Gemini Review 2025: Complete Exchange Overview

Customers can buy, trade, and store digital assets on Gemini, a forward-looking cryptocurrency exchange and custodian. The exchange gives its customers access to industry-leading security, safety, and compliance while providing quick and safe options to purchase Bitcoin and other cryptocurrencies.

It is truly a competitive environment out there in the crypto world. Not only are there a gazillion blockchain projects vying for your interest and money, but there's also a plentiful choice of exchanges to choose from, unlike traditional finance, where only a few hallowed ones truly matter. (Think New York Stock Exchange, Chicago Mercantile Exchange, Tokyo Stock Exchange etc.). Not only that, centralised exchanges (CEX) and decentralised ones (DEX), born from the emergence of smart contracts, are duking it out with each other for users and liquidity too.

Since we are still in the nascent period of crypto's emergence, where things still haven't completely stabilised yet, institutional investors still prefer CEX over DEX, not just for the liquidity but also for the OTC (Over-the-counter) services. This is because they usually deal in large orders that have the potential to make or break the market. Retail minnows like you and me swim in the main pool with everyone else. Still, "follow the money" is an oft-quoted phrase you might've come across in the crypto world, and in this case, we follow where the institutional investors like to do their business.

In this article, we'll take an in-depth look at the Gemini exchange, one of the most reputable CEXs in the crypto world.

Gemini Exchange Summary

| HEADQUARTERS: | New York, NY |

| YEAR ESTABLISHED: | 2015 |

| REGULATION: | New York State Department of Financial Services (NYSDFS) Listed as New York State Limited Liability trust |

| SPOT CRYPTOCURRENCIES LISTED: | 123 tokens listed, including the top 10 crypto assets and some less well-known ones like Smooth Love Potion (SLP), Golem (GNT), Merit Circle (MCU), Numeraire (NMR) to name a few. |

| NATIVE TOKEN: | Gemini Dollar (GUSD) |

| MAKER/TAKER FEES: | Fees vary based on trading volume and the platform used to perform the trades. Retail trader fees range from $0.99 per trade for trading value at <=$10 to 1.49% for trades > $200 while market maker/taker fees start from 0.4% for makers and 0.2% for takers. Fees listed in: USD, AUD, CAD, COP, EUR, GBP, HKD and SGD. |

| SECURITY: | Accounts: 2FA, support for hardware security keys such as Yubikey and whitelisting of withdrawal addresses. Internal Controls: Multi-sig required to withdraw from cold wallet storage and employees go through background checks. Asset Security: Hardware security modules in their possession are at FIPS 140-2 Level 3 rating or higher. Compliance and Certification: SOC 1 Type 2 exam, SOC 2 Type 2 exam and ISO 27001 certification plus compliance with PCI DSS (Payment Card Industry Data Security Standard). |

| BEGINNER-FRIENDLY: | low entry-barrier to start trading, clean interface making it easy to navigate |

| KYC/AML VERIFICATION: | Available |

| FIAT CURRENCY SUPPORT: | USD, AUD, CAD, COP, EUR, GBP, HKD and SGD |

| DEPOSIT/WITHDRAW METHODS: | Crypto/Fiat deposit and withdrawal available. |

What is Gemini

The Gemini exchange is one of the most reputable CEXs in the crypto sphere. While it started as a US entity, it has quickly moved into other regions worldwide, offering the ability to onboard holders of GBP, EUR, AUD, HKD and SGD to use its services. The platform has a rich offering of products suitable for a wide variety of users, from beginners to seasoned investors and traders.

The exchange is founded by the Winklevoss twins, Cameron and Tyler, best known for winning a lawsuit against Mark Zuckerberg for the idea of Facebook. You can watch an entertaining retelling of this story by watching The Social Network starring Jesse Eisenberg as Mark Zuckerberg. Armie Hammer played the twins. Having won the court case against Zuckerberg, they got into crypto in 2013 and were one of the earliest serious investors in Bitcoin. In 2015, they founded the Gemini exchange (named after the twin star sign).

Gemini Exchange Key Features

The Gemini platform offers a plethora of products to cater to all sorts of buyers and investors. However, for this review, we're only going to focus on those relevant to the exchange platform.

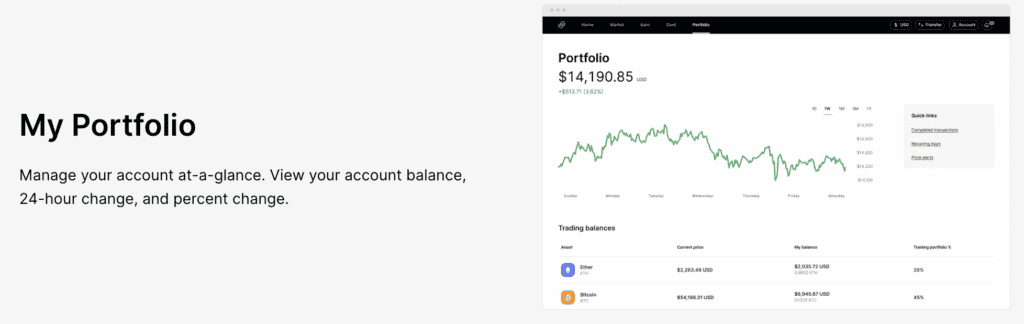

Web Trader

This platform is used by retail traders looking for something uncomplicated and easy to navigate.

The homepage has all the relevant information needed, including resources and top movers in the market, in addition to your account information. This is a nice way to get your hands wet for those new to buying and selling crypto. You can also set an alert that will give you a push notification when it hits your price.

One cool feature is the ability to set up recurring buys. These are set based on specific time periods, such as weekly, bi-weekly, monthly etc. A great way to DCA for those who like to set and forget and are really in it for the long haul.

