Bancor Network Token: Decentralised Cross-Chain Liquidity

While there are plenty of blockchain projects focused on dApps and the conversion of tokens, one that stands out is the Bancor Network and its BNT token.

Indeed, this project is one of the most well known in the cryptocurrency space. It has also had its fair share of ups and downs. From a blockbuster ICO to legal challenges. From widespread partnerships to a widely publicized hack.

However, is it something you should consider?

In this Bancor Network Token review, I will give you everything that you need to know. I will also take a look at the long term prospects and adoption potential of BNT.

What is the Bancor Network?

The Bancor Network has created an elegant solution in its decentralized network which allows traders to swap a wide selection of tokens seamlessly across nearly 10,000 token pairs, and all with a single click.

Bancor allows users to instantly convert between two tokens without needing a counterparty to the trade. This is all done right within the Bancor wallet, and this model has allowed Bancor to provide traders with automatic liquidity for trades.

More importantly, it allows the network to remain completely decentralized, and much of the functionality of the network is thanks to the innovative use of the BNT token to facilitate trades.

So, this all sounds really intriguing but in order to understand the real heft behind Bancor, we have to go over its relatively eventful history.

Bancor Network Background

The Bancor Network is overseen by the Bancor Foundation, which is based in Zug, Switzerland. The company also operates a Research & Development center in Tel Aviv, Israel, which gives the company a foothold in the rising blockchain hub in Zug as well as the rising Middle Eastern technology center of Tel Aviv.

The company was founded in 2016 by a group is Israelis with a background in Silicon Valley start-ups, as well as experience in scaling startups and blockchain technologies. It was named after the international trade balancing currency initially envisioned by John Maynard Keynes.

The Bancor Network is perhaps most well-known for holding one of the most successful ICOs ever. In 2017 it set a world record by raising over $153 million in Ethereum tokens in less than 3 hours. The world-record has since been topped by several projects (including SIRIN Labs and Tezos), but remains an impressive beginning for the project.

Since the ICO the Bancor Network has seen over $1.5 billion in token conversions take place on its platform, all facilitated by the BNT token. In addition, there are over 100 liquidity providers serving as Bancor nodes, and these nodes provide over $13 million in liquidity by staking BNT tokens to power token conversions.

More recently, on January 1, 2020 Bancor has added dramatically to its liquidity pool by airdropping all of its Ethereum Reserve, which totaled 10% of the BNT marketcap at the time, in the form of ETHBNT Bancor Pool Tokens.

In effect this added 60,000 liquidity providers, although it’s understood that many of the airdrop recipients simply turned around and sold the tokens. Still, the Bancor network has gone from liquidity of just under $4 million on January 1, 2020 to over $17 million as of mid-June 2020.

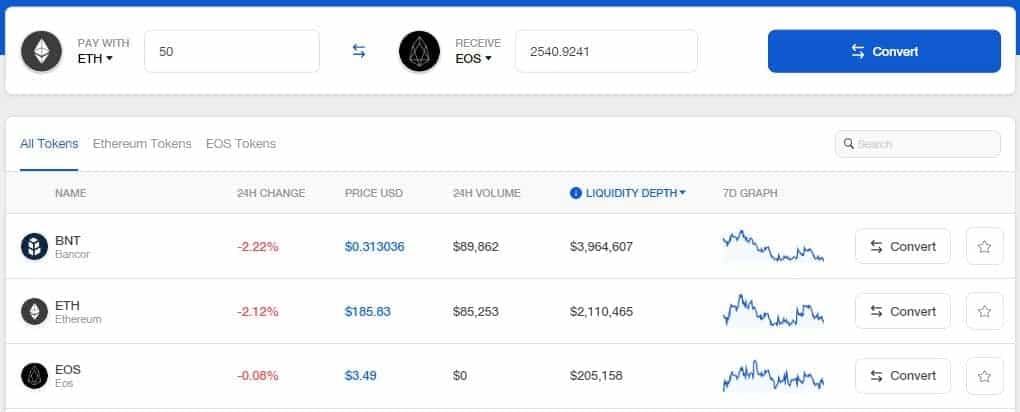

Cross-chain Conversion

Bancor has made the user experience of exchanging tokens quite easily. The intuitive wallet app is slick and allows for the quick and easy conversion of tokens similar to what users get when using Coinbase Pro or other custodial wallets.

