Binance is breaking ground on numerous fronts. Apart from their market expansion they have also been expanding protocol development with their native Binance coin.

The Binance Coin (BNB) is many things. A utility token that is used to trade crypto, a development protocol to build dApps and issue tokens, a rewards coin that incentives hodling & spending - the list goes on. Adoption on BNB is growing as fast as the exchange itself.

However, is this growth likely to taper off and is BNB still worth using?

In this Binance coin review, I will give you everything that you need to know. I will also take a look at the long term price potential and growth prospects of BNB.

What Is Binance?

Before we can give you any insight into what the Binance coin is, we have to give you a quick overview of the exchange that it was issued by.

Binance is currently the largest cryptocurrency exchange on the planet, with nearly $1bn in trading volume every single day. What makes that particularly amazing is that the exchange has only just launched in mid-2017 – on July 14, 2017 to be exact.

That means in less than a year they went from a brand new cryptocurrency exchange to overtake every other exchange and become the top global cryptocurrency exchange, with millions of registered users. We have covered it extensively in our Binance Review.

We also have in-depth articles and guides covering various aspects of the Binance Exchange that you may find interesting:

- How to Sign Up on Binance: A Step-by-Step Guide

- Binance App review: Mobile Trading on the Go

- Binance Security Analysis: Is Binance Safe?

- Binance vs Binance US: An In-Depth Look

- Binance NFT Marketplace Review

- How to Buy Bitcoin on Binance

- A Guide to Trading on Binance

- Binance US Review

Note: Users located in the US and UK are not supported.

What Is the Binance Coin (BNB)?

Binance coins are tokens used on the Binance platform, so even though they are traded on the open market and their value fluctuates, they are traditionally what you would think of as currency like the U.S. dollar or Bitcoin.

Even so, the use case for the Binance coin is very valuable, and this is why we see the value of the token continue increasing.

The Binance coin is what’s known as an altcoin, and when it was created it was based on the ERC-20 standard, using the Ethereum network and blockchain. This means that the coin also follows the rules set down by the community for the Ethereum blockchain.

However, more importantly, it allows the Binance coin to benefit from the stability and safety of the Ethereum blockchain and network. You won’t have to worry about your coins being stolen in a 51% attack or some other double-spend scenario because it is protected by being built on Ethereum.

All of that changed in April 2019, when Binance moved the BNB to its own mainnet. At the time they also burned 5 million ERC-20 BNB tokens and allocated a corresponding amount of BEP-2 native BNB tokens to its own wallets.

At the time Binance encouraged users to convert their own ERC-20 BNB tokens to the native BEP-2 tokens, but as of November 2019, Binance is still supporting the ERC-20 tokens and users are still able to convert to BEP-2 tokens, although it is not possible to withdraw the ERC-20 tokens any longer.

The Binance Blockchain

The Binance Chain serves several useful functions, such as the creation of new tokens to digitize existing assets, send, receive, burn/mint and freeze/unfreeze tokens.

You can also watch the DEX market to confirm price and market activity of certain assets, explore the transaction history and blocks on the chain, via Binance Chain Explorer, API and node RPC interfaces.

Not to mention that you can also extract other data of Binance Chain via full node or APIs, Develop tools and application to help users use Binance Chain and Binance DEX, and of course send and receive BNB tokens.

The Binance Chain uses a modified version of Tendermint BFT consensus. Tendermint was created for use in the Cosmos network and uses modular architecture to realize several goals, including the provision of networking and consensus layers of a blockchain as a platform where different decentralized applications can be built.

The main focuses for the design of Binance Chain are:

- No custody of funds: traders maintain control of their private keys and funds.

- High performance: low latency, high throughput for a large user base, and high liquidity trading. We target to achieve 1 second block times, with 1 confirmation finality.

- Low cost: in both fees and liquidity cost.

- Easy user experience: as friendly as Binance.com.

- Fair trading: minimize front-running, to the extent possible.

- Evolvable: able to develop with forever-improving technology stack, architecture, and ideas.

How BNB Works?

You might be wondering what use is the Binance coin if it isn’t a currency. As a token used on the Binance platform it serves a very valuable purpose. Remember that Binance charges a trading fee for each transaction you make.

How would you like to stop paying transaction fees? With the Binance coin you can, because that’s what it is used for, to pay fees on the Binance exchange.

Rather than paying a fee of $1 for every $1,000 in trades (which can actually add up pretty fast for active traders), you can just use Binance coins to cover the fees. This makes Binance coins extremely useful and valuable to traders on the Binance exchange.

