In this Coinsquare review, we will take a look at one of the biggest cryptocurrency exchanges in Canada.

They have grown considerably since their inception to become one of the biggest Canadian exchanges. However, they are also not free of controversy. 2020 not only saw the exchange suffer a personal data breach but the CEO was also accused of wash trading on Coinsquare's order books.

So, is Coinsquare still safe?

In this Coinsquare review, we will attempt to answer that. We will take a deep dive into the security and trading functionality. We will also give you some top tips that you need to consider before trading here.

Coinsquare Canada

As mentioned, Coinsquare is a large exchange that is based in Toronto Canada. They started out as Coinsquare.io as a pure retail cryptocurrency exchange but have since moved to Coinsquare.com and have expanded the business.

They have opened up a mining venture arm as well as a capital markets division that will focus on high-net-worth individual investors and institutions.

The company was founded in 2014 and has grown substantially since then, raising over $100m and having a team of over 200 employees. This has helped Coinsquare to onboard over half a million Canadian users and become the dominant cryptocurrency exchange in Canada.

Coinsquare has continued to see growth despite the number of other Canadian cryptocurrency exchanges that have expanded their operations. These include the likes of BitBuy, Coinsmart and Coinberry, making the market increasingly competitive.

Is Coinsquare Safe?

Security and exchange safety is one of the most important considerations for any centralised exchange.

Coinsquare has a robust approach to security, resulting in the firm not having a security incident since its inception. Below are some of these systems and tools that the exchange implements. Coinsquare also gets a firm nod of confidence as they are Canada's first IIROC-regulated cryptocurrency exchange, so users can be fairly certain that there are no shady dealings going on there as we saw with FTX.

Exchange Security

Coinsquare employs well-known security protocols when it comes to coin management and server testing. For example, they operate a system of 95% cold storage of coins in their control. Cold storage means that they store the private keys to the coins offline and air gapped away from the internet. These are some of the most secure ways of keeping hackers far away from the coins.

Another concern for an exchange is losing track of ledger management and account balances. This is something that happened at the Bitgrail exchange for example. Coinsquare manages their ledgers "about 2346" times a day so they are able to keep track of all that which is owed.

Lastly, they claim that they have stress-tested their servers to make sure that they do not fall victim to DDoS (Dedicated Denial of Service Attacks). For anyone who has traded on exchanges such as Bitfinex, they will know how stressful DDoS attacks can be as they bring down the exchange and restrict you from getting access to your coins.

User Security

Coinsquare also has measures in place on the user side to protect you from phishing attacks and hackers that attempt to get into your account. For example, they have two-factor authentication that will help secure your account in case someone gets hold of your password.

Image via Coinsquare

Image via CoinsquareOf course, it goes without saying that you should never leave a great deal of coins on any exchange. As the saying goes...

If you don't hold the keys, you don't own the coins

Data Breach

Despite all of these supposed security procedures, Coinsquare suffered a data breach in early June of 2020. The breach was not a hack but data theft from a previous employee. This information then ended up on the dark web.

The hackers that were able to get hold of the data had access to cellphone numbers, emails and ID documents. This is particularly risky as this information can be used to conduct a sim swap attack. For those that do not know, these sim swap attacks have been quite destructive for those who their coins on the exchange.

The hacker shared some of the data with the Motherboard publication in order to verify that they have indeed had access to it. They have over 5,000 user contact details. Not only was this a security threat to those users on Coinsquare but it also exposed them to potential exploits on other exchanges and services that they used.

Coinsquare said that the data breach was disclosed to all the users, the authorities and the data regulators. This is still not great to hear for those traders who have had their data exfiltrated.

Asset Coverage

Coinsquare started off as a Bitcoin exchange but has expanded their cryptocurrency asset coverage to include Ethereum, Litecoin, Bitcoin Cash, Dogecoin, Dash, Ripple XRP as well as over 50 other cryptocurrencies.

