Chainlink Review: Smart Contract Solutions for any Blockchain

Chainlink has been getting quite a bit of attention lately. So much so that LINK has risen to a market cap of more than $6 billion.

The initial catalyst for these gains was the launch of Chainlink on the Ethereum mainnet in May 2019 and a Coinbase listing. Essentially, the project’s goal is to create a widely used decentralized oracle service. If they’re successful it could change smart contract usage and effectiveness forever.

In this Chainlink review, we will take a deep dive on the project including the technology, adoption, use cases, & LINK price prospects.

Need for Oracles

When smart contracts are mentioned nearly everyone thinks of Ethereum. And that’s because when Ethereum was launched back in 2015 it contained something that took blockchain technology to the next level.

The smart contracts of Ethereum meant that blockchain technology could be far more than just a means for conducting financial transactions. Ethereum’s smart contracts expanded the utility of blockchain massively.

There was one problem with Ethereum smart contracts however, and that’s the fact that they only work with data on their own blockchain. While that still leaves them as a very useful tool, they aren’t nearly as useful as they could be. Creating a way to include data from outside the chain would give smart contracts an immense boost in the potential use cases.

The founders of Chainlink saw this, and they moved to fill the gap. Chainlink is being created as a way to use oracle’s to pull data from off-chain sources. Chainlink oracles will be able to use data pools, application program interfaces (APIs) and other real world sources. It opens up the possibility for smart contracts to use any data source at all, no matter what the source is.

Chainlink has been extremely helpful to projects that need off-chain data to be really useful. By giving blockchains access to traditional data sets, Chainlink seeks to be the bridge between traditional data and the future of blockchain technology.

If blockchains are decentralized computers and smart contracts are decentralized applications, then Chainlink can be thought of like a decentralized Internet that finally allows smart contracts to interact with the outside world while maintaining blockchain technology’s fundamental guarantees around security, transparency, and trust.

With those basics set, let’s have a more detailed look at what Chainlink is being developed for, and how it can change the blockchain space.

How Chainlink Works

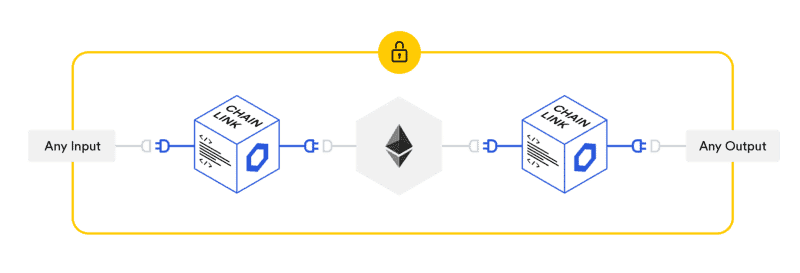

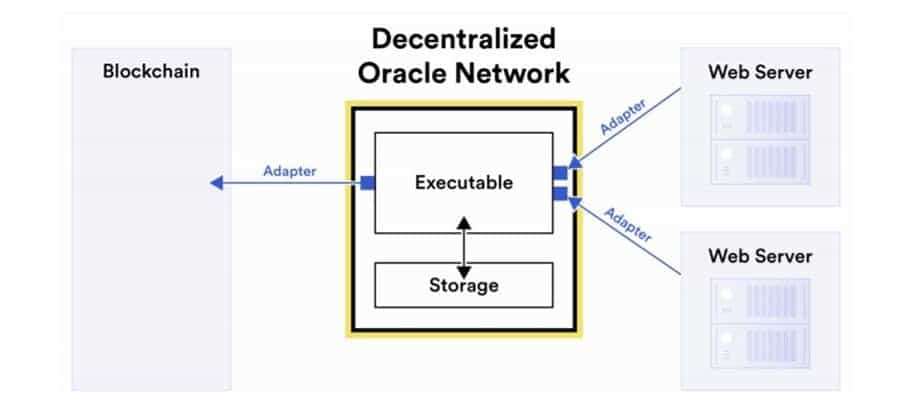

The main function of Chainlink is to create a bridge between on-chain resources and off-chain resources. This means there are two primary components in the Chainlink architecture – an on-chain infrastructure and an off-chain infrastructure. Let’s see how both work.

