ETHLend Review: Guide to The Crypto Lending Marketplace

ETHLend (LEND) was created as a decentralized peer-to-peer borrowing and lending platform for cryptocurrency.

It is trying to resolve the issue of loan defaults, saving lenders from losses suffered when borrowers are unable to pay back their loans. It is also allowing cryptocurrency holders to unlock the value from their digital assets without requiring them to sell those assets.

However, can they differentiate themselves from the countless other lending platforms?

In this ETHLend review I will take an in-depth look at the project as well as the LEND token and its long-term adoption potential. I will also give you some top tips to consider when using ETHLend.

How ETHLend Works

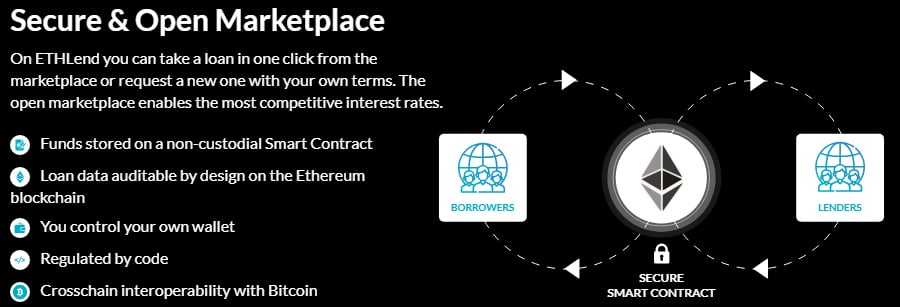

ETHLend uses the Ethereum blockchain to enable secure lending with a straightforward peer-to-peer lending model. In practice, borrowers create a loan request which creates an Ethereum based Smart Contract.

The Smart Contract is created using the data input by the borrower such as the amount of the loan, the requested interest rate, and the duration of the loan. Along with that the borrower also inserts the address for his or her cryptocurrency and the amount to be used as collateral.

When the Smart Contract is created the cryptocurrency put as collateral is transferred to the Smart Contract. Once that happens the loan is available to lenders to fund. Borrowers can also browse through lending offers, and lenders can browse through loan requests to choose those that look attractive to them.

And if the borrower fails to repay the loan on time that collateral is transferred from the smart contract to the lender to cover the loan. Once the lender receives the tokens they are free to keep them or sell them on the open market.

Since the whole thing is done via Smart Contracts on the Ethereum blockchain it’s all very secure. Not even ETHLend can access the tokens held as collateral in the Smart Contract.

The whole process creates a superior lending service that has no need for any middle-men, making it a fairer and less expensive system for borrowers, and a less risky system for lenders. Thanks to blockchain technology everyone benefits.

Lending and Collateral at ETHLEND

The ETHLend system allows you to borrow several different cryptocurrencies. At this time it is possible to borrow ETH, LEND, DAI, TUSD and ETH pegged to a number of fiat currencies. You cannot borrow straight fiat currency at this time, but that’s a functionality the ETHLend team is planning to add in the future.

Borrowers can use ETH, BTC, LEND and over 180 other ERC-20 tokens as collateral for loans. The LTV required is 50%, or 55% when using LEND tokens, which means most loans are back by 200% collateral. The ETHLend team has done this to remove as much risk as possible for lenders.

ETHLend is also looking into the idea of using Ethereum Domian Names as a source of collateral for loans. The logic behind the move is that EDNs have Ether deposited to secure them, and the domain names have a value of their own as well. The difficulty is the subjective nature of that value.

ETHLend Use Cases

Besides the obvious use in unlocking value from held cryptocurrency and providing borrowers with liquidity, there are several other uses to which ETHLend would provide value. It is possible to use the platform to raise funds for ICO investing.

It can be pegged to the USD or other fiat currencies to reduce volatility for lenders. And in the future, once all types of physical assets have had tokens created to digitize them, literally anything could be used as collateral for a loan from ETHLend.