Coinsquare is what is called a "Fiat Gateway" primarily for use by Canadian traders who want to use their CAD to buy cryptocurrencies. While many users would be comfortable with the coins that Coinsquare has on offer, there is always the option to move these coins onto another cryptocurrency exchange and pick up other altcoins.

Some of the Assets Available on Coinsquare. Image via Coinsquare.

Some of the Assets Available on Coinsquare. Image via Coinsquare.Hence, Canadian cryptocurrency investors can buy their Bitcoin with their Canadian dollars on Coinsquare and then move them to another exchange such as Kraken or Binance in order to buy the smaller altcoins. If you wanted to get an idea how much crypto you could buy on their platform with your dollars right now you can use their currency converter.

Coinsquare Fees

Trading fees at Coinsquare are relatively straightforward and simple to understand.

Coinsquare Pro Trading Fees

Coinsquare Pro charges a flat fee of 0.50% for both maker and taker trades. This means that whether you add liquidity (maker) or remove liquidity (taker), the fee applied is the same.

Coinsquare Trade Fees

For the standard Coinsquare Trade platform, the exchange has eliminated direct trading fees. Instead, it generates trade quotes using a spread, which ranges between 0.5% and 1.85%, depending on market conditions and liquidity. This spread is incorporated into the buy and sell prices, allowing for commission-free trading.

Staking Fees

Coinsquare offers staking services with varying reward rates and fees depending on the cryptocurrency. For instance, staking Ethereum (ETH) provides an estimated annual reward rate between 2.29% and 2.89%, with a 25% fee on rewards. Other assets like Solana (SOL) and Cosmos (ATOM) have different reward rates and fees.

Coinsquare Payment Methods

There are a number of ways for you to fund/withdraw from your account at Coinsquare. They have relationships with quite a few Canadian banks which means that CAD funding options are relatively straightforward. Below are the funding options together with fees and processing times.

It is important to note before you decide to fund your account that you should be verified and have completed their required KYC steps. We will cover all of this below.

Funding Account

| Payment Method | Min | Max | Fee | Processing Time |

| Interac e-Transfer (r) | $20 | $10,000 | 0% | 0-30 minutes |

| Credit Card | $100 | $5,000 | 10% | Instant |

| Wire transfer | $10,000 | Unlimited | 0% | 0-2 business days |

In the above, the "withholding" is the time that Coinsquare will take to allocate your funds to your account. This can be waived for those traders are recurring customers. The "days" listed above are business days as well. The "max" is defined by the sum total of all the funds that have come into the account in a 24-hour period.

Something that many people seem to have an issue with is the cost for crypto credit card purchases. This is pretty exorbitant at 10% (compared to 3.9% at Coinbase). However, many banks in Canada are trying to outlaw crypto credit card purchases so it seems pretty reasonable.

Of course, you can also fund your account with cryptocurrency. In this case, the time that it takes for your transaction to propagate will determine how long it will take to be placed in your account. They will not charge a fee in order to credit your account with crypto.

Withdrawal Options

If you wanted to withdraw your funds in Canadian dollars then the following are your options to do so.

| Payment Method | Min | Max | Fee | Processing Time |

| Direct Bank Deposit | $20 | $100,000 | 1.5% | 0-3 business days |

| Wire transfer | $10,000 | Unlimited | 1.5% | 0-2 business days |

| Interac e-Transfer | $20 | $2,000 | 0% | Within 24 hours |

You can also always withdraw just the coins off of the exchange. Coinsquare will not charge a fee for this but they will have to charge the going rate for the network (mining) fee.

