FBS is an online Forex, CFD and crypto broker. They have a large Asian presence and have been around for over 10 years.

They offer traders the opportunity to trade a range of different assets on both STP and ECN accounts. Using well know trading platforms, users can trade these markets with leverage of up to a whopping 3,000:1!

However, are they safe and can you Trust them?

In this FBS review, we will give you everything that you need to know about this broker. We will also give you some top tips when trading with FBS.

Overview

FBS was established in 2009 and is operated by FBS Markets Inc. They have their address at No.1 Orchid Garden Street, Belmopan, Belize. They also have a subsidiary in Cyprus that operates the fbs.eu domain.

FBS is a forex and CFD broker that has ECN and STP accounts. They state that they operate a "no dealing desk" model with no re-quotes at all. In total, 95% of client orders have been executed in under 0.4 seconds

FBS has provided a wide range of accounts that will allow their traders to choose the trading conditions that best suit them. For example, they have one of the lowest deposit accounts on the "Cent" account with only $1 deposit requirement.

They have grown substantially in the past few years and claim to operate over 12 million accounts in 190 different countries. They service most markets as evidenced by the number of languages the website is translated into - 18 to be exact!

Having said that, there are quite a countries where they have restricted traders. This includes the likes to the USA, Canada, the UK, Japan, Brazil, Israel and Malaysia.

Is FBS Safe?

This is perhaps the most important question that you have on your mind.

When we are analyzing the safety of a broker, we like to look at their regulatory oversight as well as their internal risk management processes.

Regulation

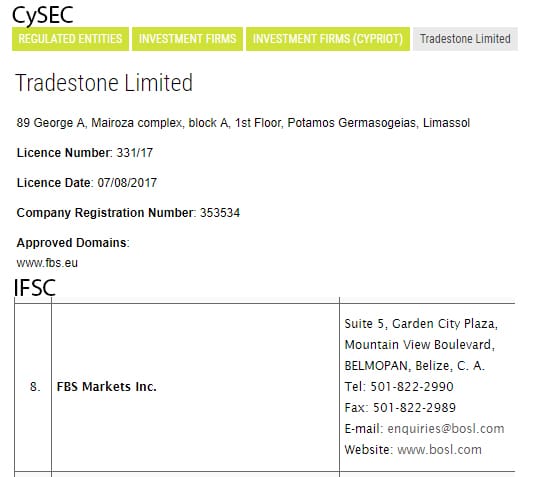

FBS has two regulatory licences. Firstly, the parent company is regulated by the International Financial Securities Commission (IFSC) in Belize. They have a licence number of IFSC/60/230/TS/18.

Their European subsidiary also has a licence from the Cyprus Securities and Exchange Commission (CySec). This licence number is 331/17 and is registered to Tradestone limited.

Copy of the Licence from CySEC and from the IFCS

Copy of the Licence from CySEC and from the IFCSWhile the CySec licence is by far the most reputable one, they both have similar protections that are afforded to the clients. These include the following:

- Capital Reserves: Before a broker is allowed to apply for a licence, they have to demonstrate capital reserves of €750k in the case of CySec or $100k in the case of the IFSC

- Segregated Accounts: Both of these agencies mandate that brokers should maintain segregated client accounts away from the broker.

- Client Compensation Fund: In the case of CySec, brokers are obligated to contribute to the compensation fund. This will cover accounts of under €25k in the event of a broker collapse

Which licence you are covered by will depend on the region that you are based in. Apart from giving you a certain level of ease, these regulations mean that you have an agency to turn to in the case of any suspicion.

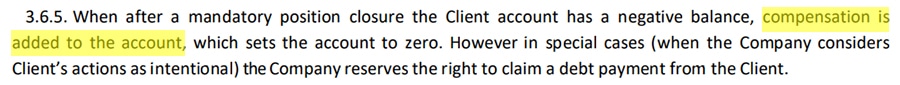

Negative Balance Protection

When you are trading with leverage, you are taking on considerable risk. Thankfully though, FBS has instituted negative balance protection.

This means that no matter how quickly and how much the market moves against you, your account will never be placed in negative territory. You will never be at risk of owing FBS any money and the maximum that you will ever lose is what you invest.

Negative balance protection at FBS. Image via Client Agreement

Negative balance protection at FBS. Image via Client AgreementOf course, this does not mean that you should not set adequate stops to protect your positions but it does give you some certainty around maximum potential losses.

