Bidao (BID) is building a decentralized Proof-of-Stake blockchain, which will also include a collateral backed stablecoin similar to the DAI stablecoin.

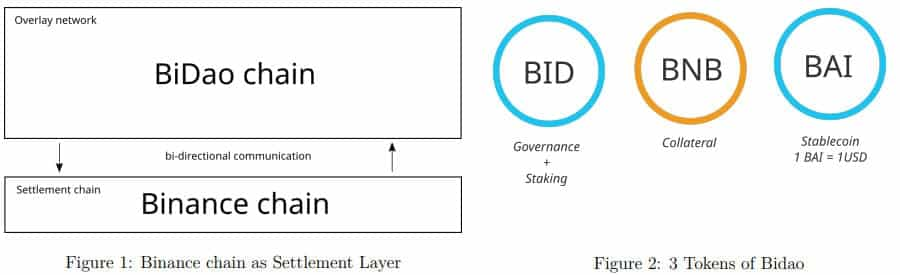

They claim to be a one stop shop for decentralized finance (DeFi) applications, and in its initial rollout will use the Binance-chain for its settlement layer. This means initially users will be able to interact with other cryptoassets on the Binance-chain.

However, can this project really be trusted and is it worth considering?

In this Bidao review I will be answering just that. I will take a look at the tech, team and use case as well as the long term potential for Bidao contributors.

Is BAI another DAI?

In some ways it appears that BiDao is trying to replicate the success enjoyed by MakerDAO with their decentralized stablecoin DAI. But rather than using the Ethereum blockchain Bidao is using the Binance blockchain. In looking at the Bidao model it is clear that it is quite similar to the model used by MakerDAO for DAI before it became multi-collateralized.

Looking back at the origins of DAI, it was created to use Ethereum smart contracts as a decentralized algorithmic stablecoin. It uses ETH as its collateral and MKR as the governance token.

Now have a look at the proposed Bidao system. The BAI stablecoin is a decentralized algorithmic stablecoin also, but based on the Binance-chain smart contracts. It uses BNB as its collateral and BID as the governance token. This system is remarkably similar to the MakerDAO system.

There are some differences however, as we will see below.

Understanding the Bidao Chain

The new blockchain being built by Bidao will use a system that’s similar to MakerDAO in the beginning, but eventually it will morph into a system more suited to decentralized finance (DeFi) as it expands to include numerous cryptocurrencies as potential collateral for the Collateralized Debt Positions (CDPs) that will be created with the Binance-chain smart contracts.

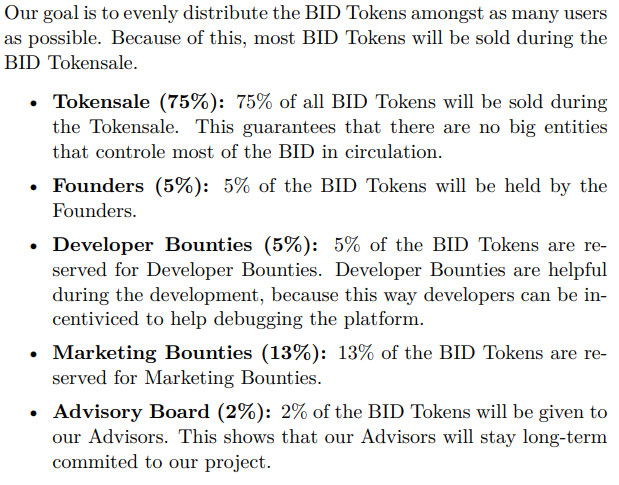

In the Bidao system there are three different tokens that are needed. The first is the governance and staking token, the Bidao or BID. The second is the stablecoin BAI, which will be paid out from the smart contracts.

The third is the BNB coin from Binance, which will be used as collateral and held in the smart contracts. Eventually this third token will expand to include a number of different blockchain’s cryptocurrencies that will be capable of being used as collateral in the Bidao system.