On-Chain Functions

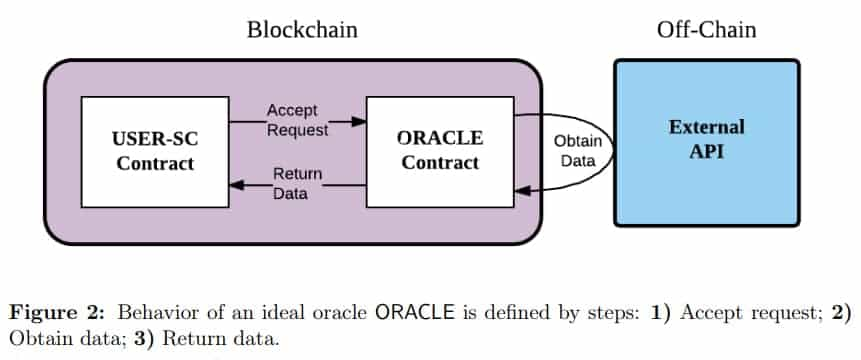

The on-chain smart contracts are the first part of Chainlink’s architecture. Included in the smart contracts are oracles which are created to process user data requests.

These oracles will take any user requests for off-chain data that are submitted to the network using a requesting contract and process them, sending them to the appropriate smart contract to be matched with an oracle that can then provide the needed off-chain data. There are three types of contracts that can help with matching: the reputation contract, the order-matching contract, and the aggregating contract.

The reputation contract ensures that the oracle provider is reliable and trustworthy. If it is, the request is passed to the order matching contract, which works to pass the requesting contract to an appropriate oracle based on the service level being requested, and the bids from the oracles. Finally, the aggregating oracle collects data from the selected oracles and delivers the best result to the requesting contract.

Off-Chain Functions

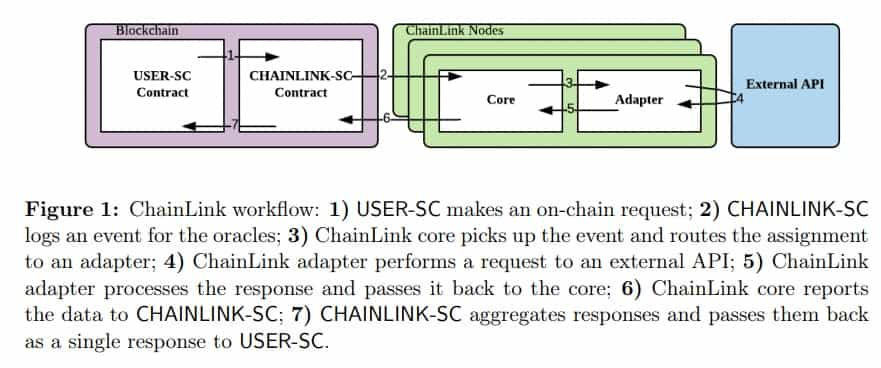

Off-chain components are the other part of the Chainlink architecture. These are oracle nodes that exist off-chain, but are connected to the Ethereum network. I say Ethereum network here because currently Chainlink is only capable of interfacing with Ethereum smart contracts, but in the future it is planned to work with many different networks and smart contracts. The bulk of the work is done by these off-chain oracles, as they collect most of the data being requested.

All of the data collected is processed through Chainlink Core, which is the software that connects the Chainlink blockchain with off-chain data sources. Chainlink Core is responsible for processing data and passing it to the on-chain oracle.

All of this work by the off-chain nodes isn’t done as charity. These nodes expect to receive payment for the data collection and transmission. And they are paid, in LINK tokens.

There’s a secondary function of off-chain nodes that make them quite useful to developers. The off-chain nodes allow for the integration of external adapters, which are like decentralized applications (dApps) on the Ethereum network. External adapters are written by developers to perform subtasks within the external nodes. This makes data collection and processing more efficient.

Cross-chain Interoperability Protocol

The Cross-Chain Interoperability Protocol (CCIP) is a new generalized cross-chain communication protocol that allows smart contract developers to transfer data and tokens across blockchain networks.

The application deployment process across multiple blockchains is currently broken, suffering from the fragmentation of assets, liquidity, and users. With CCIP, however, developers can utilize token transfers and arbitrary messaging to enable the creation of DApps that are made up of multiple different smart contracts deployed across different blockchain networks that interoperate to create a single unified application. This Web3 design pattern is known as the cross-chain smart contract.

Chainlink CCIP is in the “early access” stage of development and is currently available on the Ethereum Sepolia, Optimism Goerli, Avalanche Fuji, Arbitrum Goerli, and Polygon Mumbai testnets.