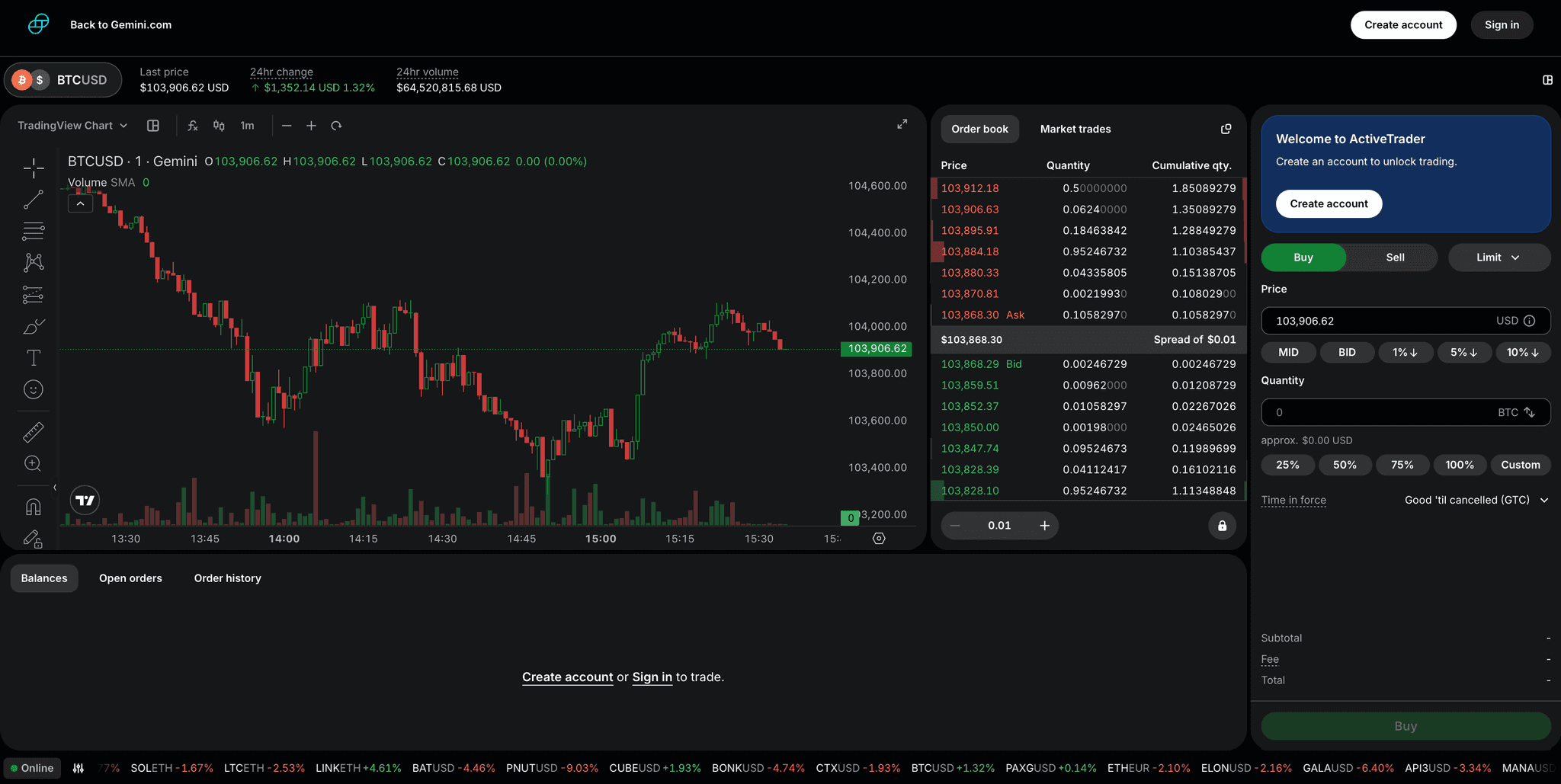

ActiveTrader

For those looking for a bit more firepower in their trading, ActiveTrader is the version for you. I'd consider this the pro version where the training wheels are off, and you can go full speed ahead for some fast and furious trading action. Note that you need to request access to it.

The types of orders you can place through this site include:

- Limit Order: This is an order placed at a pre-specified price & quantity. It will get executed when the market moves to that level.

- Market Order: This is an order that will be placed to be executed immediately. This means it will be placed at the current “bid” for a sell and the “offer” for a buy.

- Maker-or-Cancel: With this, the order will only be executed if it gets you the “maker” fee we mentioned above. If it cannot place your order as a maker, then it is cancelled.

- Immediate-or-Cancel (IOC): With this order, it will execute all or part of the order immediately. All those orders that cannot be filled will subsequently be cancelled (partial orders).

- Fill-or-Kill (FOC): With this order type, the order is executed immediately and entirely or not at all. This differs from the IOC in that partial orders are not possible.

There are two distinctive features not found in other exchanges offered by Gemini:

Auction

Gemini holds daily auctions (incl. weekends and holidays) for the crypto assets they list. The auction is a great idea because it creates a period of elevated liquidity on the exchange, which traders can use for price discovery. You can view the auction schedule and details here.

To participate in this auction, switch the ActiveTrader interface to “Daily Auction” in the top-right corner. Here you will see an overview of the results of previous auctions and the resulting price. Then, place an order to enter the auction. These are called “Auction-Only (AO)” Limit orders. With these, you specify a price/quantity, and at the conclusion of the auction, it is settled at the said price or better. Any portions that are not executed are cancelled.

