aragon Court to rule on any given dispute, with the likelihood of being selected as a juror being influenced (not determined) by the number of staked tokens and previous juror reputation.

Juror decisions are made independently and anonymously and involve a principle referred to as “plurality”. Put simply, jurors are incentivized to make the “correct” (majority) judgement as “incorrect” (minority) jurors lose their stake.

Conversely, jurors who made the correct decision earn rewards in ANJ tokens taken from the lost stake of the defendant and incorrect jurors (if there were any). Defendants can appeal a judgement by putting down more stake, at which point the same process repeats with a larger pool of jurors.

This appeal process can be repeated until every single juror on the network is summoned to resolve the dispute. You can read more details about the Aragon Court on the recently updated Aragon whitepaper.

Aragon Tokens

As you might have noticed, there are more tokens than just ANT in the Aragon network. In fact, there are currently 3 highlighted by Aragon: ANT, ANJ, and ARA. In case you have forgotten, ANT is the token central to the Aragon network and is used for governance of the network.

ANJ is an ERC-20 token that is used for staking and jury duty rewards with the Aragon Court and is bonded to ANT, wherein ANT tokens are deposited into a smart contract to mint ANJ tokens. ANJ tokens can actually be traded on cryptocurrency exchanges (albeit with low volume and quite a low price).

ARA is an upcoming token that will be used within the Aragon Chain, another protocol which will serve a pillar function within the Aragon network like the Aragon Court (more on this in the next section).

Both ANJ and ARA are referred to as Continuous Tokens, since their supply is tied to something called a Bonding Curve smart contract which creates pre-defined exchange rates between ANJ and ARA tokens based on their current price and supply. Every protocol (not DAOs) within the Aragon network will have its own native token which is bonded to ANT in this manner.

Aragon Roadmap

Similarly to other DAOs, Aragon’s does not have a fixed roadmap because it is fundamentally drawn by the will of Aragon’s community. Looking at its past milestones, Aragon launched its DAO-creating main net in October 2018.

2019 saw Aragon continue to add new DAO templates and make improvements to the network, as well as officially introduce Aragon One as the lead development team within the structure outlined at the start of the previous section. The Aragon Court was also officially launched in February of this year.

Other developments include the Aragon Agent, a template plug-in that allows any Aragon DAO to interact with other apps on Ethereum including DeFi apps such as MakerDAO. Aragon also recently implemented AraCred, a protocol which tracks the reputation of users on the Aragon network and rewards them with tokens native to the protocol they are interacting with (e.g. ANJ in Aragon Court).

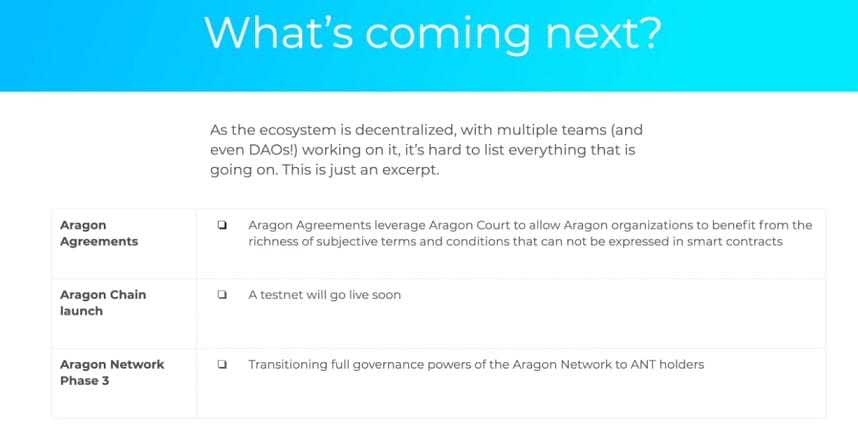

Based on recent blog posts by the Aragon Foundation and an interview with Luis Cuende, the next year will focus on the development of the Aragon Court and the Aragon Chain. The Aragon Court is currently running “precedence campaigns” to test the efficiency of the protocol before passing on governance of both the Aragon Court and the Aragon network to ANT token holders. This was actually the long-term goal of the founders of the project, which hope to see the Aragon Foundation gradually step away from the network entirely.

The Aragon Chain is currently in development and acts as a second layer to the Aragon network. Unlike the underlying network, the Aragon Chain uses a Proof of Stake consensus mechanism and will allow for fast, low risk transactions to be made between DAOs on the network at a very low cost. Putting two and two together suggests that participants on the Aragon Chain will need to stake ARA tokens which are bonded to ANT.