Oracle and Source Distribution

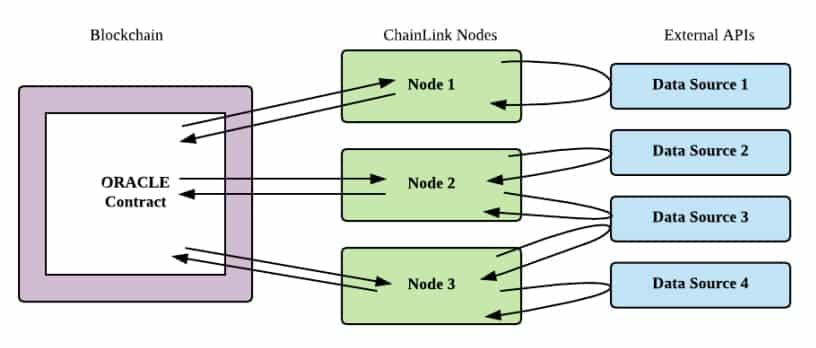

Chainlink’s decentralized nature and difference from other oracle protocols are shown by the concepts of oracle distribution and source distribution used by Chainlink. This decentralization helps Chainlink avoid centralization and other security issues.

Source distribution and oracle distribution are the keys to the security and decentralization of the oracle network. Source distribution is the concept that causes oracles to pull their data from a variety of sources. This helps them keep a good network reputation. And oracle distribution is the concept that has data requests contracted to several oracles to maintain decentralization.

The above figure shows the two level distribution on the Chainlink network. However, it helps to take a look at a practical example.

Weather Application

A company creates a user called the Sunshine Day Weather App. The user requires up-to-the minute weather data, and to get it there’s a request submitted to Chainlink. The matching oracle locates three different oracles to find and transmit the needed data, following the oracle distribution methodology to maintain a secure network.

Because the network also requires source distribution each of the oracles will draw their data from different sources. We’ll call the oracles X,Y and Z. Oracle X gets its data from Accuweather and Wunderground.

Oracle Y gets its data from the National Climatic Data Center and Open Weather Map, while Oracle Z gets its data from the National Weather Service and the National Oceanic and Atmosphere Administration.

With this oracle and source distribution the network remains totally decentralized, and Sunshine Day Weather receives aggregated data from three reputable oracles who all receive their data from different sources.

One other benefit of this system is that oracles are incentivized to remain honest, since their reported data will be compared with the data from other oracles. If fraudulent data is reported the oracle would see its reputation sink, and could face other network imposed penalties.

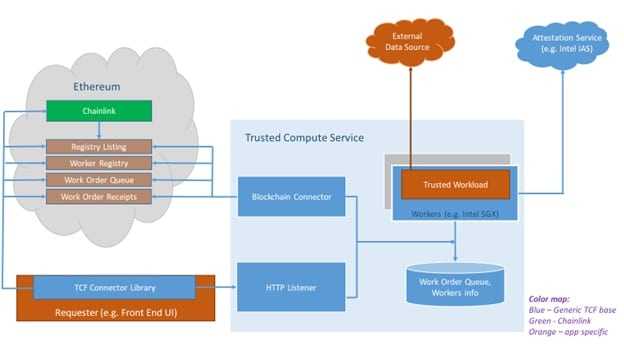

Trusted Execution Environments

Trusted Execution Environments, or TEEs for oracles, were added to Chainlink in late 2018 when Town Crier was acquired by Chainlink.

Combining TEEs with decentralized computations gives Chainlink an added layer of security for individual node operators. TEEs confer the benefit of allowing all computations performed by a node private, even from the node operator themselves.

This increases the overall reliability of the oracle network because it prevents any node from tampering with any of the computations performed by them.

Chainlink Explorer

The Chainlink Explorer is the means to make sure all of this data is available to users. It was launched in May 2019 along with the launch on the Ethereum mainnet and is designed to provide the insight into the function of Chainlink nodes in two primary dimensions:

- Detailed information regarding each node’s fulfillment of user requests. This includes both the off-chain activity and the on-chain results, and it gives the smart contract developers critical data regarding how well nodes and oracle networks are performing.

- Reliability and speed data for every node connected to the explorer are aggregated for both on-chain and off-chain activity. This allows the Chainlink developers to begin to understand how a reputation system would work within the Chainlink network, with the hypothesis being derived from real transaction data.

The Chainlink team is planning on expanding the capabilities of the explorer to provide deeper levels of insight regarding the operation of each individual node. This will include various metrics about node reliability and speed, which dApps and contracts have used a particular node, and data about each node’s fulfillment of commitments.

As real transactions increase on the mainnet the team expects to have an increased amount of verifiable proof for each oracle’s reliability, giving users and increased insight into oracle performance.

Once the team has been able to create a data-driven framework for users to choose node operators, they will be able to divide the nodes into oracle networks that achieve decentralization.

In order to reach this level, the team is working on levels of aggregation across oracle networks, looking to provide the needed security and efficiency expected from such oracle networks.