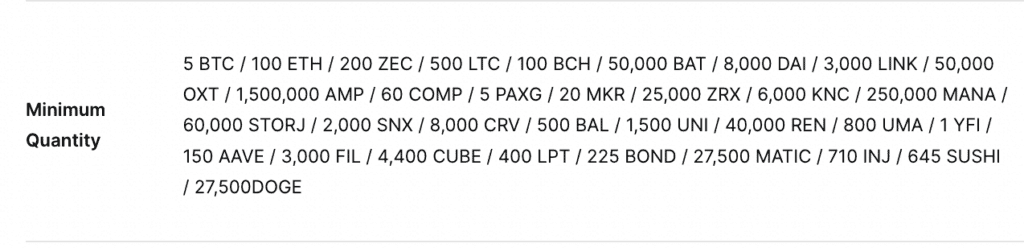

Block Trade

Placing large orders can affect the market price. This is due to the liquidity available on the order books, which may or may not be able to absorb the requested amount. As a result, you might also get quite a bit of slippage in the order. Gemini allows you to place these orders via the Block Trade function, a bit like OTC orders to prevent this from happening. To qualify for a block trade order, here are the minimum amounts required:

Similar to the Auction function, navigate to the top-right corner to use the Block Trade function. While you're able to place them any time, there is a restriction for any orders placed within 10 minutes of an auction coming up.

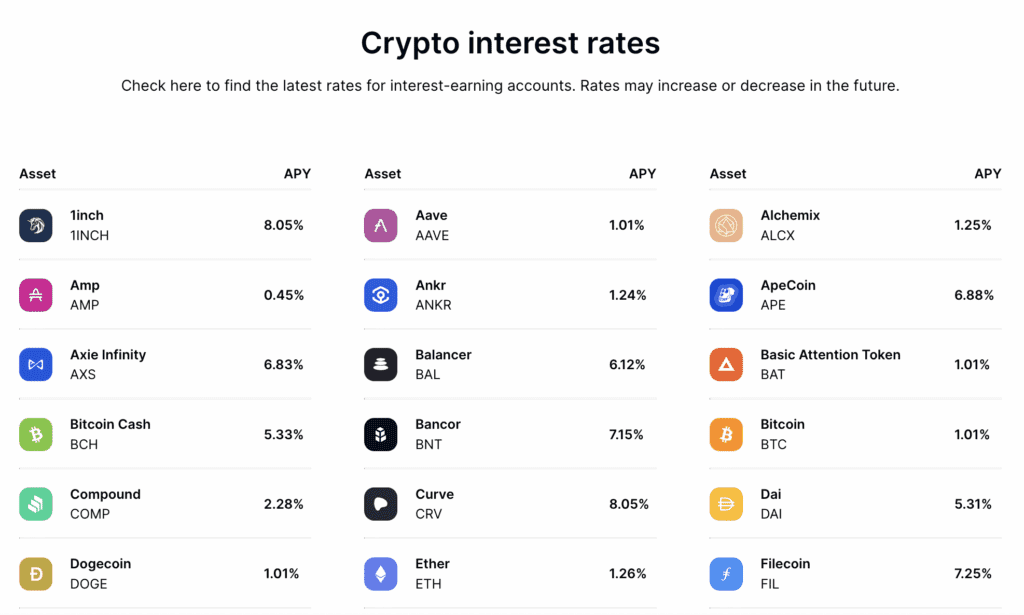

Gemini Earn

Instead of trading your crypto, you can also take advantage of the staking product offered called Gemini Earn. This allows you to earn yield on your crypto while you're waiting for the bull market to come roaring back. The rates aren't exactly spectacular though, I have to say:

Still, given what's been happening with high-yield protocols recently, it might not necessarily be a bad thing. Besides, if you can find a few gems that pay more than 5% APY, it's still worth considering. After all, some yield is better than no yield.

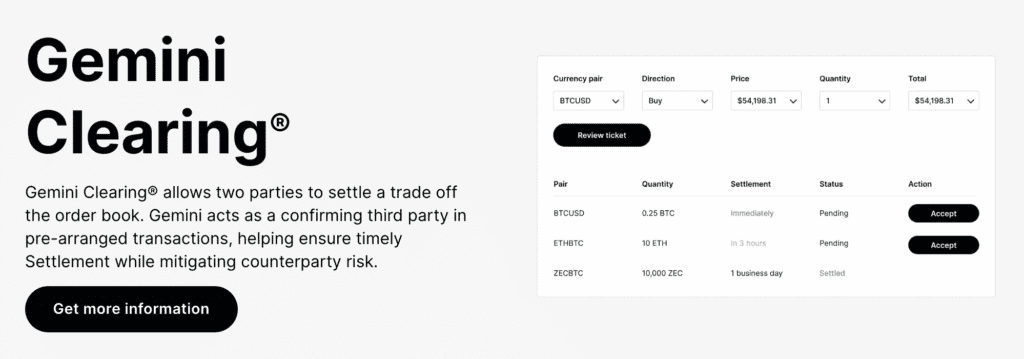

Gemini Clearing

Another unique feature of the Gemini platform is Gemini Clearing. This feature allows two parties to basically trade with each other directly with Gemini acting as the trusted third-party. Neither of the trading parties know about each other. Their details are only known to Gemini.