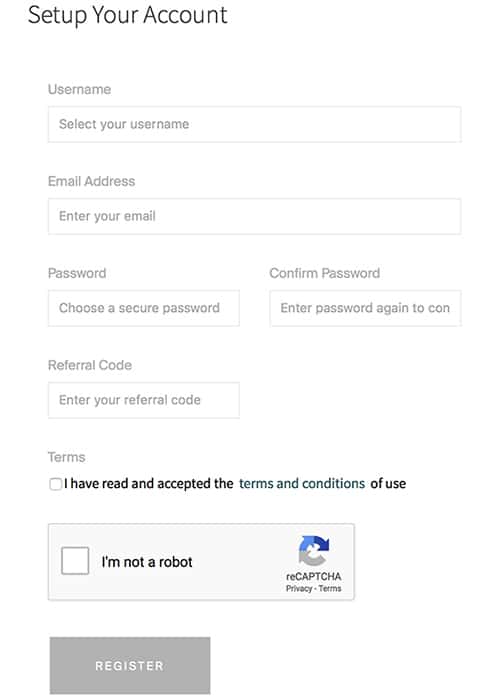

Coinsquare Login and Registration

If you wanted to start buying coins on Coinsquare then you would need to register an account. You can click the "getting started" button on the homepage and this will take you to the main registration page. This is pretty straightforward and is presented below.

Main Registration Page at Coinsquare

Main Registration Page at CoinsquareYou will need to confirm your email address before you can move onto the next steps. Once complete, you have officially signed up and created an account at Coinsquare. However, this account is an unverified account which means that you have not completed the KYC required at Coinsquare.

This is an important step and can be quite cumbersome.

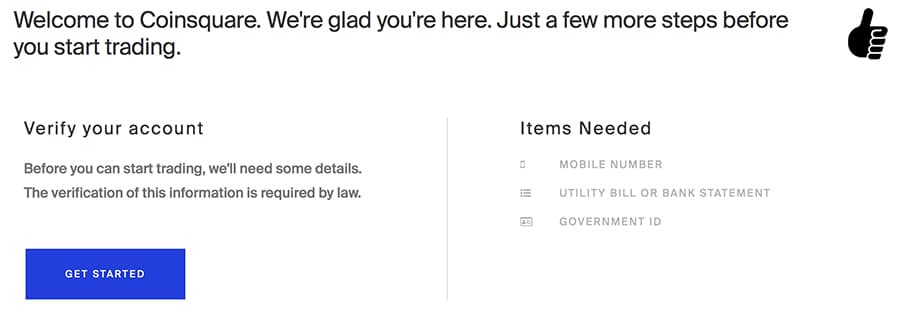

Coinsquare Verifications

Coinsquare is required by law to confirm the identity of those people who trade on their platform. This is why they require you to handover information about yourself including your proof of identity and address. These are given in the below image.

Verification Requirements at Coinsquare

Verification Requirements at CoinsquareYou will need to confirm your telephone number with a valid mobile number. They will then ask you to upload your identity document as well as your proof of address on the platform.

An acceptable identity document can be a driver's licence, passport, National Identity card, Permanent residency card or Health Card (assuming Quebec province). The proof of address can be a bank statement or utility bill.

Once you have submitted your verification documents, Coinsquare will have to take the time to read through them and make sure that they are well presented. They claim that they try to get this done ASAP but you should budget about 1 full day for the verifications to be complete.

When we registered our account and sent through the documents it took slightly over 1 day which is still quite impressive. If you were to compare this to the weeks that it took on an exchange such as Bitstamp or Kraken in December / January then one can appreciate.

Trading Platform

Depending on what sort of cryptocurrency buyer you are, the trading platform can make / break your experience. Some people would like to merely buy and "hodl". Others would like to trade the crypto markets more regularly as a day trader. The latter will therefore be really interested in the type of trading technology an exchange has.