Threshold Signatures

One step in this direction was a new approach to the utilization of threshold signatures on Chainlink, which will allow the team to create oracle networks that can contain thousands of nodes.

The main benefit of this threshold signature setup is that it allows oracles to have their signatures verified on-chain which provides added security and it does so in the most efficient manner.

Making large oracle networks efficient is a desirable goal because it will be a preferred method for offering reliable inputs for high-value smart contracts.

Smart Contract Inputs

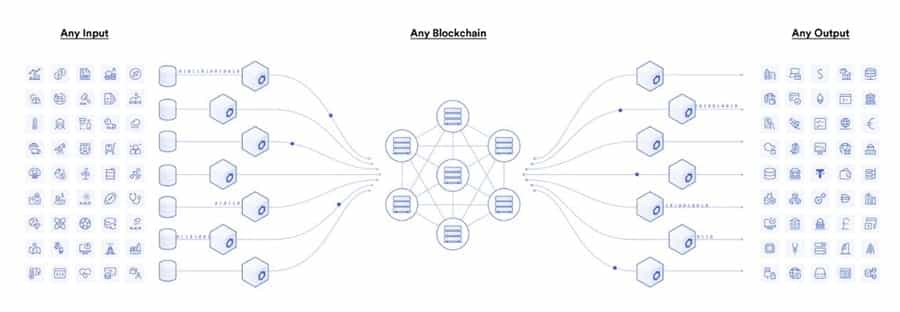

Besides creating efficient, secure and highly decentralized oracle networks, Chainlink is also trying to become the largest source of smart contract inputs and outputs.

One of the goals of achieving this state is to make smart contract development as rapid as web application development is today. Similar to the way web developers are able to draw from a large pool of APIs and data streams, smart contract developers will also be able to draw from a collection of inputs and outputs, if the Chainlink team is successful in achieving this goal.

This would make Chainlink the go-to blockchain for developers and smart contracts to find pre-made inputs and outputs that can rapidly be implemented in dApps or that can securely and easily accept specific input/output requests.

Since Chainlink is far ahead of any other oracle network of its kind, achieving these goals could cement Chainlink’s place within smart contract development and execution.ChainLink Use Cases

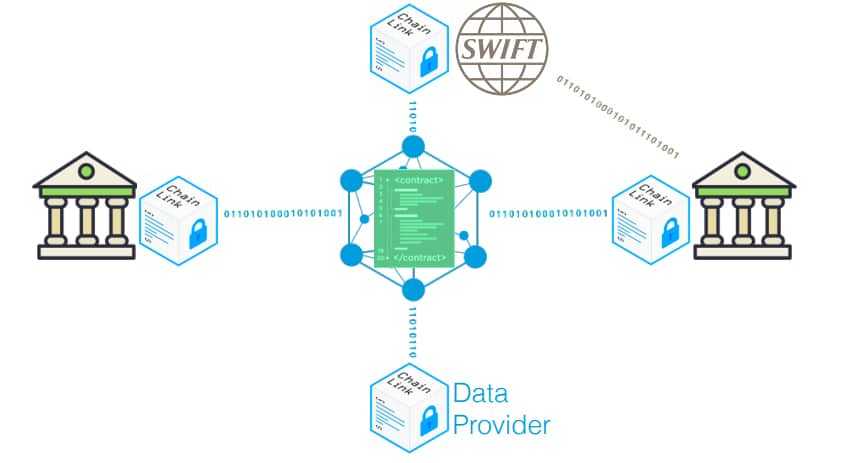

Quite possibly the biggest positive development so far at ChainLink is its partnership with the SWIFT banking transaction network. Let’s face it, SWIFT is one of the largest global financial networks, and success with them could lead to many other partnerships within the finance industry from banks to payment processors to insurance outfits.

While SWIFT isn’t flat out using Chainlink, it is developing the SWIFT Smart Oracle with the help of Chainlink, and that leaves it possible for integrations between the two.

Another positive is that Chainlink has little competition, and even those that are working on blockchain oracle development are far behind Chainlink.

But Chainlink has found its way into many other areas. Currently the top three are decentralized finance, insurance, and gaming. If you’re interested in all the different ways that Chainlink is being used you can check out the post they put together “77 Smart Contract Use Cases Enabled by Chainlink”

Decentralized Finance (DeFi)

There are so many traditional financial products that are now being built on blockchains. These include lending and borrowing, derivatives, interest-bearing cases, and much more. These financial products get the benefit of added transparency and security by being put on the blockchain, while also becoming more accessible to everyone.

DeFi applications are using Chainlink to access current prices and interest rates, to verify collateralization, and many other cases that allow DeFi applications to carry out functions such as settling an options contract, issue dividends automatically, or issue a loan at current fair market rates.

