Those that have been involved with cryptocurrencies for some time have probably heard of the Golem (GNT) project before, because it was a very popular ICO a couple years ago.

At that time it was quite promising looking, but then missed deadlines and new projects sent it into the shadows, where it remained until just recently. When the Golem team finally released its beta main net launch this past April the light shone on the project again.

So, is it a project really worth considering?

In this Golem review I will attempt to answer that. I will also take a look at the long term use cases and price potential of GNT.

What is Golem?

The Golem project is focused on creating a global supercomputer that will offer purchasable computing power through a global decentralized, distributed network of computers. It also allows those with spare computing power to make some GNT tokens by offering their idle CPU to the network.

The first stage of the service is being called Brass Golem, and this is what was launched in April 2018. It has a specific focus on CGI rendering, specifically for the 3D modeling application Blender and the rendering engine LuxRenderer.

Overview of Golem. Source: Golem Website

Overview of Golem. Source: Golem WebsiteThe team feels this is a good first offering as 3D rendering is extremely processing-intensive and can be quite costly.

As an example, let’s say you’re an animator and have created a scene in Blender that you’d like to render in full HD-resolution. You could do the rendering on your own computer, but depending on how powerful your processer is that could take days or even weeks. It’s not likely anyone wants to wait that long to render a scene. There are other options if you want it rendered more quickly.

One option would be to outsource the rendering to a rendering farm. These are dedicated services that offer to rapidly render 3D animation and other modeling. They are also very expensive. And they can be fully booked at times, meaning there’s still a delay in how long it takes to have your scene rendered.

Golem Technology

The new alternative is the one offered by Golem. You can use their software and the GNT token to rent the processing power of the users on the Golem network. And you can specify how quickly you’d like the rendering done, or how many subtasks you’re willing to accept.

You can then set the price you’re willing to pay in GNT tokens on an hourly basis. For slow renders you can set a lower rate, but if you need your render done quickly a higher rate will accomplish that.

This is great for animators who need fast, inexpensive rendering. It’s also great for anyone who has spare computing power – and that’s pretty much anyone who has an idle computer in their home. The Golem network allows you to sell your spare computing power and get paid in GNT tokens.

With the launch of the Brass Golem beta the Blender renders are the only real-life application available, but that will change in the future as the Golem team has plans for many other real-life applications. Pretty much any task that uses significant processing power can be improved through the use of the Golem distributed network.

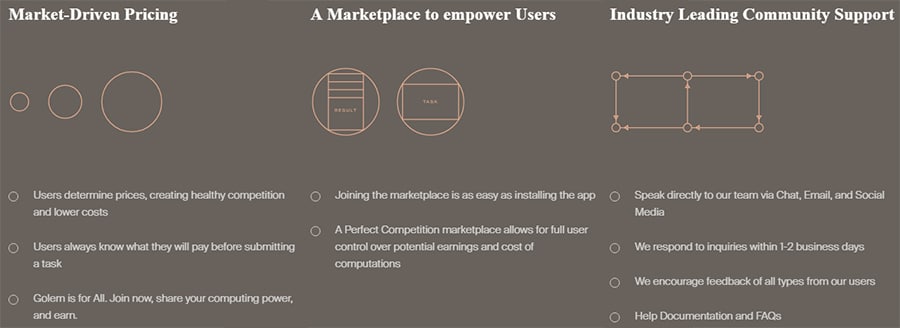

Screenshot of Golem Application. Source: Golem Whitepaper

Screenshot of Golem Application. Source: Golem WhitepaperIt should be noted here that adoption of Golem for Blender rendering has been slow, but the team is continuing forward with this new data and is planning on releasing their next iteration of the network, called Clay Golem, sometime in early 2020.

In the meantime, they are also working on a number of new use cases, which I will highlight below.

Golem Use Cases

The Brass Golem beta already allows users to earn tokens for providing unused computing power to the network. The initial use case was to allow users to render complex Blender animations and scenes far more quickly than is possible on a personal desktop machine, and far less costly than a Blender farm.

