Band Protocol Review: Secure & Interoperable Oracle Solution

A 10x increase in price is normal in cryptocurrency, especially during bull markets. What is not normal however, is a 10x increase during a 30-day period when the crypto market was relatively calm. There are only two explanations for this: either the price of this asset is being manipulated, or the asset in question is Band Protocol’s BAND cryptocurrency token.

Band Protocol has been around for a few years but only recently released its revised main net. Over the last few months, the project has partnered with dozens of notable cryptocurrency projects including ICON and Elrond and has seen its native BAND token make the cut for listing on multiple reputable exchanges such as Coinbase and HTX.

“Great” you might be saying “but what is so special about Brand Protocol”? Well, Band Protocol seeks to solve cryptocurrency’s “oracle problem” by creating a platform which sources reliable real-world data in a decentralized manner and feeds it to Dapps and smart contracts on cryptocurrency blockchains. BAND’s 10x price pump is not unwarranted hype – it might just be the beginning!

The History of Band Protocol

Band Protocol began in the mind of Soravis Srinawakoon, a Forbes 30 under 30 entrepreneur with Stanford as his alma mater (undergraduate AND masters!) and Boston Consulting Group on his resume. While working for BCG he founded several start-ups involving energy drinks, coffee, and even deep-fried Tofu chips.

Srinawakoon became involved in cryptocurrency in 2014 when he heard that MIT “airdropped” 100$USD worth of Bitcoin to all undergraduates who completed a survey. Fun fact: the 0.3 Bitcoin each respondent received is now worth over 3500$USD.

Shortly after the airdrop, Srinawakoon and his friends developed a cryptocurrency “gambling” website which doubled as a Bitcoin faucet – it rewarded users in Bitcoin for winning in casino-esque games on the website. At the website’s peak, Srinawakoon sold and used the funds to begin development on a project that would eventually become known as Brand Protocol.

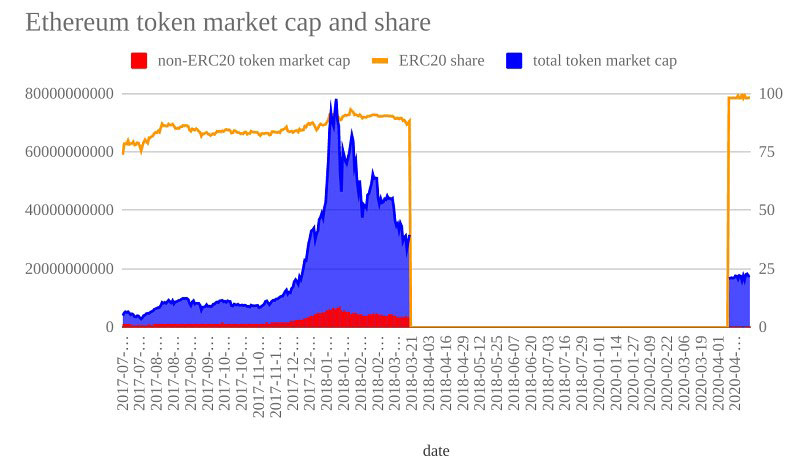

Srinawakoon realized that as communities grow, the quality of interactions within those communities decreases. In his view this is primarily due to misinformation and a lack of accountability. As such, Band Protocol was originally designed to feed accurate and reliable information into online communities built on cryptocurrency blockchains and was originally released on the Ethereum blockchain in 2017.

Over time, the Band Protocol evolved to focus more on the oracle element of its purpose. The growth of the DeFi and Dapp space brought the realization that many of these technologies cannot function if they do not have access to real world data such as the price of various cryptocurrencies. Moreover, these protocols would have very limited use-cases and user bases if they were siloed off from the real world within their own native blockchain.

Realizing this, the Band Protocol team scrapped the community-focused ethos of the Ethereum-based version of the protocol and began creating a new, specialized oracle protocol that would be faster, cheaper, and more developer friendly than any other oracle on the market. This led to the launch of Band Protocol’s new main net in June of this year. It is part of the Cosmos Network and was built using the Cosmos SDK.

BAND cryptocurrency ICO

The Band Protocol has had 2 ICOs and 1 IEO. The first ICO was public took place in August of 2018 and saw 10 million BAND tokens sold at a price of 30 cents USD per BAND, for a total of 3 million USD raised. The second ICO was private took place in May of 2019 and saw 5 million BAND tokens sold at a price of 40 cents USD per band, for a total of 2 million USD raised.