Gaming

Recently developers have begun releasing gaming applications based on smart contract technologies. One of the things most games need is a source of randomness for in-game scenarios or to determine the winner of a contest. Chainlink’s VRF solution delivers exactly the type of randomness needed, and it delivers it to the smart contract so that it can be proven fair and unbiased since no one, not even the developers, can tamper with the randomness.

Insurance

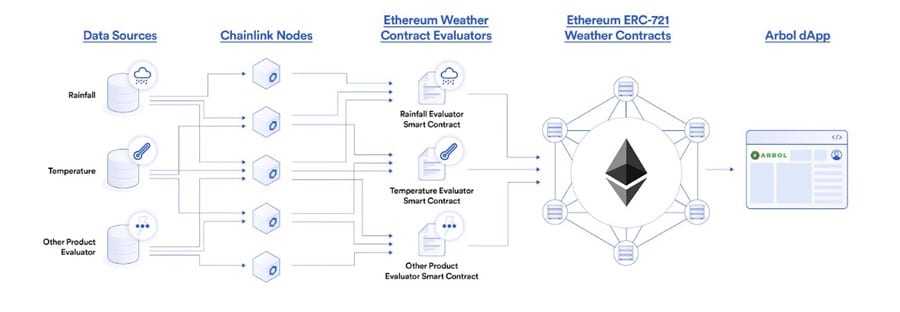

Insurance is one area that is also benefitting from blockchain technology and Chainlink’s oracles. Where smart contracts are used to create parametric insurance contracts, Chainlink is used to provide data for these contracts.

For example, Chainlink is used to provide weather data to the Arbol crop insurance market, and as a result farmers everywhere in the world can obtain parametric crop insurance so long as they have an internet connection. These policies are then settled in a fair and timely manner according to the amount of rainfall, temperature, or other evaluators the policy is set to (e.g. if it rains more than x amount this year, pay out y settlement).

Traditional Systems

Some of the other primary use cases for Chainlink are in providing data to more traditional outlets such as websites, IoT networks, and data providers. Chainlink allows enterprises a way to make their data available to blockchain networks as well. Because Chainlink is blockchain agnostic its oracles are the perfect integration gateway to connect digital data or infrastructure to any blockchain at all. In fact, an industry standard framework for using oracle networks to connect traditional systems was recently presented to the World Economic Forum. Chainlink could be the perfect solution for this standard.

These are just a few of the many, many use cases that Chainlink provides for allowing smart contracts to interact with external data and systems securely and reliably. Ultimately oracle networks like Chainlink enable far more use cases for blockchain based smart contract dApps.

Chainlink has grown into the most widely used decentralized oracle solution throughout every emerging smart contract vertical, including DeFi, insurance, gaming, NFTs, and more. The expanding suite of decentralized services available on the Chainlink Network is fueling innovation across numerous leading blockchains, providing developers with an array of key oracle functions:

- Chainlink Price Feeds provide an extensive collection of on-chain financial market data for a broad array of assets, which is used to secure billions of dollars for leading DeFi applications like Aave, Synthetix, and dYdX.

- Chainlink VRF generates verifiable randomness backed by on-chain cryptographic proofs, enabling projects like Aavegotchi to mint NFTs with provably rare attributes and PoolTogether to fairly select winners in its no-loss lottery.

- Chainlink Proof of Reserve supplies on-chain data feeds that enable smart contracts to perform on-demand audits of tokenized asset reserves, such as for stablecoins like TUSD and PAX and cross-chain tokens.

- Chainlink External Adapters give developers the tools to create connections to any off-chain resource or API, leveraged by Arbol’s parametric crop insurance market to fetch weather data and Everpedia’s prediction market users to get U.S. election results.

The Chainlink Network has achieved an expansive network effect through widespread adoption in the decentralized oracle market and is already securing billions in on-chain value. While it’s been no small feat to get to this point, we have only scratched the surface of what’s possible with decentralized oracle networks and the smart contracts they support.

