Haven Protocol Review: Digital Offshore Banking

What comes to mind when you think of an offshore bank? You probably imagine the sandy beaches of the Bahamas, the sunshine of Seychelles, or perhaps the snowy mountains of Switzerland.

Having a place where you can discreetly store currencies and assets with little to no government oversight is the reality for much of the world’s elite but is something out of reach to the average person.

As an asset class outside of the current financial system, it was thought that cryptocurrency would serve this role. As we have seen however, Bitcoin and many other cryptocurrencies seem to be merging with the status quo rather than separating from it. Haven Protocol is hoping to change this by introducing a protocol that makes it possible for anyone to truly move their assets “offshore”.

The history of Haven Protocol

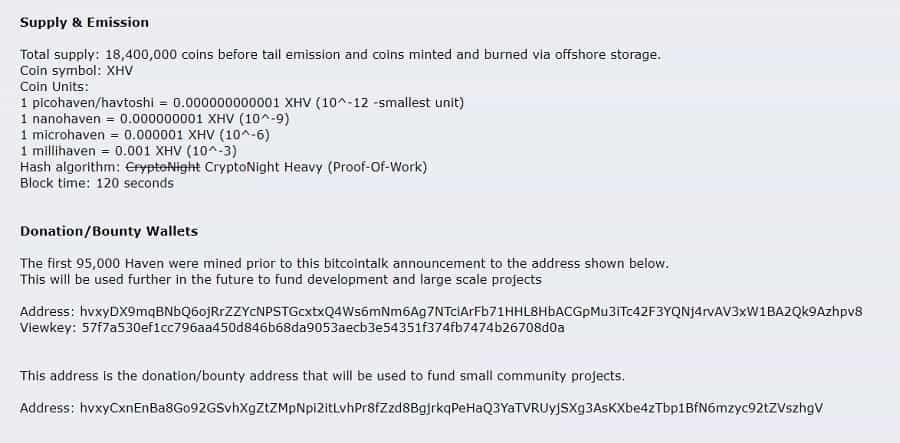

Haven Protocol has the sort of rocky history that is characteristic of many top cryptocurrencies. The project was announced on February 21st, 2018 by two anonymous developers on Bitcointalk. Haven Protocol was described as a fork of Monero that would make it possible to create coins that represent various assets including stablecoins and precious metals.

At the time, this was thought to be impossible to do on private blockchains like Monero. This is because blockchains like Monero do not support tokenization like Ethereum, and the alternative to tokenization (Colored Coins) requires a degree of transparency that is not available on private blockchains.

The impossibility of the task at hand in addition to the project having no private funding, no ICO, and only a small premine, resulted in a lot of traction for Haven Protocol when it launched. Unfortunately, the two anonymous developers soon realized that they could not accomplish what they had promised. They dumped their premined tokens on the market and abandoned the project at the end of 2018.

In January 2019, a few core members of the Haven community took over the project. They believe that the two anonymous founders had tried in good faith to deliver what they had promised. This was supposedly revealed in the original code the anonymous developers had left behind.

The new team forked Haven Protocol’s original code and turned it into an open-source project. They tasked themselves with fulfilling its original vision as being a private, offshore bank accessible to anyone with an internet connection.

With the help of some of Monero’s top developers, Haven Protocol’s new developers succeeded in adding Colored Coins to a private blockchain in May, 2020 – a huge milestone for both projects. Haven Protocol’s first synthetic asset, xUSD, went live in July, 2020. Since that time, over 4.5 million xUSD have been minted.

What is Haven Protocol?

Haven Protocol is a fork of Monero that supports the creation of private coins representing both stable and volatile assets. Virtually any asset can be created on Haven Protocol including currencies and commodities. All of these are private by default. The intention is to make it possible to create your very own digital offshore bank that is out of reach to governments and regulators.

Unlike many cryptocurrencies we see today, Haven Protocol had no premine, did not hold an initial coin offering, and did not receive any seed funding. Instead, 5% of all block rewards are automatically allocated to the development team.

Haven Protocol’s two core developers go by the pseudonyms Dweab and Neac. Dweab is a mathematician and Neac is a cryptographer. Both are also software developers and have 20+ years of experience in their respective fields.

Enjoy this photo of the Cayman Islands.

Enjoy this photo of the Cayman Islands.

In September 2020, the Haven Protocol team announced the creation of the Haven Foundation. Registered in the Cayman Islands, the Haven Foundation’s mission to increase the adoption of Haven Protocol’s native cryptocurrency, XHV, along with its various assets (mainly xUSD). This includes facilitating exchange listings (which require a legal signatory) and creating fiat-crypto on-off ramps.

How does Haven Protocol work?

