As Bob Dylan once famously said, “The times, they are a-changin'”, a song title that is commonly quoted to describe the uncertainty of the times.

When Bob wrote the song back in 1965, he had no indication of just how turbulent the decades ahead would prove to be. His prediction turned out to be true in more significant ways than I imagine he intended.

After the financial crisis in 2008, the birth of Bitcoin, the revolution of blockchain technology to follow, and then the global pandemic that caused economic disruptions in ways we've never experienced, yeah, the world certainly has changed from the world Bob knew back in the 60s.

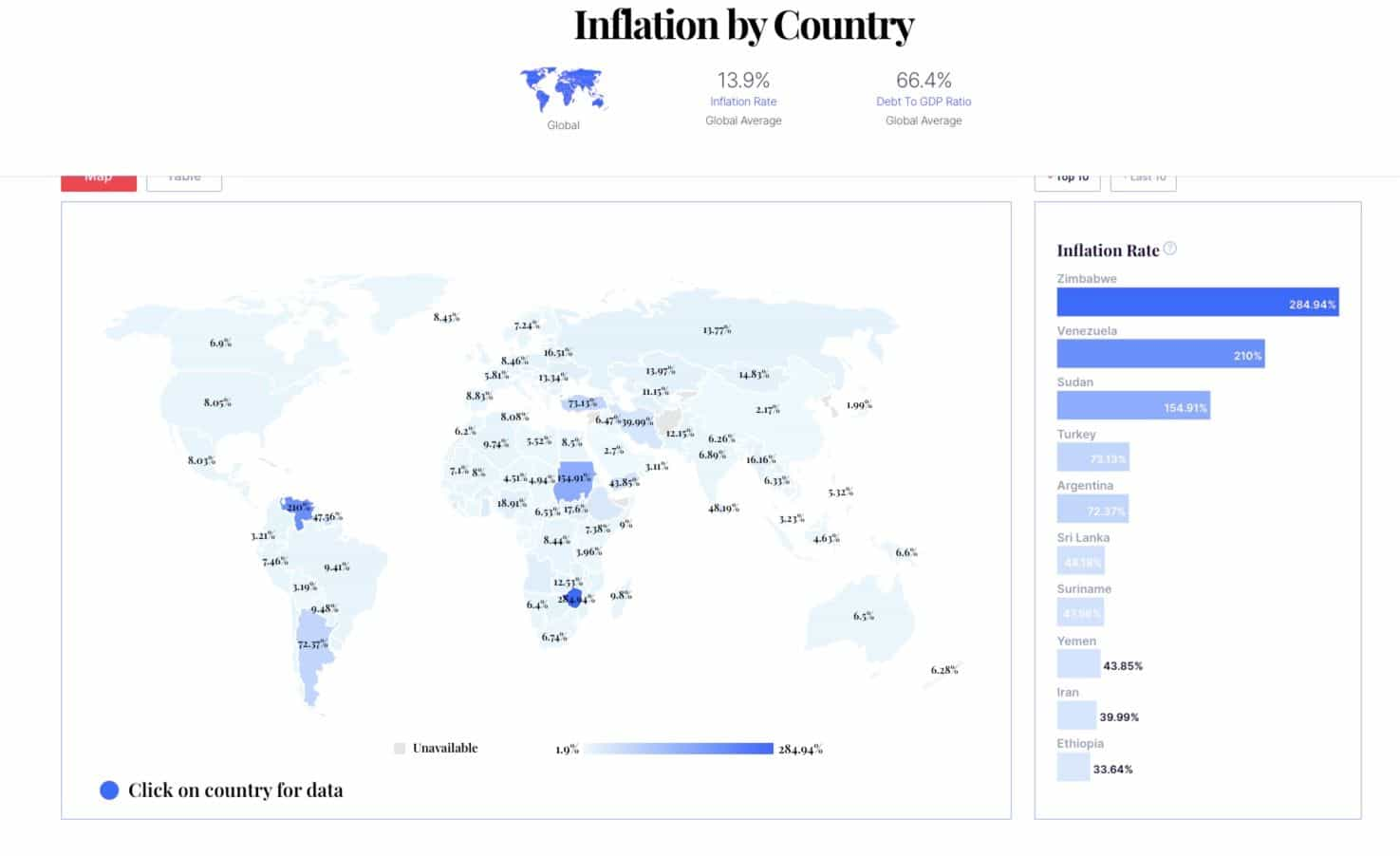

With inflation plaguing nations around the world, new investible asset classes popping up, national currencies collapsing, and digital currencies finding their way into governments and CBDCs, it is now more important than ever to take control over your personal finances. As the sayings go “An investment in knowledge pays the best interest", “The more you learn, the more you earn”, etc etc, finding trusted voices in the space to learn about managing personal finances is not only more important than ever but more accessible as well.