Chainlink’s Future

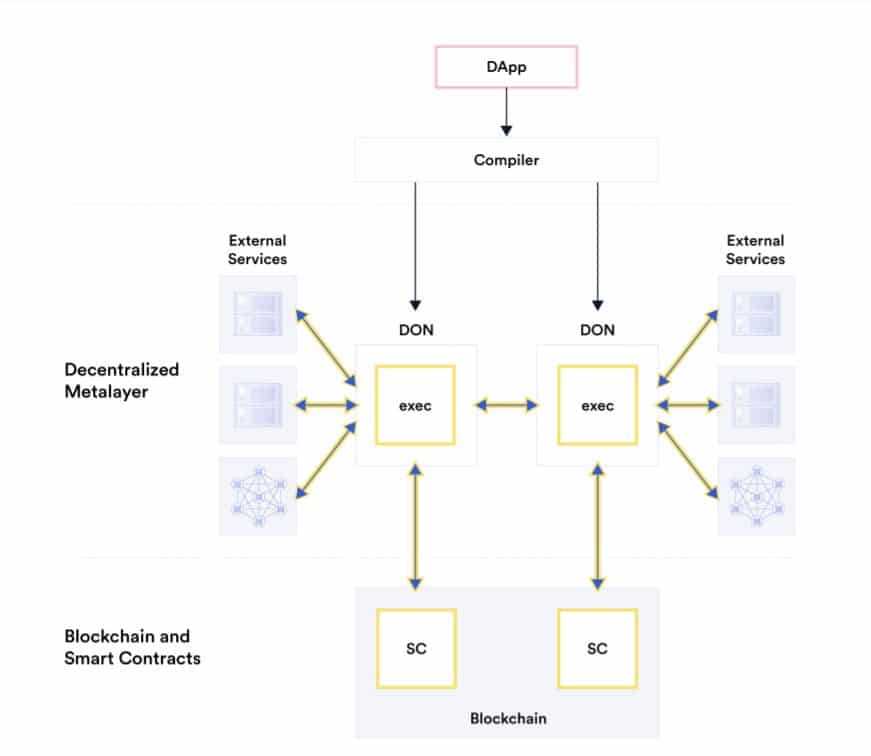

Chainlink has not simply been sitting still. In April 2021 they released a new whitepaper entitled Chainlink 2.0: Next Steps in the Evolution of Decentralized Oracle Networks. The whitepaper describes how Chainlink plans to add a decentralized metalayer that will make smart contracts even better by making them highly scalable and confidential, while also adding secure methods of off-chain computation.

One of the keys to the whitepaper is the introduction of a new architecture where the decentralized oracles of Chainlink can deliver key capabilities to smart contracts that blockchains are unable to provide. This new architecture allows for hybrid smart contracts which serve as an off-chain computation layer. This layer relies on the blockchain for security, but also operates with the scalability, feature richness, and connectedness of an off-chain system.

As a result of this new abstraction layer Chainlink can support a growing number of decentralized services, which are capable of delivering an ever larger number of use cases, while helping an larger number of users.

Redefining the Function of Decentralized Oracle Networks

The original Chainlink whitepaper introduced the concept of decentralized oracle networks, giving developers a way to feed external data into blockchains in a secure and reliable manner. In the Chainlink 2.0 whitepaper the developers suggest a framework that combines a number of interoperating Decentralized Oracle Networks (DONs), each consisting of a collection of nodes capable of bi-directional data transfer and decentralized off-chain computation. It’s similar to layer-2 technology, with the Chainlink DONs anchored to an existing blockchain which allows for the synching of data outputs and the computation of state changes off-chain. It also allows for the creation of guardrails to enforce the correctness of oracle reports and the arbitration of off-chain oracle disputes.

This is a more advanced type of off-chain computation which the Chainlink developers believe will allow DONs to provide a blockchain agnostic gateway for smart contracts whereby they not only have the ability to access off-chain data, but also gain an off-chain computing environment. This can be extremely valuable since it will allow a blockchain to execute code it couldn’t otherwise due to constraints such as cost, privacy, speed, or simply technical limitations.

This advanced solution will allow DONs in Chainlink to operate as a secure full-stack solution, and provide for the creation of hybrid smart contracts relying on a combination of on-chain code and off-chain computations. This hybrid construction will allow smart contracts to achieve serious upgrades in both confidentiality and scalability, which in turn is expected to increase the large-scale adoption of blockchain technology.

How Chainlink DONs Will Power DeFi and the Wider Smart Contract Economy

Once Chainlink is upgraded to DONs it will be able to support a number of decentralized services that use its next generation smart contract construction. Plus, the services that currently run on the Chainlink Network will also be enhanced by the advantages created by the DONs. Below is a brief listing of the advanced decentralized services that will be made possible by DONs:

- Hybrid Smart Contracts that are seamlessly connected to all necessary off-chain resources, while retaining increased levels of privacy and being secured by your preferred blockchain or layer 2.

- Enhanced Chainlink Data Feeds that provide higher-frequency updates, privacy-preserving queries, and multi-blockchain delivery, all of which lower costs and empower DeFi applications like derivatives protocols and enterprise solutions with an even more secure and reliable source of external data. Chainlink Data Feeds are already being made more scalable through OCR.