While the user interface makes it look simple, behind the scenes the Bancor wallet is transacting directly with BNT smart contracts on the blockchain, all while allowing users to retain full control of their private keys and funds at all times.

The obvious advantage of Bancor’s wallet is that it not only allows for the exchange of tokens, but it does so without the need for a counterparty. This makes it the first network to allow cross-chain conversions without requiring users to give up their private keys in the process of the exchange.

Bancor began their cross-chain integration efforts with EOS and Ethereum, however, they have plans to add other bridges over time, eventually enabling them to function as a multi-chain liquidity solution that can provide instant token conversions for many of the popular blockchains such as Bitcoin, Tron, and Ripple.

Range of Conversions

Already Bancor gives traders and investors an amazing range of conversion options, with fee-less, instant trades available for tokens across more than 8,700 token pairs right through the Bancor wallet.

To make a comparison, one of the most popular exchanges Binance has roughly 196 tokens available, but just 586 trading pairs.

Automatic Liquidity

One of the greatest benefits of Bancor and the BNT token is that they bring liquidity to cryptocurrency markets, and without liquidity, currencies are apt to wither and die. After all, who wants to own a currency that can’t be easily bought and sold.

Of course, the top cryptocurrencies like Ethereum, Ripple, Litecoin, and others in the top 20 have enough trading volume on their own, but the Bancor Protocol brings a unique solution that delivers automatic decentralized liquidity to any token.

Through the Bancor Protocol any token at all, even those privately created, can get instant liquidity, no matter what size trade volume the token enjoys. This is incredibly important functionality when it comes to facilitating the adoption of decentralized applications.

Since many dApps have their own tokens, and now those tokens are able to be converted with other cryptocurrencies instantly and with a single click right within a user’s wallet.

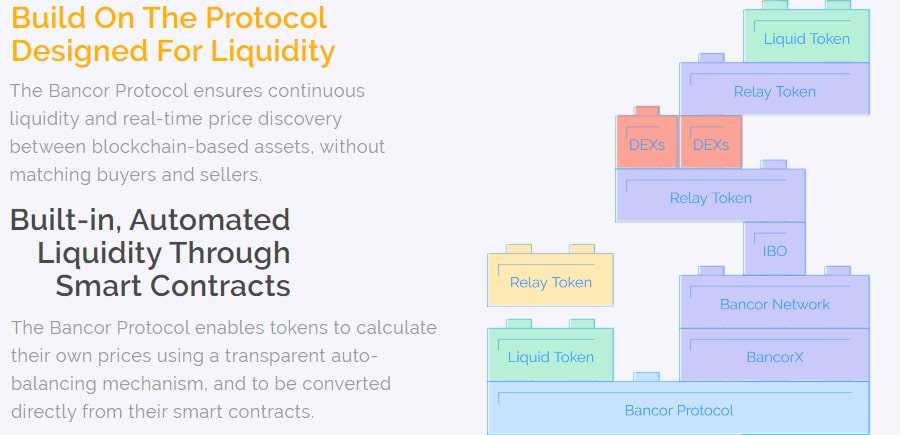

How Bancor Protocol Works

At this point, you might be wondering if it’s really necessary to have another decentralized exchange. After all, the centralized exchanges seem far more popular at this point, and there are dozens of active exchanges already providing a trading platform and liquidity for cryptocurrencies.

In short, yes the world does need another exchange, or at least it needs an exchange like Bancor. That’s because the Bancor platform provides a much-needed service of increasing liquidity for any token, and of creating a platform where any token can be exchanged without the need for a counterparty.

This is something that can’t be accomplished with any other asset. Take fiat currencies as an example. If you want to exchange U.S. dollars for Yen you need to find someone willing to sell Yen to complete the transaction. Every asset is like this. There must be a buyer and a seller for a transaction to work.

