BaseFEX Review: Complete Exchange Overview

BaseFEX is a cryptocurrency derivatives exchange that offers leverage trading on Bitcoin, Ethereum, and other cryptocurrencies. The platform provides a user-friendly interface, advanced trading tools, and a robust security system to ensure a seamless trading experience for its users.

BaseFEX is a new cryptocurrency futures exchange that gives traders the opportunity to trade crypto with leverage.

BaseFEX is based in Hong Kong and have been developing their trading platform for over 2 years. Offering leverage of up to 100x on a user friendly yet advanced product, they hope to be able to challenge the status quo.

However, can you really trust such a new exchange?

In this BaseFEX review, we will give you everything we found out about this exchange. We will also give you some top tips that you need to consider when trading here.

Overview

BaseFEX officially opened their books in December of 2018. Although the team is based in Hong Kong, they are registered in the Republic of the Seychelles as Base Investing Corporation with a company number of 205276.

The company is run by Jesse Wu (CEO) and Isaac Zeng (CTO). They claim that it is the mission of BaseFEX to be the "most reliable, transparent and advanced cryptocurrency derivative exchange, and make trading smooth, secure and accessible for traders worldwide."

Given that they are developing a cryptocurrency derivatives exchange, they are looking to challenge the likes of BitMEX, Deribit and Prime XBT among others.

They offer leverage on four different cryptocurrency pairs that goes all the way up to 100x. This is on some of the more exotic cryptocurrency pairs which we will cover in the asset support section.

BaseFEX is able to take clients from around the world and they have translated their site into 5 different languages. These include English, Japanese, Korean, Chinese and Russian.

Despite their global presence though, there are some regions where they cannot accept traders. These include countries such as the United States of America, Québec (Canada), Cuba, Crimea and Sevastopol, Iran, Syria, North Korea and Sudan.

BaseFEX Leverage and Margins

BaseFEX allows their clients to trade crypto on Margin. This means that they can enter positions on trades that are many multiples bigger than they hold for said positions. The minimum margin that you can obtain here is 1%.

Trading on margin implies trading with borrowed money which implies leverage. This means that your gains / losses can be maximized by the leverage factor. At BaseFEX, this max leverage factor is 100x which is the same as their competitors.

Warning ⚔️: Leverage is a double edged sword where you can win and lose.

The exact instruments that you are trading at BaseFEX are futures products. These are derivatives that are bets on the price of the asset at some predetermined price in the future (expiry price).

BaseFEX also has typical "perpetual" futures. These are instruments that do not have an expiry time and are rolled daily into a new contract. They remain open until they are closed by the trader. These will track the spot price of the asset most closely.

Margin Requirements

When you are trading a futures contract, you have two different types of margin requirements. These are the initial margin and the maintenance margin.

These start at 1% for the initial margin and 0.5% on the Base Maintenance Margin. These of course differ according to the contract in question as well as the size of the overall position. The below table has the exact requirements.

| Asset | Base Risk Limit (R) | Base Maintenance Margin (M) | Base Initial Margin (I) |

| BTCUSD | 100 BTC | 0.50% | 1.00% |

| BNBXBT | 20 BTC | 0.50% | 1.00% |

| HTXBT | 20 BTC | 0.50% | 1.00% |

| OKBXBT | 20 BTC | 0.50% | 1.00% |

As you can see, both I & M will differ in discrete steps based on the size of the position. You will have to add up more margin depending on the size of the position - quite logical.

You also have the option to have an isolated or a cross margin account at BaseFEX. The Isolated margin is the margin that applies to a particular position and is hence restricted to that amount. The Cross margin is shared between your open positions and could be netted.

The default option at the exchange is the cross margin. You can read more about isolated / cross margin mechanics here.

Is BaseFEX Safe?

This is perhaps one of the most important questions and is particularly relevant when using a new exchange.

There are a number of things that one should look for when determining whether they should trust a margin crypto exchange. These include the way they handle their market risk, coin risk and as well as the tools that they provide users to protect their accounts.

Let's take a look at each of these.