Asset Coverage / Leverage

There is a pretty standard range of assets that you can trade at FBS - if not on the light side. You have Forex, Metals, CFDs, Stocks and Cryptocurrencies.

In terms of the Forex pairs, you have most of the standard G10 crosses as well as a few EM currencies. In metals, you have Gold, Platinum, Silver and Palladium. You have a number of single stocks and on the crypto side you have Bitcoin, Litecoin, DASH and Ethereum.

We would have liked to have seen more selection on the commodities side as they only have Oil CFDs. Similarly, they are lacking in terms of their cryptocurrency assets as they don't have an array of other very popular coins.

Pro Tip ✔️: If you want to trade a wider array of crypto then you can check out IQ Option

You will be trading these assets in "lots" and these will vary according to the account that you have and the assets that you trade. With the Forex pairs, the lot size is 100,000 units.

Leverage

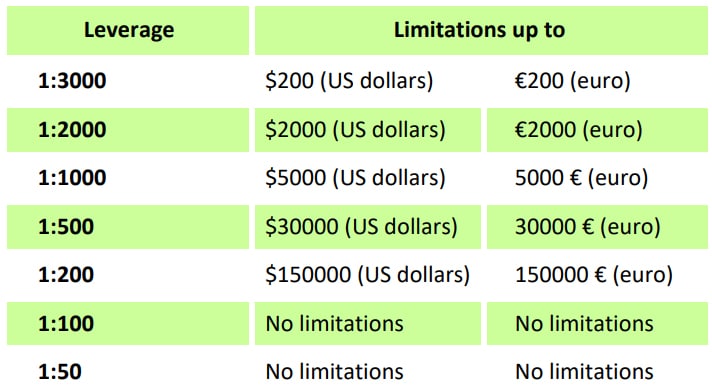

When you trade at FBS, you will be margin trading. This means that you will put up a margin that is only a small percentage of the total position size. You are trading with borrowed money which implies leverage.

At FBS, the max leverage that you can get on Forex is up to 3,000:1. This is more than we have seen at any other broker...

This is the max achievable but the exact leverage that you will have depends on the type of asset, the account that you are on as well as the size of the position you have on.

Note✍️: If trading through fbs.eu, your max leverage is 30:1 as per ESMA guidelines

For example, the Micro, Standard and Zero spread accounts will allow you the 3,000:1 leverage. However, the Cent has a 1,000:1 max leverage and the ECN has a 1:500 max leverage.

When it comes to the assets, the max leverage on these specific classes is:

- Metals: 1:333

- CFDs: 1:100

- Stocks: 1:10

- Crypto: 1:3

The crypto leverage appears to really be quite paltry and they are much lower than other brokers that we have seen. If you want to trade crypto with leverage then you could consider an exchange such as ByBit.

Finally, in order to manage the risk at the broker, the position size will also impact on the amount of leverage that you can take on. Below are the max leverage by position size:

Leverage limits according to Position size. Image via Client Agreement

Leverage limits according to Position size. Image via Client AgreementSo, all in all, some pretty respectable leverage numbers.

Although the broker does offer negative balance protection, we would encourage you to start with lower leverage limits. 3,000:1 is too risky to really consider in an optimal strategy.

FBS Spreads & Commissions

The spreads at FBS are generally low given their use of Electronic Crossing Network (ECN) and Straight Through Processing (STP) systems.

With the ECN model, FBS will route your order to their pool of liquidity providers. This means that your order is going straight onto the market and you will be getting near market "raw" rates.

For the STP accounts, you will have different spreads based on the type of account that you have set up. We cover these accounts in the section below.

To give you an idea of the types spreads that you could encounter trading here, below are some indicative levels on the different accounts for a select group of assets (in pips):

| Asset | Cent | Micro | Standard | Zero | ECN |

| EURUSD | 0.8 | 3.0 | 0.8 | 0.0 | -0.1 |

| GBPUSD | 2.0 | 6.0 | 0.7 | 0.0 | 0.2 |

| USDJPY | 2.0 | 3.0 | 1.0 | 0.0 | 0.1 |

| Gold | 10 | 6.0 | 10 | 0.0 | 0.0 |

| WTI | 2.0 | 2.0 | 2.0 | 1.0 | NA |

| BTC | 250 | NA | 250 | NA | NA |

You can view the full list of the spreads here.

Seems that the best from a spread perspective is the Zero or the ECN with some of the ECN spreads even being below the actual market rate.

Of course, there is no free lunch...