Although Haven Protocol is described as a fork of Monero, it is more accurate to call it a clone of Monero. Haven Protocol has the same transactions per second (1700 – theoretically unlimited due to adaptive block sizes), the same base transaction fees (less than 1 cent), the same block time (2 minutes), and the same mining algorithm (proof of work – RandomX).

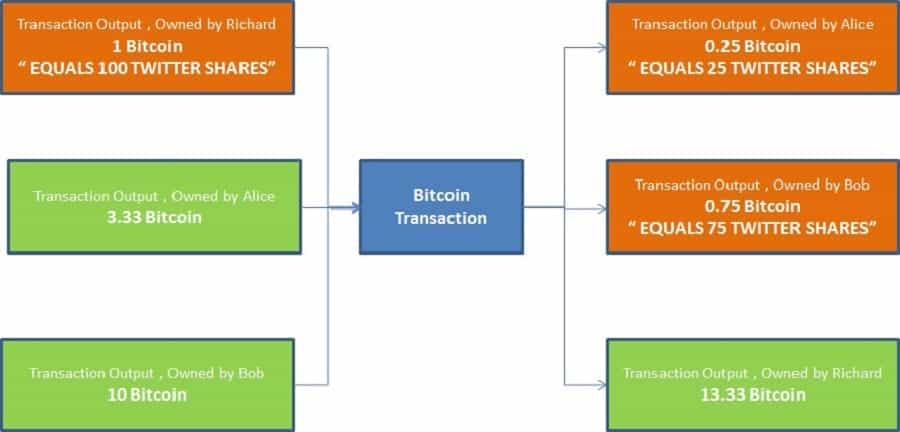

The primary difference (and perhaps the only difference) is that Haven Protocol has implemented something called Colored Coins. Colored Coins is a technology that was originally designed for Bitcoin in 2013 and allows you to assign a specific attribute to a Bitcoin (or fraction of a Bitcoin). This would make it possible for a Bitcoin to represent an asset like Tesla stock or even a single US dollar.

As noted earlier, this was thought to be impossible to do on Monero because you need to be able to see the Bitcoin (or the fraction of the Bitcoin) that is being “colored” with the attribute on the blockchain. How exactly Haven Protocol’s developers managed to implement Colored Coins is quite frankly outside of the scope of this article but is detailed in Haven Protocol’s Medium post from May 2020.

The simple explanation is that Monero uses the sum of an output to determine whether a transaction is valid and Haven Protocol’s developers managed to find a way to accurately include the values of various colored coins in this sum.

Haven Protocol XHV Mining

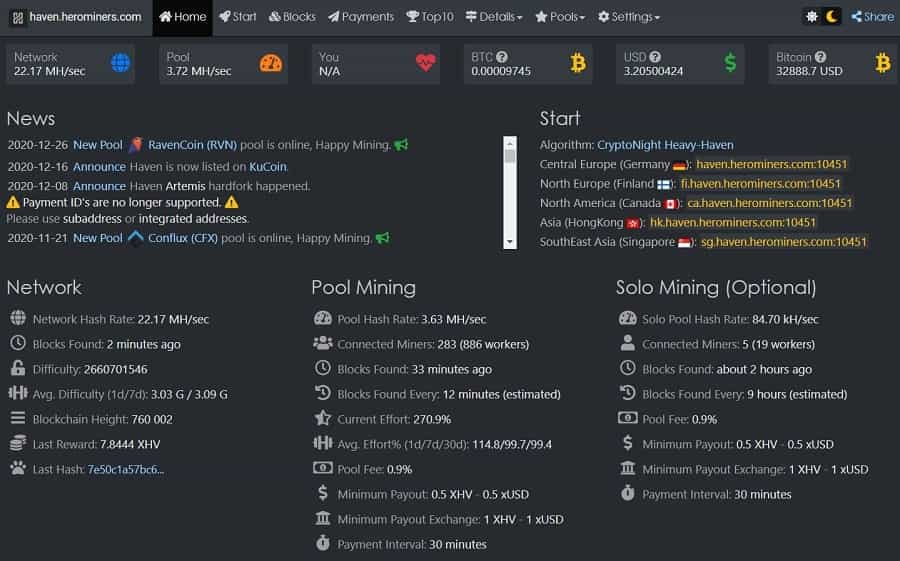

Like Monero, Haven Protocol uses a proof of work mining algorithm called RandomX. Unlike other proof of work mining algorithms, RandomX is designed to be resistant to specialized mining equipment (ASIC miners). As such, all you need to mine Haven Protocol’s native currency XHV, is a regular computer, though preferably a newer one.

XHV is one of the most profitable cryptocurrencies to mine right now. The return on mining works out to about 1$ per day and this can be 2-3x higher if you have cheap electricity. If you are interested in mining XHV, you can do so by joining one of the five Haven Protocol mining pools. You can learn how to set up your Haven Protocol node by contacting the team via Discord or Telegram.