Band Protocol’s IEO was by far its most successful funding round, raising nearly 6 million USD. This saw just under 12.4 million BAND tokens sold at a price of 47 cents USD per band via the Binance Launchpad. All BAND tokens sold during the ICO and IEO rounds were ERC-20 since the initial version of the Band Protocol was built on Ethereum.

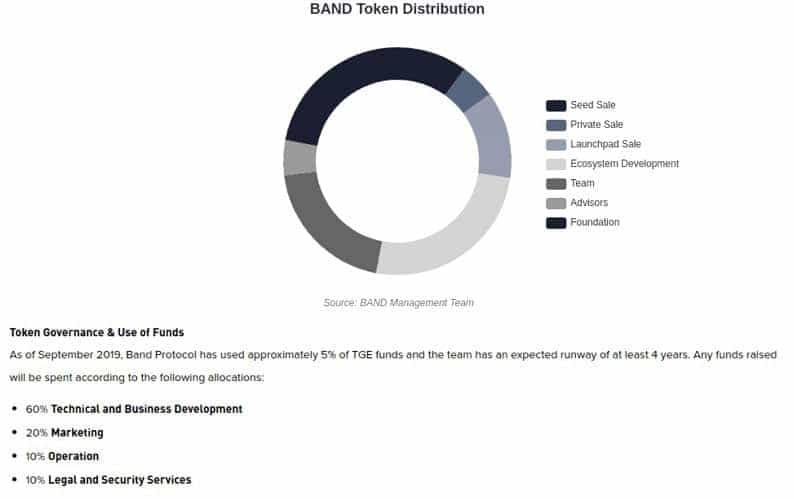

The total supply of BAND is 100 million though this is expected to change in the future (more on this later). 27.37% of all BAND tokens were sold between the 2 ICO and IEO rounds.

Of the remaining supply, 25.63% was allocated to Ecosystem Development, 20% of the tokens went to the Band Protocol team, 5% of the tokens were allocated to advisors of the project, and the remaining 22% of tokens were reserved for the Band Protocol Foundation. There does not seem to be any information about this foundation in Band’s current documentation or Medium.

What is Band Protocol?