Coin Management

Given that BaseFEX is dealing with cryptocurrency, they are constantly facing the risk of hackers trying to exfiltrate these coins. Hence, they have implemented prudent coin management protocols.

In fact, BaseFEX is one of the few exchanges that we have seen that makes use of 100% cold storage for all of their coins. This means that the coins are kept securely in an offline state away from the threat of these hackers.

Usually, we see exchanges have a limited percentage of coins in "hot" storage for paying out clients.

When it comes to the wallets that they use to manage these coins, these are multisignature wallets with 5 of 7 configuration. This means that in order to send funds, 5 of the 7 directors at BaseFEX need to sign the transaction.

Risk Management

Given that this is a futures exchange with up to 100x leverage, there is a great deal of market risk that traders are exposed to especially when it comes to liquidity.

Like other futures exchanges, BaseFEX operates a liquidation engine. This will take out those positions that have exhausted their maintenance margin (mentioned above).

They also operate what is called an "insurance fund". This is a pool to protect those traders who are exposed to late liquidation that is beyond the bankruptcy price of the trader's position. This insurance fund is replenished by the liquidations that are executed above the bankruptcy price on losing positions.

Warning ⚔️: To avoid liquidation, make sure your positions are well funded

Finally, there is an additional risk management system that has been designed to eliminate the threat of "socialized losses". This is through their dynamic Auto-Deleveraging system.

This is a system that will automatically deleverage those positions that are owned by the opposing traders according to a profit and leverage ranking. In other words, the more profitable and the higher leveraged positions are to be deleveraged first.

You can read more about their auto deleveraging system here.

User Security

Apart from security procedures in place on the exchange, BaseFEX has also provided users with some tools in order to protect their accounts individually.

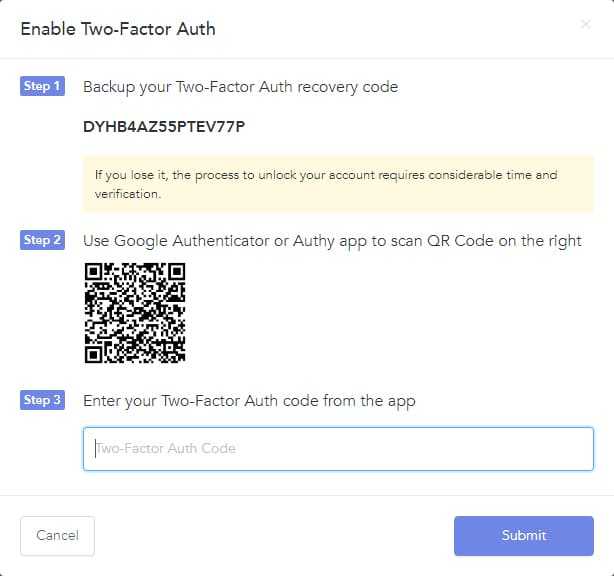

Firstly, they have standard two factor authentication security options. This means that before you can log into your account or authorize withdrawals, you will need to confirm it on your phone.

This is not enabled by default so you will perhaps want to do it the moment you have created your account. To do this, in your account management section you can head on over to the two-factor authentication section. Here you will generate the QR code that we have presented below.

Once this has been generated, you will need to sync it up with your phone. You will need an app that can manage this for you. Perhaps your best bet is the Google Mobile Authenticator.

Finally, BaseFEX also has all the standard encryption protocols in place in order to protect and secure communications. They have 256 Bit SSL encryption on their website which makes sure that all confidential communications are sent directly to their servers.

Caution ?️: Always make sure you see the browser padlock before login to BaseFEX

BaseFEX Fees

The fees that you are charged at the broker are particularly relevant when dealing with large volumes on leveraged trades.

So, how does BaseFEX stack up?

Well, they operate a standard "Maker-Taker" fee model. This is where those who make markets (create liquidity) will be charged a lower fee than those who take liquidity from the order books. Below you can see the exact fees at BaseFEX:

| Contract | Maker Fee | Taker Fee | Long Funding | Short Funding |

| BTCUSD | 0% | 0.05% | 0.0000% | 0.0000% |

| BNBXBT | 0% | 0.05% | 0.2063% | -0.2063% |

| HTXBT | 0% | 0.05% | 0.0100% | -0.0100% |

| OKBXBT | 0% | 0.05% | 0.0100% | -0.0100% |

As you can see, they will not charge you any fees when you are making liquidity on their books. However, for the takers, they will charge you 0.05% for the trades. This is about standard at other exchanges.