In addition to that initial use case, the Golem team has added a second use case, and they are working on additional use cases to increase the adoption and utility of the Golem network.

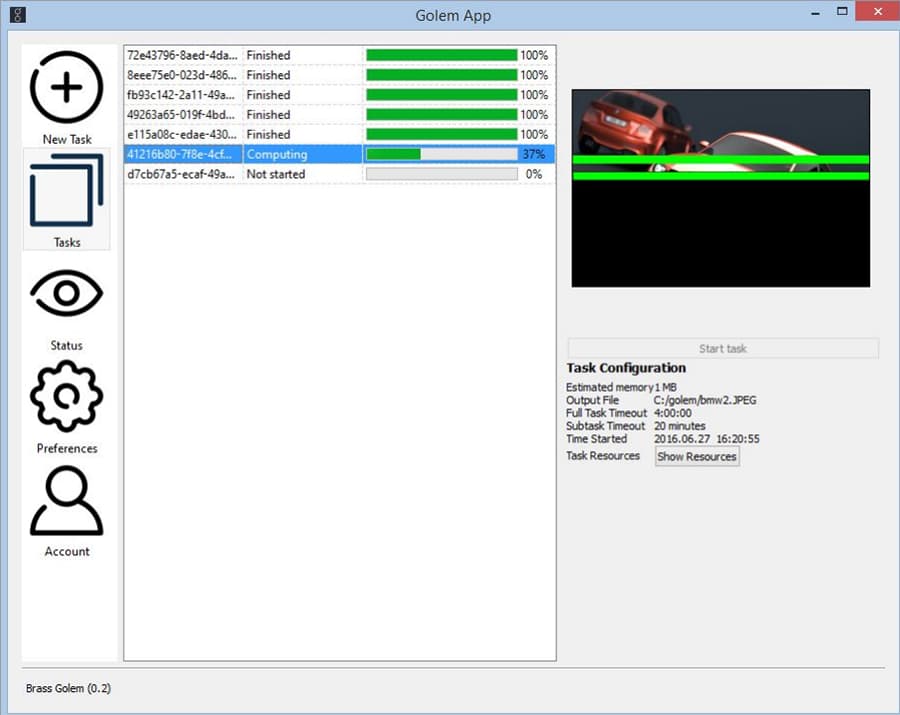

The most recent addition to the Brass Golem mainnet is gWASM, which allows developers to run WebAssembly binaries on providers' machines by turning WASM into a container for heavy server-side parallel computations.

Standard WebAssembly and the Golem Wasm. Image Source: Golem Blog

Standard WebAssembly and the Golem Wasm. Image Source: Golem BlogThis makes it easy to create new decentralized applications with a Web Assembly backend. It’s even possible to integrate existing applications by moving the computationally heavy and expensive part to Golem.

Coming soon is gLAMBDA, which was originally built as a way to support distributed RASPA execution, most useful for molecular computations. The app runs in a gVisor-secured Docker container and contains Python packages. It is the Golem network’s first foray into scientific research computing, which the team believes could be a huge use-case for Golem.

A second use case coming soon is video transcoding. It will allow users to transcode huge video files using Golem and Golem Unlimited. The development team says they will approach this as a dedicated web service which will include an intuitive interface for less tech-savvy users. This would be a step up from the interface used for Blender rendering.

Image via Golem

Image via GolemAnother initiative of the Golem developers is Golem Unlimited, which is being developed to utilize trusted computing resources during periods in which they are idle. Golem Unlimited has been created for enterprise users, such as data center setups, desktops within an organization, or render farms, where all the participants trust each other.

Golem Unlimited creates an internal trusted network of computers, with nearly all being providers, and one central hub being a requestor. Any of the organizations' computers are able to join the internal network and provide computing power for tasks.

Current use cases being explored for Golem Unlimited include MPI Computations and Hoard Compiler Gromacs. Once it is possible to run these use cases Golem will connect hubs and their corresponding networks, making them one fat provider.