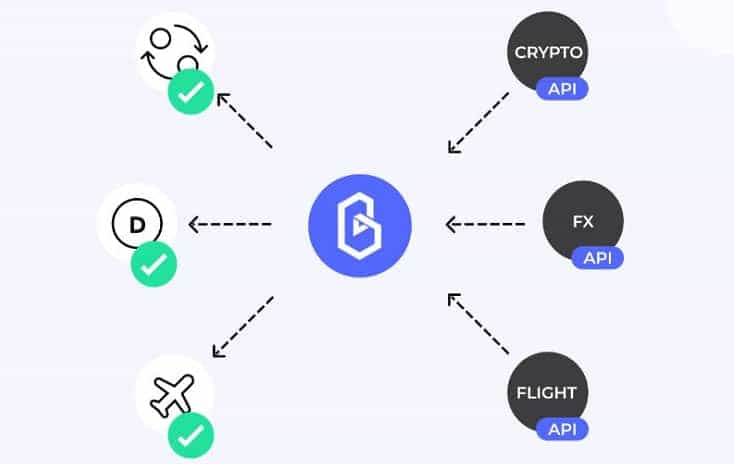

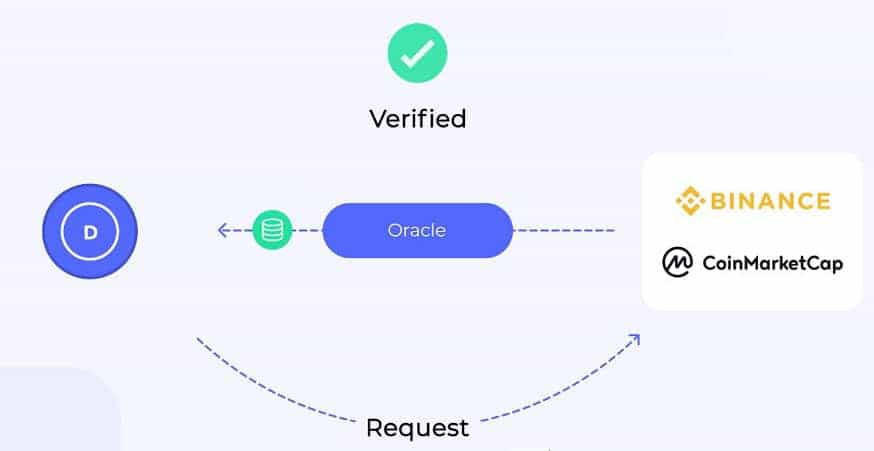

Band Protocol describes itself as a “cross-chain data oracle”. This might not tell you much if you are unfamiliar with the terminology. In cryptocurrency, a data oracle is a program which can aggregate and connect APIs and real-world data to decentralized applications and smart contracts on cryptocurrency blockchains.

This data can include things such as weather, stock price, cryptocurrency price, and even flight logs. As you might have guessed, cross-chain means that Band Protocol is able to do this for multiple blockchains and not just Ethereum, something which is currently lacking and is a major selling point for the project.

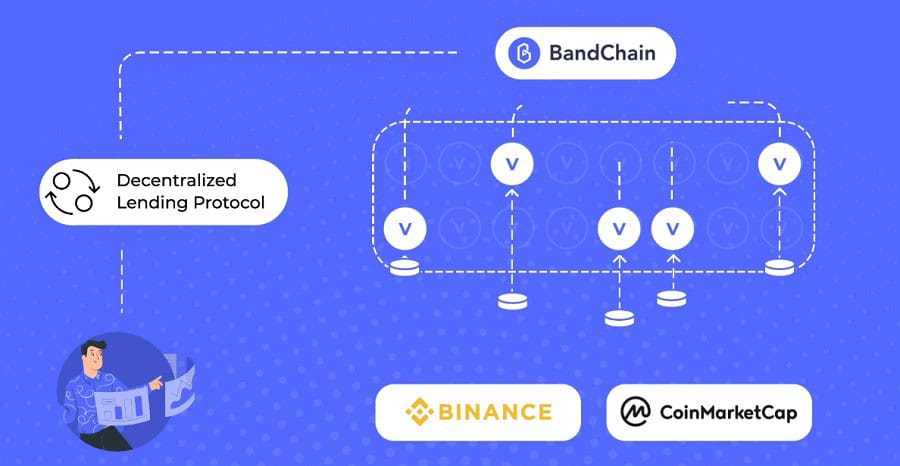

The Band Protocol blockchain is known as the BandChain and its native BAND token is used for staking by validators and delegators to incentivize accurate and up to date data feeds (more on this in a moment).

As mentioned previously, Band Protocol’s BandChain is built using the Cosmos SDK. In addition to being blockchain agnostic, Band Protocol’s oracle is fast, cheap, and easy to implement on virtually any blockchain.

How does Band Protocol work?

Luckily for you (and for us), how Band Protocol works now is much easier to understand compared to how it worked before. The Ethereum version of Band Protocol involved multiple data-based communities, each with their own unique tokens which were backed by the BAND token and fluctuated in value based on demand for the data within that community.

This is important to briefly note because a lot of the secondary sources out there (e.g. articles and YouTube videos) are about the Ethereum version of Band Protocol. The BandChain (the current Band Protocol blockchain) is a much simpler delegated proof of stake (DPos) mechanism for sourcing reliable data. It is essentially a network of validators and delegators which ensure consistent and accurate external data.

When someone wants to request data from the Band Protocol, they submit a smart contract to the BandChain containing the details of what data they want and how they want it to be aggregated. Validators are then pseudo-randomly selected based on the weighted average of their respective stake to provide the data.

They do this by fetching the data from the sources specified by the smart contract and aggregating the data in the manner specified by the smart contract. This data is then stored on the BandChain and is readily available for any other requestors (if there are any).

If this is hard to wrap your head around, you can think of it like ordering at a restaurant. You submit an order (smart contract) for a burger (data) and specify in the order that you want mustard on one bun and ketchup on the other bun (the specific way you want the data added together).

Cooks (validators) are “randomly” selected based on how well they can cook a burger (maybe the best burger cook is on the toilet, so they choose the second-best burger cook instead). After paying for your order (in BAND tokens) you receive your custom burger (data). In contrast to restaurants, this process takes 3-6 seconds from start to finish on the BandChain and costs less than 1$USD.