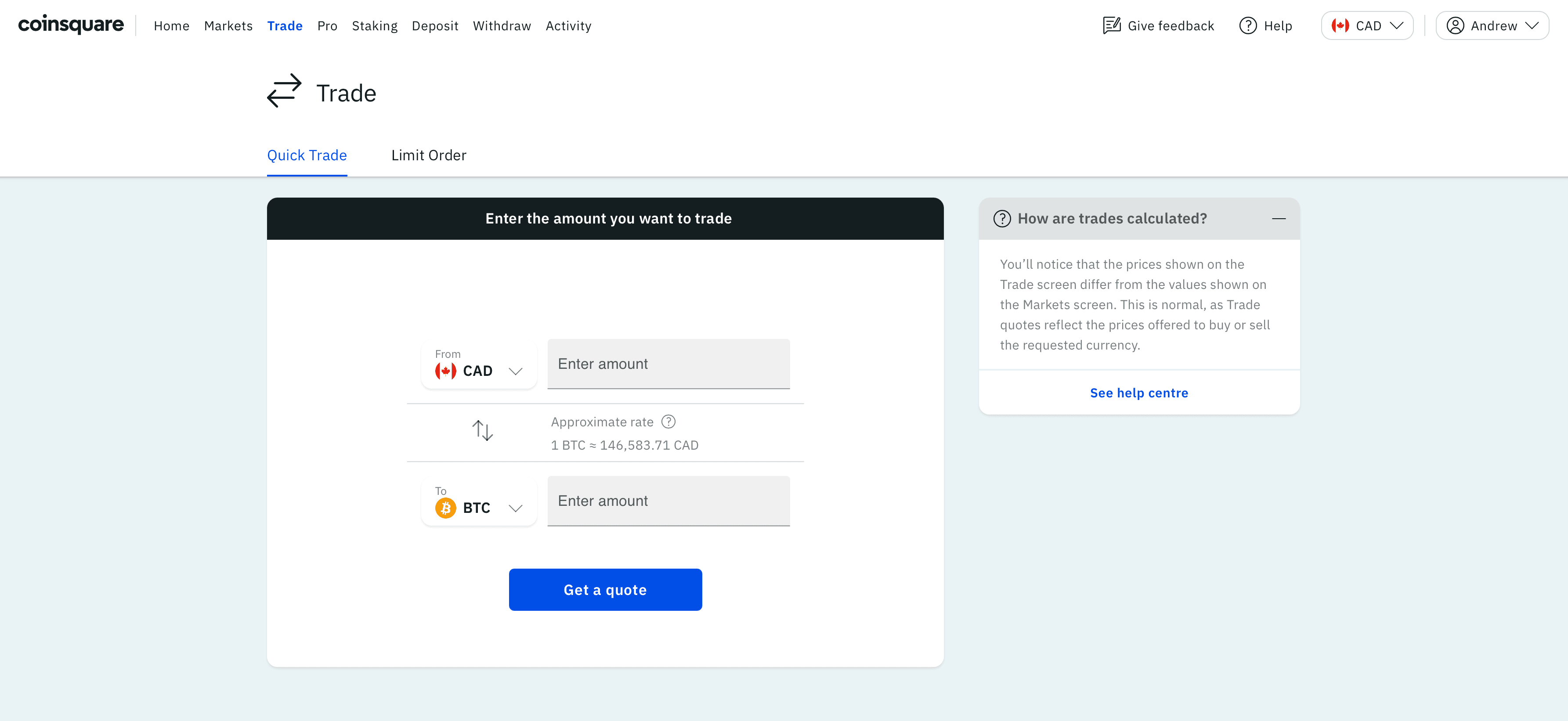

For those who are interested in merely buying a cryptocurrency quickly with a simple buy order, they will use the "Trade" option that is available right on the dashboard. Here, you can get a simple quote for the cryptocurrency that you want to buy and then place your order. It will be executed immediately and added to your wallet.