In addition to the creation of CDPs, it will also be possible for users to hold and stake BID tokens. This will allow users to help with consensus for the network and be rewarded with passive income. Currently the return for staking is set at 3% annually.

The BAI token is a decentralized algorithmic stablecoin which is paid out when creating a CDP and is pegged to the U.S. dollar on a 1:1 basis. Initially the CDPs can only be created with the Binance-chain BNB as collateral.

But eventually Bidao will become increasingly blockchain agnostic, integrating a number of blockchains and realizing the vision of becoming a blockchain agnostic DeFi application. The first steps toward this have occurred with the integration of Chainlink and Bidao in March 2020.

The Importance of Chainlink

In order to maintain security when reaching consensus, blockchains are only capable of using data already stored on the blockchain to process computations. Of course a blockchain could be made far more effective and useful when it’s able to access and use data and systems that aren’t part of the network, also called off-chain resources.

Blockchains have gotten around the security concerns of using off-chain data through the use of digital agents known as oracles. These oracles can connect with off-chain systems or data and pull it into a smart contract, and/or execute actions in the outside system based on instructions coded into the smart contract. In order for the oracles to perform correctly it’s necessary for both the external data and the delivery of that data to be as secure and reliable as the blockchain is itself.

Enter Chainlink (LINK), a decentralized oracle network. It provides decentralization at its oracle level and at the source of the data. Through the use of multiple nodes for each oracle Chainlink protects against any single oracle becoming a point of failure for the network. In the same way, multiple data sources are used in order to keep any one data source from providing false data.

The pool of security reviewed, Sybil resistant, independent operators at Chainlink has been continually growing, currently numbering 30, with each bring extensive PoS node operation experience.

In addition to its work with Bidoa, Chainlink has been working with more than 120 different projects. These projects run the gamut of enterprise size and use cases, and have come from the gaming, insurance, finance, and other sectors.

For DeFi applications Chainlink has 29 different data feeds, which are being used by many of the leading Ethereum dApps. Each node pulls its data from a pool of seven highly regarded data aggregation API providers.

The data provided by each is aggregated to create a single data point, which is then updates on-chain regularly based on specific intervals programmed into the smart contracts. These feeds give dApps the ability to use decentralized and accurate market wide pricing data which is redundantly secured by the oracle.

Using Chainlink to Secure Bidao CDPs

Chainlink already has oracles that produce price data for BTC/USD, ETH/USD and LINK/USD and Bidao is using this data as a reliable data feed to support the use of BTC, ETH, and LINK as collateral sources to back the BAI stablecoin. By using the data generated by the Chainlink oracle Bidao is guaranteeing it has price feeds which are decentralized, secure, accurate, and reliable.

In the case of the BTC/USD and ETH/USD price feeds, the data sources consist of 21 independent and highly secure decentralized oracles. In the case of the LINK/USD data there are 7 oracles.

Even with only 7 oracles it is ensures that the price feed reflects broad market price discovery that includes all the global liquidity sources. This diversity protects Bidao from market and oracle manipulation, including actions where low liquidity exchanges are attacked in order to provide false price data.

Bidao Initial Coin Offering

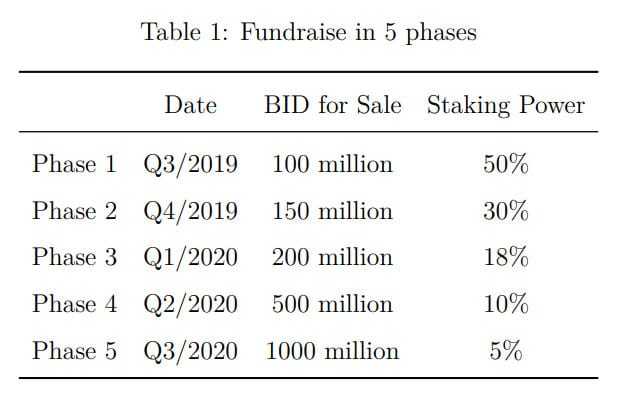

One issue with the BID and BAI tokens is the lack of listings on public exchanges, but that is set to change as Bidao has been raising funds through an initial coin offering which began in the third quarter of 2019 and will conclude in the third quarter of 2020.