How does the BandChain Work?

Validators on the BandChain are tasked with generating new blocks and processing transactions (providing data). Validators are rewarded in BAND tokens for generating new blocks and providing reliable data. Validators are able to set their own fees for the data they are providing.

Validators can also have their stake partially “slashed” if they are offline for too long, if they double-sign transactions (charge more than their stated fee for a data request) or if they are unresponsive to data requests.

In contrast to many other DPoS and PoS consensus mechanisms, the amount of stake required to become a network validator is not a fixed number but is instead dependent on the size of other validators’ stakes.

If you want to be a validator on the BandChain, you must be among the top 100 largest stakers on the network. You can place on this leaderboard either by shelling out the BAND required to do so or convincing enough people to delegate their BAND to you.

Delegators delegate their BAND tokens to validators of their choice in exchange for a small cut of the block rewards and the validator’s data request fees. While there is no binding rule forcing delegators to vet the validators and their data, they are incentivized to do so because if the validator they staked on behaves maliciously, delegators will also see part of their staked BAND tokens slashed.

Both delegators and data requestors can use the Lite Client protocol to verify the quality of data provided by validators.

Band Protocol Governance

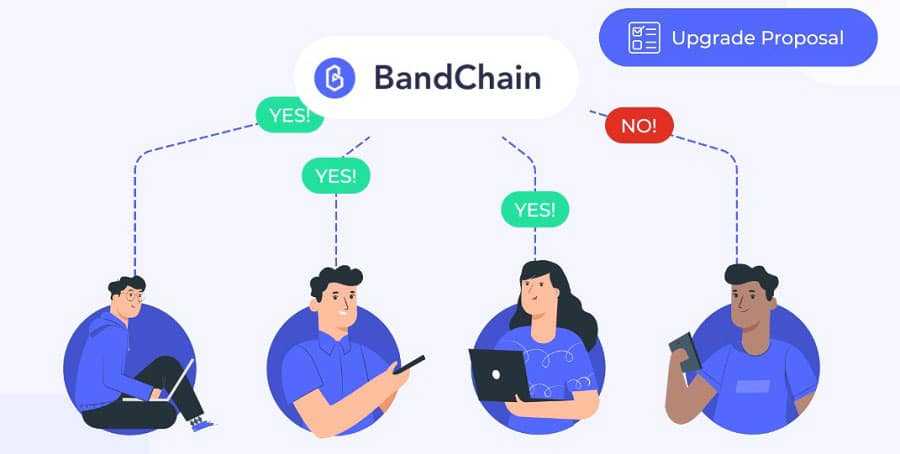

Both validators and delegators can vote for or against proposed changes to the protocol wherein 1 vote is equal to 1 BAND token. Delegators do not have to vote in the same manner as the validator they are staking on.

In fact, the votes from delegators override the votes cast by the validators to “counterbalance” the protocol’s governance. If a delegator does not cast his or her vote, their would-be votes are automatically cast in the same manner as the validator’s votes.

There is one last thing to note about how Band Protocol works. Call it clever or cruel, but the new version of Band Protocol is designed to introduce a variable inflation rate to the BAND token supply. This can be anywhere between 7-20% per year and exists to incentivize network participation among BAND token holders.

The goal is for a minimum of 66% of BAND’s total circulating supply to be staked on the network by validators and delegators. This is inflationary pressure was introduced to ensure the protocol remains sufficiently decentralized and secure.

Band Protocol vs. Chainlink

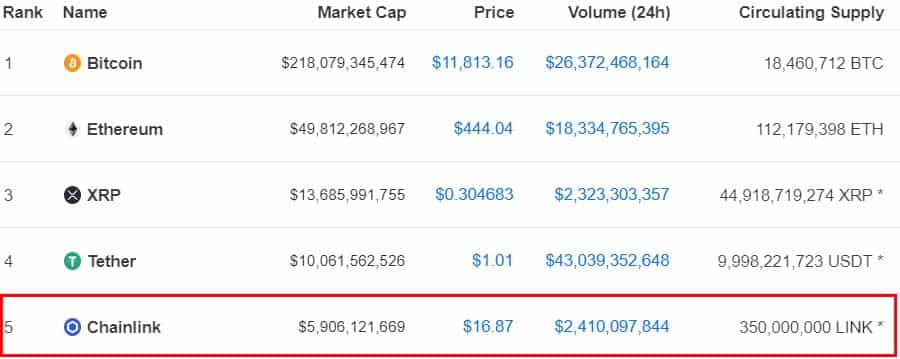

If you are thinking “wait a minute, this sounds a lot like Chainlink!” then you are correct. Band Protocol is considered to be a direct competitor to Chainlink, which is currently the most popular oracle in the crypto space by a long shot. Some of Band Protocol’s features are best appreciated and understood when compared and contrasted to those of Chainlink, hence why we shoved this section under how Band Protocol works.