Haven Protocol Privacy

Haven Protocol has the same privacy features as Monero. Though the technology behind these is also outside the scope of this article, there are three you should know about.

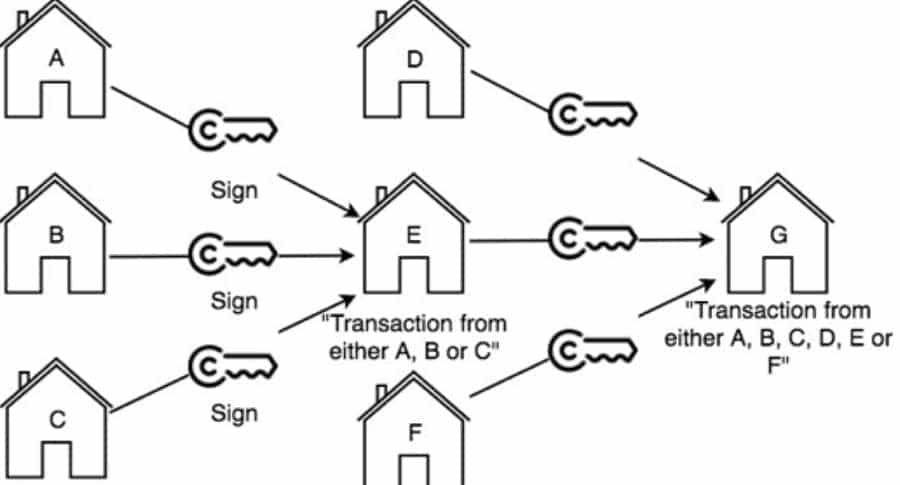

The first is Ring Signatures which hide the identity of the wallet sending a transaction. In a Ring Signature transaction, any wallet belonging to the same group of wallets can sign for that outgoing transaction. This makes it impossible to tell which wallet the transaction actually came from.

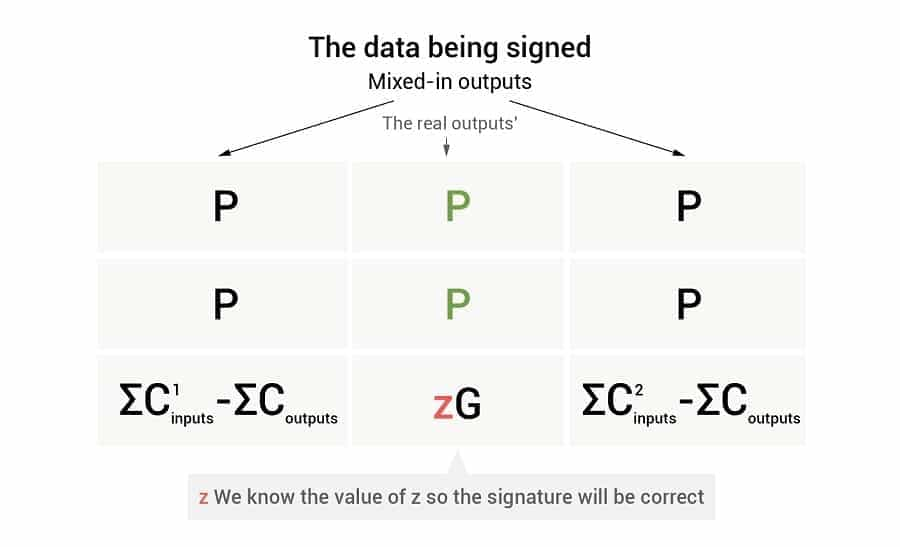

The second is RingCT which obscures the amount of coins being sent in any transaction. Instead, only the sum of inputs and outputs is accounted for. If you could not tell, this is the privacy feature that makes it so hard to implement Colored Coins on Monero.