Bancor only requires one person to complete a trade, with the liquidity provided by the native BNT token and its smart contracts. The BNT token’s smart contracts ensure that there is a balance between tokens at all times. Once any trade is concluded there will also be a total remaining that represents the BNT balance coded into the smart contract.

This structure removes the need for the exchange to act as a third-party to transactions. With Bancor and its BNT token, you are able to continually perform exchanges for Ethereum and EOS compatible tokens right through the Bancor wallet.

You can think of the system as an hourglass. It’s a closed system and it doesn’t matter how you turn the hourglass, it always holds the same quantity of sand. In this analogy, the hourglass represents the BNT smart contract, and the grains of sand are the tokens being traded.

And next up from the team will be a development marketplace for dApps that will also make use of the cross-chain compatibility and balanced smart contracts. Also in the pipeline for the future is staking rewards to incentivize liquidity, and a BancorDAO to add self-governance to the blockchain and fully decentralize.

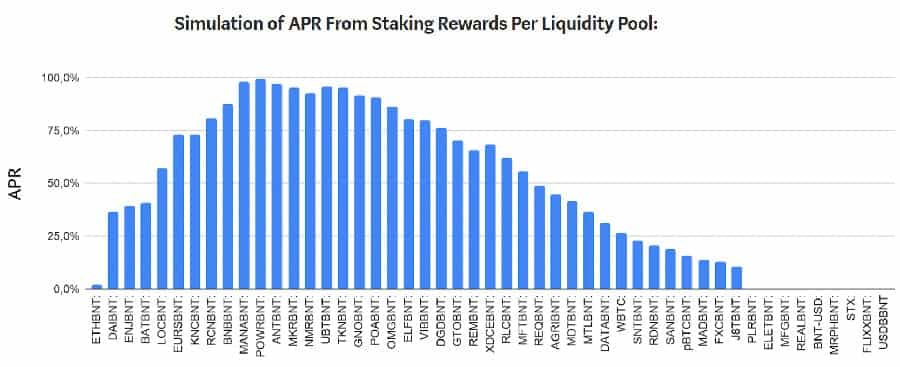

Bancor Staking Rewards

BNT staking rewards are a future enhancement that is planned to incentivize users to provide liquidity for the network. The basis for adding staking is that Bancor needs liquidity to lower fees for traders, while also increasing trading volume and overall network fees. By providing users with an incentive to add liquidity to the network Bancor is expecting to see its network grow and flourish.

While plans for adding staking rewards are in the early stages the basics are that users will receive rewards of BNT for holding their BNT in an existing liquidity pool such as MKR/BNT or ETH/BNT. The amount of new BNT that will be created as staking rewards and the distribution of staking rewards to different pools on the network will be decided by users voting in the BancorDAO.

This type of reward system is expected to pull new users into the ecosystem thanks to the APR generated by fees and staking rewards. Bancor is carefully designing their staking rewards system to avoid concentrating the rewards in a small number of pools, choosing instead to provide an even distribution across dozens of network pools.

Bancor Vortex

Vortex is the solution implemented in February 2021 which allows users to provide liquidity in BNT to borrow funds while continuing to obtain yield from swap fees.

Vortex reworked the existing vBNT mechanism, which gave the token more uitility aside from providing governance. As you’ll see later this turned out to be very good when Bancor moved to gasless voting, otherwise the vBNT token would have lost all utility.

vBNT is received when staking BNT into a liquidity pool making it the pool token for the Bancor network. Vortex adds additional functionality to vBNT such that user are able to sell vBNT for actual BNT tokens. That means once vBNT is converted the resulting BNT can be exchanged for any other token.

The addition of this functionality makes Vortex a no-liquidation lending platform, which is pretty cool since it allows a liquidity provider the ability to receive future rewards immediately. And because the principal will continue accruing swap fees the loan eventually repays itself.