Trade Tab on Coinsquare

Trade Tab on CoinsquareCoinsquare Pro

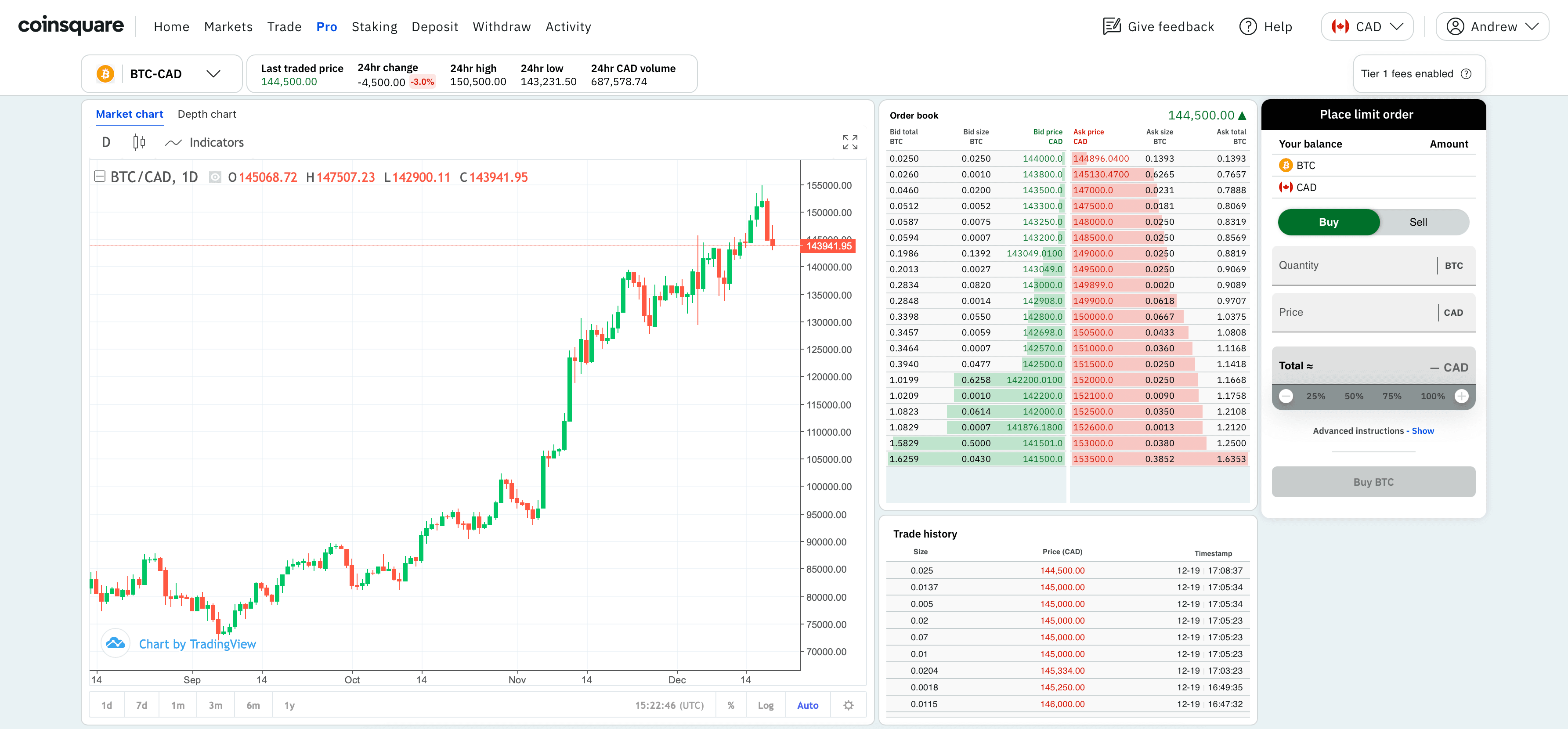

For those day traders among you that would like to have a few more tools at your disposal, you can head on over to the Advanced Trade tab on the platform. This will give the trader greater functionality when it comes order types and of course slightly lower fees (maker / taker).