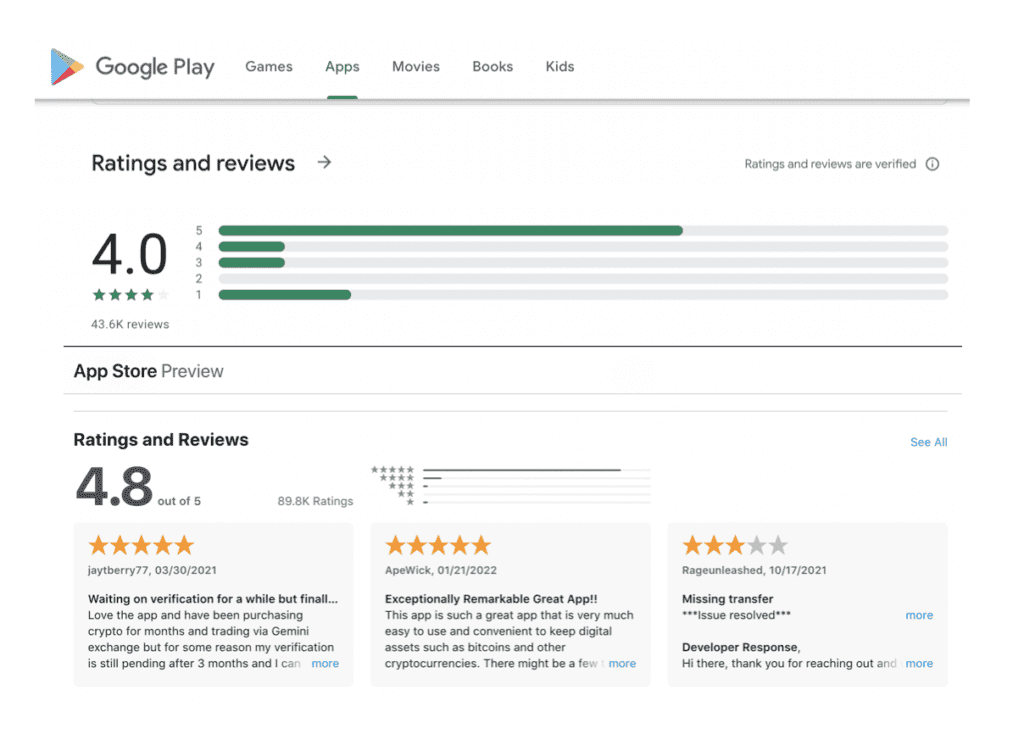

Gemini Mobile

This is a mobile version of the Web Trader but it doesn't have access to the ActiveTrader. Built with the idea of enabling convenient trading for retail customers, its functionality are basically the same as what you can do on Web Trader. The fees charged using this platform is similar to the web version, which you will see later for yourself. How good is it? Well, we'll let the reviews speak for themselves!

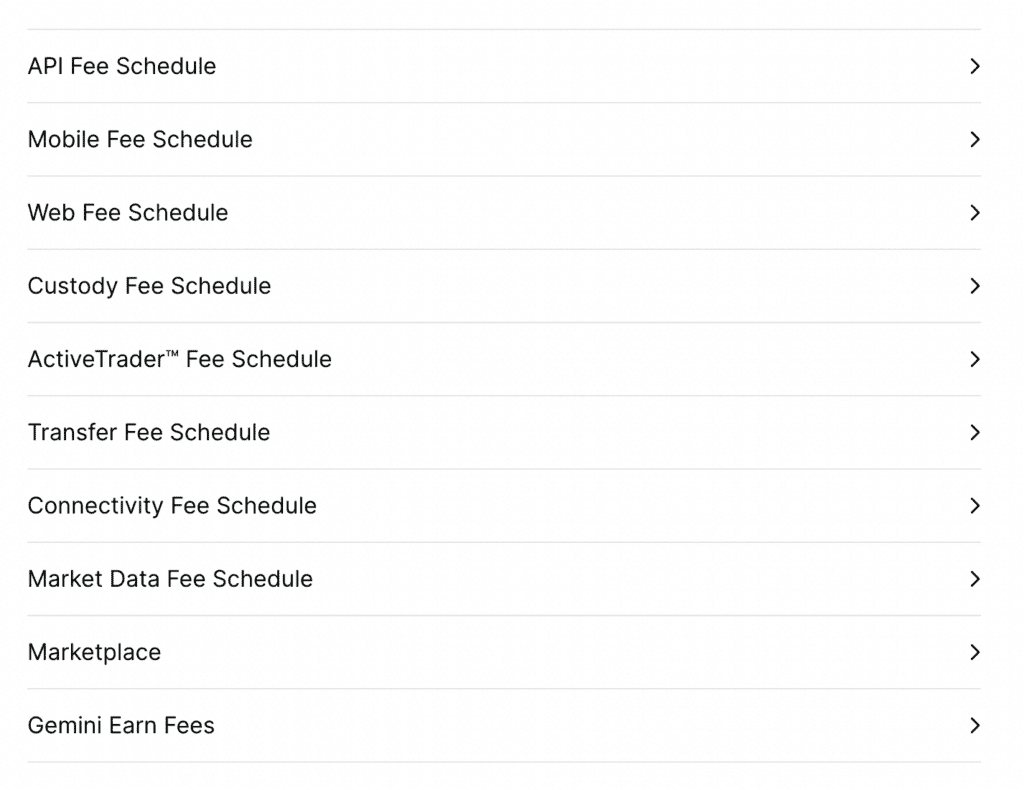

Gemini Fees

Most exchanges make their money from fees, which represent the main source of income. For Gemini, they really throw out a full spread when it comes to fees. That's because they offer a variety of them. However, the ones that concerns most people using the exchange are the mobile and web app fees.

