Bitcoin has remained the leading cryptocurrency, but there are some solid contenders. One of those is Dash, which got its name as a short form of “digital cash”.

This was originally a fork of Bitcoin & was developed to be a simpler alternative for mass adoption. In order to reach that goal, it has built on the basics of blockchain technology and has since expanded on that by adding new features.

However, given the newer competition, is it still worth considering?

In this Dash review I will attempt to answer that. I will also analyse the long term adoption and price potential of the DASH coin.

History of Dash

Dash first appeared in 2014 and was developed by Evan Duffield. At the time he called it xCoin, and soon after the name was changed to Darkcoin. It wasn’t until March 2015 that the coin was renamed Dash, and it’s continued using that name since.

History of Dash with Xcoin, Darkcoin & Dash

History of Dash with Xcoin, Darkcoin & DashThe primary focus for utilization of Dash is in the transactional space, for use as a payment to merchants. Dash uses Proof-of-Work as its consensus mechanism, which means it can be mined. And of course, it can also be purchased from a large number of exchanges.

Dash was one of the first coins to successfully adopt self-governance and self-funding. It receives its development funds from the proceeds generated by the blockchain, and its governance is controlled by the owners of network master nodes. This also makes Dash one of the first successful decentralized autonomous organizations (DAOs).

Dash Basics

At its heart Dash works in a very similar manner to Bitcoin. It is completely decentralized, with no authority controlling transactions or activities on the blockchain. Everything that happens with Dash is recorded its distributed ledger, and all value transfers happen in the most transparent manner.

The Dash network is comprised of master nodes, which are servers that have their resources allocated to processing and verifying transactions on the Dash network in return for rewards of Dash fees and coins.

While the use of master nodes doesn’t immediately seem so important, this architecture gives the Dash network significant processing power and has allowed for the inclusion of two important Dash features: InstantSend and PrivateSend. These two features make Dash a unique project.

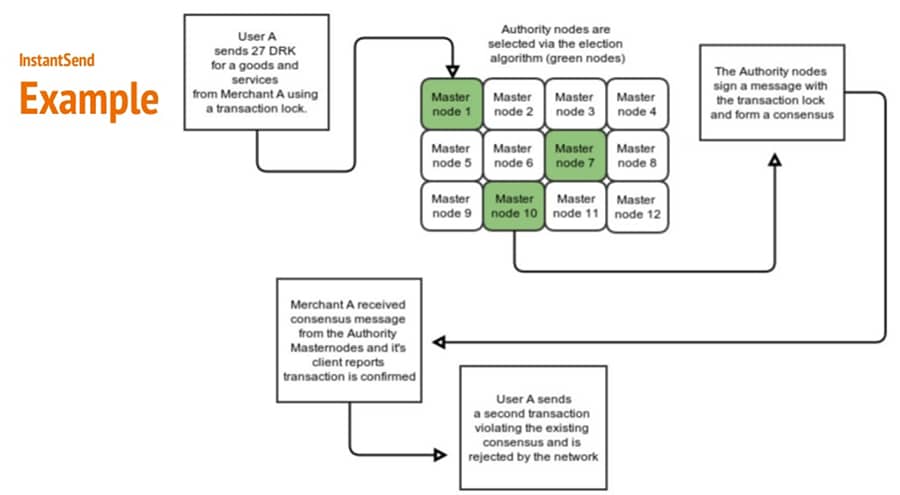

Example of Dash Instant Send. Image via slideshare

Example of Dash Instant Send. Image via slideshareTo keep things simple I’ll just mention that InstantSend isn’t literally instant. It takes about 4 seconds to confirm an InstantSend transaction. That’s pretty near instant when compared with the 10 minutes or more that the Bitcoin network needs to confirm a transaction.

The master nodes do the initial consensus on the validity of each transaction, and they then lock the funds to promise the network that the transaction will be completely validated in the coming blocks.