Apart from these accounts requiring a larger deposit, you will also have to pay a standard "lot commission" on the trades. This is charged per lot that you trade and it ranges from $12 on the Zero to $6 on the ECN.

Note✍️: You will also be charged a Swap fee. This is standard among brokers and it reflects the difference in interest rates between the two pairs.

Deposit / Withdrawal Fees

Thankfully, the deposits are almost entirely free at FBS. The only method of payment that will charge you is via SticPay which has a 2.5% + $0.3 deposit commission.

Surprisingly, there are also withdrawal fees although these are relatively low. Below are the fees that you will pay according to method:

- Visa Card: $1

- Neteller: 2% commission with min of $1 and a max of $30

- SticPay: 2.5% + $0.3

- Skrill: 1% + $0.29

- Perfect Money: 0.5%

Account Types

As mentioned, FBS has quite a range of accounts that you can sign up with. In total they have an impressive 5 account options.

They will differ according to the type of spreads you get, minimum funding levels and the assets / platforms that you can trade on. Below is the complete list:

FBS Account Options

FBS Account OptionsAll of the accounts have the same volume options from 0.01 to 500 lots with a step of 0.01. They also all allow you to develop your own Expert Advisors (EAs).

When it comes to execution speed, the ECN account routes through the liquidity providers which means that the time will vary. The other accounts are STP and your order will be executed at speeds that start at 0.3 seconds.

If you are a crypto trader, then you will have to focus on the Cent and the Standard. These are the only accounts that you can use the MT5 on and hence give you the chance to trade crypto.

Note ✍️: FBS offers "swap free" Islamic accounts in countries that are predominantly Muslim. You can request this in your dashboard

VIP Accounts

If you fund your account with more than $10,000 and you have traded more than 10 lots then you will get access to the VIP level.

This account level has a range of additional features that you could make use of. This includes the likes of priority deposit / withdrawal processing, your own account manager, gifts and a VIP "client certificate".

Many of these appear to mostly be cosmetic and the last one made us chuckle. A client certificate is such a token symbol that has zero value for the trader.

So, if you are funding 10k and intend to trade that volume then it could be a nice touch but you should not do it just for the sake of it. It should also not incentivise you to trade more volume if you did not intend to.

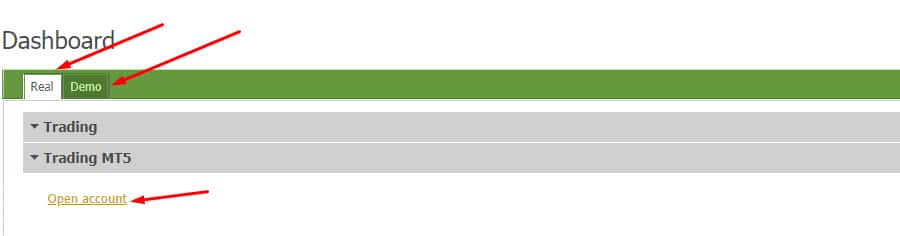

FBS Demo Account

Why risk your funds on a live account to start if you can use a free demo account?

This is a great way to test your trading skills in a non threatening manner. It is available on any of the accounts at FBS and you can use either of the trading platforms corresponding to those accounts.

Note ✍️: Demo accounts are not able to replicate the impacts of "slippage" that you will get on the live accounts.

This demo account will allow you to trade for up to 45 days and they will give you $1m in demo funds to start trading with. These can be topped up right on your dashboard if you run through it too quickly.

If you want to start trading on demo then you will first have to create an actual account. They will require some basic information including name, phone number and email.

Setting up demo account in FBS Dashboard

Setting up demo account in FBS DashboardAlthough the demo account is limited to 45 days, there is no reason that you cannot request additional time if you think that it could help inform your decision.

FBS Platforms

When it comes to trading platforms, FBS uses the MetaTrader platforms.

These are trading software that is provided by the MetaQuotes company. They are third party technology providers who have extensive experience in trading technology. The result are well refined and efficient trading platforms.

MT4

This is the most well-known trading platform that was first released in 2005. It is used by millions of traders and countless brokers.

The MT4 is well tuned for Forex trading and has a long track record among brokers. It also makes switching brokers that much easier as the software is standard. Once you know how to use an MT4 platform you can easily switch.

The FBS MT4 platform is a technical analyst’s dream as it allows for a great deal of charting and other functionality. You have a plethora of technical studies and indicators at your disposal.

