Einsteinium Review: Funding Scientific Research with Crypto

Einsteinum (EMC2) is a pretty established cryptocurrency that was developed with complete inbuilt altruistic intentions in mind.

Einsteinium is a peer-to-peer and proof of work cryptocurrency similar to Bitcoin, and it was created with no pre-mine and no ICO. It was designed to provide funding for scientific, technological and blockchain projects deemed to be beneficial for the future. In essence, it is quite like a charitable fund created with Bitcoin.

However, can Einsteinium really achieve these ends?

In this Einsteinium review, I will give you everything that you need to know about the project. I will also take a look at the long term adoption potential of EMC2 tokens.

What is Einsteinium

Einsteinium was initially created back in 2014, but the founding members soon abandoned the project and it went ungoverned until the summer of 2016 when it was picked up by the current board of directors. One of the first steps they took was to register the Einsteinium Foundation as a non-profit organization in Montreal, Canada, making it the first blockchain based non-profit organization.

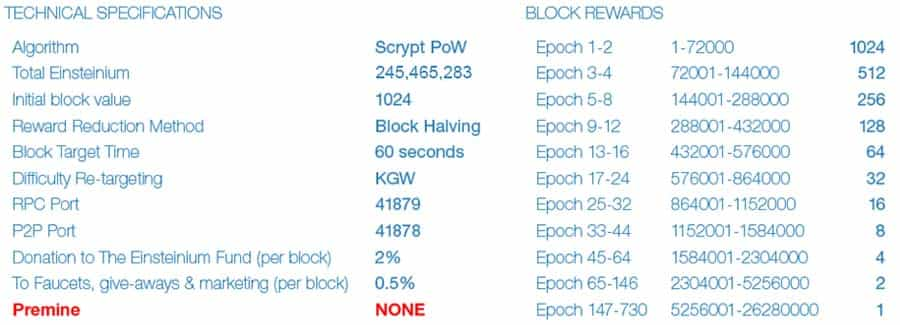

The Einsteinium Foundation has become the organizational and governmental hub for choosing projects to support and for distributing charitable funds. The Foundation receives 2.5% of the block rewards under the Proof-of-Work mining system and uses this to fund projects. The funds are split, with 2% going to scientific research and the other 0.5% going to marketing, donations, and faucets.

To fully understand how projects are chosen for funding and how much funding they receive you need to understand the concept of epochs under the Einsteinium Proof-of-Work consensus.

Einsteinium Epochs Explained

Einsteinium uses a concept called “epochs” to determine block rewards. An epoch in Einsteinium is the amount of time it takes to build 36,000 blocks in the Einsteinium public ledger. This is about 25 days, and Einsteinium was created with 730 epochs during which miners can receive rewards.

Once an epoch concludes all the funds received during that epoch by the Einsteinium Foundation go to fund scientific research or work in technology or blockchain. The choice of projects and amount of funding is voted on by members of the Einsteinium community based on which projects they feel offer the most promise to the planet and humanity.

The way Einsteinium was developed calls for block rewards to scale downwards as epochs advance. So, the first and second epochs had block rewards of 1,024 EMC2. The third and fourth epochs saw that reward halved to 512 EMC2.

Currently, the network is on epoch 65, with a block reward of 2 EMC2. That reward will remain the same until epoch 147 when the reward will halve to 1 EMC2 per block. That will be the final halving and the reward will remain 1 EMC2 until the end of epoch 730.

With block rewards almost at their lowest level possible, you might wonder what is the incentive for miners to continue mining and that’s a very interesting question indeed.

The answer was once Wormhole Events

Einsteinium was created with an extremely unique feature that kept interest from miners high, despite the declining block rewards. That feature was called the Wormhole Event and it was a phenomenon that occurred randomly once during each epoch.

When the Wormhole Event occurred it lasted for 180 blocks and during that time the block reward increased to 2,973 EMC2. It was a lottery system that kept mining interest within the community high even though the standard block reward was declining.

Wormhole events could have made mining increasingly profitable as time went on and the value of EMC2 increased, but the team had to make the decision to remove the Wormhole Event feature back in September 2017. The reason was that malicious miners had learned how to perform chain reorganizations and get the entire Wormhole reward. This reduced the eventual total number of EMC2 coins by 55,075,320.

There is good news coming about the Wormhole Event, so keep reading...