The no-liquidation aspect of Vortex arises because vBNT and BNT are essentially the same token. Thus any change in the price of BNT is closely mirrored by vBNT. And while vBNT is created in a 1:1 ratio when staking, the price relationship between the two is not that simple.

vBNT Burner Contract

Originally Bancor Vortex was envisioned with a token supply management solution that would capture a portion of trade revenue and use it to buy and burn vBNT. That original model was dynamic and complex, however in March 2021 the DAO voted to replace the dynamic model with a flat-fee model.

Under that flat-fee model 5% of the total protocol swap revenue is shifted to the vBNT Burner Smart Contract, and the addition of this will turn vBNT into a scarcer asset. That is long-term deflationary and positive for the Bancor ecosystem.

The flat burn rate will be incrementally adjusted over the course of 18 months, with the final target being 15%. The theory is that as trade volumes increase the burning of vBNT will also accelerate. In the coming years this vBNT burn mechanism is expected to be a critical part of the flexible monetary policy employed by the DAO.

In the vBNT burn mechanism the burning of tokens is not automatic. Tokens are moved to the burned smart contract and users are then offered the chance to interact with that contract, also paying the necessary gas fees associated with the burn.

Each vBNT token burned represents a BNT token that is locked into the network forever. That increases the scarcity of BNT and supports the growth in total locked value over time.

The Bancor team also envisions new gamified DeFi strategies coming from this model. In addition to direct incentives to activate the burn mechanism, a new type of transparent and equal-opportunity game becomes available for vBNT.

Speculators will have ample capacity to observe each other’s activities on-chain, and may choose to simultaneously create and seize arbitrage opportunities on the vBNT pool at their leisure.

Bancor Team

The Bancor Network was founded in 2016 by Israeli siblings Guy and Galia Benartzi. Both remain active with the project, with Guy on the Foundation Council, while Galia is in charge of business development. She is also a strong proponent of women in blockchain and crypto.

Other board members include Olivier Nathan Cohen, who is also the founder and COO of Altcoinomy, a crypto KYC operator- facilitating cash out in Swiss private banks, AML screening of ICO investors, and institutional crypto/fiat transactions.

The CTO of Bancor is Yudi Levi, and he’s held that position since the start of Bancor in 2016. Prior to that, he was co-founder and CTO of AppCoin. He also spent over a decade as a chief architect of several mobile projects, including Real Dice, Mytopia, and Particle Code.

The team also has an impressive list of advisors, including Brock Pierce, the Chairman of the Board at the Bitcoin Foundation, and venture capitalist Tim Draper.

The BNT Token

As was mentioned earlier, Bancor held an ICO on June 12, 2017 that raised $153 million in just three hours. That ICO sold roughly 40 million BNT tokens at an average price of $3.92 each. Currently, there’s a circulating supply of BNT of nearly 70 million tokens.

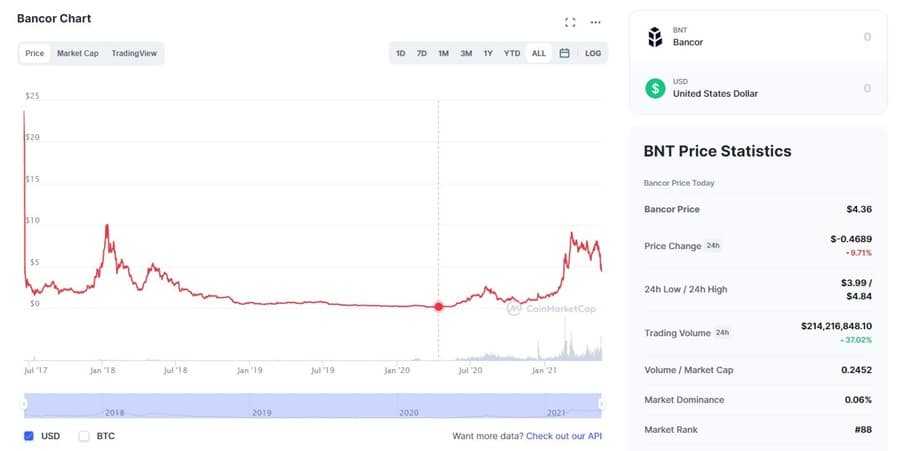

The BNT token hit its all-time high of $10.00 on January 10, 2018 and its all-time low of $0.117415 on March 13, 2020. As of mid-June 2020 it recovered remarkably from its March all-time low and traded at $1.17 just three months after for an amazing gain of 1,500%! That gain was primarily powered by news of the July 2020 release of Bancor V2.