You will also see that they charge a "funding fee". This is a financing fee that is applied because you are trading on the margin with borrowed money. This is charged every 8 hours which is the funding interval.

Take Note ?️: BaseFEX offers bulk discounts of 50% on fees for those traders with more than $35m in volume

Finally, given that they are a crypto only exchange, you will not have to pay any deposit / withdrawal fees. The only fee that could be applied is an arbitrary miner fee which clears your transaction on the network.

Asset Coverage

In terms of asset coverage, BaseFEX currently offers 4 different types of contracts. These are all perpetual futures contracts but they are on some pretty interesting assets. Below are these assets:

- BTCUSD: The Bitcoin price in USD

- BNBXBT: Binance Coin Price in BTC

- HTXBT: Huobi Token Price in BTC

- OKXBT: Okex token in BTC

As you can see, they have the standard contract on Bitcoin but they also have the proprietary tokens from the other exchanges including Huobi, Binance and Okex.

These are all settled in Bitcoin and there are reasonable levels of volume for them on their books. There are some specific limits and contract specifics that you can read more about in their docs.

Unfortunately, they do not offer any other crypto derivative assets.

They have Ethereum on their homepage but they do not appear to offer a market in these yet. They also claim to offer standard futures but all of the contracts above are perpetual. Perhaps these are still to be added as the exchange is still brand new?

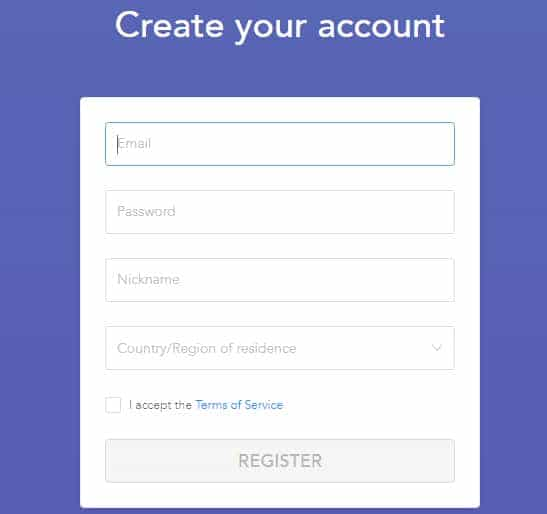

BaseFEX Registration

If you wanted to register at the exchange then you will head on offer to the signup page. All they need from you in order to create an account is an email address and a nickname. Below is is said form:

Once you hit submit then they will send you a confirmation code to the email supplied. You will need to insert this before your account is fully activated.

Take Note ?️: This code expires within 10 minutes

For those of you who are privacy conscious, you will be happy to know that BaseFEX is an anonymous exchange. They do not require you to complete KYC or submit any identifying documentation.

This is unlike other futures exchanges such as WCX or brokers such as 24option which require users to send them extensive documentation.

BaseFEX Testnet

Something that we found was quite a nice touch was the fact that BaseFEX offers a testnet platform at testnet.basefex.com. You can think of this as a demo account that are offered at other brokers.

This is great as it allows you to trade on the BaseFEX platform in a non-threatening way without risking any real funds. They will give you demo funds of 10BTC that you can practice your trading with.

Although the testnet is run through a separate sub-domain, it still has all the same features and functions as the live account platform. Hence, you are getting the exact feel of how it would look when you are trading with the live account.