- Enhanced Chainlink VRF with enhanced security, cryptoeconomic security, and cost-efficiency to support more secure gaming, NFT minting, and any other applications that require a secure source of randomness for end-to-end security.

- Chainlink Keepers that provide decentralized and highly reliable automated maintenance of key smart contract functions like harvesting yield and triggering liquidations, currently being primed for production and tested by top projects.

- Chainlink Fair Sequencing Services (FSS) that use DONs to order user transactions on a blockchain as a means of mitigating front-running, back-running, and other related attacks, as well as other types of transactions like oracle report transmission caused by miner-extractable value (MEV).

- Chainlink Decentralized Identity in which privacy-preserving oracle protocols interoperate with existing systems in a backwards-compatible manner to open up new use cases like on-chain credit-based lending.

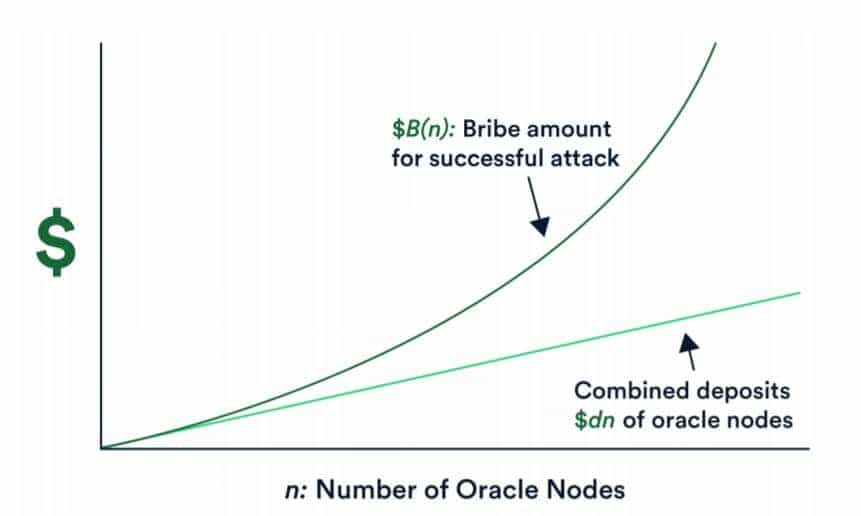

Chainlink Cryptoeconomic Security (Super-Linear Staking)

Another new concept introduced in the Chainlink 2.0 whitepaper is that of super-linear staking. This is a major enhancement to the design of the staking mechanism. In super-linear staking an attacker would need to have resources which are greater than the combined security deposits of all the DON nodes. Also included are a concentrated alerter system and a two-tier adjudication system that provide greater cryptoeconomic security guarantees when compared with other systems.

The initial beta version of Chainlink staking (v0.1) was released in December 2022, and it consisted of a 25 million LINK staking pool that supported the cryptoeconomic security of the ETH/USD data feed on Ethereum. The next iteration (v0.2) is set to launch in the fourth quarter of 2023, with an initial expanded pool size of 45 million LINK.

The launch of the v0.2 beta upgrade will progressively expand access to a broader scope of participants, starting with a priority migration period for existing v0.1 stakers before entering early access and then general access.

For more information on super-linear staking and the other forms of cryptoeconomic security being developed, refer to Section 9 of the whitepaper.

ChainLink Partnerships

The partnerships that ChainLink has forged are a part of its strength as well. The SWIFT partnership is the largest, but it isn’t the only solid partnership already formed by ChainLink.

It’s interesting because it seems the team behind Chainlink has focused on building partnerships rather than on marketing, and that’s a large part of the reason the coin goes unnoticed by many cryptocurrency enthusiasts. The following are the largest Chainlink partnerships to date:

- SWIFT: Chainlink and Swift recently concluded blockchain interoperability tests that revolved around linking traditional financial assets with blockchain networks. SWIFT said in a release that the tests demonstrated a “secure and scalable way to connect multiple blockchains for movement of tokenised assets around the world.” Global banking giants such as Citi, BNY Mellon, Lloyds and ANZ, among others, were part of the experiments.

- Zeppelin OS: An operating system that was developed specifically for creating smart contracts;

- Request Network: An exchange platform that aims to be the standard for exchanging fiat and cryptocurrencies;

- Signal Capital: A London based private asset firm.

Chainlink has been extremely active in adding new partners and node operators since the launch on the Ethereum mainnet. It seems as if hardly a day or two goes by without a new announcement of a partner joining to run a Chainlink node.

All of this has been extremely positive for Chainlink, increasing the adoption of the blockchain even as the team continues focusing on development rather than marketing. It appears that Chainlink markets itself, and new partners come looking for Chainlink rather than the other way around.