As the world opened back up and resumed a level of normality after the lockdowns, we have started witnessing a few interesting trend changes. Fewer people are commuting to work five days a week as remote working has become more widely adopted. Commercial real estate is at higher vacancy levels than normal, average folks are being priced out of the housing market at an accelerated pace, and more people are discovering their entrepreneurial side as more businesses were started during lockdown than at any point in history. We are finding ourselves entering a different world from the one we knew before.

Discovering Financial Literacy

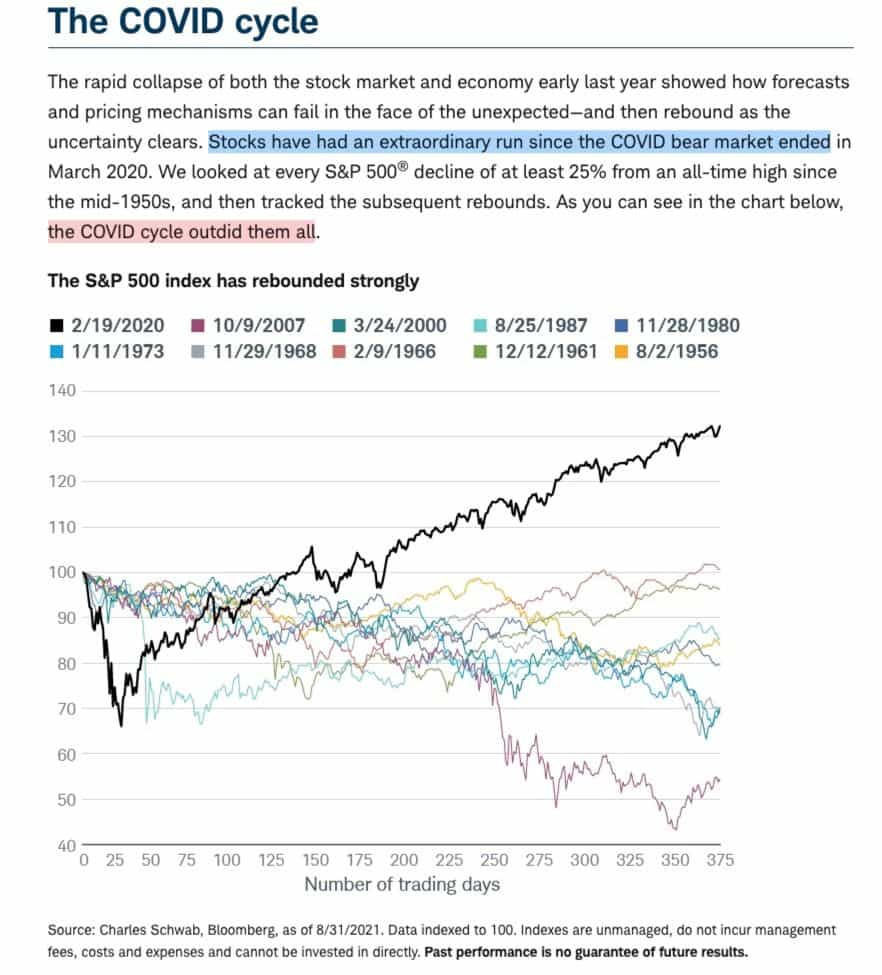

As the weeks and months of lockdown rolled on, with little else to do, many turned to investing and trading as a way to pass the time and make some money. The unprecedented growth experienced by stock trading companies like Robinhood, the euphoric crypto cycle we found ourselves in as billions worth of retail money started trading and investing in digital assets, and then we witnessed the phenomenon of instances like the Wallstreet Bets Gamestop saga, it was clear that people were taking an active interest in finance, investing, and trading to higher degrees than ever before.

And this trend continues. It seems that once people started down the rabbit hole of seeking out financial knowledge and literacy, there has been a significant increase in financial books, podcasts, YouTube channels, newsletters, and more, being consumed by the average person at accelerated rates.