ANT Price Analysis

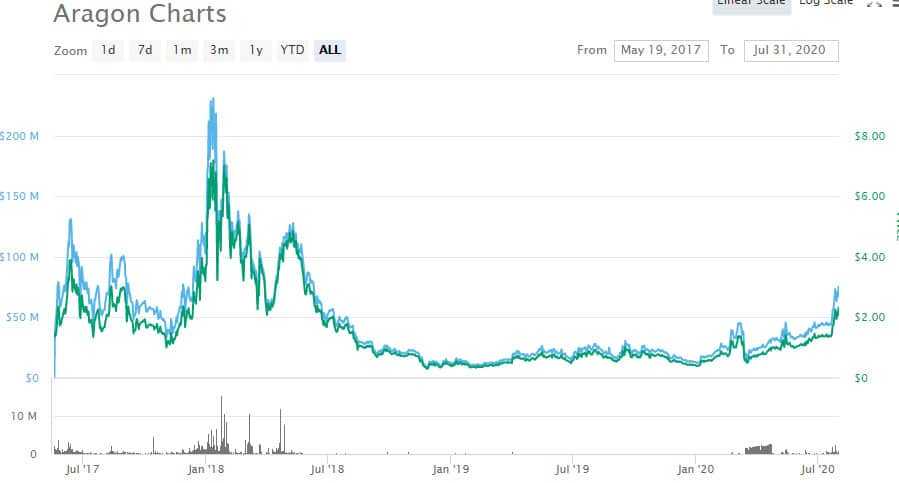

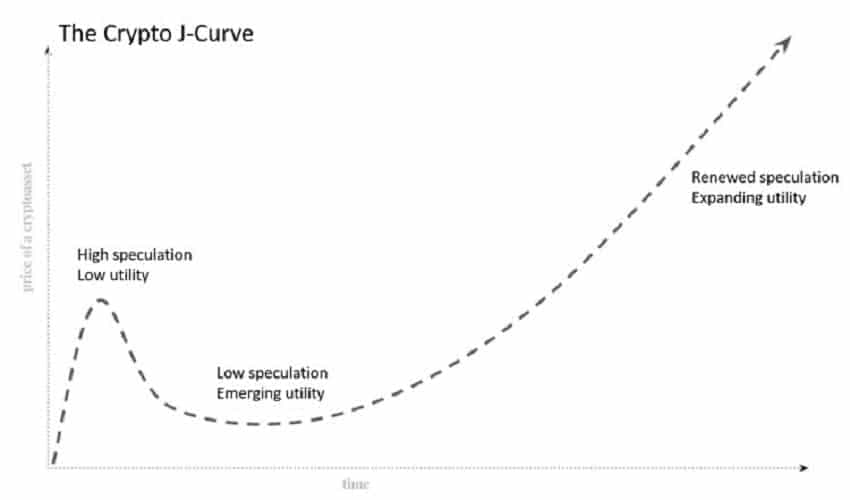

The price history of ANT is relatively unimpressive compared to most other cryptocurrencies. It debuted on the crypto market in May of 2017 at a price of roughly 1.50$USD per token, which was less than double its initial ICO price of 0.90$USD. ANT hit an all time high of nearly 8$USD in January 2018. While other cryptocurrencies were seeing gains of over 100x compared to their ICO prices during the bull run, ANT did not manage to even just 10x its original valuation.

That being said, ANT has been in a visible uptrend since January of this year when each token was worth a mere 0.40$USD, a price it had fluctuated around since late 2018. The launch of the Aragon Court brought a significant degree of fanfare, especially after renown venture capitalist Tim Draper purchased a million dollars USD worth of ANT tokens from the Aragon Foundation at a price of 0.50$USD per token.

Although the flash crash in March of this year set ANT back to square one, prices have recovered to levels not seen since mid-2018, and experienced a sharp spike to over 2$USD in early July when it was announced that the Aragon network was finally going to give governance of the protocol over to ANT token holders without restrictions. It appears that ANT will continue to appreciate for the foreseeable future (this is not financial advice, though!).