FBS MT4 Trading Platform Screenshot

FBS MT4 Trading Platform ScreenshotThe MT4 platform also has a modular design. This means that you can easily drag and drop the various windows into the ideal positions for your trading preferences. This is ideal for those traders with more than one screen.

As we mentioned above, FBS allows you to develop EAs. These can be developed on the MT4 platform through the use of their proprietary MQL4 coding language. This is relatively easy to understand and there are numerous guides across the web.

The FBS MT4 platform is available on Mac, PC, Linux as well as through your browser on the Webtrader. However, we would suggest you avoid the Webtrader as there is more latency than on the computer program versions.

FYI ✔️: If you have to trade multiple accounts you can use the MT4 multi-terminal to manage them concurrently

MT5

As you can probably tell, the MT5 is the latest generation trading platform from MetaQuotes.

At FBS, the MT5 is available on the Cent and the Micro and this is the platform that will give you access to the cryptocurrency markets.

From a technology point of view, there are a number of things that are now included on the MT5 platform. For example, it has a slightly more intuitive UI and you also have more chart customisation options.

MT5 platform at FBS. More charting functionality

MT5 platform at FBS. More charting functionalityOther interesting features that are included are an Economic Calendar as well as the market liquidity charts. The latter is really helpful especially in the crypto markets as it gives you an indication of bullish / bearish sentiment.

The FBS MT5 platform also has a completely different coding language in MQL5. This is more functional than the MQL4 as it is an Object Orientated language. You can develop your own custom indicators to supplement your charts.

Pro Tip 💯:You can use the MQL5 developer community to download some time-tested open source scripts

The MT5 is available on the same operating systems and platforms as the MT4 and you can download it straight from the FBS website.

So, MT4 or MT5?

Well, if you have to trade crypto then MT5 is your default option. However, in general traders tend to prefer the MT4 as it is time-tested. There is also broader support from other brokers for the MT4.

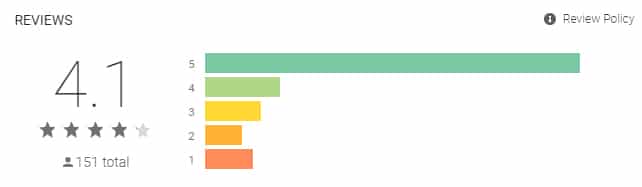

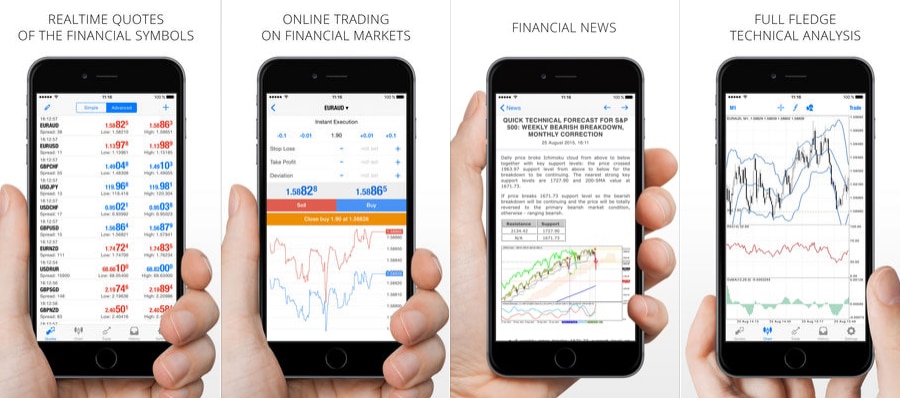

FBS Mobile Apps

If you are always on the go then you are most definitely going to want to make use of the numerous mobile apps on offer at FBS.

Firstly, FBS has developed their own proprietary mobile application. This is available on both iOS and Android and has as simple and intuitive trading interface.

It is also easy to place trades, manage orders and do elementary charting. Funding / withdrawals and other account management options are also available on the app so you can easily top up while away from your desk.

If we take a look into the two app stores, we can see that it has pretty positive reviews from a number of users. Even more encouraging than that is the fact that the developers are very responsive and address all concerns immediately.

FBS Trader App Reviews in the Google Play Store

FBS Trader App Reviews in the Google Play StoreIf you are more of a fan of the MT4 and MT5 platform then you can always use their own mobile application to trade your account through.

These apps are the most popular trading apps currently on the market and combined, have been downloaded more than 15 million times across the iOS and Android.