Speaking of the BaseFEX platform, let's move right onto the belly of the beast…

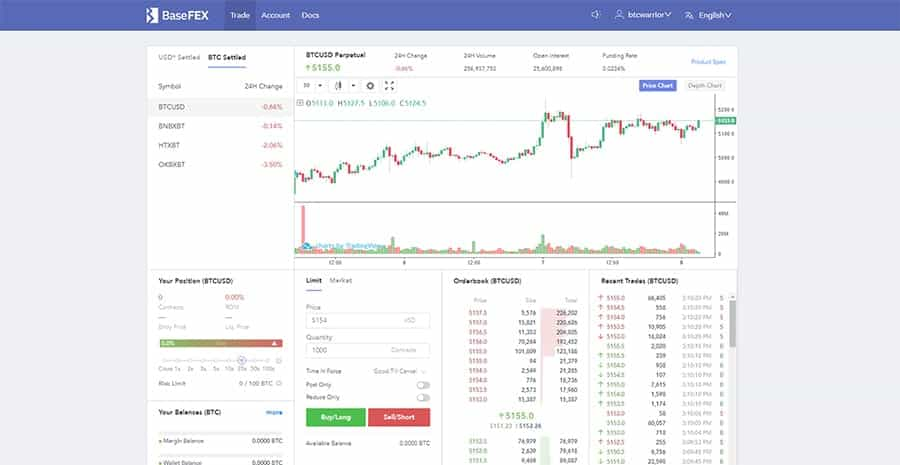

BaseFEX Platform

The trading platform is actually quite advanced yet relatively intuitive and user friendly. One can see that the developers spent a great deal of time focusing on the UI of the platform.

Below you can see the web-based platform. On the left you have the different markets that you can toggle between. To the right of this you have your charts. Like many exchanges, BaseFEX makes use of third-party trading software from tradingview.

Tradingview charts are well known to many traders and have a range of technical analysis tools and studies. You can also switch between the price chart and the market depth chart to get a more clear picture of the market.

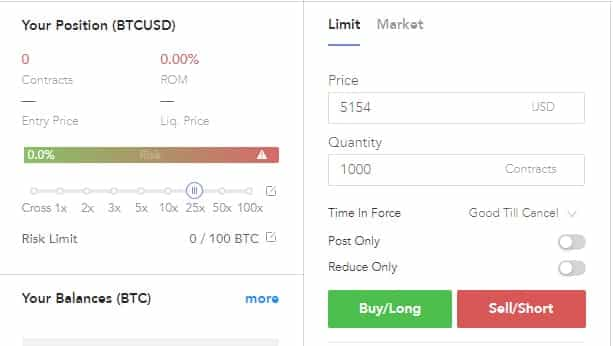

Below the charts you can adjust the leverage that you would like to take on. Next to that you have your order forms, orderbook and recent orders. Below all of these you have your recent trades, open orders and open positions.

Order Types

BaseFEX gives you some customization in how you can place your orders on their platform.

Firstly, next to the order you can adjust the amount of leverage for the positions. When you adjust these parameters, it will show you the liquidation price, active margin and Entry price.

Then, next to this you have the order forms where you can place a range of different orders. These include the following:

- Market Order: These are orders that are executed at the market rate and should be executed the moment that you have placed them

- Limit Order: These are orders that you will place at a certain level that may be away from the market price. These could be above or below the price and will only be executed once the market reaches these levels. How long this order remains open depends on order life. There are three different variants at BaseFEX:

- Good Till Cancelled: These orders are left open as long as the trader decides to leave them there. They have an indefinite order live

- Fill or Kill: With this, the order will either be executed in full at the price that has been chosen or it will not be executed at all (no partial orders). The order will then be cancelled.

- Immediate or Cancel: Here, all or part of the order will be executed immediately whereas the those that are not filled immediately will be cancelled. This differs mainly from the "Fill or Kill" in that partial orders are accepted.

You also have additional Limit order parameters in that you can select a "post only" order. This will not be executed immediately at the market such that you can get the maker discount.

They also have the "reduce only" that will only reduce to a current position that you have and not add to it. If the order were to increase your position it is amended down or cancelled entirely.

Currently, we could not see any stop orders on their order form. This means that you cannot place more involved risk reducing stop losses or take profits. They seem to mention this in their docs so perhaps this is on the way.

Pro Tip ✔️: You can use Limit orders that are away from the market as a Quasi "stop loss" or “take profit”

Funding / Withdrawal

Assuming that you were happy with the platform from the demo run, you will need to fund an account to start trading. As we have mentioned, this is a Bitcoin only exchange which means that they do not take fiat currency.