Another interesting idea that’s been suggested for the platform is the addition of decentralized insurance. In this case, insurance companies would be able to assess the risk profile of ETHLand users and offer them insurance policies based on the users risk profile.

The ETHLend Team

ETHLend is owned and operated by the Fintech company Aave, and is incorporated in Estonia. However, despite being registered here the bulk of the team is based in Helsinki, Finland.

The ETHLend website and Aave website no longer have information regarding the team. Previously there were 22 team members and 6 advisors listed on the website. The founder and CEO of ETHLend is Stani Kulechov and he is joined by Jordan Lazaro Gustave as the COO.

Despite the seeming lack of marketing on ETHLend’s part, there were several team members who were focused on marketing and media correspondence. There are also a number of legal, financial and technical advisors listed on the project. What I find missing is actual developers and programmers.

ETHLend Benefits

The major benefit of ETHLend is that it is a trustless lending platform. That prevents anyone from changing or manipulation loans and loan data. You get full transparency about the borrowers and lenders, which will bring fairness and democracy to the lending industry. And because ETHLend is a global platform it gives access to the billions of unbanked citizens of the world.

Leveraging Digital Assets

One of the main benefits of the ETHLend service is the ability to get cash now for your digital assets and use that cash while your digital assets continue to appreciate in value. It’s far better than having to sell your cryptocurrency and later missing out on profits. Using ETHLend you can get needed cash for other investments, or to start a business, or even for an emergency such as illnesses or accidents.

Tax Benefits

Many countries will require you to pay taxes on your cryptocurrency, but regulations are still quite confusing in many jurisdictions. Some aren’t even sure how to classify this new breed of asset yet.

In the U.S. at least, if you sell your cryptocurrency you are required to pay a capital gains tax on the appreciation in value, namely your profits. If you take a loan against your cryptocurrency instead you get to defer those taxes until a later date.

It doesn’t make sense to do this just to avoid taxes however. Remember you will have interest to pay on any loan, so the tax deferral is only useful if you truly need the loan to begin with.

Potential Risks of ETHLend

However, there are a few things that could be pose as risk to lending on ETHLend. This is mostly related to what information is missing about the lending process.

Poor Disclaimers and Process

The ETHLend website does a pretty poor job of explaining how the whole process works, and instead pretty much throws you right into the borrowing or lending process without a clear explanation of how the platform works, what the fees and responsibilities are, and many other aspects of the loan process. There needs to be clarity added and more explanations prior to tossing people into the borrowing process.

Arbitration Process

Decentralization can handle many of the common issues in the loan industry, but what about disputes? If two parties disagree over something there will still need to be an impartial third-party to hear the dispute and resolve the issue between the two parties.

This requires some type of central authority. Will that be ETHLend employees? Or some group of independent arbitrators? As more people begin to use the ETHLend platform this problem is sure to surface sooner rather than later.

The LEND Token

LEND is an ERC-20 token that is used for several purposes in the ETHLend ecosystem. One of these is to increase the LTV for borrowers from 50% to 55%. Another is to take advantage of microstaking on the platform. I’ll talk about this more a bit later. LEND holders can also take advantage of feature listings for their loans. And of course, LEND can be used to pay fees on the platform.

ETHLend held their ICO in November 2017, raising $16.2 million by selling nearly 1 billion tokens for $0.0176 each. Soon after the token got caught up in the crypto-fervor of December 2017 and January 2018, reaching an all-time high of $0.442615 on January 7, 2018.

Since then the token has seen its price declining steadily, and after hitting an all-time low of 0.006225 on December 7, 2018, the price has rebounded slightly, but remains well below its ICO price. As of April 29, 2019, one LEND is worth $0.008323, representing a loss of more than 50% for those who bought at the ICO.

You are unable to purchase LEND using fiat currency, and will need BTC or ETH if you want to buy LEND. It is available at a handful of exchanges, including BiteBTC, ABCC and Binance.