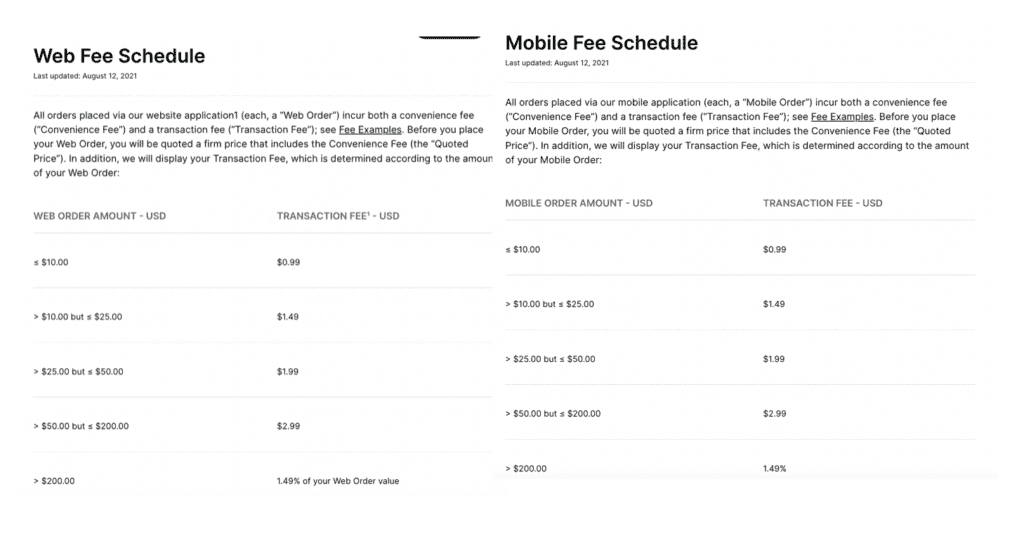

Unlike other exchanges, Gemini makes a distinction regarding which platform you use to make your trades. Each trade carries a Convenience fee and a Transaction fee. Each quoted price includes the former while the latter is a seperate line item based on the amount of the order. Fees are also quoted in the fiat currencies supported by Gemini.

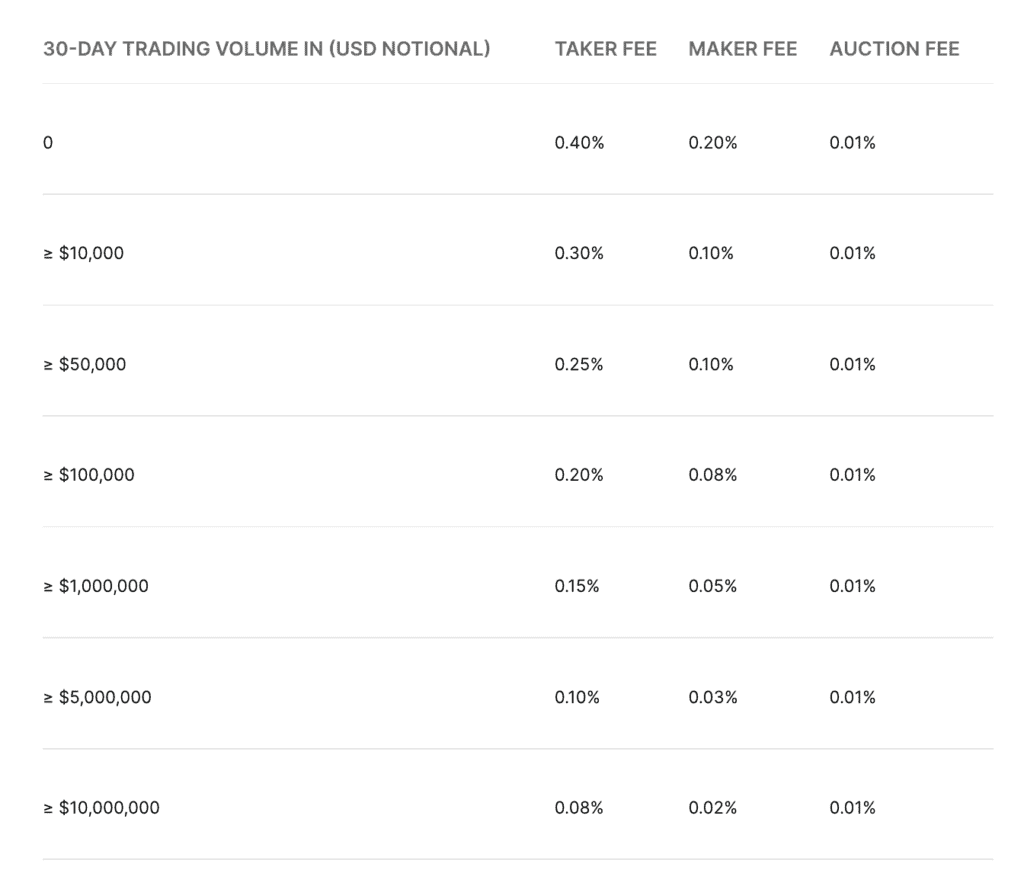

For traders using the ActiveTrader product, fees are calculated on a different scale. Volumes make a big difference in fees as you can see in the chart below:

Note: Maker fees refer to buy orders because they give liquidity to the exchange. Taker fees are the sell orders because they remove liquidity from the exchange.

I can't say that these are trader-friendly rates as one can easily find cheaper ones elsewhere. However, it could very well be that these fees pay for more solid security which is just as important. Perhaps pay a bit more for peace of mind?

Gemini also charges API fees for those who do algorithmic trading with bots. It's pretty much the same as the maker/taker fees.

