More than half of the world’s population is living in Asia and nearly half of those are connected to a central power grid for their electricity needs.

This is a huge marketplace, and as countries increasingly liberalize their electricity markets there will be an explosion of innovation from entrepreneurs who will use the existing infrastructure to increase private energy production and distribution.

We’ve seen this already in some Western countries, and when combined with blockchain technology, consumers will have an increasingly varied choice of where to get their energy from.

The World Energy Council has already predicted that in less than 10 years at least 15% of the world’s energy needs will be distributed using decentralized networks.

As countries around Asia gear up for the liberalisation of their electricity markets, ELECTRIFY will deliver value through our marketplace and peer-to-peer (P2P) platforms

With consumers increasingly focused on clean energy, and markets becoming increasingly open, innovators are needed to help find ways to distribute energy in an efficient and intelligent way.

The Electrify Asia project is looking to do just that, and has already launched with a token that can be traded, and an existing infrastructure and offchain marketplace.

The Electrify Asia Team

The Electrify Asia team brings a wealth of experience in electricity distribution and technology to bear. The CEO and co-founder of the project is Julian Tan, who previously worked at Sunseap Energy and who also spent time as a Research Engineer at the Solar Energy Research Institute of Singapore.

Electrify Asia Team. Source: electrify.asia

Electrify Asia Team. Source: electrify.asiaJoining him as COO is Martin Lim, another alumni of Sunseap Energy, where he worked as a Business Development Consultant. Prior to that he spent 15 years working as Creative Director at a variety of companies.

Head of the Engineering and technology at Electrify Asia is Sean Eu, an IT specialist with more than 20 years experience developing systems and enabling business transformation through information technology. He was previously the CTO of GlobalRoam group, and has held numerous technology leadership roles over the past two decades.

Finally, the Electrify Asia project has OmiseGo founder Jun Hasegawa as the lead advisor of the project. Jun is assisting the project with payment solutions and blockchain scalability.

Core Value Proposition

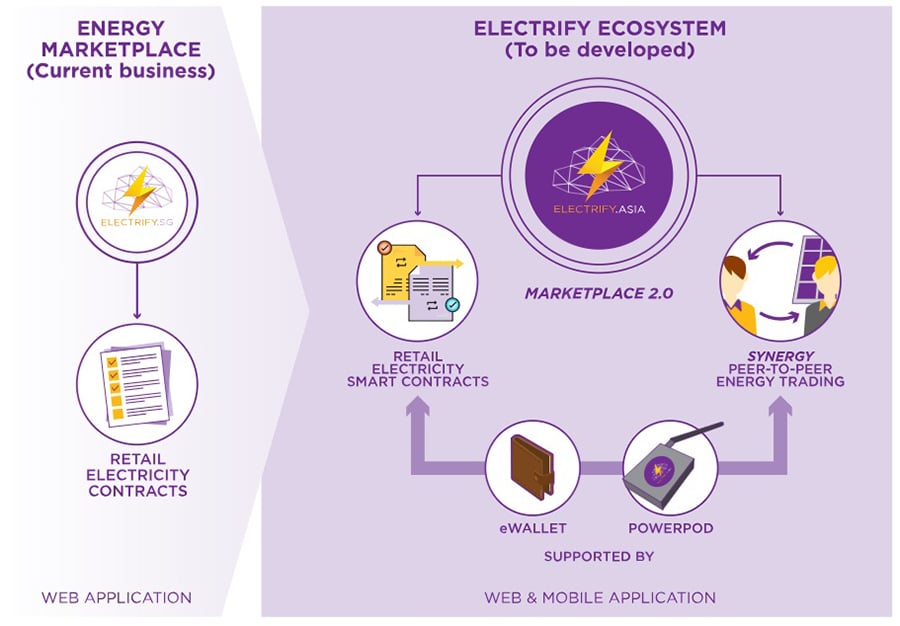

Electrify Asia has as its core value proposition the decentralization of power production and distribution, thus giving consumers a wider variety of energy sources, and lower prices. This will be realized by bringing the existing Electrify Asia intelligent offchain marketplace onto a blockchain based marketplace.

The Marketplace 2.0 will replace the current offchain version and allow users of Electrify Asia’s service to access the Marketplace online via web browser and mobile applications. All of this will be conducted on a blockchain, and it provides consumers several key benefits.

Current Marketplace vs. Proposed

Current Marketplace vs. ProposedFirst, it will allow retail customers to purchase their energy at discounted wholesale rates, saving money. Next, it will give consumers more choice in their energy delivery, opening up more alternative and clean energy sources in a P2P marketplace.

The Marketplace will run on energy smart contracts that are secured on the blockchain, and the whole process will be fueled by the ELEC token. The ELEC token, which is an ERC-20 compatible token created on the Ethereum blockchain, will allow producers and retailers alike access the Electrify Asia ecosystem.

In order to offer energy in the marketplace, the producers and retailers will be required to stake ELEC as a deposit. Transactions fees will also be paid by the energy providers in ELEC tokens.

Consumers will create accounts, and will be able to log in to purchase their energy from producers in the Marketplace 2.0. This will be facilitated by the PowerPod, and Internet of Things device created by Electrify Asia to enable producers to log their energy output on the blockchain.

The PowerPod is basically a smart energy meter, that will decentralize the tracking and data collection associated with energy production and consumption. All of the data collected will be accessible via the Synergy P2P Trading dashboard.

Electrify Asia Opportunity

Image source: electrify.sg

Image source: electrify.sgElectrify Asia is off to a strong start with an established working energy marketplace in Singapore. This marketplace was designed for enterprise clients and has about a dozen retailers already participating to deliver energy. This first generation marketplace establishes the validity of the Electrify Asia business plan, as well as a working architecture for the company’s expansion into foreign markets.