First, Chainlink’s oracle is only compatible with the Ethereum blockchain. Band Protocol’s oracle is chain agnostic – it is compatible with dozens of blockchains including Ethereum. Second, Chainlink’s oracle is a sort of “by request” service.

When you request data with Chainlink, you can choose which one of their trusted providers you want to fetch it for you and receive it after handing over some LINK tokens as payment.

With Band Protocol, chances are that the data you need is already stored somewhere on chain because it is constantly being fed into the network. This means that you receive the data faster and get it at a lower cost.

Even at the granular level, requests for data are handled on the BandChain as a single transaction on the blockchain. Chainlink sends out the request and receives the data in two separate transactions, meaning that there can be significant delay if the Ethereum network is congested.

The third difference between Chainlink and Band Protocol involves Know Your Customer (KYC) regulations. If you want to be a data provider with Chainlink, you must provide documentation proving your identity as an individual or organization. This is not necessary with Band Protocol – anyone can submit data if they have the stake required to be a validator.

One interesting thing to note is that the absence of KYC does not seem to make much difference since many data aggregators found on Chainlink are also active on Band Protocol. This conveniently brings us to our final point: exclusivity.

According to some sources, Chainlink prefers working with blockchain projects which grant them exclusivity over their role as oracle. That being said, it is common for cryptocurrency applications to use multiple oracles, especially in DeFi where errors in price data could lead to unprecedented chaos.

Band Protocol Roadmap

Band Protocol’s revised long-term vision is to be an oracle other blockchains both inside and outside of cryptocurrency. To achieve this, the team has outlined 4 phases of development named after notable Chinese icons.

- Phase 0 (Wenchang): This was the main-net launch of the current iteration of Band Protocol which occurred on June 10th of this year. This phase also included swapping ERC-20 BAND tokens for main-net BAND tokens (there are still many ERC-20 BAND tokens in circulation).

- Phase 1 (Guan Yu): This is which we are currently in, involves introducing a custom scripting language for smart contract oracle data requests on the BandChain. It also focuses on integrating BandChain with applications found on Ethereum and Cosmos-based blockchains.

- Phases 2 (Laozi) and 3 (Confucius): These focus on improving blockchain interoperability, allowing for alternative payment methods, and opening the doors to enterprise blockchains. Srinawakoon has noted that Band Protocol will be focusing on Asian markets for the foreseeable future (possibly due to Chainlink’s dominance in North America).

BAND Crypto Price Analysis

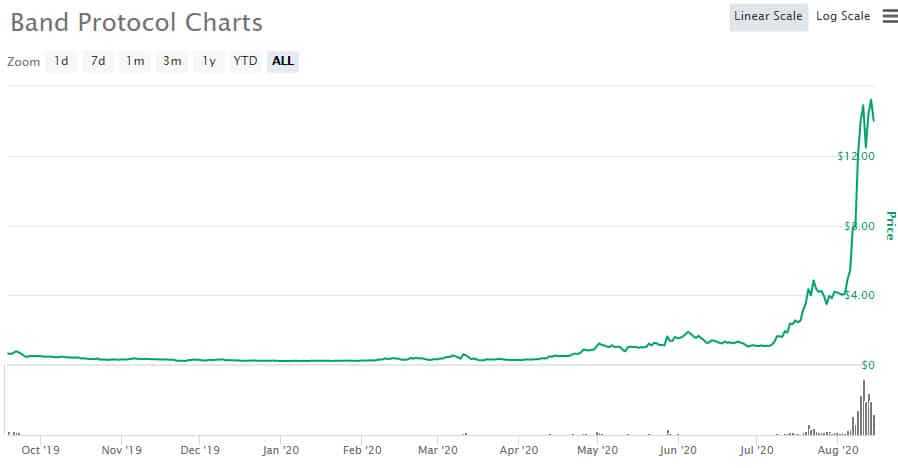

BAND’s price history is a sight for sore eyes and tells a tale of a little (virtual) engine that could. BAND was introduced to the market in the middle of the cryptocurrency bear market in late 2019. Its price remained flat at around 20-30 cents USD for months. This was just under its ICO price of 30 cents USD per token.