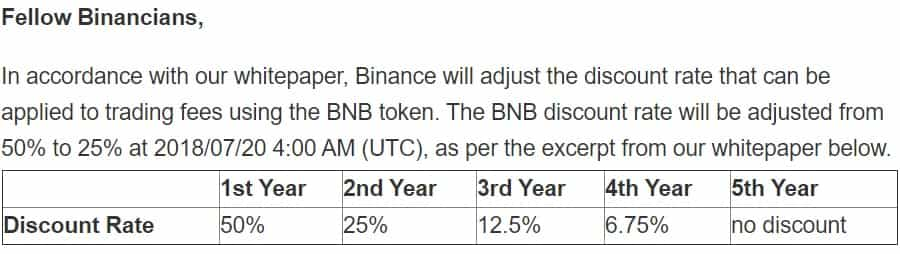

Here’s exactly how it works. Binance will rebate trading fees for those wishing to use the Binance coin when trading – for the first five years. And there is a sliding scale, so in the first year, you can get a 50% rebate of your fees by using Binance coins.

The discount halves each year, so in year two the discount is 25%, in year three it is 12.5%, in year four it is 6.75%, and in the fifth and final year the discount is removed.

This discount is automatically calculated and deducted if you have Binance coins in your exchange wallet. If you don’t want to use your Binance coins to cover fees you can also easily turn off this feature.

But what then? If your discount keeps decreasing won’t that make the token worthless eventually?

Well, that will be helped as more and more people come to the exchange, but the founders at Binance also found another solution to keep the value of the token from dropping.

BNB Coin Burn

Every quarter they take 20% of their profits from fees and use it to buy coins and “burn” them, or destroy them. This has happened nine times already, with the most recent burn happening on October 16, 2019 when Binance burned 2 million BNB.

It was the second-largest burn ever, indicating how strong business has been at Binance. The largest coin burn occurred on April 15, 2018 when Binance burned 2,220,314 BNB. By taking coins out of circulation, Binance makes the remaining coins that much more valuable. This will continue until half the coin supply, or 100 million BNB, has been destroyed.

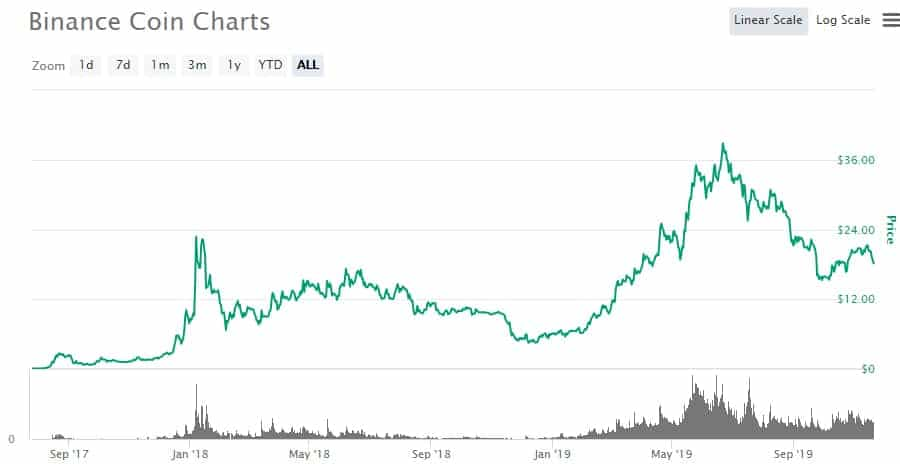

If you look at a price chart of BNB, you’ll see that the price of the coin has run-up each time a burn was coming (with the exception of the first burn as it wasn’t known it was coming).

While price does drop immediately following the burn, it doesn’t return to the pre-rally levels. In fact, BNB was one of the best performing coins in the first quarter of 2018, when most cryptocurrencies saw their value cut in half more or less.

The next coin burn should occur around January 15, 2020, and while there’s no way to predict that the coin will follow the same pattern, it seems likely it will. This means buying BNB about a month before the burn could yield some very nice profits.

The January 2018 burn would have been especially profitable as it occurred while the bull run in crypto was still mostly happening and BNB went from $3.34 on December 15, 2017, to $21.48 on January 15, 2018 when the burn happened.

The 2018 burns happened during a bear market, but you still would have seen your BNB coin go from $9.18 on March 15, 2018 to $13.06 on April 15, 2018. Keep in mind that Bitcoin and most other cryptocurrencies fell in value over the same period.

The most recent October 16, 2019 burn actually saw BNB fall 5% immediately following the burn, but since then it’s recovered and at one point was up more than 5% versus the pre-burn price.