The Apps are great for doing elementary technical analysis and have many of the same features that you will find on the PC based MetaTrader platforms. The apps have quick one click ordering which we found quite nifty. You can also monitor / manage your EAs directly from this app.

MT5 Mobile App screenshots. Source: Apple iStore

MT5 Mobile App screenshots. Source: Apple iStoreThese apps are loved by the trading community and the ratings / reviews that they have attracted no doubt reflects that.

Which app you do decide to use will come down to your own trading preferences and experience. However, we would suggest that you stick to trading on your PC. This is because mobile screens are not well optimised for charting. Moreover, mobile connections are not the most effective.

Funding / Withdrawal

If you have been trying the demo and decide that you want to move onto the live accounts, you will need to fund it.

There are a number of options to fund your account and it is relatively easy. You head onto the account funding section right there on your dashboard. You will see the below funding options.

Range of Funding options at FBS in Admin

Range of Funding options at FBS in AdminThe biggest omission that we have noticed on this list is that you cannot fund by a wire or bank transfer. We find this quite weird indeed as this has been offered by multiple brokers that we have reviewed.

However, they do offer something called "Local Exchanges". These are the local money exchangers that are popular solutions in Asia. Unfortunately, you do not have any Bitcoin or cryptocurrency funding options.

Pro Tip 💯: If funding in a different currency, you can lock in the price rate on deposit / withdrawal with fixrate

Withdrawals are just as simple as deposits. You have all of the same options apart from through CashU.

If you funded your account with a credit card then on withdrawal, they will send the deposit funds back on the credit card. If you have any profits above this then then you will have to pay the balance through some other means.

It is also worth noting that before you are allowed to withdraw, you will have to complete their obligatory KYC procedures. This may require a copy of some identity documents and proof of address.

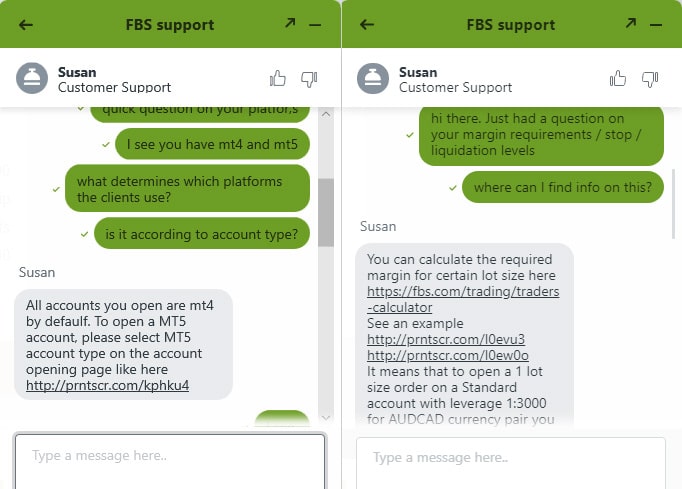

FBS Customer Support

We have often found that customer support can make or break a trading experience. So, we decided to test out the FBS customer support to see how they stack up.

Perhaps the quickest way to get help from them is through their online chat function. This is available to both current and potential clients. When we reached out, they responded immediately.

Susan answering our questions comprehensively

Susan answering our questions comprehensivelyWe did this on a number of occasions and asked a range of questions. All of the operators were very professional and knew exactly what was needed when asked.

Top Tip☎️: Prefer to speak on the phone? You can always request a call back from the broker

If you do create an account at FBS and have an account related query then you are perhaps best suited to deal with their support through their ticket system. This way they can track an ongoing support request. You can raise this right in your account dashboard.

If your support request is taking a bit longer than you would like then you can always reach out to them through one of their numerous social media and messaging channels. They have a Twitter, a Telegram and a Viber account.

Finally, if you have a more general question then you can always use their Knowledge base. This will have the answers to most of the questions that other clients have asked in the past.

FBS Bonus & Promotions

We were quite impressed with the extensive list of promotions and bonuses on offer at FBS. These range in their scope and coverage and are clearly designed for a broad array of traders.

If you are going to be taking advantage of any of these, be sure to check the eligibility with your country / account.

100% Deposit

This is a deposit bonus that will give you the exact amount that you deposit as a bonus. This can be a great way for you to augment your balance with some additional liquidity.

Note✍️: This is not available on the ECN account and it is limited to $10,000

Of course, there is nothing in life that really comes completely free. You will have to meet a certain minimum traded lots in order to be able to withdraw this bonus. There are a number of other conditions that may be attached so be sure to read the bonus T&Cs.