The Golem Team

Golem’s development and management team is based in Poland. The co-founder and acting CEO/CTO of Golem is Piotr Janiuk. After receiving a dual Masters's degree in Mathematics and Computer Science he went on to software developer jobs and eventually found himself as a senior lead developer at imapp, which was where most of the original Golem team came from.

Another co-founder and acting COO of Golem is Aleksandra Skrzypczak, who began her career with a Bachelor’s degree in Informatics and then went on to get a Master’s degree in Mathematics by writing a thesis about the usage of machine learning in social networks. She also worked as a senior lead developer for imapp before helping found the Golem Project.

One further co-founder of Golem is Julian Zawistowski, who recently moved from his role as CEO of Golem and took the position of Director at the Golem Foundation. He was an economics and international politics student at the Warsaw School of Economics, graduating with a Master of Arts degree in the field of economics.

Golem Team Members Celebrating MainNet Launch. Source: Golem Blog

Golem Team Members Celebrating MainNet Launch. Source: Golem BlogIn addition to Golem, he was also the founder of a company called imapp which provides programming and analytics for businesses. He only stepped away from imapp in June 2019.

The rest of the team consists of just over 2 dozen individuals, most of whom previously worked with Zawistowski, Skrzypczak, and Janiuk at imapp. Most of the developers and software engineers are computer science majors from Polish universities.

Overall the team is solid, but there are no blockchain rockstars working on the Golem project. They have missed deadlines in the past, but as proven by the main net release of Brass Golem they eventually get the job done.

Golem GNT Token

Computing power is bought and sold on the Golem network using its native GNT token. The GNT is an ERC-20 token that is tied to the Ethereum blockchain. The team decided to use a blockchain token for its system to make it trustless.

With the GNT transactions occurring on the blockchain there are no worries about a failure to pay or a breach of contract. And the actual file transfers and rendering occurs off the blockchain, so there’s no need to worry about the throughput of the network.

GNT was pre-mined and there are a total of 1 billion GNT in existence, but just 980,050,000 in circulation. The token was sold in an ICO that took place on November 9, 2016. The ICO raised roughly $8 million and tokens were sold at $0.01 each. The token hit its all-time low of $0.008797 soon after on December 12, 2016.

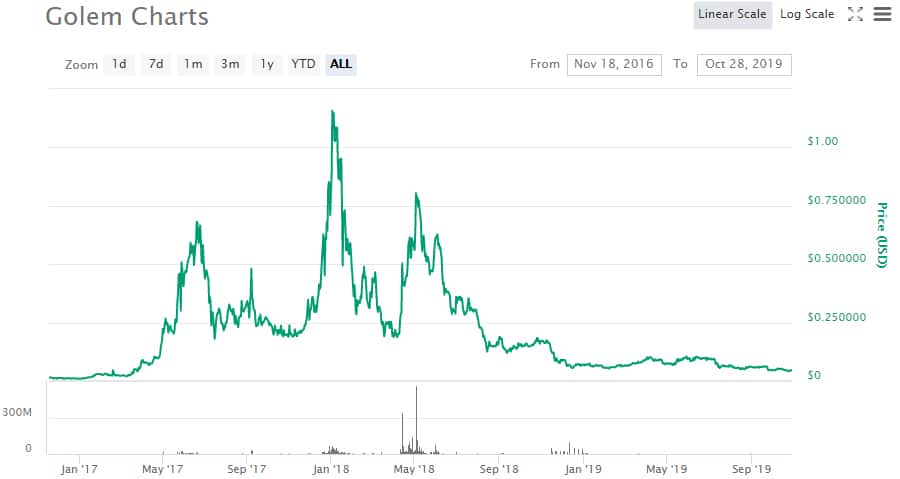

GNT Price Performance. Image via CMC

GNT Price Performance. Image via CMCAs of October 24, 2019 the GNT token is trading at $0.040533. While this is the lowest price for GNT since March 2017 it is still a good return over a 35-month span since the ICO.