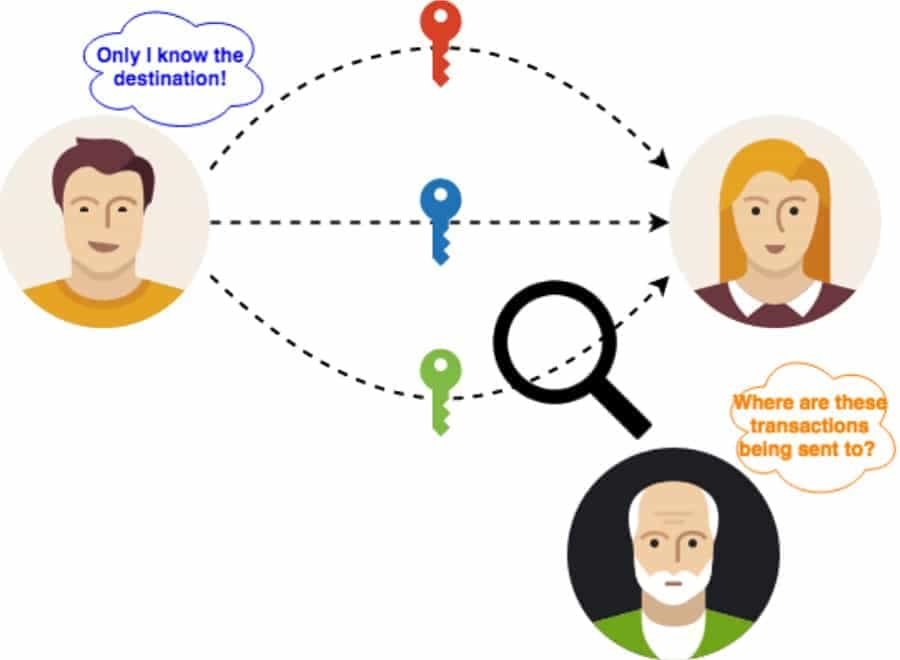

The third is Stealth Addresses which hide the identity of the wallet receiving a transaction. This involves creating a one-time address that makes it impossible for the transaction to be connected to the recipient, even though they are using a single, stable address. Since only the sender and recipient know what the one-time address is, only they can determine whether a transaction was sent.

Haven Protocol xUSD

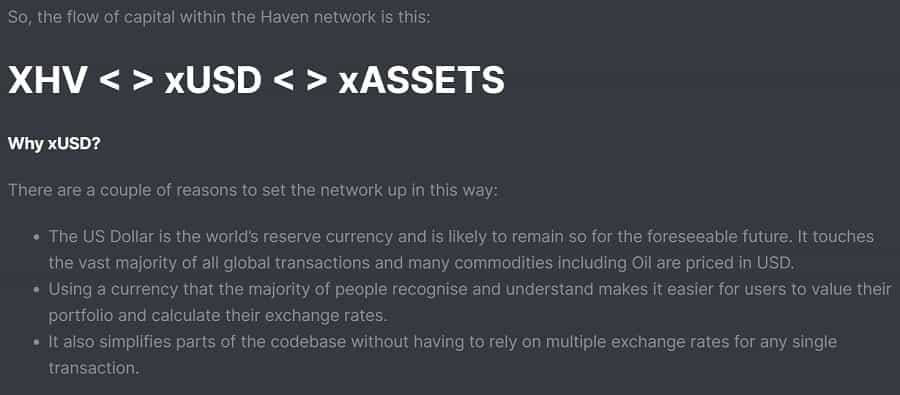

xUSD is privacy preserving stablecoin. It also functions as the cornerstone xAsset on Haven Protocol that is used to mint other types of xAssets.

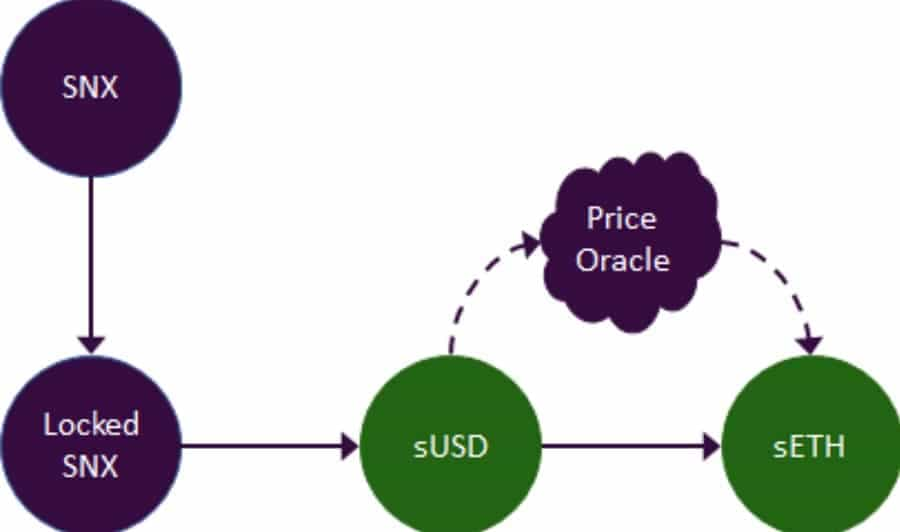

xUSD is a synthetic stabelcoin. This means that there is technically nothing backing it. Instead, it simply mirrors the price of the asset it is supposed to represent. xUSD falls into this category, and Haven Protocol uses Chainlink and Band Protocol to check the price of XHV, xUSD and other xAssets. This means that unlike the other three types of stablecoins, xUSD cannot lose its peg to 1$USD.