Trade $100 Bonus

This is a relatively new bonus that will give you a free $100 to trade with and improve your trading skills. This bonus does not require any form of funding so it can be considered truly "free".

Get the Trade 100 Bonus at FBS

Get the Trade 100 Bonus at FBSThis is also a great way for you to get a real feel for the market above the standard demo account. It will perhaps best replicate the trading that you will get on a live account.

If you want to unlock the $100 before you can withdraw, you will need to trade the minimum of 5 lots in a 30-day period. If you have managed to maintain or increase the balance then you can withdraw it after the period.

Cashback

This is a promotion that will pay you cash back on the lots that you trade. This can be up to $15 per lot for every lot - losing trades included.

This is free to enter and you can activate it in your account area. It is also available on all accounts at FBS. You can see an exact breakdown of the cashback numbers in this table. Clearly the micro account has the most cashback for lots traded.

Note✍️: The Cashback promo is not available if you came through an IB or if you are trading on bonus funds

Of course, you should be perfectly clear about the conditions that are required to claim this cashback. The primary one that we noticed was that the difference between opening and closing price on the complete transaction should exceed 5 points.

This is regardless of the trade being profitable or not. Also, this "5 points" number is only applicable for those with 4-digit quotes. For the 5-digit quote, the difference between opening and closing should exceed 59 points.

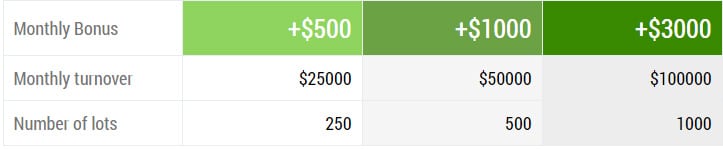

Partner Bonus

If you are an affiliate (see below) and refer traders to FBS then you qualify for this partner bonus. This is a great way for you to add up to $3,000 on top of your monthly commissions.

This partner bonus will depend on the amount of volume that your referred clients trade. There are three tiers of monthly bonus based on the amount of lots traded by these clients:

Partner Bonus levels at FBS

Partner Bonus levels at FBSThis is a bonus that is on top of the normal IB and affiliate earnings that you make so it really is a juicy offer.

Win a Car

We don't often see brokers giving away prizes like this but FBS has done this on a number of ocassions. They hold regular "raffles" which the traders can enter to win one of these cars.

They have given away cars like a Mercedes Benz, Range Rover, Audi and even a Porsche!

To enter the competition is really pretty simple. All you have to do is keep an eye on the competition section and enter your name when the raffle becomes available. They will enter your trading account number in a lotto style draw and choose the lucky winner.

Other Offers

It is always a nice touch when the broker includes other offers that could help improve your trading experience.

With FBS, you can also make use of their VPS offer, join their loyalty and rewards program, or jump into one of their trading competitions.

Trading VPS

FBS has partnered with a VPS provider to give you free access to a Forex VPS. Pro traders know the many benefits that come from using a dedicated trading machine.

Below are some of the reasons that you may want to consider a VPS:

- Trade 24/7: The VPS is operational 24/7. This means that you can leave it trading even while you are away from the desk

- No Downtime: VPS is located in a datacentre which limits up-time to nearly 100% continually

- Low Latency: Datacentres have internet connections that are multitudes faster than those of a home connection. This reduces order execution time.

Perhaps the best reason for you using a VPS with FBS is that they allow you to run EAs on all of their accounts. This means that you can leave your EAs trading the market 24/7/365!

This VPS can be applied for in your account area. It will remain free as long as you have funded your account with a minimum of $450 and you trade at least 3 lots per month.

Note ✍️:This VPS offer is not valid on BTCUSD pairs and the lots traded on the ECN account are excluded