Where to Get ANT

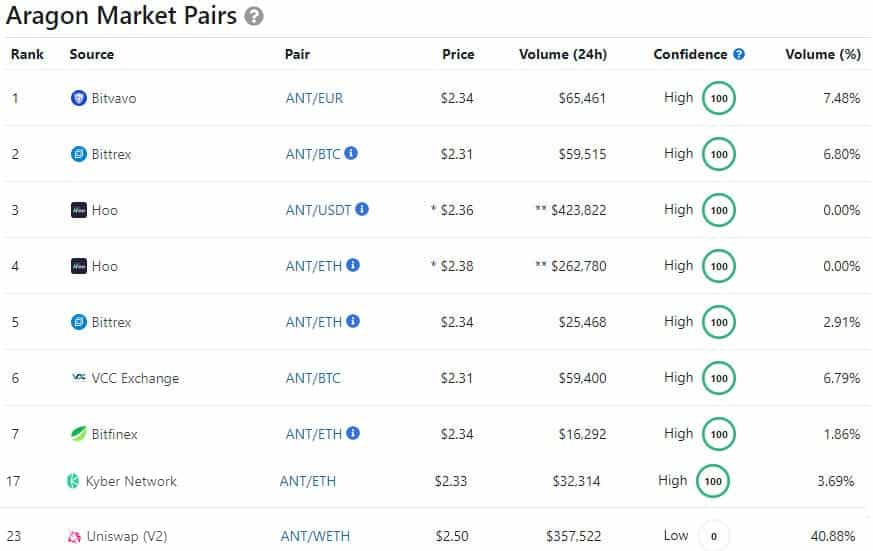

If you are looking to get your hands on Aragon’s ANT token, unfortunately you do not have many options. There are only about two dozen trading pairs with the ANT token, most of which are on unknown exchanges or decentralized exchanges with low volume. Your only viable option seems to be Bittrex, and even the volume there is not all that high.

It is also important to highlight ANT’s 24-hour volume and its total supply. ANT’s 24-hour volume is incredibly low given its market cap, and it appears that some of that volume may be fake as well.

Regarding its total supply, when the Aragon network gets handed over to ANT token holders, they will have the power to change the supply cap of the token as well as its inflation as they see fit. This could throw a wrench in your desire to invest if you are not a fan of inflationary currencies.

ANT cryptocurrency wallets

Since Aragon’s ANT token is built on the Ethereum network as an ERC-20 token, you will be able to store it just about anywhere that you can throw down your ETH. Some good software wallets include MyEtherWallet (web), Exodus wallet (desktop/mobile), Atomic Wallet (desktop/mobile), and Trust Wallet (mobile). Hardware wallets include Ledger, Trezor, and Keepkey devices.

Our Opinion of Aragon

When it comes to how we feel about Aragon, we are in the same boat as its founder and lead developer, Luis Cuende. While Aragon aims to do something incredible and is making serious progress, the question remains: will anyone actually use it?

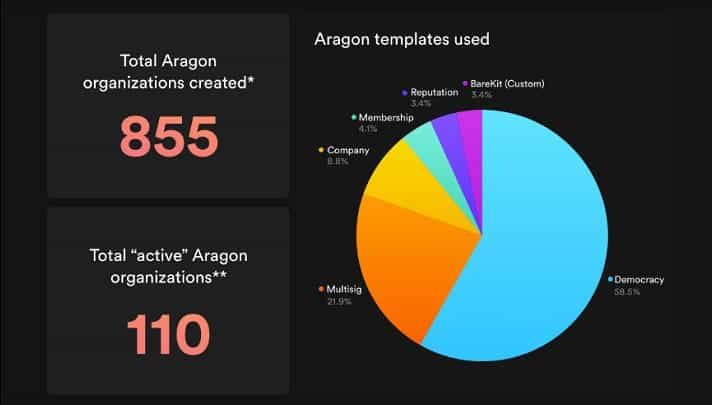

Although over 1400 DAOs have been created using Aragon’s ingenious “governance Lego blocks”, achieving any sort of meaningful adoption of their technologies is proving to be incredibly difficult.

In a recent interview, Cuende was asked about the shockingly low Aragon network participation rate of 7% among ANT token holders. Although he is not happy about that number either, he said that it is not the number of participants but the quality of the outcomes that counts. He also accurately points out that this low participation rate is endemic in decentralized applications (especially those unrelated to DeFi).

Most importantly, Cuende is very aware of the fact that there is a huge knowledge and experience gap between the average person and seasoned cryptocurrency geeks. Not only that, but many protocols and applications within the crypto space are legitimately unappealing to the user.

This is part of why one of the “commandments” of the Aragon Manifesto is inclusion – an intuitive user experience that makes it easy for the average person to operate and contribute to the network. In Cuende’s eyes, Aragon still has a long way to go in this respect.

All in all, it is a shame that Aragon has not gotten the attention it really deserves. It is one of the few projects where the community is actually in the driver’s seat. It has had the final say on how the Aragon Foundation’s treasury funds are allocated since the Aragon network was launched.

The ICO was equitable and the project never had any powerful venture capital firm pushing the Aragon Foundation to engage in the same sort of shady practices you see behind the scenes with many similar projects.

Izquierdo said last year that Aragon has enough funds to continue development for at least another decade. This means that the Aragon network is here to stay at least until then and may just make the progress necessary to cement themselves as one of the leading projects in cryptocurrency. This seems more likely than not given that their lead developers are some of the best on the planet.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.