In fact, I had an interesting interview on financial literacy with Dr Goldston, a professor at Georgetown University and TEDx speaker, where we talked about a few observations we have both had about how younger and younger generations are expressing interest in finance and economics. I mentioned that when I was in my late teens, all I cared about was video games and seeing friends, and he mirrored the sentiment and mentioned how he has first-year University students talking about the Fed Chairman and interest rates, conversations that weren't even happening between Master's students when he was in school.

This observation is further echoed by the number of YouTubers out there under the age of 25 who are delivering sage advice video after video to their followers.

The Growth of Personal Finance

Once upon a time, people left their monetary affairs in the hands of trusted professionals such as financial advisors, portfolio managers, accountants, brokers and the like. The age of the internet, with instant access to knowledge and investing platforms has changed that. The professionals are still in business, but many millions of small-scale, part-time investors are taking matters into their own hands. After all, why pay someone a hefty retainer when you can do the necessary research yourself?

Personal finance is big business and, over the last year especially, interest has surged amongst people eager to take charge of their money. Whether it’s investing or trading or both, there is a growing hunger for knowledge, guidance and tips on how to maximize your financial strategy. There is a wealth of information out there and one of the most popular places to find it is on YouTube.

As with crypto, there are plenty of channels discussing personal finance and, as with crypto also, there are good ones and not-so-good ones. It can be hard to figure out which ones are best, as many of those with high numbers of subscribers are little more than get-rich-quick moonboys, or those merely eager to boast about how much they’re worth.

So, we’ve gone out into the wilds of YouTube to find you ten of the best personal finance channels out there. If you’re going to take the responsibility of managing your own finances, then doing plenty of research is vital. The YouTubers on this list have all enjoyed a great deal of success and are sharing their knowledge through high-quality, informative content.

In no particular order, here they are:

Top 10 Personal Finance YouTube Channels

Andrei Jikh

There’s no getting away from the fact that an awful lot of the personal finance gurus on YouTube tend to be absurdly young, flashy, or downright boring. Andrei certainly doesn't fall under the boring category and conducts himself with a healthy amount of “flash” with his magic tricks and antics, just enough to keep his videos entertaining as well as educational, although, for some, the young part may be offputting, but perhaps it shouldn't be, hear me out.

At first, it can seem a little disconcerting to see such youthful faces talking about investing and making money. After all, it’s natural to assume that older, wiser heads are more likely to offer sound advice, having presumably made their fair share of mistakes and learned from them over time. When I first started my financial journey, I had the same assumption and decided it wasn't worth taking financial advice from anyone under the age of 40.

Warren Buffet is a prime example in this regard. He’s been in the game for decades and is consequently one of the richest people on the planet. He will have forgotten more than most of us will ever know about making money.

But after coming across a few fantastic young YouTubers like Andrei, Graham Stephan, and others, I realized that we are not living in Mr Buffet's world anymore and these “youngsters” of today will be the Warren Buffets of tomorrow and there is a lot we can learn from those who have amassed vast amounts of wealth in modern times, not decades ago.

It's also interesting to note that YouTube is not really the sort of place you’d expect to find grizzled old investors, it’s a young person’s game these days and hey, if someone has made a lot of money through their own smarts, then who are we to quibble about how they look like they should still be in high school?

Andrei Jikh has certainly done alright for himself at the ripe young age of 34. Born in Russia with parents who were circus performers, he moved to the US with his family when he was nine after his father got a job with Cirque du Soleil. His first great passion was cardistry – tricks and illusions with playing cards – which he still puts to good use in his videos.

It’s probably Jikh’s background as a performer that makes him such a natural in front of the camera. His style is engaging and fast-paced, with plenty of humour thrown in for good measure. It’s served him well too, gaining him 2.27 million subscribers to date since he started the channel in 2019. After a slow start, he reportedly made $100,000 in his first year and hasn’t looked back since.

Jikh’s channel is home to a wide range of videos covering all manner of topics. Stocks, trading apps like Robinhood, passive income, real estate, Teslas, thoughts about the markets and yes, even crypto are all covered.

Like all the best YouTube channels Jikh’s is ad-free, so his videos play without pesky interruptions. The main attraction though is Jikh himself: fast-talking and funny, he clearly knows his stuff and has the lifestyle to prove it.