Binance Launchpad

The Launchpad is another interesting proposal that has just been launched by Binance. This is token issue platform that is Binance's alternative to the Etheruem ICO. It will allow transformative projects to issue their own tokens right on the launchpad.

This is also really important for the Binance Coin (BNB) as it will be used as the native token in the issuance. Much like ICOs raised ETH in the Ethereum backed sales, BNB will be exchanged for the token that is issued by the project doing the raise.

This has already being used quite effectively in the BitTorrent token (BTT) raise in January of this year. Demand was so strong that the entire sale concluded in under 20 minutes. This surprised many people given the current bear market conditions.

There was also a recent rally in the price of BNB on the news that another project will be using the launchpad to issue their tokens. The project Fetch.ai which brings the new AI-based autonomous machine economy to life.

This is further confirmation that activity around the launchpad can lead to demand for the BNB coin. As more users wanted to get their hands on BNB to invest in Fetch.ai, they continued buying BNB to invest in it.

Binance DEX

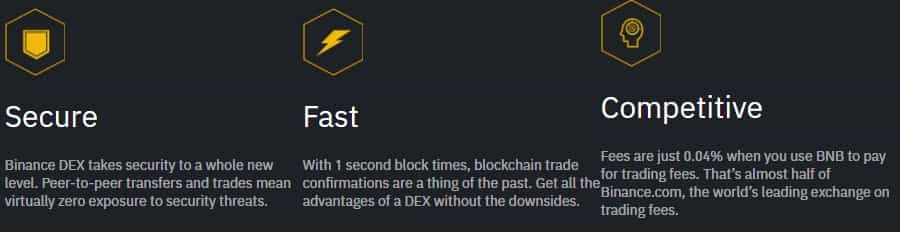

While Binance is a large centralised exchange, they have realized the demand from traders for decentralised exchange trading. Hence, they have recently launched their Binance DEX.

For those that do not know, a decentralised exchange (DEX) is a cryptocurrency exchange that allows for peer-to-peer trading amoung participants. There is no need to send crypto to an exchange wallet and place your orders.

The Binance DEX is Binance's answer to this. It was built on top of the Binance Chain and the native asset that powers the exchange is of course BNB.

Some of the other features of the binance DEX include:

- Issue New Tokens

- Send tokens to other's on DEX

- Burn tokens as needed

- Freeze some tokens, and unfreeze them later

- Propose New trading pairs

In just over 6 months, the Binance DEX has grown in trading volume to become the largest decentralised exchange as ranked on CoinMarketCap. There have been over 300k wallets created and currently there are 114 trading pairs.

This growth is of course great news not only for traders who want decentralised liquidity, but also for the Binance Coin. It will increase its use not only as a utility but also as an issuance token.

BNB Price History

BNB is the 8th largest cryptocurrency by market cap as of November 20, 2019, and has a market cap of $2.87 billion. The all-time low of $0.096109 for the coin occurred not long after it was launched on August 1, 2017.

The all-time high was much more recent, with BNB hitting $39.57 on June 22, 2019. Of course, since then it has been more than cut in half and trades at $18.47 as of November 20.

While the price is well off the June highs, it does look as if it may have bottomed in the first week of October 2019, and the price has been trending slowly higher since.

It is also important to note that the price dynamics of BNB is quite different from a number of other altcoins with similar market caps.

Firstly you have to consider that the cointinuing coin burn is decreasing the supply of BNB on the market. Then you have the increasing demand that is been brought onto the project.

These two factors are why BNB has been less volatile than other coins. Moreover, it serves Binance's interest to have a relatively stable native currency as a trading pair.

Having said this, they have recently released their own versions of fiat stablecoins. These include the likes of the Binance USD and the Binance GBP stablecoin.

Trading & Storing BNB

It goes without saying that volume and liquidity for the Binance Coin is quite high. Similarly, the bulk of this volume is taking place on Binance across the Tether (USDT) and Bitcoin pairs.

However, it is listed on a number of other exchanges that provide added liquidity and price discovery. These include the likes of P2PB2B, Coinsbit, MXC etc.

Binance coins are stored in a wallet, just like any other cryptocurrency. Previously they could be stored in any ERC-20 compatible wallet but since the April 2019 move to the mainnet and BEP-2 tokens you need a wallet that’s compatible with the BEP-2 tokens.

Fortunately, there’s no shortage of wallets the support BNB. If you want the strongest security you can choose a hardware wallet like the Ledger or the Trezor.

If you prefer a mobile wallet you can use Coinomi, BRD, Trust Wallet, or Atomic Wallet. Jaxx Liberty also supports BNB as do a handful of other wallets.