The ICO is offering 1.95 billion tokens at a set price of $0.01 per token which would provide Bidao with $19.5 million. Holding BID tokens during the ICO provides 30% staking power, which will drop to 3% once the ICO is complete.

In order to purchase BID tokens during the ICO period users are required to create an account with Bidao, which includes providing their email address. The maximum amount of BID that can be purchased by an individual is 1 million BID or $10,000 worth.

Payment can be made via USD bank transfer or by using BTC, ETH, or LTC. Tokens will be held in the users account until the ICO ends in the third quarter of 2020, after which tokens will be transferred to users wallets no more than four weeks following the end of the ICO.

Note that residents of the following countries are not permitted to participate in this ICO: People’s Republic of China, Singapore, United States of America, Canada, Hong Kong, South Korea, Afghanistan, Crimea Peninsula, Cuba, Eritrea, Gaza Strip, India, Iran, Iraq, Kosovo, Lebanon, Libya, Myanmar, Palestine, Somalia, South Sudan, Sudan, Syria, Venezuela, Yemen, North Korea.

Bidao Staking Rewards

In addition to being the governance token for the Bidao blockchain the BID token is also the staking coin that brings consensus to this Proof of Stake system. That gives holders of BID tokens the ability to generate passive income by receiving staking rewards.

During the ICO period the staking power of BID tokens is as high as 50%, but once the ICO is completed in the third quarter of 2020 the annual percentage yield for staking will drop to 3%. That’s still a lot more than you can get these days from most savings accounts and bonds.

In order to stake BID all that’s needed is some BID tokens and the official Bidao wallet. Once the tokens are transferred to the wallet the staking rewards will begin to be paid out within 12 hours. There’s no need to collect this reward, it is automatically deposited to the wallet address where the BID tokens are being held.

Bidao Technology Stack

There are a number of mechanisms that underpin the Bidao chain technology. Let's take look at them shall we?

Settlement Layer

Similarly to the way MakerDAO set up its blockchain with Ethereum as the settlement layer, Bidao has been created with Binance-chain as the settlement layer of the blockchain.

Rather than using ETH as collateral in the Bidao system Binance Coin (BNB) is used as collateral. The creators of Bidao believe there are a number of benefits to using BNB rather than ETH as the collateral for their system.

- On the Ethereum blockchain ETH is primarily used for code execution rather than as a store of value. By contrast BNB can be used as a store of value, and it is regularly burned by the Binance Exchange, which makes it more valuable for holders.

- Binance-chain is focused on its speed and reliability as a settlement layer, making it ideal for that purpose. Ethereum is excellent for developing smart contracts and dApps, but is slow and needs a lot of memory, plus it does not scale well.

- Binance-chain can easily utilize sidechains, which means smart contract functionality can be outsourced to sidechains while still using Binance-chain as the settlement layer.

Proof of Stake Consensus

The consensus mechanism used by the Bidao chain is Delegated Byzantine Fault Tolerance Proof of Stake (dBFT PoS). This type of consensus is capable of supporting thousands of transactions per second.

The BID token is the staking token for the chain and it will have an annual reward of roughly 3%. With the dBFT PoS consensus mechanism staking is made easier for users who only need to place their BID in the official wallet to begin receiving rewards.

Cross Chain Communication

One of the key needs for the Bidao chain to be successful will be its ability to communicate effectively with other blockchains. In the beginning this was limited to Binance-chain, but with the recent integration with Chainlink there are now two chains available to Bidao.

In coming months and years more blockchains will be added, which will make it possible for users to create collateralized debt positions using many different cryptocurrencies.