One thing I have grown to appreciate about Andrei is his down-to-earth approach and reliability. He did not come from riches and he’s happy to admit to his past mistakes.

Coin Bureau

Ok, so there’s no getting around the shameless self-interest here, but hey. We at the Bureau are proud of what we’ve got going on and what we offer our loyal subscribers: thoughtful, well-researched and wholly impartial advice about crypto.

There are plenty of moonboys out there more than happy to shill whichever coin or token they’re holding, without going into much detail about why it’s supposedly going to make you rich. Right from the start, Guy knew that wasn’t the way he wanted to go with Coin Bureau and he’s stayed true to that ever since. There are no moonboy antics or shilling on this channel, and that is one of the things our community have grown to expect from us and why we have become one of the most trusted voices in the industry.

The focus is all about education - with a bit of entertainment thrown in to keep things from getting too heavy. Guy loves nothing better than getting right down into the nitty-gritty of a crypto project, regulations, or macroeconomic factors, and quite often we have to edit some of his videos down to prevent them from being hours long. The aim is to help viewers with their own research, as they decide whether or not a project is worth investing in.

It was a steep learning curve when the channel started out, with any number of different disciplines to get to grips with. Progress was slow at first, but Guy and the team persevered, in part because of their belief in what they were doing and in part because they quickly realised that they loved it too. Through late nights, repeated reshoots and the occasional piece of news making a freshly edited video out of date, they kept going.

One thousand videos and over 2.3 million subscribers later, the channel is still growing strong. Subscribers seem to love the fact that they can get an in-depth knowledge of a project they’re interested in, from a respected and trustworthy source. There’s no getting around it, Coin Bureau is the best crypto YouTube channel out there: free of hype and free of ads too, as it happens.

The majority of Coin Bureau’s videos are naturally crypto-focused, but Guy does occasionally explore other areas relevant to personal finance. He especially enjoys exposing the tricks and scams that some of the big beasts of mainstream finance like to indulge in, all with the aim of making the case for crypto as part of a balanced portfolio.

As subscriber numbers have climbed, so too has the number of places where you can follow Guy on his journey through the cryptoverse. He’s now active across other platforms besides YouTube and is showing no signs of slowing down.

Graham Stephan

“What’s up Graham, it’s guys here.” Another fresh-faced American success story is at number three, but he’s got the highest subscriber count of all, with over four million to his name. Those are impressive numbers and Stephan deserves them: he’s made himself a lot of money through hard work and dedication in real estate, he turns out the videos like clockwork and he’s an entertaining host for his videos.

Stephan is a native of Los Angeles and got started on the road to riches when he went into real estate aged 18. Having not made it into college, he dedicated himself to selling houses and found he had a knack for it. From there he progressed to YouTube in 2016, where he started by making videos about making money from real estate.

Fast forward to now and his impressive output has expanded to cover all manner of other topics, including stocks, the markets, crypto, Teslas (his ride of choice), his response on how he is approaching certain economic factors, as well as his collaborations with other YouTubers like Andrei Jikh and Meet Kevin. He’s been so successful that he’s launched two additional channels, The Graham Stephan Show and The Iced Coffee Hour, both of which have some pretty decent subscriber numbers themselves.

Although his videos may give the impression that he leads a pretty high-end lifestyle, Stephan claims to save the vast majority of his income, with outgoings largely limited to the essentials (mortgage, bills, insurance etc). This strategy, combined with healthy revenue streams from YouTube, real estate and a few other related sources, saw him become a millionaire by the time he was 26. Some of his most popular videos showcase his frugal lifestyle and how people can save money in creative and innovative ways.

He keeps his subscribers updated on the make-up of his portfolio, as well as giving them a glimpse into his lifestyle. His girlfriend, Savannah Smiles, herself an up-and-coming YouTuber, also makes a few welcome appearances too.

4. Meet Kevin

May 2020 was probably a pretty forgettable month for most people out there, as the pandemic ensured that the majority of us were locked down with nowhere to go. But Kevin Paffrath and his wife Lauren had plenty to celebrate, as they banked over $1 million in monthly income for the first time.

Like a lot of personal finance YouTubers, Kevin started his career as a realtor. He and Lauren - who knows a thing or two about the real estate business herself - bought a rundown house in 2012 for $305,000 - using the bulk of their savings with only $8,000 leftover for renovations. After managing to turn a healthy profit, they realised where their future lay.