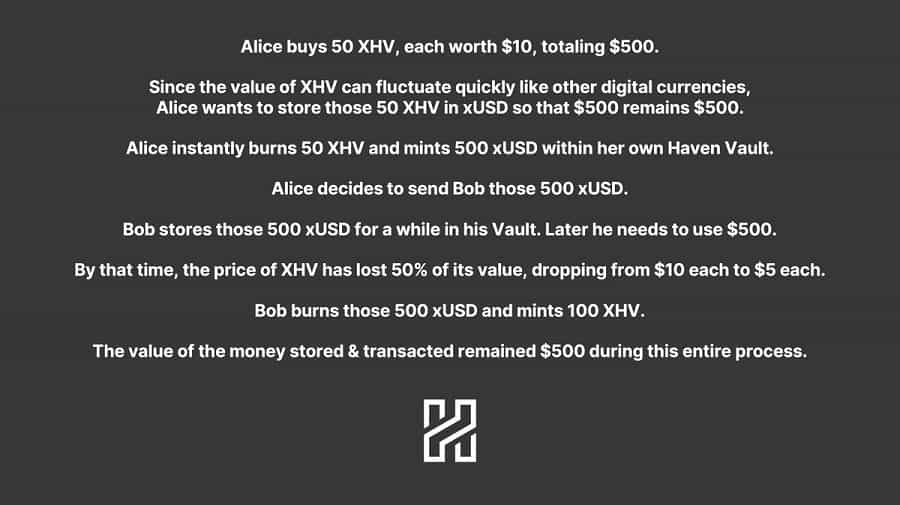

If there is nothing backing xUSD, then where does it get its value from? This is where Haven Protocol’s minting and burning mechanism comes in. To mint xUSD, you must burn an equivalent USD amount of XHV. So, for example, if 1 XHV is worth 1$, minting 100 xUSD would require 100 XHV.

Here is where things get a little crazy. You are also able to burn xUSD to mint an equivalent amount of XHV in USD. So, for example, if the price of XHV drops down to just 50 cents USD, burning 100 xUSD would give you 200 XHV. You could then sell this XHV on an exchange to get 100$USD in fiat (if that is what you are going for, we will not judge you).

What this does in practice is that it allows you to create your very own untraceable USD bank account vis xUSD. Thanks to the minting and burning mechanism, you can actually exchange xUSD for real USD via XHV using a cryptocurrency exchange. This system maintains its equilibrium thanks to Haven Protocol’s unique transactions and fees, which will be discussed momentarily.

Haven Protocol xAssets

xAssets are synthetic representations of real-world assets on Haven Protocol. There are quite literally no limitations as to which assets can be represented, nor is there a limit on the liquidity of that asset (i.e. you can buy as many synthetic shares of Tesla as you want). This is because like xUSD, there is technically nothing backing any xAssets. They just reflect the prices provided by the oracles.

To mint another xAsset, you must burn xUSD. It is not possible to go directly from XHV to any xAsset other than xUSD. This is primarily for simplicity on the developer side, and is also justified by the fact that most commodities (e.g. oil, precious metals) are universally valued in USD.

That said, you can mint other synthetic currencies such as xEUR or xGBP using xUSD. xAssets have not been implemented at the time of writing, and the first set of xAssets to be supported is detailed in the Roadmap section of this article. Oh and of course, all xAssets are completely private like XHV and xUSD.

Haven Protocol Transactions

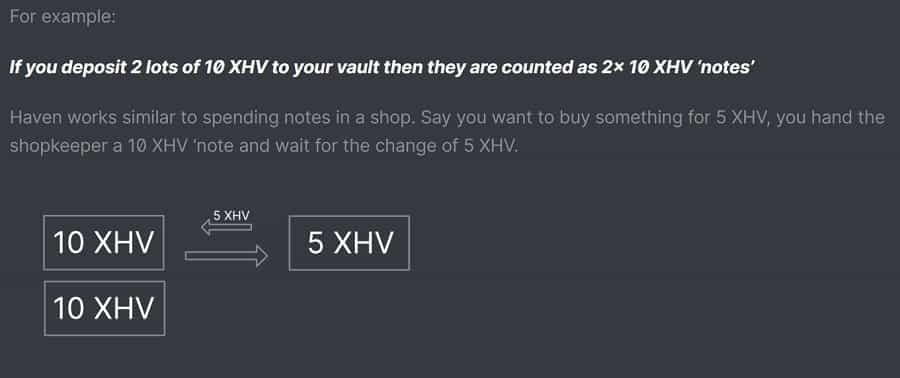

In addition to the privacy features mentioned earlier, Haven Protocol has added a few additional features to its transactions to ensure the mint and burn mechanism for xUSD remains stable. The first is something called ‘notes’.