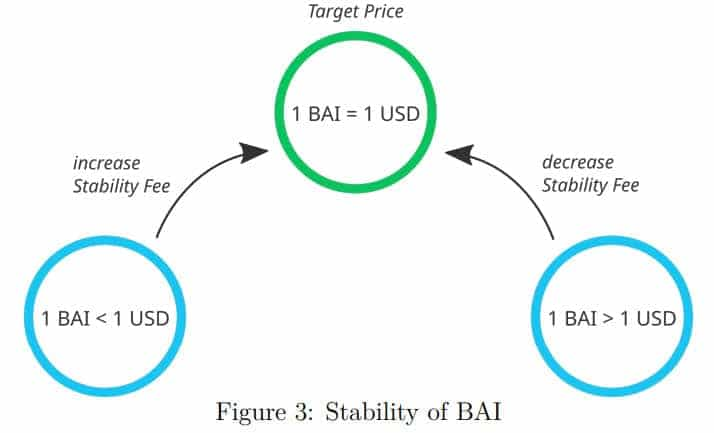

A Stablecoin

The BAI stablecoin will be paid out for any CDPs created and it can be used just like any other digital currency. Most importantly, as a stablecoin it will maintain a 1:1 peg to the U.S. dollar, removing the volatility that is associated with most cryptocurrencies.

The peg will be held using modifications of an internal stability fee, which is the fee paid to close a CDP and withdraw collateral from the system. In the case where the BAI becomes worth less than $1 the stability fee will increase to restore equilibrium, and in the case where the BAI is worth more than $1 the stability fee will decrease to restore equilibrium.

The Bidao Team

The CEO of Bidao is Bastian Aigner and according to his LinkedIn profile he has been with Bidao since February 2018. He is not listed as a founder for the project however, and it is unclear if he is actually the founder or not.

It is clear that he is still quite young, as he is still completing his Computer Science degree from the Technical University of Munich. That aside, he has previously been a co-founder of Crococoding, a website design firm, and has been an Apple WWDC Student Scholarship winner three times.

The CTO at Bidao is Brian Condenanza, a native of Argentina and current resident of the U.S., where he recently completed a Bachelor’s Degree in Business Administration. He joined Bidao in August 2019 and is also an advisory board member of the IDACB. In 2018 he was the United Nations Youth Assembly Delegate for his native country of Argentina.

The CMO at Bidao is Caroline Kurpiers, who joined the project in September 2019. In addition to her role at Bidao she also works for Accenture in Strategy Consulting, giving her extensive experience that she also brings to Bidao. She has a Masters Degree in Management and Technology from Technical University Munich.

The COO and Head of Asia Development for Bidao is Xiaolong Zhang. We were unable to find additional information as his LinkedIn profile was unavailable.

Conclusion

In effect the BiDao project is MakerDao on the Binance-chain. That isn’t necessarily a bad thing, and Bidao is bringing some benefits in using Binance-chain as its Settlement Layer.

It is also targeting decentralized finance applications through the integration of multiple blockchain tokens for use as collateral. Whether this will be successful long term obviously remains to be seen as the project is still in very early stages.

One criticism some have leveled at the project is its year-long ICO, which is unnecessarily long in the eyes of some. The reasoning behind the long token sale is the new model being used, called the Power Stake Token Sale.

In this model early investors are able to begin staking immediately, receiving dramatically increased rewards. It’s basically a way to generate early interest in what would otherwise likely be an overlooked project.

At $0.01 per BID it isn’t expensive to get in early on this ICO and generate the larger staking rewards offered for early investors. On the other hand there’s also no guarantee the project will be able to gain traction once the ICO ends.

With a lack of concrete information aside from the Whitepaper and Tokenoffer document (which are basically the same document anyway) we aren’t fully confident in the long term prospects of the project, but you should do your own research to determine if BiDao might fit your own investment objectives.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.