Bancor’s BNT did not experience quite the same rally as many other altcoins in 2021, although it did see some upside as it reached $9.15 on March 7, 2021. Since then it has cooled significantly and as of May 22, 2021 it is trading at $4.36.

The circulating supply can change however since BNT is created as needed to initiate exchanges. The Bancor protocol will create as much BNT as needed to match the value of currencies held within the smart contract. Once staking rewards are added the circulating supply will necessarily increase more rapidly and regularly.

Trading & Storing BNT

You’ll find that most of the trading volume in the BNT token is at Bancor, naturally. It is also offered at a number of other platforms, including Binance and Coinbase, although trade volumes are pretty low.

Moreover, if we were to take a look at the order books on an individual exchange such as Binance it is clear that there is a lack of liquidity there. You will need to be very careful when placing an order there as if reasonable sized orders are likely to lead to slippage.

Once you have your BNT tokens you are going to want to store them in a secure offline wallet. Given that these are ERC20 tokens it means that you can store it any Ethereum compatible wallet.

If you’re trading or staking then storing BNT in the native Bancor Wallet will make sense.

Bancor V2

Late in April 2020, with the BNT token languishing around the $0.20 level the team announced that they would soon be releasing Bancor V2. The token didn’t immediately respond, but by mid-May it had began a serious rally, and a month later is trading at $1.17. That’s especially amazing given that the token was at its all-time low just a short time before in mid-March 2020.

The Bancor Protocol V2 is expected to add several important features that will put Bancor at the front of the pack of decentralized finance projects. The changes are meant to address four key issues commonly cited as obstacles to the widespread adoption of Automated Market Makers (AMMs):

- Exposure to “impermanent loss”

- Exposure to multiple assets

- Capital inefficiency (i.e., high slippage)

- Opportunity cost of providing liquidity

It’s interesting to see that the new features were created as opt-in and users are able to create and fund new AMMs with some, all, or none of the new features.

Bancor V2 features:

- A new automated market maker (AMM) liquidity pool integrated with Chainlink price oracles that mitigates the risk of impermanent loss for both stable and volatile tokens.

- Provide liquidity with 100% exposure to a single token

- A more efficient bonding curve that reduces slippage

- Support for lending protocols

Bancor V2.1

Even before Bancor V2 was fully launched the Bancor team was already discussing the necessary changes for Bancor V2.1. This next level update was designed to take the AMM model to the next level and it differs from Bancor V2 by finally offering solutions to two problems that have plagued AMMs ever since they were created. Those problems are:

- Involuntary Token Exposure

- Impermanent Loss

Unlike other AMM protocols, Bancor uses its native BNT protocol token as the counterpart asset in every Bancor pool. Through the use of an elastic BNT supply, the v2.1 protocol co-invests in pools alongside LPs to support single-sided AMM exposure and to cover the cost of impermanent loss with swap fees earned from its co-investments.

Single-Sided Exposure

In the majority of 1st generation AMMs it’s necessary for liquidity providers to contribute equal amounts of each asset represented in the pool.

Obviously this is not only inconvenient, but it can also be a liability when an LP is only interested in providing liquidity for one asset, or possibly even holds just one asset. Bancor v2.1 breaks this by allowing LPs to provide a single token rather than and even or determinate pair.

Using Bancor v2.1 LPs are able to provide single-sided liquidity exposure using either ERC-20 tokens, or the Bancor BNT token.

Impermanent Loss Insurance

It’s well known that AMMs which are subject to arbitrage opportunities also suffer impermanent loss as a side effect. Any time there are two assets paired in a constant product AMM the product of those two assets must remain constant.

That means any price variations in either asset leads to changes in the amount of each asset held. So, assets that rise in value are liquidated, while assets that fall in value are purchased to maintain the constant product.