The Einsteinium Team

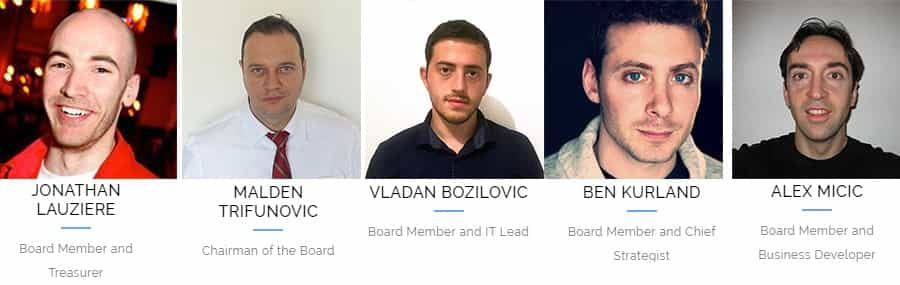

As mentioned above, the original Einsteinium team abandoned the project back in 2014. It took some time, but by the summer of 2016 there was a governing team in place once more, and they have remained since then to continue guiding and growing the Einsteinium project.

One of those new members was Jonathan Lauziere, who was a university Computer Science student when he joined the Einsteinium project in September 2014, following the departure of nearly all the original team members. He serves as a board member and as Treasurer of the Einsteinium Foundation.

Next is Malden Trifunovic, a serial entrepreneur and early investor in cryptocurrencies. He was previously the founder of a software consulting business but now serves on the board of the Einsteinium Foundation as its Chairman. He has a master’s degree in Microprocessor design and worked as a C++ developer.

Third of the six board members is Vladan Bozilovic. In addition to being a board member, he also serves as the IT lead for the project. He started his career as a software developer and has gained experience in all phases of the software life-cycle. His expertise stretches from mobile and web technology to data structures and networks.

The fourth board member and Chief Strategist at the Einsteinium Foundation is Ben Kurland. Ben is an actor and blockchain enthusiast, but prior to joining the Einsteinium Foundation, he was working as a managing partner at a financial mediation company.

The lead Business Developer and fifth board member is Alex Micic, who brings investment analysis experience to the project. He has substantial consulting, strategy, corporate finance, business development, and investment management experience.

The sixth and final member of the Einsteinium board and Project Coordinator for the development of Einsteinium is Ryan Wright. He has been involved in blockchain projects since 2013 and joined the Einsteinium Foundation in August 2017.

EMC2 Token Trading

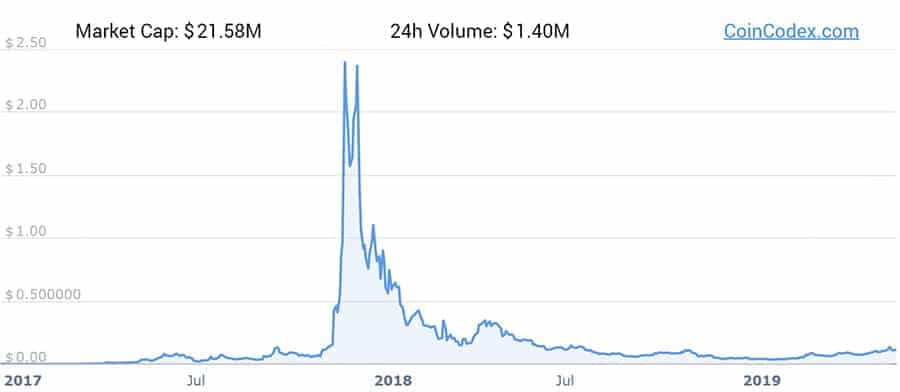

With no pre-mine and no ICO things were pretty quiet for the EMC2 token from its creation in 2014 until the Einsteinium Foundation was created in 2017. For example, in 2014 EMC2 remained mostly between $0.0001 and $0.0002, but by mid-2015 it had fallen below the $0.0001 level and remained there until early 2016, where it hit a low of $0.000054 on January 18, 2016.

By the end of 2016, it had reached $0.001 and began climbing more aggressively in 2017, reaching $0.01 by April and then $0.1 by June. Price pulled back until the December 2017 / January 2018 rally in crypto markets. Then it rocketed higher, quickly hitting $1 and then reaching its all-time high of $2.88 on December 7, 2017.

From there is slowly declined along with the rest of the market, returning to $0.1 by August 2018. It continued lower still from there and eventually bottomed around the $0.03 level in December 2018 / January 2019. We’re seeing a recovery from those levels and as of June 2019, it is back above $0.1 at $0.112762.

Einsteinium is only available from a small number of exchanges. The largest trade volume is on Upbit, so that’s your best bet if you want to purchase Einsteinium. Another exchange with a large trade volume is BCEX.