The token hit an all-time high of $1.25 on January 8, 2018 but has fallen throughout 2018 and 2019 as the overall crypto markets have experienced broad-based weakness. It is possible the token could get a boost when the team releases the Clay Golem version sometime in early 2020, so now might be a good time to buy.

GNT Trading & Storage

The GNT token is trading on many different exchanges, with the largest volume trading on CoinEx. There’s also a good amount of volume on DCoin, UpBit, Binance, and Poloniex, with smaller volumes on a good dozen other exchanges.

It is worth pointing out that the Golem team has no intention to boost the value of the token. Their intent is simply to use the GNT as a payment means on the Golem network, and they have no partnerships with exchanges or any plans to market the token as a speculative investment.

In terms of GNT market liquidity, over 60% of the volume is taking place on CoinEx. This means that the token liquidity is quite centralised and dependent on a single exchange - not always the best from a market microstructure perspective.

Register at Binance and Buy GNT Tokens

Register at Binance and Buy GNT TokensEither way, there is reasonable volume for GNT on Binance. Taking a look into the GNT / BTC order books on the exchange you have a reasonable level of turnover with relatively deep order books - although you may encounter some slippage with larger orders.

Once you have your Golem tokens you will want to move them off of the exchange into a cryptocurrrency wallet. Keeping a large holding of crypto on an exchange is not a wise move given the numerous risks that are posed by the likes of hackers etc. We have covered a list of some of the top Golem wallets where you can store your GNT.

GNT Price Forecast

Remember that the Golem team has no desire to have the GNT used as a speculative investment token. There were claims that the token was overvalued in the past, but after the 2018 selloff in cryptocurrencies, that’s really no longer the case.

Even so, markets have once again slipped and stumbled late in 2019, so with no coordinated push from the team, it isn’t likely we’ll see a significant increase in GNT price levels anytime soon.

The GNT definitely has room to grow from current depressed levels, and the addition of several use cases should help to foster growth. If the team can create a platform that’s much easier to use than the current Golem network setup we could see a huge upside for the token.

Currently, it’s simply too technical and complex to get a node up and running and to purchase rendering time. The Golem team needs to make this far easier for non-technical people to gain mass adoption.

With that said, even the rendering market is big, and with additional use cases added the processor usage market is immense. Consider the billions in profits being made by the likes of Amazon, Google, and Microsoft with their cloud businesses.

We could see slow steady growth for GNT until a major use case is added or a simple platform is unveiled.

Golem Development

Although Golem has been criticised for the delays in the release of the mainnet, this is not always in the hands of of the developers.

It takes time to code a robust and comprehensive protocol while making it safe and secure. Hence, I am sometimes more interested in seeing the raw coding output to see how much work is being done.

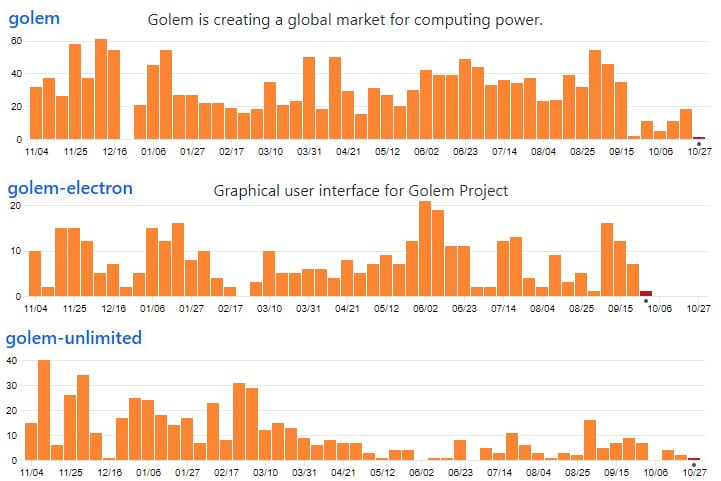

By diving into a projects public GitHub repository, we can get a good sense of this. Below are the code commits over the past year for the top three most active repos in the Golem GitHub.