There appears to be a reasonable level of liquidity for LEND tokens across these exchanges. However, over 50% of the volume is being traded on BiteBTC which is a less well known exchange. In fact, prices from this exchange are excluded from the calculation of LEND prices on CoinMarketCap.

Once you have your LEND tokens you are going to want to store it off exchange in a safe location. Because LEND is an ERC-20 token you can hold it in any ERC-20 compatible wallet, but to reap the benefits of holding LEND tokens you need to keep them in the wallet provided by ETHLend.

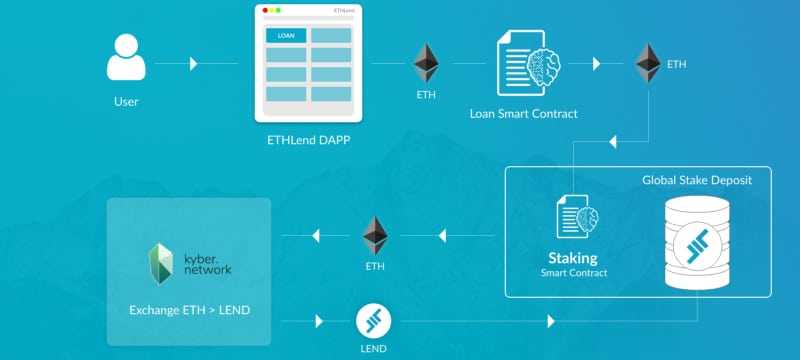

Micro-staking LEND

Since August 2018 ETHLend has introduced the concept of micro-staking LEND in order to make holding it more attractive for investors. Micro-staking basically creates a Smart Contract on the platform where a small amount of ETH is sent for every transaction and is converted to LEND to be held as a Global Staking Deposit.

Periodically a small percentage of thee LEND tokens are released to a user staking Smart Contract. LEND tokens are received by users based on the amount of ETH they’ve sent to the Global Staking Deposit. In this way, greater usage of the platform translates to greater rewards.

The LEND in the user staking Smart Contract continues growing as long as a user is active. They can claim this stake while active, but a small amount will be sent back to the Global Staking Deposit as an early withdrawal penalty. If the user wishes to collect the entire stake they must wait until they are inactive on the platform and then withdraw during the Withdrawal Timeframe.

Stakes not withdrawn during the Withdrawal Timeframe are locked and can only be reactivated by the user accessing and using the platform again.

ETHLend vs. Salt

ETHLend is not the only cryptocurrency lending platform currently on the market. One of the most well known competing projects is that of Salt.

Salt is a centralised cryptocurrency lending platform. The main difference between this and ETHLend is that it gives you the ability to borrow regular fiat cash in exchange for your crypto as collateral. This means that you can unlock instant fiat liquidity for your crypto holdings.

Moreover, Salt is a more established company with a strong team and advisor pool to draw on. They have also developed a more functional and intuitive lending platform that has been used by thousands of crypto users to make loans.

Having said that, Salt lending is not open to everyone. For example, only accredited investors in the US can invest in it. This means that they have to be able to demonstrate that they have over $1m in Net Worth. It is also only available in some US states, the UK and New Zealand.

This means that users who are in other countries cannot benefit from Salt lending. Moreover, this also means that the network is more centralised than that of ETHLend. As we all know, centralisation is always a risk to a trustless blockchain.

Conclusion

ETHLend is looking to provide a full-blown solution for decentralized lending. They expect this to make the lending process more attractive to borrowers and lenders, as well as giving the billions of unbanked global citizens an alternative when it comes to borrowing.

The system has been created to minimize risks to lenders, while maximizing the benefits to borrowers. This is especially true for those unlocking the liquidity of their digital assets.

ETHLend provides a way to continue holding cryptocurrencies to enjoy price appreciation, while also unlocking the current cash value in order to participate in additional investments or to fund a business.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.