Electrify Asia is already benefitting in Singapore from first-mover advantage and a lack of competition, which should give them a clear path to growth in their home country once they successfully implement the Marketplace 2.0 onchain technology. All that will be needed at that point is to clearly demonstrate the advantages of the blockchain solution to the average consumer.

This shouldn’t be difficult as consumers are expected to see savings of 25-30% in the electricity tariffs compared with the Singapore government utilities provider. This is expected to yield a 20% savings on electricity bills. These reduced rates will come from retailers who will be able to buy electricity at wholesale rates and then resell to customers at a discount on the Electrify Marketplace.

This savings provides a huge incentive for both businesses and consumers to switch to the Electrify marketplace. The fact that the electricity remains on the main grid, with no loss of stability and quality, will be an added incentive for consumers to switch over to Electrify.

Another really important advantage that Electrify Asia has is their partnership with Tepco, which is the largest electricity supplier in Japan and one of the largest in the world. This would come as no surprise as Japan has a liberal regulatory environment, and a very receptive attitude towards blockchain technology.

Electrify Asia Weaknesses

One of the main selling points for the Electrify Asia project is the liberalization of the energy marketplace. The glaring issue is that there is no clear trend in Asia towards market deregulation, especially in the more centrally controlled economies. This could pose significant regulatory hurdles for Electrify Asia as they try to penetrate many Southeast Asian markets.

Power Ledger Signs with BCPG. Image source: Medium

Power Ledger Signs with BCPG. Image source: MediumConsider the Philippines, where government provisioned electricity is quite strong. Electrify Asia will find it nearly impossible to break into this market without a government linked backer, or a partnership similar to that established by Power Ledger in Thailand.

Throughout the developing world it is very common to see governments providing electricity through state-owned generation, or in collaboration with crony companies that kick-back to the government leaders.

It isn’t likely that these governments will welcome competition in a sector that delivers generous profits to the government and/or to its politicians. The only way to break into these countries will be through developing connections with high-ranking government officials.

More open economies seem like an easy area for expansion on the surface, but because of the open nature of these economies, Electrify Asia will almost certainly see increased competition from other blockchain based energy marketplaces, especially if the competition has already made progress.

One good example of this is Australia, which is being targeted by Electrify Asia, but has already seen pilot programs established by projects such as Power Ledger.

Understanding the ELEC Token

The key to powering the entire Electrify Asia ecosystem is the ELEC token, and ERC-20 compliant token created on the Ethereum blockchain. Energy producers and retailers will use the token as a deposit to gain access to the Marketplace and list their available energy for sale.

ELEC tokens will also be used to pay transaction fees on the network. Additionally, there are plans to issue ELEC tokens to consumers as part of a loyalty rewards program. Actual payments from consumers to retailers will remain in fiat currencies, as will the payments made on the peer-to-peer Synergy energy trading platform.

ELEC ICO Token Sale

The ICO for ELEC was completed on March 2, 2018 with a hard cap for the sale of $30 million. 375 million of the planned 750 million tokens were available during the ICO, with a price of $0.08 per ELEC and payments made in Ethereum.

The Electrify Asia website isn’t clear on how much was actually raised, but it does say the ICO was a success, and since the current circulating supply is 411,567,025 ELEC it’s likely the team reached the $30 million hard cap goal.

Out of the funds raised, 52 percent goes toward development, technology, and research. An additional 19 percent goes to staffing, 10 percent to operations, 10 percent to business development as well as partnerships, and the final 9 percent to accounting and legal.

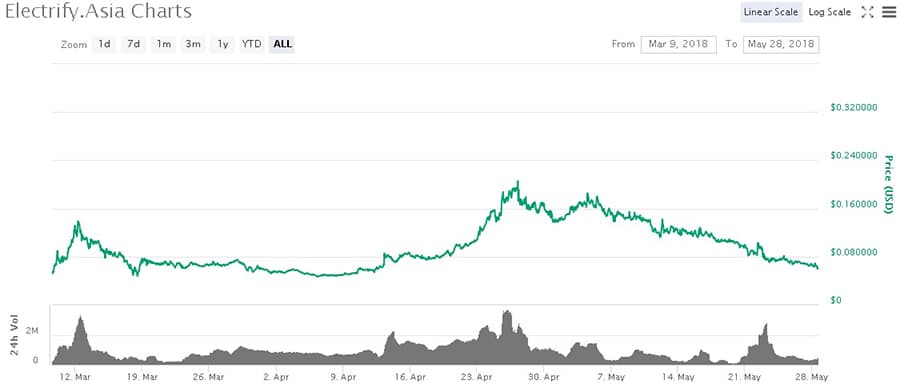

ELEC price performance. Source: coinmarketcap.com

ELEC price performance. Source: coinmarketcap.comSince the ICO the ELEC token traded as high as $0.193292 in late April 2018, but the price has been on a steady slide lower since then and as of the end of May 2018 the price of one ELEC token is $0.064992.

Most of the volume in ELEC trading is on KuCoin, so it’s obvious that the token could benefit significantly by being listed on one of the major exchanges such as OKEx, Binance, HTX or Bitfinex. Liquidity is only average, with less than $500,000 in daily trade volume.

Conclusion

Trading energy on the blockchain is a perfect use case for the technology, and competition within the space will only increase in the coming years. Electrify Asia has a jump on most of the competition, and a large first-mover advantage in its home country of Singapore.

However, the nature of the energy industry tends towards high levels of regulation and government involvement, which could serve to make an energy marketplace a difficult product to bring to consumers.

Electrify Asia needs to leverage their dominant position in their home country to sell the marketplace in foreign jurisdictions. If they can find a way to partner with the existing infrastructure or regulatory bodies in the new countries being targeted they could see success.