Lauren now runs their real estate business, while Kevin devotes himself mainly to pumping out the content for his 1.8 million-plus subscribers. He works a 12-hour day most days and it shows in the sheer number of videos he creates, on all manner of finance-related topics. It’s not unusual for him to post several videos a day and they rack up some impressive viewing figures too. Kevin even took an active interest in politics in 2021, announcing his candidacy for the Democrat party.

Some friendly advice from Graham Stephan helped Meet Kevin monetise his channel back when he was starting out and he hasn’t looked back since. He and Lauren now pull in north of $6 million a year, with over $7 million in their investment portfolio, as well as their property empire. Needless to say, the obligatory Tesla sits on their driveway. I have found a lot of helpful tips and tricks in his videos for anyone interested in real estate investing, and especially, for anyone wanting to get into flipping real estate.

5. Jordan Page, FunCheapOrFree

Personal finance on YouTube is not confined to videos about how someone has made a boatload of money. Sometimes it’s not all about how money is made, but how it is managed and made to go further. This is where Jordan Page comes in, with her channel devoted to budgeting, frugality and general good financial sense.

Jordan makes a refreshing change from your more stereotypical personal finance YouTuber and her focus is on making every penny count - a necessity for her seeing as she’s a mother to eight - yes, eight - children. Her admission that ‘I’m willing pretty much to do anything to save a buck’ may sound extreme, but she is as good as her word. She’s not too proud to ask neighbours for any leftover food and once managed to bake cookies on the dashboard of her car.

Jordan’s channel is much more focused on providing for a family than on making gains in stocks or crypto. It may not be what a lot of people are looking for, but there’s a lot of sound advice to be found there and Jordan’s always-positive, can-do persona always keeps things entertaining.

It’s an approach that has netted her nearly a million subscribers and saw her being featured on the likes of CNBC, TLC, Good Morning America, and more. Though her YouTube video has slowed down in terms of output, there are plenty of great tips and tricks for those looking to make every penny count.

The Financial Diet

Another great channel that features minimal amounts of real estate chat is The Financial Diet, which has been around since 2015 and boasts over one million subscribers to date. It provides a well-rounded and different approach to all things finance-related and states that it ‘talks about personal finance in a way that doesn’t make you want to curl up in a ball and cry.’

The Financial Diet is different from a lot of the other channels on this list, as it features a range of presenters and breaks its videos down into specific categories. Chelsea Fagan fronts matters but is joined by a wide variety of guests who contribute their expertise on all manner of topics.

Here is an example of just a few of the useful videos on the channel, broken down into easily digestible format:

- Investing vs Paying Off Debt

- The Lazy Person Budget

- ADHD and Money

- Will AI Take Your Job?

This is a great place to go to find videos that explore some of the myths around finance and that take a sceptical look at some supposed fixes that don’t work. In other words, it’s a channel that isn’t afraid to take a contradictory view of many of the fads and nonsensical ‘life hacks’ that seem to be everywhere these days. This alone makes it well worth a sub, but there’s plenty of down-to-earth, useful advice to be found there too.

Debt Free Millennials

Millennials are an intriguing generation. They are capable of the easiest, fastest, and most accessible methods of wealth generation than any previous generation, while simultaneously living in a world that has priced them out of the housing market, is lacking job security, has rumours swirling about governments running out of pension money, and being faced with higher interest rates not seen in decades, making borrowing less attainable. Yes, financial life can be bittersweet for the millennial generation.

accused of being obsessed with social media and financially imprudent by boomers who grew up in a world of affordable housing and job security. While there may be plenty to mock millennials for, there’s no denying that they’ve been dealt a pretty crappy hand when it comes to money.

Then many who decide to take the education route and manage to secure a decent career find themselves weighed down for decades under the burden of student debt, along with all the other crippling expenses that modern life imposes.

Debt Free Millennials host Justine Nelson is on a mission to help her fellow millennials navigate their way out of this hole. Despite earning $37,000 a year, she managed to pay off her $35,000 student debt in under three years and her channel is full of helpful ways in which viewers can do the same.

There’s no sugar-coating the fact that Justine has had to work hard to achieve her goal and she doesn’t offer easy fixes or “get rich quick” schemes. Her videos are full of hard truths, things people don't want to hear, but overall sage advice about tactics that will help serve you well in the long run. As the saying goes “Take care of the pennies and the dollars take care of themselves.”