You can think of notes as being equivalent to physical banknotes (cash). Transactions on Haven Protocol are designed so that any ‘change’ associated with a given note cannot be spent or moved until the transaction has completed.

For example, suppose you bought 100 XHV on an exchange and sent it to your wallet. Unless you manually split that amount in your wallet, it will be treated as one note. This means that if you want to send 50 XHV to one person and the other 50 XHV to another, you have to wait until the first 50 XHV transaction completes before sending the second one.

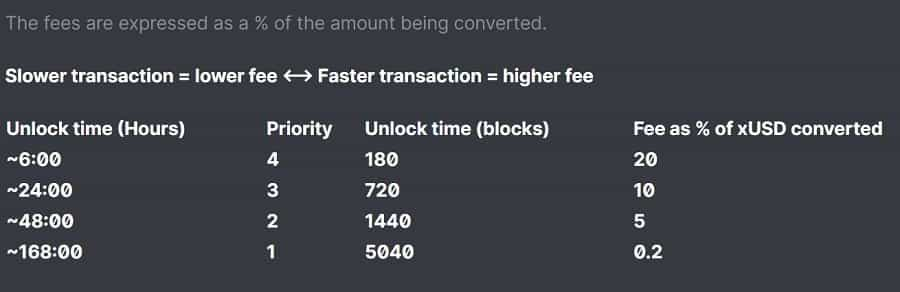

This might seem silly given that transactions on Haven Protocol only take a couple of minutes, but it makes sense once you factor in the second feature: the unlock time between xUSD and XHV. This unlock period can range from 6 hours to 7 days. This is to prevent people from manipulating the xUSD mint and burn mechanism (which happened during the first two months of its release).

To prevent any discrepancy that could occur during the unlock period, the conversion fee along with the price at which you purchased the asset is locked in when you execute the transaction. For example, if you initiated the conversion between 100 XHV to 100 xUSD but the price of XHV dropped to just 50 cents USD, you would still get 100 xUSD regardless of the unlock period you chose.

XHV Cryptocurrency Analysis

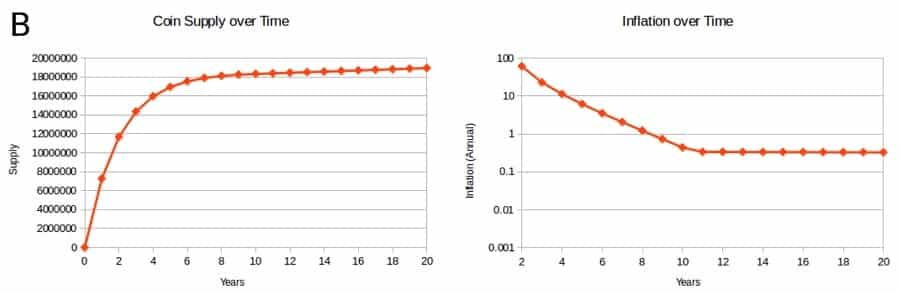

XHV has a current supply of roughly 14.25 million. Since XHV has the same emission schedule as Monero, this means that 2 XHV will be mined every block (every 2 minutes) until May 2021, when the block reward is reduced to 1 XHV per block.

After May 2022, Haven Protocol will enter something called tail emission, wherein the block reward will be 0.6 XHV indefinitely into the future. That said, Monero (and by extension Haven Protocol) could change their mining algorithm and block reward if a new one is found to increase privacy and decentralization (resistance to ASIC miners).

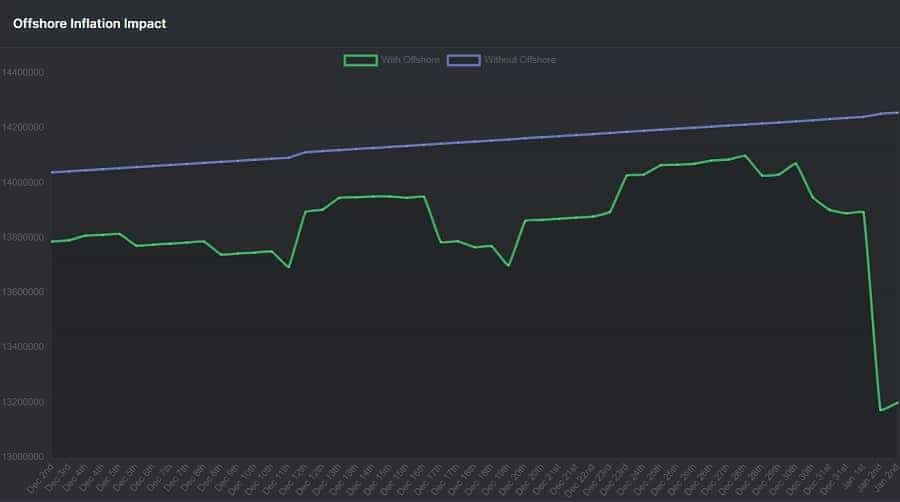

Although Haven Protocol’s tail emission technically makes it inflationary, the actual supply of XHV changes from day to day as people burn XHV to mint xUSD and vice versa. This means that XHV technically has two emission schedules/circulating supplies with Offshore (including xUSD and xAssets) and without Offshore (excluding xUSD and xAssets). These can be seen in the image above.