It will also give you more information on the order books, current pricing as well as the most recent orders. Below is a screenshot of the advanced trading platform with the order form to the left of that.

Pro Trade Tab at Coinsquare

Pro Trade Tab at CoinsquareThe first thing to point out is that Coinsquare allows you to change the theme of the advanced trading platform. This is ideal for those traders who love that space grey dark theme. This is also a relatively new feature on the platform and it is a welcome change.

If you take a look at the chart on the left, it will be quite familiar to most traders. This is because the chart is a Tradingview chart. Coinsquare is using the software from this well-known charting package provider. It is also used by a number of other exchanges as their charting software of choice.

Tradingview charts give you a whole range of tools that you can run technical analysis with. Not only can you chart out the patterns and trend lines but it also has a compendium of indicators that can serve the chartist well.

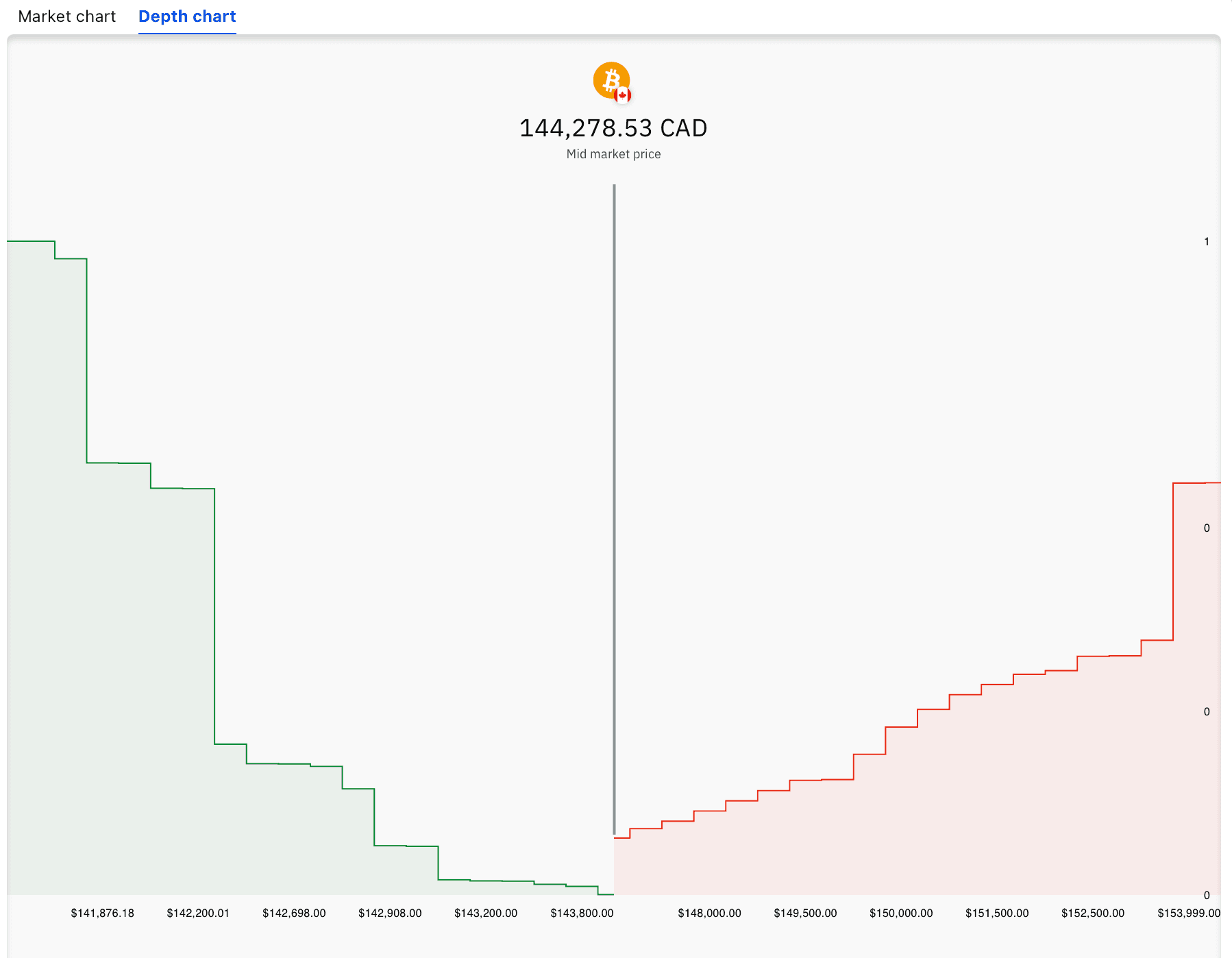

Moving back to the platform, you can also toggle between the price chart and the depth chart. The depth chart is a handy indicator which gives traders an idea of how the order books look. It allows one to ascertain the liquidity in the market and where sentiment is heading.