This means that if you want to fund your account you will need to use a fiat gateway crypto exchange in order to get your Bitcoin. These include the likes of Kraken or Bitstamp.

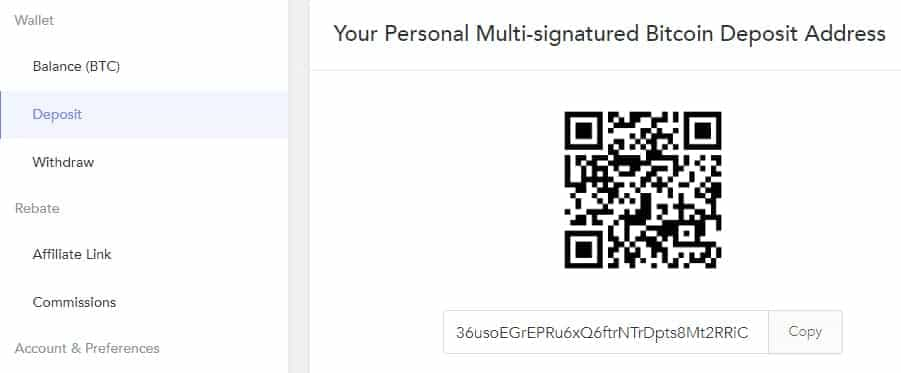

Once you have got your Bitcoin then you will need to head over to your wallet section on the exchange and hit "deposit". This will bring op your unique wallet at BaseFEX in both QR code and string form.

Note ?️: The minimum deposit amount is 0.0001BTC and it will be credited after 1 confirmation

Withdrawing is just as simple. You will head on over to the withdraw section where you can insert the address of your offline wallet. They will present you with the fee that will be applied to the withdrawal which is the network fee.

Once you have submitted your withdrawal request, you will have to first approve it in a confirmation email that will be sent to you.

Given that they store 100% of their coins in cold storage, your withdrawal request will have to be completed manually. Therefore, you should factor in some time for them to complete this.

Note ?️: Withdrawals are processed at 07:00 UTC every day so make sure to have submitted before

Customer Support

For those people who have experienced bad customer support from exchanges, you will understand that it can make or break your trading experience.

So, how does BaseFEX stack up?

Well, given that they do not have to complete KYC on their traders, it does free up a lot of the time that the support staff can spend on more important account queries.

They claim to operate a dedicated support team that works 24/7 to address trader concerns. They can be reached through a number of mediums including the following:

- Email Support on [email protected]

- Through a telegram channel that is run on the exchange.

- On their official Twitter account at @basefex

Unfortunately, there is no dedicated phone line or chat function on the exchange. Perhaps this is something that they could implement somewhere down the line.

We wanted to test out the effectiveness of the customer support team so we reached out to them on their support email. We had a general question on the order types and they responded in under an hour - quite efficient and helpful.

Pro Tip ?️: General questions will get answered that much more effectively in their FAQ section

BaseFEX API

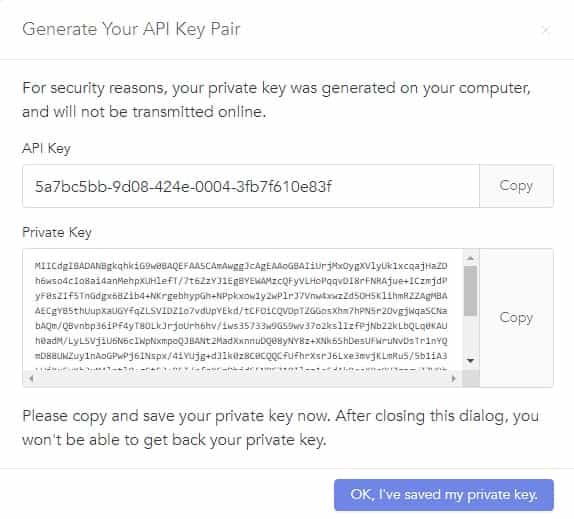

For those developers among you, you will be happy to know that BaseFEX offers full API functionality. This will allow you to develop scripts and bots that will trade crypto algorithmically.