Code Commits to Select Repos in Past 12 Months

Code Commits to Select Repos in Past 12 MonthsAs you can see from the above commits, there has been quite a bit of activity over the past year. There are also a further 83 other repos in their GitHub with varying degrees of commits.

This is more than we have seen at other projects at this stage of development. In fact, if we were to take a look at the commits compared to other projects, Golem comes in at number 20.

So, although there has been a long delay in launching the Main net, one cannot claim that this is as a result of slow development. If you want to keep up to date with the latest then you can head on over to their official blog.

Something else that I really want to look at is plans that Golem has for the next few months with their adoption timeline.

Golem Adoption Timeline

As you might have guessed by the description of the project it’s sweeping in scale, and can be expected to take quite some time to reach a level of fairly widespread adoption in the 3D rendering industry.

It could take even longer for Golem to be able to tackle other use cases and industries, but the team has already been working on the project since 2014 and is optimistic about its future development and adoption.

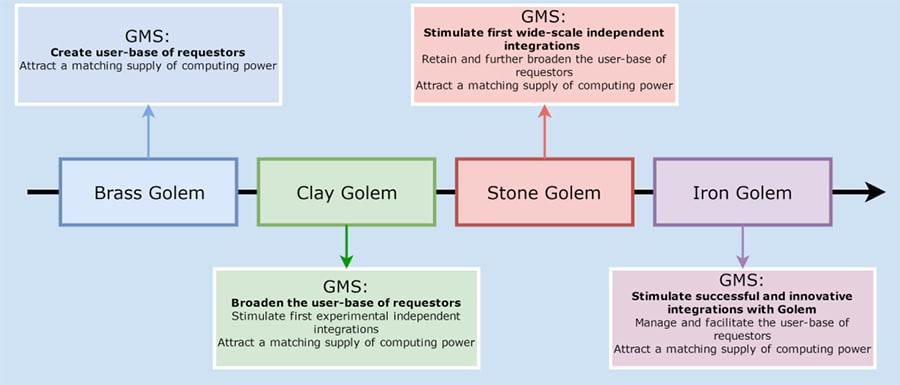

Golem Roadmap with Go-to-Market Strategy for each stage. Source: Golem Whitepaper

Golem Roadmap with Go-to-Market Strategy for each stage. Source: Golem WhitepaperThe April 2018 release of the Brass Golem beta main net came almost a year later than initially planned, but it has proven to be a solid platform so far. It is specifically for CGI rendering, but the team expects to have a completed product released sometime in 2020 and has been able to add smaller more specific use cases to the platform in the year-and-a-half since the launch of Brass Golem’s beta mainnet.

The project has stopped posting a roadmap as of 2019 and instead releases mid-term Kanban boards which helps show where the team has been and where they are is headed but doesn’t put a timeframe around any of the deliverables. You can see the Kanban board here.

Conclusion

When you think about the potential of a global supercomputer you can see what a cool project Golem is. If you imagine out decades into the future it can begin to seem like science fiction, with all the world’s computers forming an interconnected network capable of processing power we can only dream of today.

Of course Golem is only in its infancy now, but in the coming 4 or 5 years they could conceivably already have millions of computers all contributing processing power to complete massive tasks quickly and seemingly effortlessly.

The downside to Golem right now is the lack of marketing from the development team, and the slow pace at which they seem to be working. Fortunately for them there is no other project that is close to what they’re doing, but the slow pace could end up being their downfall if a strong competitor arises.

They do have a strong community following them however, with a lot of attention on Reddit following their main net launch, and nearly 150k Twitter followers.

In the coming months it would be great to see the team expand from its base in Poland and add some global team members, as well as creating some strong partnerships. It would also be great to see the pace of development increase, but I suppose that’s true for most blockchain projects.

Disclaimer: These are the writer's opinions and should not be considered investment advice. Readers should do their own research.