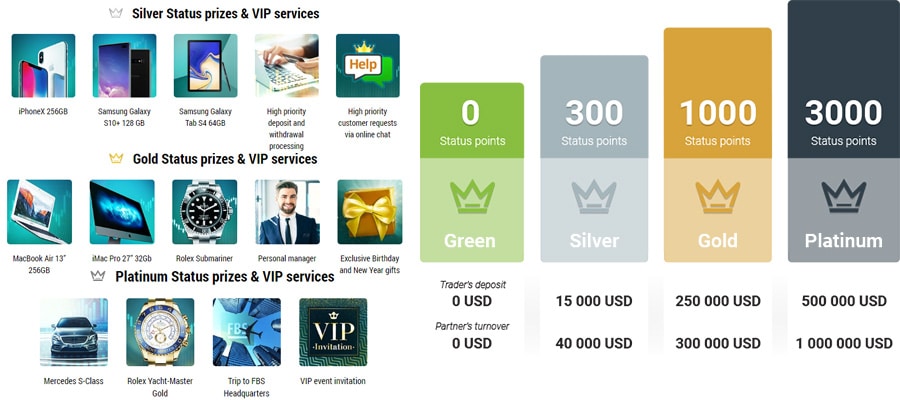

Loyalty Program

When you trade at FBS, you will earn loyalty points. These points can then be converted into a number of gifts at FBS.

There are three tiers of awards that you can win on FBS. These are the Green, the silver, the Gold and the Platinum. The green includes goodies such as cashback and private coaching. The Silver is a range of cellphones. The Gold includes a Rolex, PCs etc. The platinum even has a Mercedes Benz up for grabs.

What Loyalty Points can Get you & the Points System

What Loyalty Points can Get you & the Points SystemSomething else that is pretty neat about this is that it is not only your trading volume that will count but also that of any traders that you refer.

Contests

If you have a bit of a competitive flair then FBS has a range of contests that you can take part in. These can be a great fun way to test out your trading skills.

When we looked into the contests, they had the following available:

- Ramadan Trading: With this contest, FBS will add a 300% bonus on to your account. Then, all of the spreads that are earned on this account by FBS are given to a charitable cause during the month of Ramadan.

- 10 Years Award: This is no longer running but it was a competition which celebrated FBS' 10 year birthday. There were a number of prizes that were up for grabs.

- Super Trader: This is a group competition where you could team up with other traders and go head-to-head.

- FBS Pro: This is a contest where you will trade on a demo account with $10,000 in demo funds. The winner will get $450 credited to their account.

- FBS Star: This is a bit of a different competition. It is a photo competition where you must submit your funniest photo. It will get sent to the FBS Facebook and users will chose the funniest. The prize funds are $1,500.

These are quite interesting although some do appear a bit gimmicky. If you are going to be entering any of these competitions, be sure to read the terms and conditions.

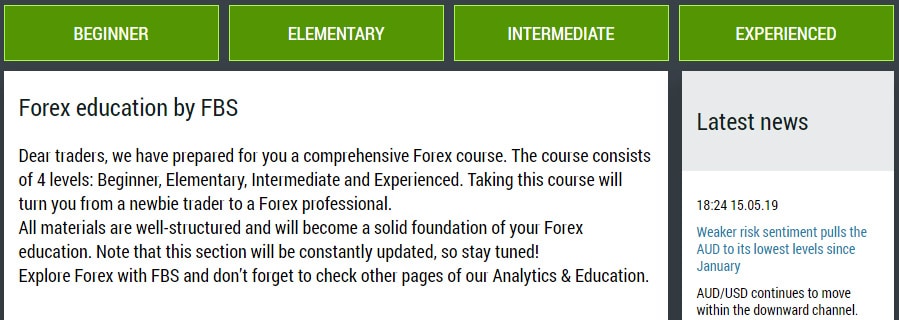

Education

It is one thing for a broker to provide a platform to you to trade on. It is another when they give you the training required to make money on it.

FBS has a range of educational material which could help to augment your knowledge. There are also a host of other useful market analysis pieces.

Forex Guides & Books

The Forex guides are helpful step-by-step posts that take you through numerous disciplines in Forex trading. These are positioned at traders of all skill levels and are fairly comprehensive.

For example, on the beginner level they went through some of the most elementary disciplines of Forex including the differences between Technical and Fundamental Analysis. The Elementary went through the basics of charting.

Forex Guides and their Levels at FBS

Forex Guides and their Levels at FBSThen, on the more experienced side, the intermediate and the advanced went through more complicated disciplines in Technical Analysis and Algorithmic Trading.

We were quite impressed with how well written and in-depth the guides were. When possible, they are supplemented with useful charts that illustrated the disciplines. It is quite clear that whoever compiled these guides must have spent quite a bit of time doing so.

Note ✍️: For any of those "foreign" forex terms you can head right on over to their glossary

Apart from these guides, FBS has also included a list of hardcover trading books that you can buy through your account. These are more theoretical and could help give you a more in-depth understanding of the markets.

Tips for Traders & Videos

These are more regular analysis pieces that delve into some interesting concepts that you may not have encountered before.