They offer a full REST API as well as a WebSocket streaming connection.

In order for you to start using the API, you will have to get your API key. This can be accessed within your account management section. You will head on over to the "API Keys" tab. You will be presented with the below:

Here you can choose the name of the API key as well as whether you would like to bind this key to only one IP address. This will prevent hackers or other users from trading on your account should they have access to your key.

Once you have approved the creation, you will be presented with your API key as well as your private key. Both of these will be required to create an authorization token for API access.

Warning ⚠️: Your private key is only generated once and displayed once. Write it down and keep it safe

The rest of the process requires you to generate an access token. You can follow the instructions presented in their GitHub as it is quite involved and requires coding experience.

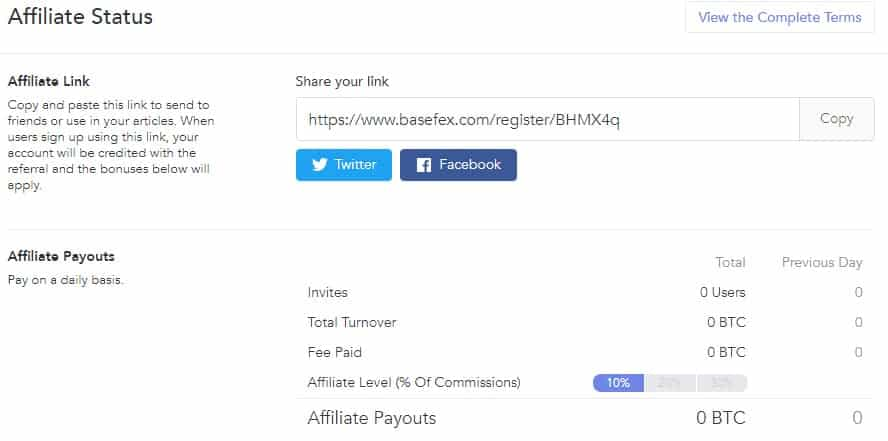

BaseFEX Referrals

If you have been trading on BaseFEX and you found your experience to be quite a pleasant one then you could always suggest it to friends and followers.

Why not get paid for it?

BaseFEX will give you referral commissions for the traders that you send their way. This commission is based on the total trading commissions that are earned by the exchange. It is also tiered and will increase the more volume that your traders do.

If you wanted to start referring these people to BaseFEX then you will need to get your affiliate link. This is also in your client area. Here you can also see the amount of commission that you have generated and the tier of referral you are on.

There is also an affiliate dashboard where you can see how you stack up compared to some of the other traders on the platform. If you are going to be referring people you should make sure you read the T&Cs before you do.

Areas for Improvement

While there was a great deal that we really liked about BaseFEX, we have to point out some areas that we think can be improved on.

Firstly, they do have a limited asset coverage. Although they do offer exotic BTC pairs, they do not have any of the other more mainstream cryptocurrencies such as Ripple (XRP) and Ethereum (ETH).

Secondly, there is no mobile app on the exchange as of yet. This means that if you wanted to trade on BaseFEX away from your desk then you will need to use the mobile browser which is far from ideal for a crypto platform.

Moreover, their order functionality is still quite limited. This could change when the implement the more advanced stop losses and other parameters that they mentioned in their support docs.

Finally, they are still a brand new exchange which means that they don't have a "track record" per se. Of course, this is a catch 22 situation where all exchanges may have found themselves in when they started. As long as they run an efficient operation they can build this reputation up.

Conclusion

In the end, our BaseFEX review found them to be quite an attractive exchange that would be able to challenge the status quo in the crypto derivatives markets.

They have reasonable fees and a user-friendly platform. They have also augmented this with a prudent coin management protocol as well as strong trading risk management systems that avoid socialized losses.

Of course, there are areas for improvement but the exchange is still new and it is likely that they can easily implement these changes.

So, are BaseFEX really worth it?

We encourage you to do your own research but if you are looking for a relatively intuitive futures exchange with attractive leverage then you should consider them.

Warning ⚡️: Trading with leverage is risky. Make sure to practice adequate risk management

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.