There is also a modest amount of trade volume on Bittrex. The Einsteinium website also shows the EMC2 coin listed on TradeSatoshi and DigitalPrice, which is true, but there’s no trading volume at all on either exchange.

The outsized impact that Upbit could have on the price is quite a risk for the EMC2 trading. This is because it is well known that the Korean market is much more susceptible to FUD and news flow. This means that the price is likely to be that much more volatile than competing coins.

The limited exchange coverage could open up additional liquidity risk in the event that Upbit were ever to delist EMC2 tokens. However, a delisting is still an unlikely scenario at this stage given the demand in the Korean market.

Storing Einsteinium

Once you have got your EMC2 tokens then you are going to want to find a safe wallet to store them in. Keeping your coins on an exchange is quite risky in the event of any exchange hacks.

The best choice in wallets will be the official Einsteinium wallet available from the Einsteinium website. The latest version is called Lightsaber and it is available in Windows, Linux and Mac OS versions.

They also recently released Weeee Cash, which is not only a mobile EMC2 wallet for Android devices but is also a fun social platform where you can connect with your friends.

Finally, there is also support for EMC2 on Coinomi’s wallets. Coinomi is a third party wallet developer that has both a desktop and mobile wallet. The wallet also supports over 500 other coins which means that you can store more than just EMC2.

One thing that you will need to consider when storing your EMC2 tokens is that the Coinomi wallet is not open source whereas the Einstienium wallets are. Some crypto purists prefer to use open source wallets over those that are closed source.

Einsteinium Development

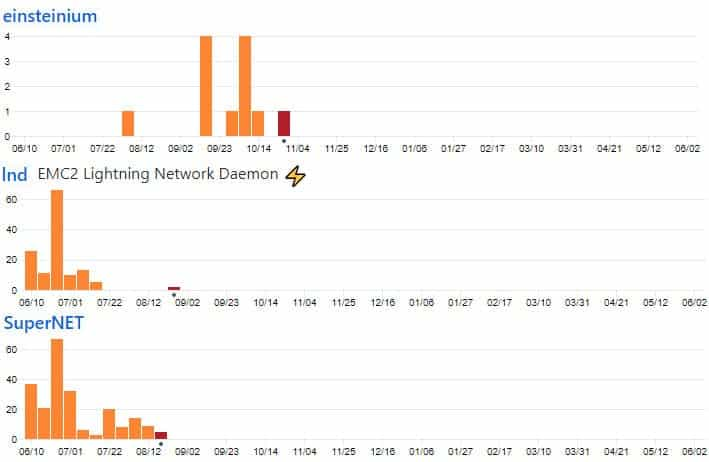

Determining exactly how much work is being done on a project can sometimes be challenging. However, it helps to take a look into their public code commits as this is the direct output of that work.

Hence, I decided to jump into the Einsteinium project GitHub to get a better sense of just how much code the developers have actually been pushing over the past year. Below are these code commits for three of their top repos.

As we can see, the developers are still active maintaining the code. However, the number of commits is much less than I have seen on other projects. Perhaps this is because Einsteinium is already an established project and much less protocol groundwork needs to be done.

Of course, this level of activity could change in the coming months as the team works on their new MIL token.

Future for Einsteinium

The Einsteinium team is currently devoting most of their energy to the creation and launch of a new MIL token that will compliment EMC2 and will also bring back the popular Wormhole Event.

The MIL coin will also be used to fund scientific research and will have a maximum supply of 2.7 billion coins. The first 660 million will be airdropped to EMC2 holders at a rate of 1:3, so for every EMC2 token held users will receive 3 MIL tokens. You can read more in the project Bluepaper.

Once the MIL token is launched the team has plans to further develop the new Weeee Cash wallet and social network, adding new coin support and new functionality. There are also ongoing efforts to get the coin added to more exchanges, and integration with more wallets, including Exodus and BitPay.

You can see all the planned upcoming changes on the project’s roadmap.

Conclusion

Einsteinium is completely unique in the blockchain space. There is no other project that uses its cryptocurrency to fund charitable giving, and the team should be applauded for the work they are doing. Already the Einsteinium Foundation has been able to make a difference in scientific research through its contributions.

While the token might not be the best investment, it is certainly worth buying just to support the mission of the Einsteinium Foundation. Or you could buy now and enjoy the benefits of the MIL airdrop that’s coming soon. And mining MIL could become extremely profitable with the return of the Wormhole Event.

Taken altogether there’s nothing really negative to be said about Einsteinium. It’s a good project, with a good mission, and it’s already achieving great things. If you believe in philanthropy and scientific pursuits you almost have to invest something in EMC2.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.