For example, if you were to take a look at the below charts depth charts you can see that there are substantial sell walls on BTC / CAD. This means that it could be harder for the bulls to regain the upper ground as there are large sell orders that need to be chewed through before prices can advance.

Coinsquare Advanced Depth Chart and Open orders

Coinsquare Advanced Depth Chart and Open ordersBelow the charts you have an overview of the orders that you currently have in the market (both open and closed). To the right of that you have the full order books as well as the order forms where you will be placing your order.

In terms of the order types you can place, you can elect to take a "Market" or a "Limit" order. The latter is merely an order level that is chosen by you and placed on the books (getting you the maker fee). The Market order means that your order will be executed at the market rate and you will be charged the taker fee.

So is the trading platform advanced?

Well, it is definitely more advanced than the basic option and has more functions and tools than most other Canadian exchanges. The Tradingview charting means that it can be used to run most of the analysis that the technical analyst may need to do.

Coinsquare App

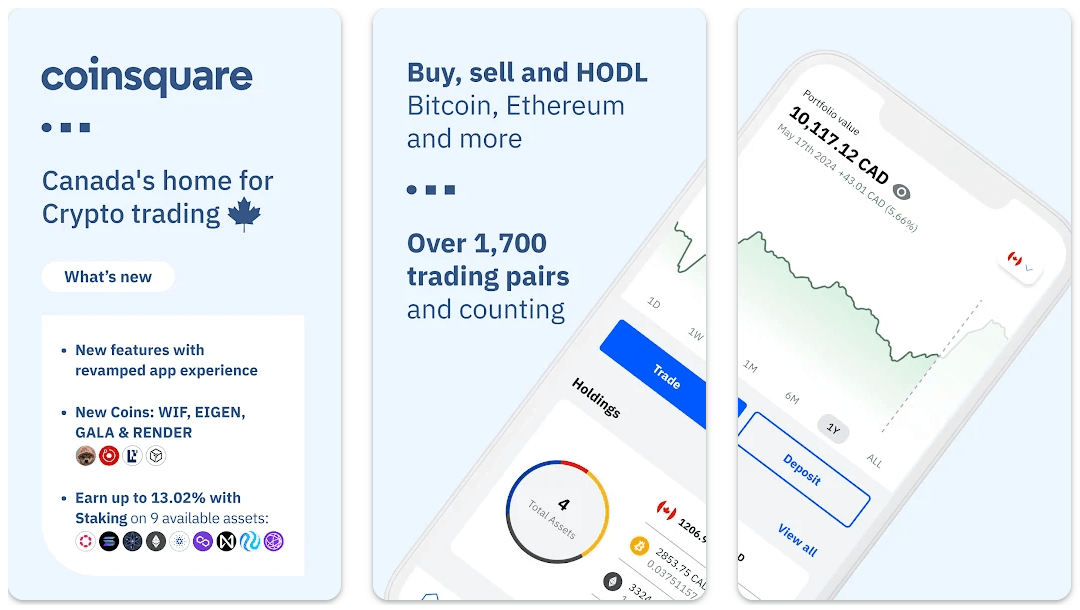

For those traders and cryptocurrency users who cannot be in front of their PCs the whole day, then the Coinsquare mobile application will no doubt come in handy. This was developed for both Android and iOS and has some of the same functionality of the online trading platform.