Haven Protocol XHV ICO

As noted earlier, Haven Protocol had no ICO, no premine, and no seed funding from any venture capital firms. That said, the aforementioned Haven Foundation received a 1 million dollar donation from an anonymous entity in late September, not long after they became officially incorporated in Cayman Islands.

XHV Cryptocurrency Price Analysis

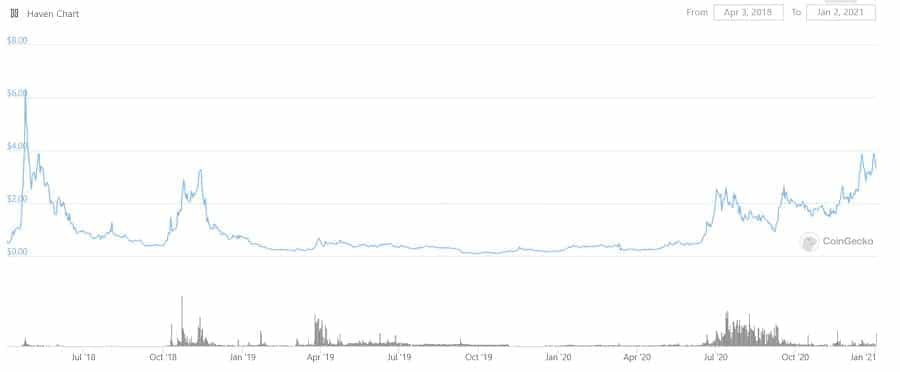

If you think the price chart for XHV looks a bit bizarre, you would be correct. The massive pump in late 2018 was apparently caused by a Telegram group. The fact that it coincided with the time that the original developers sold their premined XHV led to accusations of an exit scam by the Haven Protocol community.

Needless to say, if you discount the price action from before 2019 (which is arguably justifiable given what happened), this means that XHV has seen a 30x move from its all time low of 10 cents in September 2019. XHV seems to have begun its parabolic move in May, around the time the Haven Protocol developers announced they found a way to implement Colored Coins.

Where to get Haven Protocol XHV

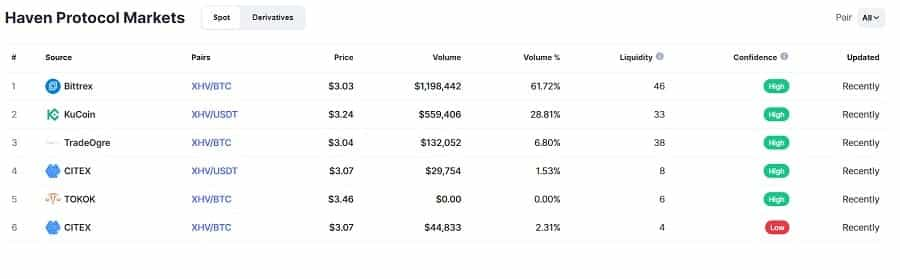

If you want to start your own offshore bank account with Haven Protocol, you are going to need some XHV. Unfortunately, your options are quite limited for the time being – its Bittrex or bust. The trading volume there is not the best but has been increasing in recent weeks.

As this article was being written, Bittrex announced they will be delisting a handful of privacy coins. Though not named, XHV may be affected. Although the price has dropped over the past day, it seems to have made an impressive recovery as most XHV holders seem to have opted to swap for xUSD instead of selling XHV on an exchange.