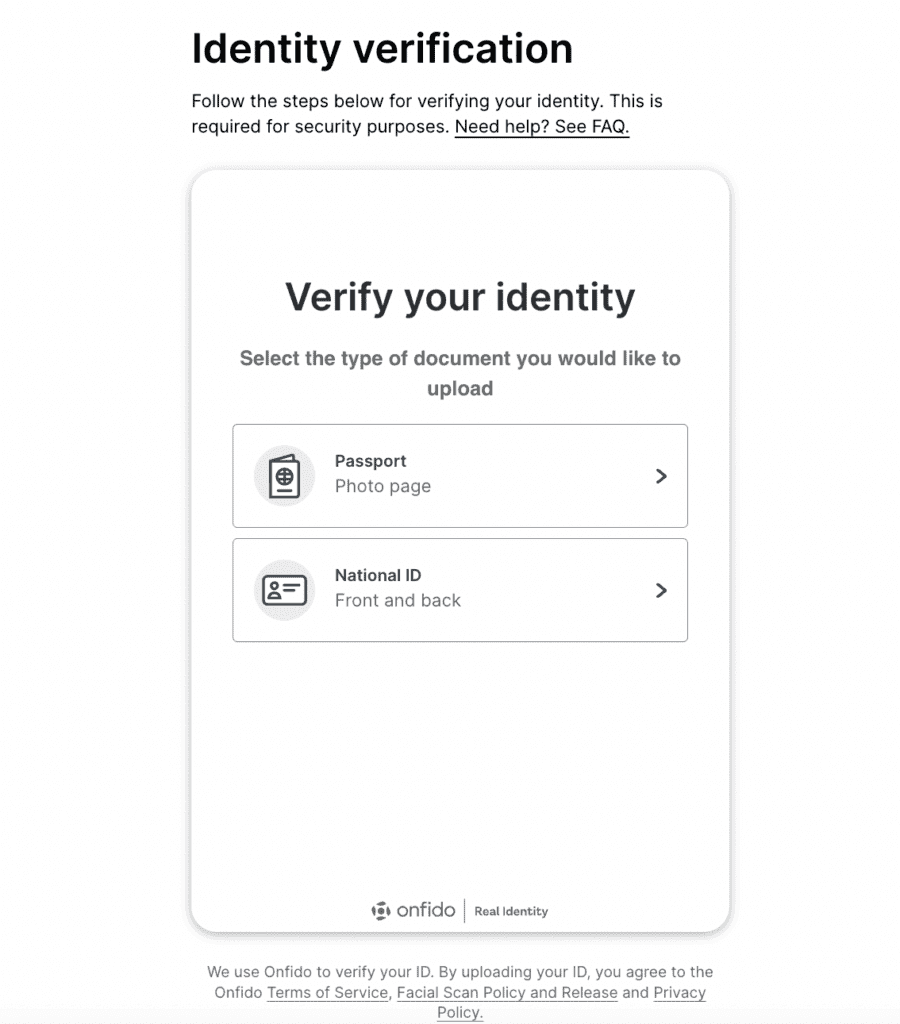

KYC and Account Verification

Gemini takes KYC seriously as part of their stance concerning compliance. Unlike other exchanges that allows you to open an account with just a username and email address, while the KYC part can be done in a separate process, Gemini insists on doing KYC as part of the sign-up process with no exceptions.

Throughout the sign-up process, they will send you an SMS code to verify your phone number and email verification for the email address. Once you've submitted the required documents, you will need to wait for them to manually process your application, which could take anywhere from 2-5 days, depending on the number of cases. Needless to say, signing up during a bear market will bring you faster results than during a bull market, so even if you have no wish to trade now, it might not be a bad idea to sign-up first and buy later.

Security

Gemini exchange prides itself on security. This is one of the key selling points on their main page, with an entire page devoted to it. Given the level of attention they pay to their security measures, it is definitely something worth crowing about.

They outlined four main areas of security that should help put anxious minds at ease. These are:

Account Control

Two-Factor Authentication (2FA) for account log-ins and withdrawals, support for hardware security keys such as Yubikey for additional personal security, and the whitelisting of withdrawal addresses, making it difficult for scammers to add withdrawal addresses on your behalf.

Internal Control

Gemini keeps the majority of the crypto in cold wallets that requires multiple signatories to access the funds. The private keys to the wallets are stored offsite in a high-security facility, while the systems can only be accessed with hardware security keys. This prevents phishing attacks. Bearing in mind that people are usually the weakest link when it comes to security breaches, all employees undergo an ongoing background check during their employment with the company. Both founders are also unable to access any of the online or cold wallets jointly or individually, so you don't need to worry about them running away with your funds unless they're in cahoots with other staff members.

Asset Security

Their website says, "The hardware security modules (HSMs) we rely upon have achieved a FIPS 140-2 Level 3 rating or higher." For you and me, who don't know what an HSM is, let's first start with that. According to Wikipedia, it is "a physical computing device that safeguards and manages digital keys, performs encryption and decryption functions..." In other words, a piece of hardware that keeps private keys safe through various built-in security mechanisms. Therefore, the website means that there are different grades of the hardware and what they have is premium grade.

Not only that, the location of these HSMs are spread out around the world, requiring serious coordination efforts to gain access to the keys and thus the funds. On top of that, Gemini also uses multi-sigs so that no one individual/entity has complete control of keys.

Premium grade private key manager + diverse locations + multi-signatories = very low risk of funds being stolen.

Compliance

Gemini is playing very much by regulation rules in this section, and here's how they do so:

- Obtained the following certification:

- ISO 27001 - this is about information security: only authorized personnel can access and change secure information.

- SOC 1 Type 1 - a standard of financial operations compliance and customer reporting, "designed to mitigate the risk of significant error, omission, or data loss." according to their blog on this topic.

- SOC 2 Type 2 - done annually, this is the next level of compliance, showing that Gemini has not only met standards but has consistently followed them for an extended period.

- Regulated in three regions: US (NY Department of Financial Services), Singapore (Monetary Authority of Singapore) and the UK (UK Financial Conduct Authority)

They also take a proactive manner to identify problems and weaknesses through:

- The hiring of independent third parties to test the system's robustness by performing penetration tests, done annually. Any vulnerabilities found are addressed by the administration promptly.

- Run a private bounty program for ethical hackers which they call Coordinated Disclosure Program. Anyone who has discovered vulnerabilities in the system is welcome to report them.

There's also a section for people to report scams and frauds, together with a link to a Trust and Safety page offering advice on preventing scams and where to make a report if you encounter one. That's decent community service which also speaks to the platform's integrity. Not too many have this prominently displayed on their website.