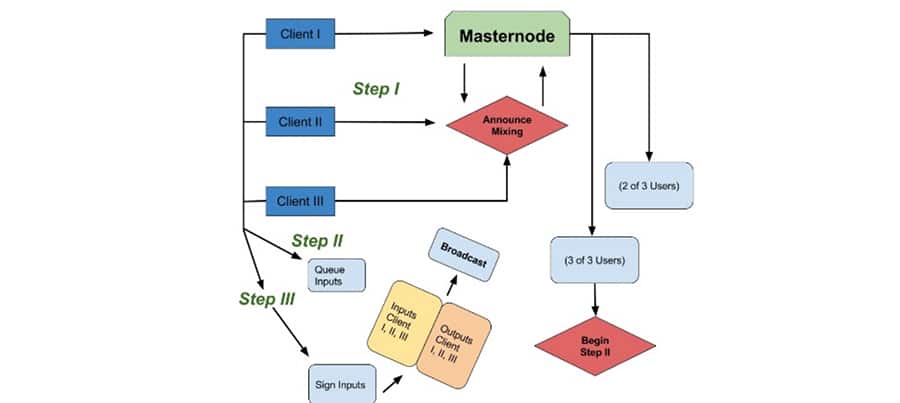

Example of Dash Private Send. Image via slideshare

Example of Dash Private Send. Image via slidesharePrivateSend is a great feature since it allows users to keep their identity hidden, while also obscuring the origin of funds sent, thus keeping accounts private as well. Dash accomplishes this through a process of virtual mixing of wallet inputs. This mixing doesn’t involve any transfer of coins, but it serves to solidly obscure where funds come from.

Dash versus Bitcoin

Dash may have started from Bitcoin, but it has moved on from the oldest and largest of the cryptocurrencies, adding new features meant to make it more suitable to be used as a transactional digital currency. Those changes include the larger block size of Dash, but there are other improvements as well.

Unfortunately for Dash enthusiasts, the fact that Bitcoin is the oldest and most popular cryptocurrency has kept Dash well in the shadow of Bitcoin, even though Dash has been innovating and adding superior features. It is still early in the history of cryptocurrencies though, so that could change in the coming decade.

In addition to using larger block sizes, Dash also gets faster transactions from the use of master nodes. They allow for more verifications, faster and also give Dash the ability to run its special features such as PrivateSend and InstaSend. The master nodes also provide the budgeting and governance features of Dash, as well as other features that simply would not be possible without this layer of the network.

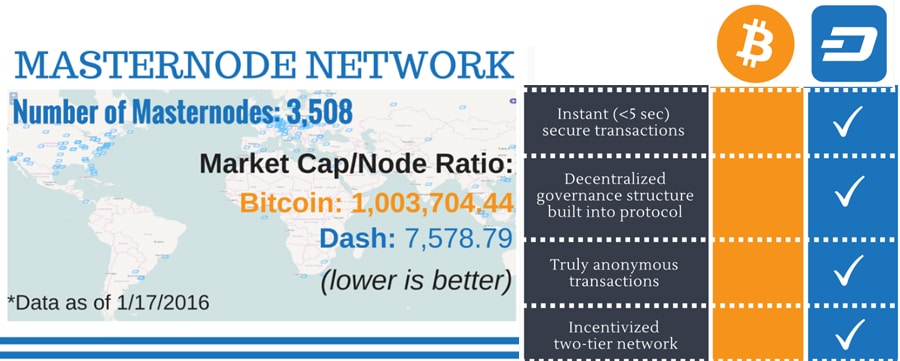

Bitcoin & Dash Compared. Image via Dash

Bitcoin & Dash Compared. Image via DashOne of the major differences between Bitcoin and Dash is the governance system added to Dash. Since the genesis of Bitcoin, we have seen how a lack of stakeholder governance can cause issues, making the lack of governance a major stumbling block.

Dash avoids such issues by allowing master node owners a say in the network. They are able to vote on budgeting concerns and on network changes. This is only fair since the master node owners do have a definite stake in the network, having to put up collateral of 1,000 Dash to run their nodes.

Currently, there are 4,939 master nodes, which gives a good deal of decentralization to the decision making process. These 4,939 decision-makers help determine the course of the Dash network by voting on change proposals. Compare that with Bitcoin, where a small number of insiders are responsible for making governance decisions.

The X11 Algorithm

When Even Duffield created Dash he wanted to use an algorithm that wasn’t exploitable by the powerful ASIC mining rigs that control Bitcoin mining.

As a result, he created an algorithm known as X11. The X11 algorithm is a proof-of-work algorithm, just like Bitcoin’s SHA-256, and it uses the processing power of computers to solve a cryptographic problem, thus proving work has been done, validating transactions, and preventing abuses on the network.