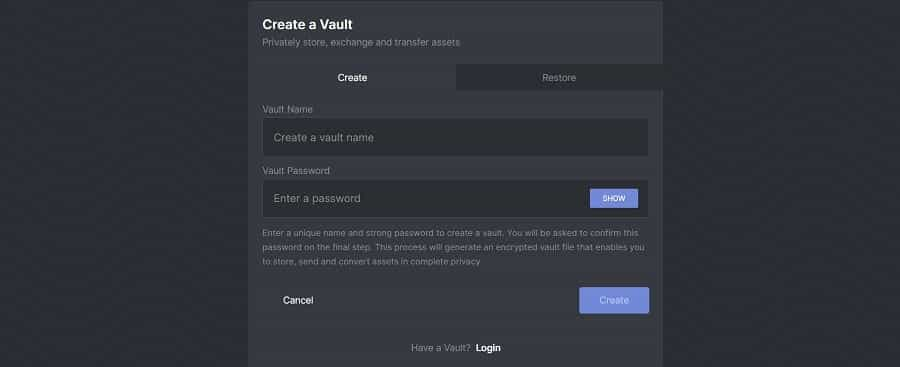

XHV Cryptocurrency Wallets

If you want to store your XHV cryptocurrency, your only option is the native Haven Vault (web wallet). Although the Haven Wallet is also available for mobile devices, reviews suggest that the user experience is not the best.

The Haven Protocol team is currently developing a more stable version of the mobile wallet, along with a downloadable desktop wallet.

Haven Protocol Roadmap

Haven Protocol may have one of the most exiting roadmaps of any cryptocurrency. And better yet, the Haven Protocol roadmap is clearly defined on their website.

For starters, Haven Protocol is in the process of integrating with Travala, meaning it will be possible to use XHV to pay for vacations (not the best timing though). Haven Protocol hopes to eventually add xUSD as a payment option as well.

Haven Protocol is also currently in the process of integrating with WooCommerce. This will make it possible for XHV to be used as a payment method with various merchants using WooCommerce. This would not be particularly noteworthy were it not for the fact that they intend to make it possible to also pay for services using xUSD and other xAssets.

Speaking of xAssets, Haven Protocol will begin introducing them in the first quarter of 2021. The first xAssets to be supported will be gold, silver, Chinese Yuan, and Euros.

Haven Protocol’s blog post about announcing the Haven Foundation also seems to hint that they will be building payment tools such as cryptocurrency debit cards that will support XHV, xUSD, and other xAssets. It also hints that it aims to turn the project into a decentralized autonomous organization. Neither of these two are noted on their roadmap at the moment.

While these development goals are promising, they pale in comparison to the holy grail: trustless asset swaps. As some of you may know, many in the Monero community believe it is only a matter of time before Monero is delisted from most exchanges and becomes generally unavailable for trading.

To protect against this, many Monero developers and community members have been working on a way to make it possible to swap between XMR and BTC in a trustless manner using atomic swaps. Haven Protocol is also currently focusing on working with ThorChain to make it possible to swap XHV with other cryptocurrencies.

Since Haven Protocol is essentially a clone of Monero, if and when this atomic swap technology becomes available for Monero, it will also become accessible to Haven Protocol. The same is likely true for Monero regarding Haven Protocol and ThorChain. This will make it possible to trade your BTC for Monero and xUSD, a privacy preserving stablecoin, without the use a third party like an exchange.

Our take on Haven Protocol

Haven Protocol may just be one of the most valuable projects in the cryptocurrency space. The crypto markets have become incredibly reliant on stablecoins issued from centralized parties, namely Tether (USDT). With rumors circulating that regulators could go after these stablecoin issuers, it is high time to explore crypto-based alternatives.

Overcollateralized and algorithmic stablecoins are arguably not developed enough to fill the void centralized stablecoins would leave. Consider the fact that a substantial amount of the cryptocurrency that backs the DAI stablecoin is actually USDC! Though there are likely to be improvements in those camps, neither of the two can adequately preserve privacy.

Many of you will know that there are dozens of blockchain firms that make a living by tracking the public transactions on public blockchains on Bitcoin and Ethereum on behalf of governments and regulators. Even if USDC and USDT stick around, they are subject to the same surveillance since they are built on public blockchains. Moreover, they can snap their fingers at any time and freeze your stable assets.

If cryptocurrency wants to become something that is outside of the financial system, it must take back the privacy it had when it first emerged with Bitcoin in 2009. Relying on centralized, overcollateralized, and algorithmic stablecoins is not the way to do this. xUSD seems to be the solution, or at least a precursor to what will become the solution.

That said, there are a few concerning elements. First, it is not clear where the 1 million dollars in funding came from, and despite what the blog post may say, that money has strings attached no doubt. Second, Haven Protocol’s reliance on public oracles is their Achilles heel. If they lose access to those oracles, the project could crash and burn. The risk of this is quite low, however.

Finally, Haven Protocol has arguably not yet battletested their protocol. There are likely many more exploits of the mint and burn mechanism that they have not yet discovered, and there is likely a long way to go before it becomes something reliably useful.

That said, it is only a matter of time before the developers at Monero figure out how to do atomic swaps with Bitcoin. Once that happens, the value of a privacy preserving stablecoin will be realized. Haven Protocol could therefore become one of the most valuable projects in the space, but it still has a long way to go.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.