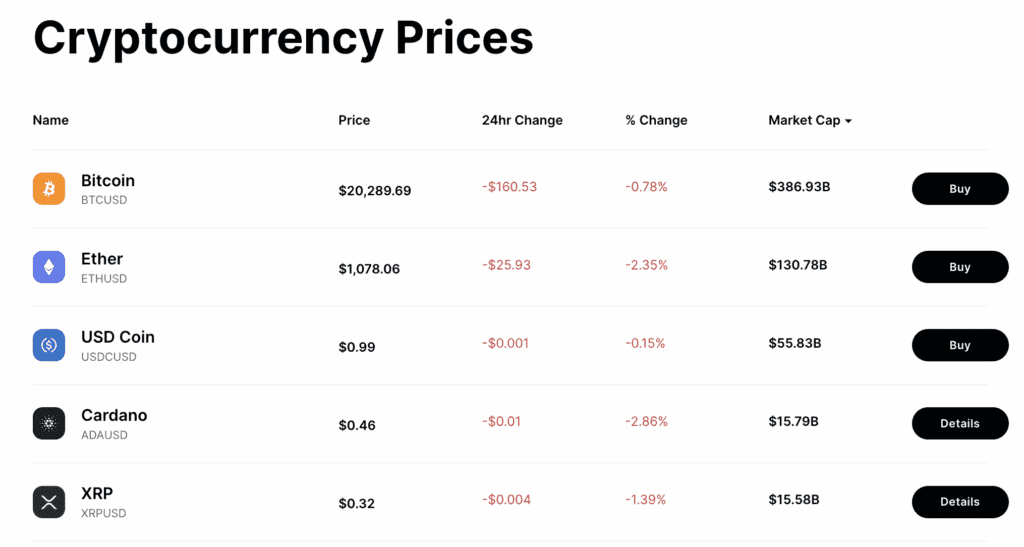

Cryptocurrencies Available at Gemini

Compared to many of the other top exchanges, the offerings on Gemini are a bit on the light side as they offer fewer trading pairs than most. The list you see below is a snapshot of what they offer, which is about 125 tokens with the top 20 well-represented and a few other alternative tokens that might be of interest to smaller niches.

The flip side is that they take a much more cautious view when deciding what to list on their platform. Even though from a business point of view, they make money from each trade that's made and are not necessarily endorsing what they choose to list, users still perceive the listing as an indirect kind of endorsement. At the very least, the thinking that "if they did their due diligence by listing it, and I trust their diligence, I should be fine" may be a more prevalent view. After all, there's only so much time one can do DYOR. If I can't trust the data provided by Glassnode or Dune Analytics, how else can I DYOR?

Deposits and Withdrawals at Gemini

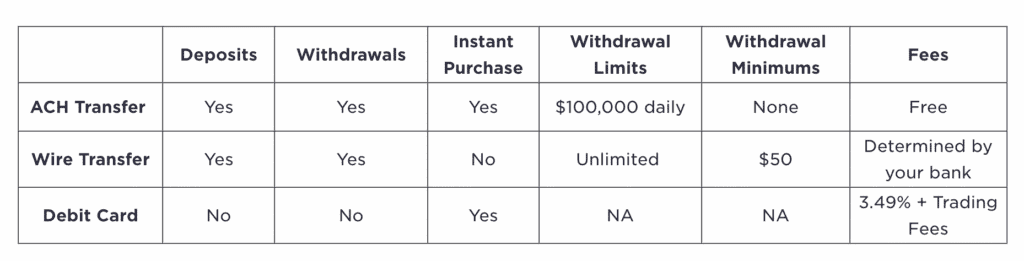

There are a myriad of ways to fund your Gemini account. If you are new to crypto and want to get started buying crypto, here are your choices for making fiat currency deposits:

Please note that ACH Transfers are only available for US customers. Non-US customers can only use wire transfers to fund their accounts. These funds are available immediately for trading once the Gemini account receives them. This could be anywhere from the same day (if transferred domestically before 3 pm EST) or a few days, depending on the internal processes of the sending bank.

Regarding withdrawals, funding done via ACH must wait four to six days before the money will show up in your account. As for wire transfers, again, it will depend on the processing time for your bank. While Gemini doesn't charge any wire fees, your local bank may decide to nip a bit of a commission for facilitating the transfer. TradFi, eh?

You can also purchase crypto using debit cards. However, this will incur a 3.49% fee in addition to trading fees, so I'd see it as a last-ditch, desperate approach, like if the price is too good to pass on. You also can't withdraw cash to your debit card, only to a bank account.

On the other hand, funding your account via crypto is relatively straightforward. After signing in, navigate to the Custody section to generate a wallet address for the token of your choice. This will be the deposit address to receive the token into your account.

Top tip: When making transfers, always check the blockchain network supported by the exchange and where the receiving wallet address is located. If unsure, check this article on supported networks. Any tokens sent via the wrong network may result in a loss of funds. For example, sending MATIC tokens via the Polygon network to an ERC20 address is a common error that warrants its own article on the subject.

Gemini offers a nice touch with up to 10 free monthly crypto withdrawals (50 if you are an institutional client). Any amount above that will depend on the asset as each has its own withdrawal minimum.

Tokenomics: Gemini Dollar (GUSD)

Instead of issuing a native token, Gemini issues its own stablecoin known as the Gemini Dollar (GUSD), an ERC20 token on the Ethereum blockchain. This is a US dollar-pegged token used within the Gemini ecosystem for staking and yield generation. It can also be used to provide liquidity in major DeFi protocols that support the token, such as AAVE, Maker, and yEARN to name a few. Combined with Gemini Pay, you can even use GUSD to pay for items, giving it real-world utility, which is not something many tokens can do.