In April of this year, the BAND token price slowly began to climb, eventually exploding to over 17$USD on August 10th, exactly 2 months after its main net launch. This is a whopping 56x gain from its ICO price, and in the last month alone BAND token saw a 10x move as it was successively listed on reputable exchanges. Although there has been a slight correction over the past few days, BAND prices remain sky high compared to previous lows.

How to get BAND

The BAND cryptocurrency is available for trading on several well-known exchanges including Binance, HTX, and Coinbase Pro. If you prefer decentralized exchanges, you can trade BAND on the likes of Kyber Network and Uniswap (though with limited liquidity). Your best bet is probably Binance, considering that nearly 80% of BAND trading is happening there.

Register at Binance and Buy BAND

Speaking of liquidity, the 24-hour trading volume of BAND is almost equivalent to its market cap! This is very uncommon and even less common among stakeable cryptocurrencies (since they are locked in their designated protocols and cannot be traded). There have not yet been any changes to the total supply of BAND according to CoinMarketCap.

BAND Wallets

Now that BAND is on its own native blockchain, your options are quite limited when it comes to wallets. The only digital wallets which support BAND seem to be Trust Wallet, Coinbase Wallet, and Atomic Wallet.

The Ledger hardware wallet is in the process of adding BAND to its list of supported cryptocurrencies. If you currently have the ERC-20 version of band, we recommend sending it to an exchange such as Binance where you can withdraw it as the “new” BAND token.

Our opinion on Band Protocol

Band Protocol is a very, very exciting project with serious potential. This is for one simple reason: oracles are necessary for any sort of useful decentralized application to work.

Srinawakoon accurately describes the oracle problem as being worth “billions of dollars” and arguably just as valuable to Dapps as the blockchains which run them. Oracles like Band Protocol are quite literally the ‘internet connection’ which make “world computer” blockchains like Ethereum useable and valuable.

Earlier in this article we compared Band Protocol to the current leading oracle in cryptocurrency, Chainlink. You may be wondering how Band Protocol sizes up to Chainlink on an economic level. While we cannot provide any financial advice, we can point out a few things. Let us start with the numbers.

Chainlink is almost 20x larger than Band Protocol by market cap (6 billion vs. 300 million at the time of writing). Even though Chainlink is restricted to the Ethereum blockchain, this does not really matter given that almost every widely used Dapp or DeFi protocol is built on Ethereum. As such, Band Protocol’s ability to be blockchain agnostic is not very valuable when nothing is really being built on other blockchains.

On the flip side, the reason why Ethereum remains dominant could be because there is a lack of reliable and cost-effective oracles available for other blockchains to build competing Dapps and ecosystems. If this is the case, then Band Protocol could stand to become the Chainlink of non-Ethereum blockchains.

There is no way to determine what this would mean in terms of price, but we believe that Srinawakoon’s assessment that oracles are just as valuable as the blockchains they service is 100% correct. This means that Band Protocol and even Chainlink are both undervalued.

Given the accelerating pace of DeFi, they will only continue to grow in value as Ethereum and similar blockchains gradually take the center stage in crypto, perhaps even challenging Bitcoin as the largest cryptocurrency.

The only real issue we see with Band Protocol is one that is unfortunately universal within cryptocurrency and that is token allocation. Not even 30% of BAND’s total supply is in the hands of investors and BandChain participants.

To add insult to injury, Srinawakoon once remarked in an interview that “users don not care about decentralization” and the protocol seems to be headed in a direction wherein it will consist of a centralized conglomerate of validators with passive delegators.

Despite these concerns, we are still incredibly bullish on BAND. The Band Protocol still has a lot of room to grow and has a serious shot of being one of the most valuable cryptocurrencies on the market.

This will fundamentally depend on how much other cryptocurrencies grow, specifically those which are trying to be “Ethereum killers”. The good news is that from a long-term perspective, it is not too late to invest in BAND!

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.