These analysis pieces are incredibly comprehensive and are intuitive, thoughtful and most importantly, actionable. They are updated about every two days so you have relatively fresh content

However, what happens if you are trading and don’t have the time to read an extensive guide?

That is where the FBS video lessons come in. These are really helpful video guides that take you through many of the disciplines that they cover in their standard guides and trader tips.

The material has helpful cues and it is all backed up with relevant charts and analysis. We did, however, find the presenters accent to be quite thick and may be hard to follow for some of you. Perhaps they could have added some handy subtitles.

Forex News & Analysis

Forex news are live updates of the current market conditions during the day. They go over price levels, Economic announcements and other market moving information.

These posts differ from the others in that they are short and sweet. FBS will post at least three a day in order to keep the analysis as fresh as possible.

FBS also has their daily trade ideas in their analytics section. These look at particular trade ideas and profitable setups. There are at least two of these a day and you can refine them based on whether you want a Technical Analysis idea or a Fundamental Analysis viewpoint.

Some of the most recent Analysis at FBS

Some of the most recent Analysis at FBSFinally, you have live Forex TV. These are daily updates from FBS that go over their "trading plan" for the day. These look at potentially profitable setups from a technical perspective.

They also have weekly market outlook videos that go through the key markets to watch for the upcoming week. These were decent videos but as is the case with the educational guides, the presenters accent made it quite hard to understand.

Seminars / Webinars

This is something that we really liked at FBS. They have an extensive range of free seminars as well as online webinars that you can partake in.

Seminars are a great way for you to engage with others in the trading community. FBS also uses these as an opportunity to give you more training in a lecture type environment. These seminars also have a host of fun events packed into them.

FBS has held seminars all around the world in countries such as Thailand, Malaysia, Vietnam, Brazil, Morocco and Indonesia. If you want to register for the next seminar then you should probably keep an eye on the announcements on their website.

If, however, you cannot attend a Seminar then you can always jump into one of the many webinars that they run. These cover a number of different topics and are quite interactive. It also gives you the chance to ask questions from the professionals who are presenting.

FBS Affiliate Program

If you found your trading experience at FBS to be pleasant one then you can register with the FBS affiliate program and start earning commissions for the clients that you refer.

FBS has some of the highest commissions that we have seen among other brokers. You can earn up to $15 per lot for the traders that you refer to the broker. They also have a tiered commission structure where you can also earn commissions from the traders that your referrals bring to FBS.

Benefits of the FBS Affiliate Program

Benefits of the FBS Affiliate ProgramFBS claims that payments for these commissions are made every day and that you will get your very own IB manager who can help you make the most of your affiliate status.

If you want to join the affiliate program then you will need to first register a partner account and make an application. Once this has been approved then you can generate your affiliate link in your partner dashboard and start promoting FBS.

As mentioned above, you can combine your regular affiliate earnings with partner bonuses to bring home more commissions.

What We Didn't Like

We could not complete a full FBS review if we did not list some of the things that we thought warranted improvement on the platform.

Firstly, their asset coverage is really on the light side. You can't trade any indices, there is only one commodity asset and four cryptocurrencies. They don't include any of the other popular cryptocurrencies such as Ripple (XRP) or Monero (XMR).

Secondly, we were really quite surprised to see that FBS did not accept any form of wire transfers. This is something that nearly 90% of international brokers provide and the lack of bank transfer options could limit deposit size.

Need a Wire? 🤔: Consider a broker such as Pepperstone. They are an ASIC regulated broker with numerous funding options.

Finally, there are a number of countries where FBS restricts traders. Countries such as the United States, Japan and the United Kingdom also have keen traders who would like to make the most of their trading platform.

Conclusion

Our FBS review has found this broker to be quite reasonable. They have tight spreads with a large variety of accounts that will satisfy most. Their promise of no re-quotes and negative balance protection helped to put our minds at ease.

It was also a plus for us that they used the well regarded MetaTrader platforms. The great customer support made dealing with the broker a pleasant experience. Moreover, their extensive range of promotions, educational material and bonuses was an impressive addition.

Yes, there are things that we did not like but these can easily be improved on. If FBS is receptive to their trader's feedback then they may be receptive to changes.

So, should you trade with FBS?

We would encourage you to do your own research but if you are looking for a well-established broker with favourable trading conditions then they should be considered.

Warning ⚡️: Trading CFDs is very risky and you could lose your entire investment. Make sure that you practice adequate risk management

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.