In some cases swap fees are used to offset impermanent losses, however these losses can easily exceed any swap fees earned by the LPs. In this case the LP experiences a negative return when they eventually withdraw their assets.

Bancor v2.1 was designed to avoid this situation and ensure that every LP gets back the same value deposited plus trading fees. This is accomplished through a unique concept called Impermanent Loss Insurance.

Impermanent Loss Insurance isn’t automatic, however. It accrues by 1% each day over time, and after 100% it achieves 100% protection on funds in the pool.

There is also a 30-day cliff used, which means any LP who withdraws their capital before it’s been in the pool for 30 days will incur the same impermanent loss as if there was no insurance protection. Once 100 days has passed the insurance protection is full and the LP can receive 100% compensation for any loss incurred within the first 100 days or any time thereafter.

When the pool does not contain enough tokens to cover the losses fully with the staked tokens the insurance can be paid out in an equivalent value of BNT tokens.

Limitations

Bancor v2.1 has some very special features, but to allow for the positive features there are also three notable limitations in the platform:

- Bancor v2.1 will only work with two-asset pools. For pools with more than two assets and custom weights. Developers need to deploy legacy v1 pools.

- Bancor v2.1 does not support dynamically adjusting supply tokens ("rebase" tokens) that can control and adjust token balances in users' wallets.

- When withdrawn from the system, BNTs are locked for a pre-set time (default 24 hr) to prevent panic liquidation.

Roadmap

Bancor does not have a formal roadmap, but they do have a focus and continue improving the platform and adding new features. As of May 2021 Bancor has announced three pillars of development that they are working on:

- Token Onboarding: Open Bancor’s doors to as many assets as possible by lowering the barrier to whitelisting, and making bootstrapping and incentivizing liquidity easier and cheaper for token projects.

- Financial Access & Control: Design powerful financial tools for LPs to earn high yield on their idle assets and manage returns in a stress-free, user-friendly environment.

- World-Class Trading Venue: Capture a growing share of total crypto trading volume by offering the best prices on a broad range of assets, a world-class trading experience including advanced charting & analytics, and novel tools for professional and retail traders.

Gasless Voting

Gasless voting via the Snapshot governance platform was added in April 2021. The popularity of the proposal to move to Snapshot was apparent as the Bancor community not only passed the proposal with a 98.4% majority, it was also the largest voter turnout for any DAO decision thus far, with 84 unique address participating.

The implementation of Snapshot makes it far easier for community members to participate in governance, and this has been borne out in the real world, with over two dozen proposals added to Snapshot in the month following the addition of gasless voting.

If there is ever a problem found with Snapshot there is a quick-release mechanism that will revert governance back to the Ethereum blockchain. This will serve to protect the DAO in the case of emergency.

Conclusion

One of the major roadblocks in mass adoption is the lack of liquidity, and difficulty in exchanging various tokens for each other. The Bancor Protocol has done away with this problem through the automation of liquidity.

It’s true that complete beginners will face a small learning curve, but the UI of the wallet is as simple as they come. Anyone new to cryptocurrencies should have no problem learning how to make exchanges using the Bancor wallet.

And the newest update to the online platform is making things even easier for users as the team is now focusing its efforts more on creating a powerful and easy to use platform rather than building liquidity.

Moreover, the Bancor Protocol is making it easier for developers to build a seamless exchange application between a plethora of tokens. There are also a host of updates that have been planned for the next 6 to 12 months. This is part of the ongoing upgrades to the protocol and applications involved in the Bancor ecosystem.

Of course, there are still questions linger around the project including the issues of regulations in the U.S. and beyond. Potential centralisation of control in the three year transition period may deter some who fear the potential for arbitrary frozen accounts.

You also have the really paltry token performance of BNT especially over the past year. While the majority of tokens were soaring 500% or more in early 2021 the gains for BNT were relatively tame. It was one of the few tokens that did not reach a new all-time high in 2021.

Either way, Bancor does have some great technology, use cases and a strong team powering it forward.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.