Binance Chain Development

Indeed it does seem that there is a lot going on in the BNB ecosystem. But how does this translate to raw developer output and are there any protocol updates taking place?

Thankfully given that the Binance Chain is an open source project, we are able to look right into their code repositories to get a good sense of this.

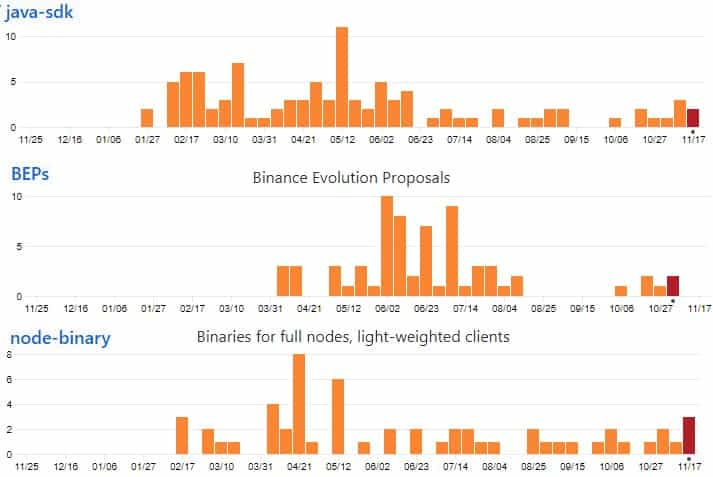

Code commits are a great barometer to determine exactly how much protocol level work is being done. Below are the code commits to the top three most active repos in the Binance Chain GitHub over the past year.

As you can see from this commit activity, they are still quite active pushing code. It is also important to note that there are a further 23 repos in the GitHub with varying degrees of commits.

From my experience looking at other projects, this looks to be quite an active ecosystem. Something else that is important to note is how active the Binance Evolution Proposal (BEP) repo is which is shown above.

BEPs are the Binance Chain equivalent of Bitcoin Improvement Proposals and they are some of the things that the community would like to see implemented.

There are a plethora of BEPs on the horizon for us to look forward to. Of course, the broader BNB ecosystem also has a pretty robust roadmap of initiatives.

Let's take a look at some of these shall we?

Plans for Binance Coin

Binance coin started as little more than a token strictly used to pay for trading fees, although some would argue that the speculation on open markets in the coin makes it a digital currency in its own right.

This won’t always be the case, however, as the Binance team has plans for expanding the scope of what can be done with the Binance coin. This becomes even more important as the price of BNB continues to increase, and the rising user base at Binance wants to use the coin to save on trading fees.

Already the Binance coin can be used to invest in the ICOs being hosted on the Binance Launchpad platform, which gives holders of BNB a way to realize a return on their coin holdings.

These ICOs have included Bread, BitTorrent, Elrond, WINk, Kava and a number of other blockchain projects. So far the Binance Launchpad coin sales have been quite successful, which gives the BNB token a further leg up.

On top of this you have the continuing coin support on the Binance DEX. As more decentralised markets open up to trade unique coins you are likely to see an increase in the demand for BNB to power these.

Other uses for BNB at this time include paying for travel expenses with select merchants in Australia, paying your Crypto.com credit card bill, buy virtual gifts on the Mithril platform, pay for anything from stores using the PundiX XPOS system and a number of other uses. Granted most of these are tied to individual platforms, but as usage grows, the BNB ecosystem will also continue to grow.

As Binance continues to grow and add new features the number of things you can do with Binance coins is almost certain to increase.

Plus, you can already trade BNB coins as a speculator, looking to get in at a low price and then sell the token at a higher price, just as many other traders are already doing!

Conclusion

There’s no denying that the fate of the Binance coin is tightly related to the performance of Binance as an exchange. While Binance is slowly phasing out the trading discount provided by the Binance coin, they are finding other ways to make the coin valuable.

These include burning coin supply and creating a decentralized exchange that will use the Binance coin as its native currency. This would not only increase the value on Binance Coin but would also give it utility far into the future. They are also adding new uses for BNB, making it increasingly useful and driving demand for the coin.

Of course, the potential for increased value in the Binance coin hinges on the success of Binance as an exchange. If the exchange can maintain the momentum that took it from just launched to number one in trade volume within six months the future should be quite bright for Binance coin, and for those that own the Binance coin.

So far it seems this is a foregone conclusion, but things change rapidly in the cryptocurrency space.

And while BNB seems to hold its value better than other altcoins, it still follows the overall trend in the markets, which is currently flat to downward.

Helpful Links

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.