Coinsquare Mobile App

Coinsquare Mobile App We downloaded the app and started using it just to test the functionality. It is relatively well laid out and you can easily toggle between the different functions from trading to funding and withdrawals. It does, however, lack the advanced trade option so you cannot use the more advanced order types.

Coinsquare Support

Customer support is a very important consideration for a crypto trader. There is nothing more frustrating than having to wait days on a support ticket without getting any updates. Coinsquare appears to be pretty efficient in this respect.

For starters, if there is a general question that you had then you are probably best suited to try out the online FAQ section. In at least 90% of the cases, the question that you have can be resolved in the FAQ section.

If you have a more specific question that you need help with then you can make use of their chatbot / ticketing system. We are not massive fans of chatbots but they make up for it in terms of their response times to the tickets that you submit.

The support office hours at Coinsquare are form 9:00am to 5:00pm EST Monday to Friday. They say that the response time that you can expect is 1-3 days but when we reached out the support usually got back to us within 12 hours.

Unfortunately, there is no telephone support for those with standard accounts. Perhaps as the Coinsquare team grows and more support personal are brought on board they can begin offering this similar to what Coinbase has started offering now.

CEO Wash Trading

June 2020 was not a great month for Coinsquare. On top of the data breach that occured because of the employee theft, there were also a number of reports that the CEO had encouraged employees to conduct wash trading on the exchange.

For those that do not know, Wash Trading is the practice of simultaneously buying and selling the same asset in order to make it look like there is more activity on the exchange than there really is.

These were based on leaked documents that were also shared with the Motherboard publication. They showed that the CEO directed his employee to turn on the wash trading algorithms after they were visited by the regulators.

So, it is important to know about these accusations if you are going to trade there. Wash trading is actually illegal and is a form of market manipulation that has been outlawed by the Securities and Exchange Commission (SEC).

What We Didn't Like

While Coinsquare seems a reasonable alternative for most Canadians, there are a number of things that we think need to be addressed before the exchange can really expand.

Firstly, you have those questions that surround that data breach. By allowing an employee to steal 5,000 user accounts without any sort of protection mechanisms in place was unfortunate. Users should consider this before they hand their data over for KYC purposes.

Secondly, the wash trading allegations are no doubt serious ones and do raise a number of questions about the conduct of the exchange and the CEO. One cannot be entirely comfortable using an exchange where they know that the volume is not legitimate.

Onto other improvements though, we also think that Coinsquare should integrate more cryptocurrencies. There are a number of large altcoin cryptocurrency exchanges that have begun accepting Fiat wire deposits. They will no doubt eat into Coinsquare's market share unless they can offer a viable alternative with a range of other Altcoins.

Lastly, we also think that Coinsquare should find a more affordable credit card processor. Charging 10% for a credit card purchase is unpalatable to many people and reflects badly on the exchange.

Conclusion

Our Coinsquare review was relatively easy to complete. It's a pretty large exchange that has been offering Canadians with an attractive trading alternative for a couple of years now.

Moreover, they are trying to expand vertically in the cryptocurrency industry as they are also investing in crypto mining ventures as well as a larger capital markets business.

However, despite this there are a number of concerns that surround the exchange. They have to take concrete steps to address their data breach and wash trading allegations. This is especially true given the competition they now face in Canada.

It will be interesting to see what course of action the exchange takes in light of this. However, if you were looking for a relatively quick and easy way to get your hands on crypto with CAD then this coul be a decent alternative.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.