That’s a good sign for any type of business…

LINK Token

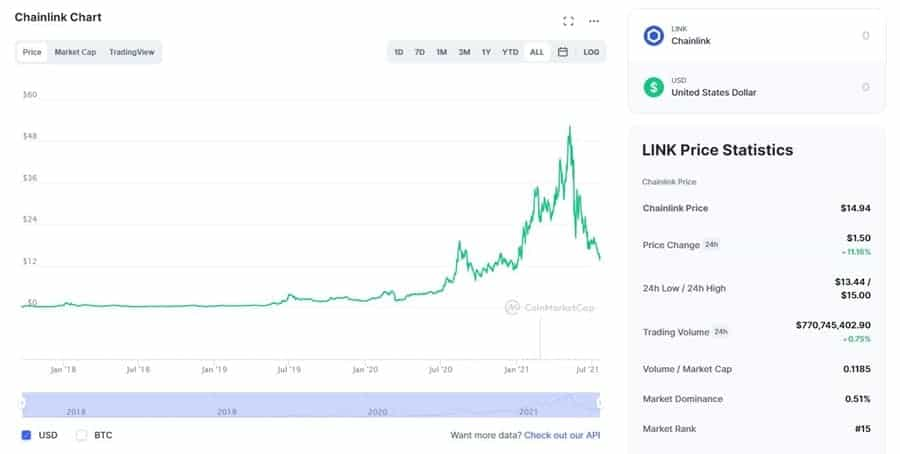

The LINK token rallied strongly right after its ICO and by October 2017 it reached $0.47. After dropping from that high it rallied again in December 2017 and January 2018 along with the rest of the cryptocurrency markets, hitting a high of $1.35 in January 2018.

It dropped in 2018 along with the rest of the market, hitting a low of $0.1647 at the end of June, but by September 18, 2018 it recovered and was trading at $0.2872 and was the 50th largest coin by market cap, with a market cap of $100,530,182.

From September 2018 through May 2019 the price of LINK remained roughly between $0.25 and $0.50 as the crypto markets began a slow recovery. May 2019 is when the price took off again as investors were encouraged by the launch of Chainlink on the Ethereum mainnet. By June 29, 2019 it was trading up to $4.54, however it pulled back to the $1.60 area by September 2019.

The gains weren’t finished however as price rallied once more to $18.80 in August 2020. There was a drop to the $10-12 range for the rest of 2020 and then the massive 2021 rally began, taking LINK to an all-time high of $52,88 on May 10, 2021. After hitting that high price retreated dramatically, and as of late July 2021 LINK is trading back at $14.94.

Buying & Storing LINK

In the past, if you wanted to purchase LINK yourself you needed to do so with BTC or ETH as there were no fiat purchases available for the token. However, it was recently added on Coinbase, and can now be purchased there using USD.

Binance is still the best exchange to purchase LINK from though as the bulk of the trading volume is on that exchange. You can also buy at Huobi, OKEx, and Mercatox as well as dozens of other small and medium-sized exchanges.

In terms of LINK liquidity, it is pretty well spread out across all of the exchanges where it is listed. This means that you are not dependent on the liquidity from any single exchange which further reduces the risk.

Looking at the individual orders books on the likes of Binance, they are quite deep and there is a reasonable level of turnover. This means that you would be able to place large block orders without much price slippage.

Once you have your LINK tokens you will want to keep them in an offline wallet. Give that these are ERC20 tokens any wallet that supports Ethereum will do. These include wallets such as MetaMask or MyEtherWallet.

Conclusion

The Chainlink project isn’t the easiest to come to grips with, but once you do it’s easy to see how it can benefit the blockchain ecosystem massively going forward. Blockchains by themselves are very limited, and they require oracles to unlock their full potential. Because Chainlink is one of the few projects working on oracle development they could easily become an industry leader for years to come.

The original whitepaper is a long-term, multi-year view of how Chainlink will evolve. However with the release of the 2.0 version of the whitepaper we have a vision for the project that extends for a decade or more.

This ambitious vision for the Chainlink Network will be implemented incrementally with new decentralized services being released in parallel, so we can formally analyze the security impact of this vast array of new oracle functionalities.

We’re confident that Chainlink will enable smart contracts to take the next major leap in their evolution, powered by a hybrid on-chain/off-chain architecture. Just as Chainlink’s secure data oracles have unlocked innovation across the DeFi ecosystem, Chainlink 2.0’s expanded Decentralized Oracle Networks will empower hybrid smart contract developers to build the scalable and privacy-preserving decentralized applications that mainstream users have been waiting for.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.