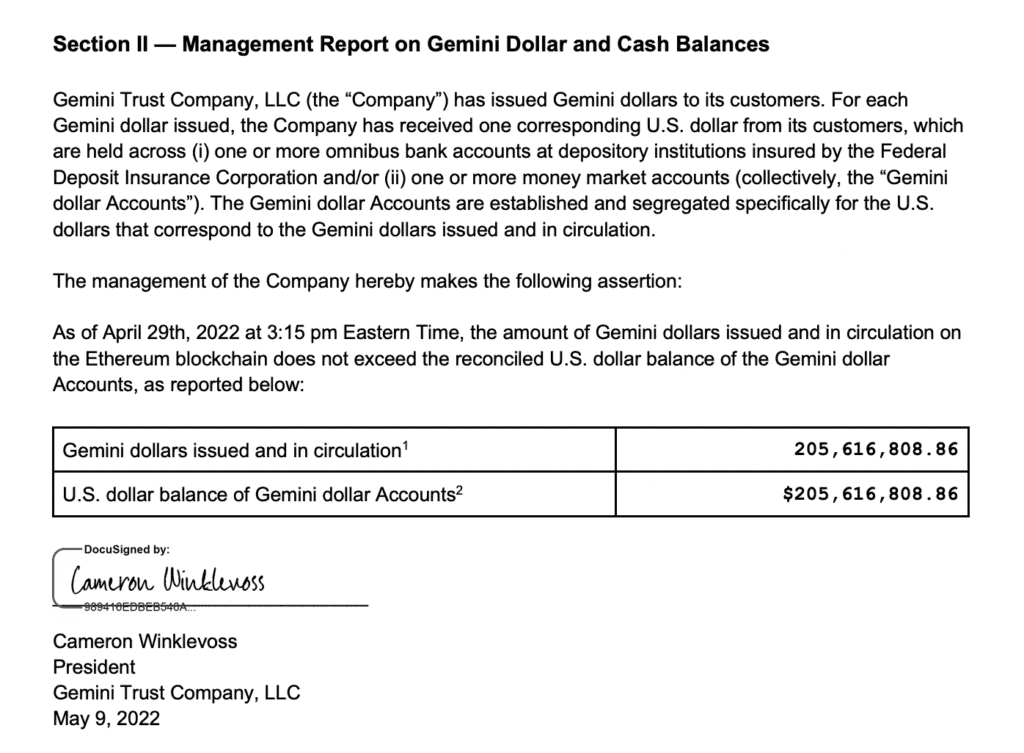

What also makes GUSD a solidly-backed asset is that each dollar backing GUSD is held in FDIC-insured banks, i.e. the US government will give you your money if there is a bank run). The website lists the audits done each time, with a sample below of the latest audit:

The audits are done by an independent audit firm BPM LLC while the smart contracts are audited by another company called Trail of Bits, an information security research and development firm.

Gemini Customer Support

The first impression I get when I click on the Support page is the emphasis on self-help. The page is neatly divided into various categories serving as a navigation guide for customers looking for answers.

I like that there is an Education section allowing users to learn more about crypto besides the Gemini products. The more people know, the savvier they get, which will help them make better investment decisions. If all else fails, there's still the option to chat with someone, although you'd need to first prove that the bot can't help you at all before you get passed to a real person.

Gemini Top Benefits Reviewed

Gemini has some great things going for it, which we can summarise here in brief:

- Strong security - The exchange has not been hacked since its inception (knock on wood), and it's apparent they've spared no effort in this area.

- Easy-to-read support articles - this is helpful for those new to crypto and is a good source of information for them to start their DYOR journey. They even have an education section called Cryptopedia that provides basic general information about blockchain and crypto. Many of the contributors are from the blockchain projects themselves, making for trusted reading.

- Multi-currency support - while Gemini may not have US and international versions like Binance, I appreciate that it's making an effort to reach out to non-US customers while staying firm to its US roots. With GUSD, it indirectly allows non-US customers to hold USD in a US bank, which is quite cool.

- Recurring buy feature - this is wonderful for customers who want to DCA in without needing to check the market like a hawk.

- GUSD and Gemini Pay - even though this is mostly available in the US, it lets people see the benefits of crypto in a utilitarian format instead of just being a speculative commodity. This helps to spread the crypto gospel positively.

What can be Improved

- Listing more assets - this will help it to capture more business.

- Lower trading fees - it is a very competitive arena it's operating in so every little bit counts.

- Better staking rewards - it's possible that this part is not an area of focus for the business but surely it can't hurt to raise the rates just a little bit?

Gemini Review Conclusion

Gemini is one of the few exchanges I've come across that doesn't try to dazzle you with a lot of bells and whistles. Instead, it places itself on firm foundations by focusing on making the platform as solid as possible, even if it means that it's a bit behind the curve when it comes to having less variety in its offerings. However, what it does offer is also not something other exchanges would have, thus proving itself that it is not busy copycatting others yet knows what needs to be available to remain competitive.

Given the Winklevoss twins' family background and connections, a lot of the real money is probably made by institutional trades. As I mentioned earlier in the article, we follow where the money goes. The crypto world is full of people looking to make a quick buck and taking high risks. However, these people are also the same who have to sustain an equally high probability of crashing and burning. Those who are truly in it for the long run have the patience to do things properly which is what Gemini has been doing and continues to do.

Frequently Asked Questions

Yes. Their security is as top-notch as you can ever find in a crypto company and the twins are building a business for the long-term, so it is unlikely they will find devious ways to abscond with the funds. They also understand that credibility is what separates them from other projects.

Coinbase is certainly the more contentious of the two in this comparison. Gemini's lower-key profile is to its advantage given the amount of negative press swirling Coinbase these days. In terms of functionality and useability, both are similar with each having their own strengths and weaknesses.

OKX offers a lot more bells and whistles with a wider variety of offerings than Gemini, not to mention more types of tokens. It will depend on the user's preference. If you're not looking to try too many things but want to have some skin in the game, Gemini is sufficient. If you want to go a bit more degen, you may prefer OKX.

Similar to OKX, Binance offers a lot of options to try a number of different things that may appeal more to those with an adventurous spirit. Gemini has a slightly better reputation than Binance in general.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.