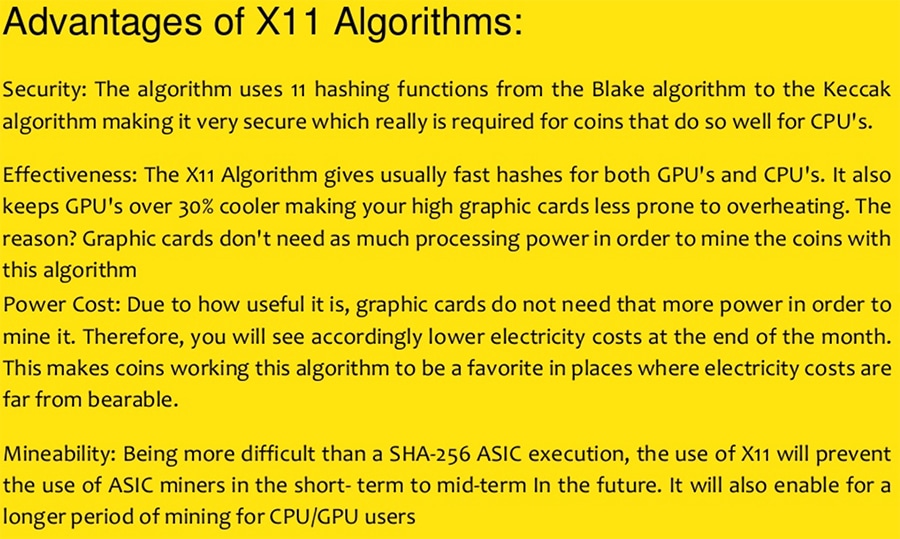

Advantages of X11. Image via Slideshare

Advantages of X11. Image via SlideshareX11 is different from other proof-of-work algorithms because it uses 11 different hashing processes. That made it extremely difficult to create an ASIC rig capable of mining Dash, which kept the distribution of mining and coins more equitable.

Dash wasn’t able to block ASIC’s forever, and by 2018 an ASIC capable of mining Dash was released. Dash has been able to keep coin distribution equal and fair however by increasing the difficulty level of mining, and by decreasing rewards over time.

The Benefits of using Dash

I’ve already discussed one of the greatest benefits of Dash, which is the PrivateSend feature. While it does keep all the transactions transparent on the ledger, it also makes it nearly impossible for someone to dissect transactions to trace the origin of coins and get an idea of the balance of various accounts.

And Dash does have functions in place that would allow law enforcement to trace fund origins if necessary, but for the general users, transactions are far more anonymous on Dash when compared with most cryptocurrencies.

Dash has also made itself extremely decentralized by using the master node approach. This decentralization makes the Dash network more secure, gives it better uptime protection, and increases the redundancy of the network.

Perhaps one of the greatest benefits is that Dash was built with scalability in mind. While many cryptocurrency projects have spent the past 12-18 months focused on how to improve scalability, Dash has already been built to scale up to block sizes of 400 MB if necessary. This gives Dash 400 times the number of transactions per block when compared with Bitcoin.

The Dash Team

Evan Duffield is the creator of Dash, and he is still with the team, but in the role of a strategic advisor.

The CEO of Dash is Ryan Taylor, and he’s held that position since April 2017. Prior to that, he was the Director of Finance for Dash. A graduate of Columbia University’s MBA program, Taylor has a long and successful history in the financial services industry, first with McKinsey and later as the owner of his own equity research firm.

The CTO at Dash is Bob Carroll, and he’s held that role since May 2018. Prior to joining Dash Carroll created a number of his own ventures, as well as serving as CTO of Everspring for 5 years. He is a well-rounded technology professional with strong entrepreneurial tendencies.

Glenn Austin holds the reins as the CFO at Dash since March 2018. He has a strong financial background, working for Morgan Stanley for 5 years, and later spending 6 years as a Global Key Account Manager at UBS. He is a graduate of both Harvard University and Columbia Business School.

DASH Coin

Dash remains one of the most popular cryptocurrencies, ranking number 17 in terms of market capitalization, with a market cap of $617 million as of September 29, 2019. Interestingly, the trading volume for Dash is greater than many of the cryptocurrencies with larger market caps, in some cases much greater, highlighting the high adoption rate and popularity of Dash.

When Dash was created (as XCoin at the time) one unit was worth roughly $0.21. I’m sure early investors and miners had no idea how much those coins would soon be worth. By the time the coin was rebranded to Dash in March 2015 one unit was worth a bit over $3. The rebranding did set off a rally in the coin, and on March 21, 2015, it hit $7.11, but quickly dropped from that level.

Between mid 2015 and late 2016 DASH remained rangebound. It traded between $3 and $12 as the entire cryptocurrency market was about to be picked up by the monumental bull run.

January 2017 saw Dash trading rally above $15, and by the end of February, the coin had reached $30. It remained on fire, climbing above $100 in March and remaining there for 9 days before finally falling back to the $70 in April.

DASH Price Performance. Image via CMC

DASH Price Performance. Image via CMCThe weakness didn’t last long, and by May price was back above $100. In June price doubled again, hitting $200 briefly. It continued to bump above $200 in July, and in August it doubled once again, hitting the $400 level.

Price settled back to the low-to-mid $300 level in September and October, but the best was still to come. As the 2017 rally in cryptocurrencies kicked off Dash hit $500, $600 and then $800 in November. It continued climbing, doubling once more to hit its all-time high of $1,642.22 on December 20, 2017.