Justine's laid-back personality and relaxed conversational style make them a pleasure to watch. She doesn’t go in for much fancy production either, but her content is all the better for it.

As well as getting out of debt, Justine also covers other aspects of personal finance, so you can figure out what to do with all that extra cash you’ll have lying around once all those pesky debts have been cleared. Her channel may have only a little over 70,000 subscribers - pretty small compared to most on this list - but that just makes it more of an undiscovered gem. It's also good to see her channel is growing at a faster pace than some of the mentions on this list, a testament to the quality and value on offer.

Nate O’Brien

Nate is another interesting addition to this list as he is quite a stark contrast to some of the other YouTubers on this list. For example, while the other YouTubers show off their Teslas and mansions, Nate has decided to move out of his apartment and live in his truck.

Yes, that's right, one of Nate's attractions comes from those interested in living a minimalist lifestyle and he has plenty of videos showing his viewers how to live off the grid, fly for $15, and how he sold everything in his apartment.

But it isn't just extreme savings videos, Nate touches on everything from investing, side hustles, passive income, entrepreneurship and more. Money-saving tips are just one arrow in his quiver of wealth generation or preservation techniques.

I have come to enjoy Nate's unflashy, down-to-earth approach. While many YouTubers seem to shout, have ridiculous thumbnails of silly faces, and have the dial on enthusiasm turned to 11, I much prefer Nate's style and how he just seems like an average, everyday Joe.

A visit to the channel can also yield a lot more viewing pleasure than just finance talk. Other notable videos include his thoughts on books, motivation, productivity, overcoming phone addiction and keeping a journal.

Wealth Hacker - Jeff Rose

Jeff Rose is a veteran of the YouTube personal finance space, having been around since 2011. His channel is all about ‘teaching you insanely actionable wealth building, investing and online marketing strategies.’ It’s brought him over 370,000 loyal subscribers and over 26 million views for his videos.

Rose is a US military veteran who served in Iraq and retrained to become a Certified Financial Planner (CFP) on his return from active duty. His quest for financial freedom is inspired by the debt struggles that his parents endured while he was growing up, which he believes contributed to his father’s death.

Rose’s channel has a range of videos on most of the usual topics we’ve come to expect, with a lot of content devoted to tracking finances, building wealth and smart portfolio building. He’s a little older than most of the faces we’ve seen on this list and his perspective is generally a little more worldly as he has experienced his fair share of hardships.

Besides the YouTube channel, Rose also runs financial education courses, writes for the likes of Forbes and Business Insider and has been featured in the likes of USA Today and the Wall Street Journal. He also has a successful blog cleverly titled Good Financial Cents.

Visit Wealth Hacker - Jeff Rose

Jack Chapple

Jack is an interesting YouTuber to follow as he mixes things up a bit. He combines the familiar talking-to-camera approach with some well-produced documentaries for which he provides the voiceover. Chapple has been providing this style of educational content since 2016 and has over 600,000 subscribers and over 50 million views for his videos.

What I appreciate from Jack is he takes some unorthodox concepts that you wouldn't normally think about and creates high-quality and thoroughly researched arguments as to why they may be plausible. Topics such as:

- How Morrocco Secretly Controls the World

- How Australia and Chile Are Trying to Control the Future

- The Netherlands is Controlling China

are just a few of the off-beat concepts he explores in his videos. They certainly give you plenty to sit and ponder over.

The channel is a good place to go to if you’re looking to understand some of the greater economic forces at work in the world today, as well as for the usual content about investing, side hustles and stock market plays. Chapple’s macro view of economic issues gives a useful and thought-provoking insight into how our lives and finances are shaped by events beyond our direct control.

Finance Literacy is Everyone's Responsibility

The popularity of these and other channels shows that there is a growing realisation amongst millennials - and others - that financial self-reliance and responsibility are more vital in today’s world than ever before.

One of my favourite quotes of all time comes from Donny Miller:

"In the Age of Information, Ignorance is a Choice" (source)

And that could not be more true as we have the entire encyclopedia of human knowledge readily available from a device we carry in our pockets.

Many of the certainties and safety nets of the past are gone forever and young people have little option but to wise up or face a lifetime of financial struggles.

It’s heartening to see personalities like all of those above preaching the doctrines of hard graft and good sense. Not everyone will be able to achieve what they have, but some sound advice and good examples can go a long way.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.