Price slid steadily lower in 2018 as the bear market in cryptocurrencies lingered. By December 2018 the price of Dash had fallen back below $100. It found support around the $70 level and spent the next few months trading mostly between $70 and $85. Prices have since settled to just above $70 at the time of this post.

While the current price is quite low considering the all-time high for Dash, it is also quite high when you consider where Dash came from just 5 years ago. Early investors who bought at $0.21 have a huge profit, even at the current depressed levels.

Buying & Storing DASH

As you might expect for one of the largest and earliest cryptocurrencies, you can buy and sell Dash on well over 100 different exchanges. Interestingly the largest volume of trades is at Cat Ex where Dash is matched with TRX (Tron). There’s also a good amount of volume at Bitinka and LATOKEN. Of course, Dash is also available at larger exchanges such as Binance, Huobi Global and even Coinbase.

This volume also appears to be pretty well spread out across the exchanges which means that there is relatively little risk from a key exchange perspective. On the individual order books, the turnover appears to be strong and the order books are wide.

Register at Binance and Buy DASH Tokens

Register at Binance and Buy DASH TokensThere’s a wide variety of Dash wallets available, including support from the major hardware wallets – Ledger, Trezor and KeepKey. There is also a Dash Core desktop wallet, and support from the Exodus, Jaxx and Coinomi wallets. On the mobile side, there are well over a dozen wallets to choose from, including the native Dash Android or Dash iOS wallets.

If you are looking for a more in-depth analysis of the wallet options then we have covered a piece on the best wallets for DASH.

Development & Roadmap

So how much work have the Dash developers been doing? Well, one of the best ways to get a sense of this is to check out their GitHub Commits.

The open source code commits are perhaps one of the most direct ways to get an indication of work being done on the Dash protocol and all the other features.

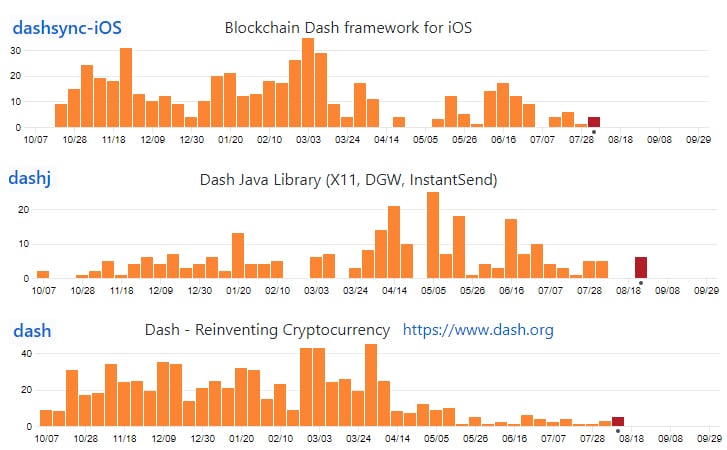

Hence, I decided to dive into the Dash GitHub repos and observe the number of code commits. Below are the commits to the top 3 most active repos over the past year.

Code Commits to Select repos over past 12 months

Code Commits to Select repos over past 12 monthsAs you can see the developers are quite busy with a number of updates both to the core software as well as the mobile wallets. It is also worth pointing out that there are a further 80 repos spread across two separate GitHubs.

So, this shows that the Dash developers are still driving the project forward. This would perhaps make sense when viewed in conjunction with their roadmap.

The Dash team has completed a number of the milestones that they had in their roadmap for 2019. However, there are still three major milestones that remain in 2019. These include the following:

- Dash Core v1.0: This will include username based payments, Decentralised API, Decentralised data storage and development libraries

- DashPay Wallet: In this stage, it will allow users to register a personalized username. They will also be able to connect with their contacts by username instead of their DASH address. Finally, they will be able to make and receive payments based on usernames

If you wanted to keep up to date with the development on the Dash protocol then you are perhaps best suited to follow their official blog. Here they give users in-depth information on their progress.

Conclusion

Dash is positioned well and has a good deal of support from its users and the cryptocurrency community in general. The development team has continued to grow, from one person in the early days to over 40 individuals currently.

The goal today is the same as it has always been – to make Dash as easy to use as current payment systems such as PayPal.

The Dash developers have added features that make it superior to Bitcoin and other transactional payment systems, and the resilience of the Dash coin even through the 2018 bear market is doubtless encouraging for investors. The additional master node layer added to Dash has helped it solve scalability, speed, governance and anonymity issues.

Dash remains one of the top contenders for global adoption as a transactional currency, but only time will tell how successful it can become. Thus far it looks promising for the future of Dash.